Table of Contents

Table of Contents

Key Takeaways

- Probate is the legal procedure for distributing a deceased person's estate.

- The process differs significantly with or without a will.

- Executors play a key role in managing and distributing estate assets.

- Specific strategies, like living trusts, can help avoid probate.

- Understanding which assets are subject to probate is essential for effective estate planning.

What Is Probate?

Probate is the legal procedure governing the distribution of a deceased person's assets to their heirs and beneficiaries and settling any debts owed to creditors.1 It typically involves validating the deceased's will, appointing a legal executor, and administrating the estate.2 Understanding probate is crucial for effective estate planning and management.

The length and complexity of the probate process may vary significantly, depending on the complexity and size of the estate, the clarity of the will (if one exists), and whether there are any disputes among heirs or creditors. Some assets, like those in living trusts, joint tenancy, or with designated beneficiaries (like life insurance or retirement accounts), may not go through probate.

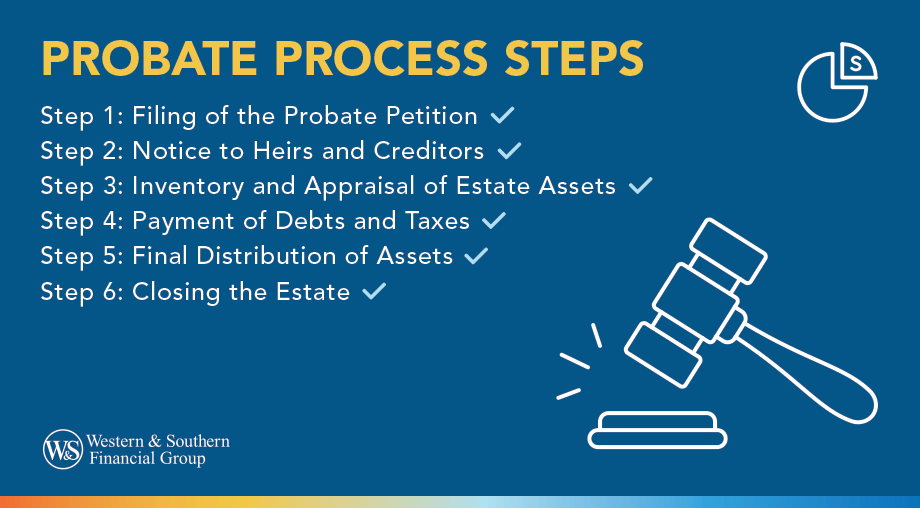

How Does Probate Work?

Probate works through a series of steps to ensure the legal and fair distribution of a deceased person's assets.3 Here's a general overview of how the court-supervised process works:

Step 1: Filing of the Probate Petition

With a Will

To initiate the probate process for a will, someone (often the will's listed executor or another representative) must file a probate petition in the county where the deceased individual resided, accompanied by submitting the decedent's valid will and death certificate. This initial step engages the legal process necessary to authenticate the will and allows the probate court to evaluate the document's validity and claims.

Upon filing the probate petition, the probate court schedules a hearing to ascertain whether the will adheres to the Probate laws and to address any potential objections. During the hearing, the court officially opens the probate case if no disputes arise and the will is deemed legitimate.

This action by the probate court is critical as it formally appoints the executor, the individual nominated within the will to administer the deceased person's estate. Once appointed, the executor has the legal authority to represent and act on behalf of the estate, a fiduciary role that carries significant responsibilities and is a court-supervised proceeding.

Without a Will

When a person dies without a will, the situation is referred to as dying "intestate." Without a will, the distribution of the deceased's assets is determined by state intestacy laws. These laws vary but typically distribute assets to the closest surviving relatives, such as spouses, children, parents, or siblings, in a specific order and proportion.

Since there's no will naming an executor, the probate court will appoint an administrator (often a close relative) to manage the estate. This person has similar responsibilities to an executor, like gathering and valuing assets, paying debts and taxes, and distributing the remaining assets.

