1099 Frequently Asked Questions & Answers

What Is a 1099?

A 1099 is an Internal Revenue Service (IRS) tax form that reports income earned outside of traditional employment. Any entities that issue a 1099 have paid out non-employee compensation for work OR are using it to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., in a taxable year. Such payments are referred to as “taxable events.” Non-taxable events such as qualified rollovers or a 1035 exchange must be reported to the IRS and may also trigger a 1099.

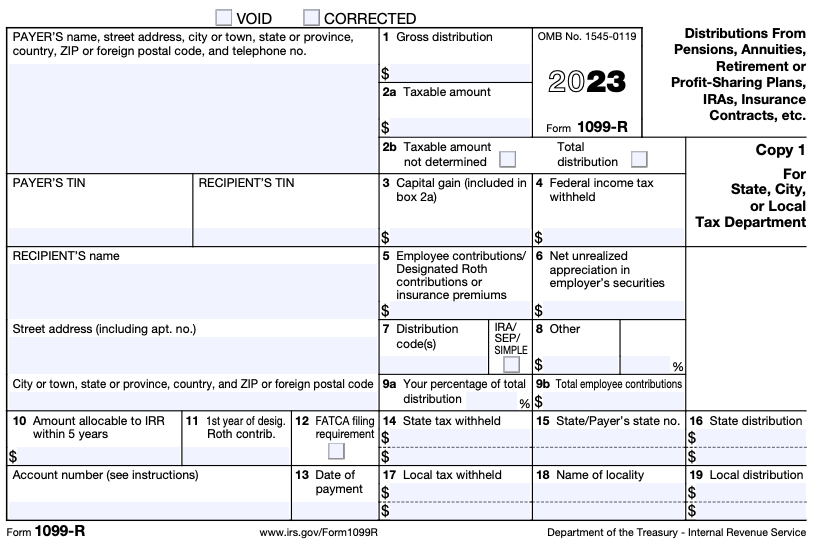

There are several different types of 1099 forms used to report income to the IRS. Important sections of a 1099-R form include —

Account number: Contract number.

Box 1: Total amount distributed from your contract, including income taxes and fees withheld, if any.

Box 2a: Total amount of your distribution reported to the IRS as taxable. This will be zero when the distribution is reportable but not taxable (such as a qualified rollover or 1035 exchange).

Box 4: Total amount of federal income tax withheld from your distribution.

Box 7: Defines how your distribution is reported to the IRS. For example, Code “7” is a normal distribution, and Code “6” is a 1035 tax-free transfer. Refer to the “Instructions for Recipient” section

of your 1099-R for a complete listing of distribution codes and descriptions reported in Box 7.

Boxes 14–19: Report state and local tax and withholding information.

IRS Form 1099-R.1 For illustrative purposes only.

Who Receives a 1099?

Individuals who have received income beyond salary or wages OR who collected or earned on a “taxable event” such as a distribution from an annuity or insurance contract, should expect to receive a 1099. Non-taxable events such as a qualified rollover or 1035 exchange must be reported to the IRS and may also trigger a 1099.

Life insurance is generally taxable when a distribution is made in excess of premiums paid.

If you have specific questions on why you are receiving a 1099, please review your transaction history for potential taxable events (payments, withdrawals, interest, dividends, or capital gains received, etc.) or reach out to a tax professional or financial representative to discuss specific taxable events or treatment.

Should I Receive a 1099 if I Completed a Qualified Rollover or a 1035 Exchange to Another Insurance Company?

Yes. Although qualified rollovers and 1035 exchanges (company to company) are generally not taxable events, they still need to be reported to the IRS. The 1099 should include a Code “G” in Box 7 for qualified transfers or Code “6” for 1035 exchanges. Additionally, Box 2a should show the taxable amount as $0.00, indicating that it was a tax-free transaction. Please reach out to a tax professional or financial representative with any specific questions regarding your rollover or 1035 exchange.

When Should I Receive My 1099?

All 1099 forms will be postmarked by January 31. Please allow up to 10 business days for mailing. If you do not receive your 1099 tax form by February 15, please contact us, or for faster service, see below for instructions on how to request a copy.

How Can I Get Another Copy of My 1099?

Duplicate copies may be requested only after February 15. To request an additional copy of your 1099, please email us at Duplicate1099@wsfinancialgroup.com with your full name and policy number. Please note that copies can only be sent to the account address on file. Allow up to 10 business days from the date of your request to receive your copy via USPS.

What if I Think There Is a Mistake on My 1099?

If you think there is a mistake on your 1099 form, please review your account statements for any withdrawals, interest, dividends, or capital gains received. If you still have questions or feel there is a discrepancy, please contact us and we will be happy to assist you.

I’m a Beneficiary. Why Am I Getting a 1099?

If you, as a beneficiary, received a distribution, you will receive a 1099 with a Code “4” in Box 7. Code “4” identifies the type of distribution received. If you have specific questions on why you are receiving a 1099 as a beneficiary, please reach out to a tax professional or financial representative to discuss specific taxable events or treatment.

Why Did I Receive Two Separate 1099 Forms?

You may receive multiple 1099 forms because the information on each form is limited to a single contract, distribution code, and withholding state.

For example, if you took recurring withdrawals and surrendered a policy in the same calendar year, you will receive two different 1099 forms.