Probate without a will can be complicated and take longer than probate with a will. This is because the court must determine legal heirs and their respective shares, which can be complex, especially if there are multiple potential heirs or family disputes.

Without a will to clarify the deceased's wishes, there's a higher chance of disputes among family members regarding the distribution of assets. This can lead to legal challenges and strain family relationships.

Implications of No Will

- Higher Costs: The probate process without a will can often incur higher costs, including legal and administrator fees, especially if the process is drawn out due to disputes or a complicated estate.

- Guardianship of Minor Children: The court will appoint guardians if the deceased has minor children who lack a surviving parent. A will often includes the deceased's preference for guardianship, but without a will, the court decides.

- Potential for Unintended Heirs: Because state laws govern asset distribution, assets might go to relatives the deceased had little contact with or did not intend to benefit. Close friends, unmarried partners, or favored charities would not receive anything without a will specifying such wishes.

- Public Process: Like all probate proceedings, intestate succession results in publicly available estate details and heirs' identities.

Individuals should include a will in their estate planning process to avoid these issues. A will provides clear instructions for asset distribution and can help prevent disputes and legal challenges.

Step 2: Notice to Heirs & Creditors

Upon the appointment of the executor, it is imperative to promptly notify all heirs and beneficiaries about the decedent's death and the commencement of the probate proceedings. This step is integral to the probate process and informs interested parties of their potential interests in the estate and their right to contest the will if they choose to do so.

The executor named in the will must diligently attempt to locate and notify each heir and beneficiary as outlined in the estate planning documents. The notification process typically involves sending a formal notice that includes information about the deceased persons, the executor's appointment, and details on the probate court where the estate is being administered.

The executor must also adhere to state-specific requirements, which may include publishing a notice in a local newspaper to alert potential creditors and claimants who might have an interest in the estate. This procedural step ensures transparency in handling the deceased's affairs and provides a structured timeline for the beneficiaries to come forward and assert their rights.

Step 3: Inventory & Appraisal of Estate Assets

Following the notification of proper heirs and beneficiaries, the executor's next critical responsibility is to inventory and appraise the deceased's assets to ascertain their total value for the probate process. This step thoroughly assesses the assets subject to probate. Such assets typically include bank accounts, retirement accounts, stocks and bonds, real estate, and other valuable personal property, like art collections.

The probate administration process relies heavily on the fair appraisal of the deceased's assets to distribute assets equitably among beneficiaries. An estate without a clear and comprehensive inventory could lead to disputes and delay the distribution process.

Step 4: Payment of Debts & Taxes

After the comprehensive inventory of the deceased's assets, the executor must settle any unpaid debts and taxes owed by the estate. This step involves an analysis of the estate's liabilities to ensure that all financial obligations are met per probate law. The following actions apply:

- Review and Payment of Debts: The executor must scrutinize all claims against the estate to determine their validity and priority before using estate funds to pay them.

- Tax Obligations: File a final income tax return for the deceased and pay any estate taxes due. This action may require professional tax advice to navigate complex tax laws.

- Estate Account Management: Establishing an estate account is essential for tracking payments and maintaining transparency.

When dealing with matters such as intestate succession or small estate procedures, seeking legal advice can be beneficial to determine whether probate is necessary and to ensure compliance with relevant laws. Executors may need an attorney to navigate the intricacies of settling money owed and fulfilling tax requirements.

Step 5: Final Distribution of Assets

Having settled all outstanding debts and taxes, the executor allocates the remaining estate assets following the decedent's will. This step involves distribution to the beneficiaries named in the will.

The executor must ensure that this distribution adheres strictly to the decedent's wishes as outlined in the legal document. The executor must also maintain detailed records throughout this process, which facilitates transparency and accountability.

The executor may encounter various costs associated with transferring assets, such as recording fees or expenses related to property sales. These costs must be accounted for before distributing the remaining assets. In some cases, heirs may wish to avoid probate through mechanisms such as living trusts; however, whether probate can be circumvented depends on how the assets were held and planned for before the decedent's passing.

If an individual dies without a will (intestate), distributing the remaining estate follows the state's intestacy laws, and the executor, or state-appointed administrator, must act on behalf of the estate to ensure lawful distribution. Executors must navigate this process diligently, as any misstep can lead to legal complications or disputes among heirs.

Step 6: Closing the Estate

Once all debts, taxes, and distributions have been settled, the executor/administrator files a final account and petition with the probate court for the distribution and closure of the estate. After approval, the estate is officially closed, completing the probate process.

Is Probate Always Required?

No, probate is not always required. Here's the breakdown:

Scenarios Where Probate Is Typically Needed

- When someone dies with a significant estate value: This varies by state, but generally, larger estates exceeding a certain threshold require probate.

- When the deceased lacks a valid will: In this case, state laws ("intestacy" rules) dictate who inherits, and probate helps execute those rules.

- When assets are not titled jointly or with beneficiary designations: Joint ownership with right of survivorship or assets with named beneficiaries can often bypass probate.

- When debts or taxes require settlement: Probate helps ensure these are handled before beneficiaries receive assets.

Scenarios Where Probate Might Not Be Required

- Small estates: Some states have streamlined procedures under a specific value for simple estates.

- Assets with beneficiary designations: Retirement accounts, life insurance policies and some bank accounts can transfer directly to named beneficiaries, avoiding probate.

- Jointly owned assets with right of survivorship: The surviving owner automatically inherits ownership, bypassing probate.

- Living trusts: Assets in a living trust avoid probate as the trustee already manages them according to the trust terms.

Important Considerations

- Legal complexity: Some strategies, like living trusts, involve legal complexities and might require professional guidance.

- Tax implications: Consult with a tax professional to understand the potential tax implications of different strategies.

- Estate size and composition: The effectiveness of each strategy depends on your estate size and asset types.

It's crucial to consult with an estate planning attorney to understand your specific situation and determine if probate is necessary. They can provide guidance with estate planning strategies to minimize or avoid probate altogether, saving you and your loved ones time, money, and stress.

Some estates may not need probate with thoughtful asset distribution and planning. Start My Free Will4

How Can I Avoid Probate?

Avoiding probate can save time, money and privacy concerns for your heirs. Here are several strategies to consider:

- Create a Living Trust: One of the most effective ways to avoid probate is establishing a revocable living trust. You move your assets to the trust, which you control as the trustee during your lifetime. After your death, the successor trustee you've named transfers those assets to the trust beneficiaries. This process does not involve probate.

- Joint Ownership with Right of Survivorship: Owning property jointly with a right of survivorship means that upon death, the surviving owner automatically becomes the sole owner of the property. Types of joint ownership include joint tenancy and community property with the right of survivorship.

- Designate Beneficiaries: Many financial accounts, such as retirement accounts, life insurance policies, and bank accounts, allow you to name a beneficiary. These are often called "payable-on-death" (POD) or "transfer-on-death" (TOD) accounts and can bypass probate, going directly to the named beneficiary.

- Gifts: Giving away property while alive means it won't be part of your estate at your death. Be mindful of potential gift tax implications depending on the size and nature of the gift.

- Simplified Procedures for Small Estates: Many states have simplified probate processes for small estates (though the definition of "small" varies by state). If your estate qualifies, it may be exempt from the standard, more lengthy probate process.

- Use of Beneficiary Deeds for Real Estate: Some states allow the use of beneficiary deeds, also known as transfer-on-death deeds, enabling property to be passed directly to a beneficiary without probate.

Consider working with an estate planning attorney who can help ensure these strategies are implemented appropriately and align with your overall estate plan. Each method has its nuances and legal requirements, and what works best can depend on your specific circumstances, including the type and value of your assets, your family situation, and your state's laws.

What Assets Are Subject to Probate?

Assets subject to probate generally fall into two categories: solely owned assets and assets not titled with beneficiary designations or right of survivorship. Here's a breakdown:

Assets Typically Subject to Probate

- Real estate: Homes, land and other properties owned solely by the deceased.

- Bank accounts: Solely owned checking, savings and investment accounts that lack POD or TOD beneficiaries.

- Vehicles: Cars, motorcycles, boats and other vehicles titled solely in the deceased's name.

- Stocks and bonds: Individually owned shares and bonds not held in a jointly titled account or trust.

- Business interests: Ownership shares in companies or partnerships held solely by the deceased.

- Personal property: Furniture, artwork, jewelry and other valuables owned solely by the deceased.

- Life insurance proceeds: If there are no named beneficiaries or they are invalid, they may go through probate.

- Intangible assets: Intellectual property, patents and copyrights owned solely by the deceased.

Assets Typically Not Subject to Probate

- Jointly owned assets with right of survivorship: The surviving owner automatically inherits ownership, bypassing probate.

- Assets with named beneficiaries: Individual retirement accounts, life insurance policies and some bank accounts with designated beneficiaries avoid probate.

- Living trusts: Assets titled in a revocable living trust are already managed by the trustee and avoid probate.

- Payable-on-death (POD) or transfer-on-death (TOD) accounts: These designations direct asset transfer to beneficiaries upon death, bypassing probate.

Remember:

- State laws can vary, so it's crucial to consult with an estate planning attorney familiar with your state's specific rules and your unique situation.

- Even if you use strategies to avoid probate for some assets, others might still require the process.

- Consulting a professional ensures an optimal estate plan and minimizes potential legal and financial complications for your loved ones.

How Much Does Probate Cost?

The cost of probate can vary greatly depending on several factors, making it difficult to give a definitive answer without more information.

Factors Impacting Probate Cost

- Estate value: Generally, the larger the estate, the higher the probate costs as a percentage. Costs are often calculated as a percentage of the estate value.

- Complexity of the estate: Estates with complex assets, numerous beneficiaries or contested wills incur higher costs due to additional legal work and potential litigation.

- State laws: Probate fees and procedures vary significantly by state. Some states have simplified procedures for small estates, while others have more complex processes.

- Executor or attorney fees: Legal fees can be significant, typically ranging from 3% to 7% of the estate value, depending on the complexity and attorney experience.

- Court fees: Filing fees, publication costs and other court-related expenses can add up, though these are usually lower than attorney fees.

Here’s a Breakdown of Typical Cost Components

- Attorney fees: As mentioned above, these can be the most significant expense, ranging from thousands to tens of thousands of dollars, depending on the factors mentioned earlier.

- Filing fees: Court fees for initiating probate and filing necessary documents can vary by state but typically range from a few hundred to a few thousand dollars.

- Appraisal fees: If the estate holds assets requiring professional appraisal (e.g., real estate, collectibles), expect additional fees based on the value and complexity of the assets.

- Publication costs: In some states, legal notices in newspapers to notify potential creditors may be required, adding to the cost.

- Bonding: If the court deems it necessary, the executor might need to purchase a surety bond, incurring additional costs.

- Miscellaneous expenses: Accounting fees, travel expenses and other administrative costs can contribute to the overall cost.

Conclusion

Understanding the nuances of probate is crucial for effective estate planning and management. Whether you are drafting a will, acting as an executor, or just planning for the future, being prepared can make a significant difference.

Plan ahead to minimize the time and expenses associated with probate. Start My Free Will4

Sources

- What Is Probate? https://www.actec.org/resource-center/video/what-is-probate/.

- Probate. https://corporatefinanceinstitute.com/resources/wealth-management/probate/.

- Deceased person. https://www.irs.gov/individuals/deceased-person.

- Free Will from Fabric by Gerber Life, a member of the Western & Southern Financial Group Family of Companies. https://www.westernsouthern.com/about/family-of-companies.