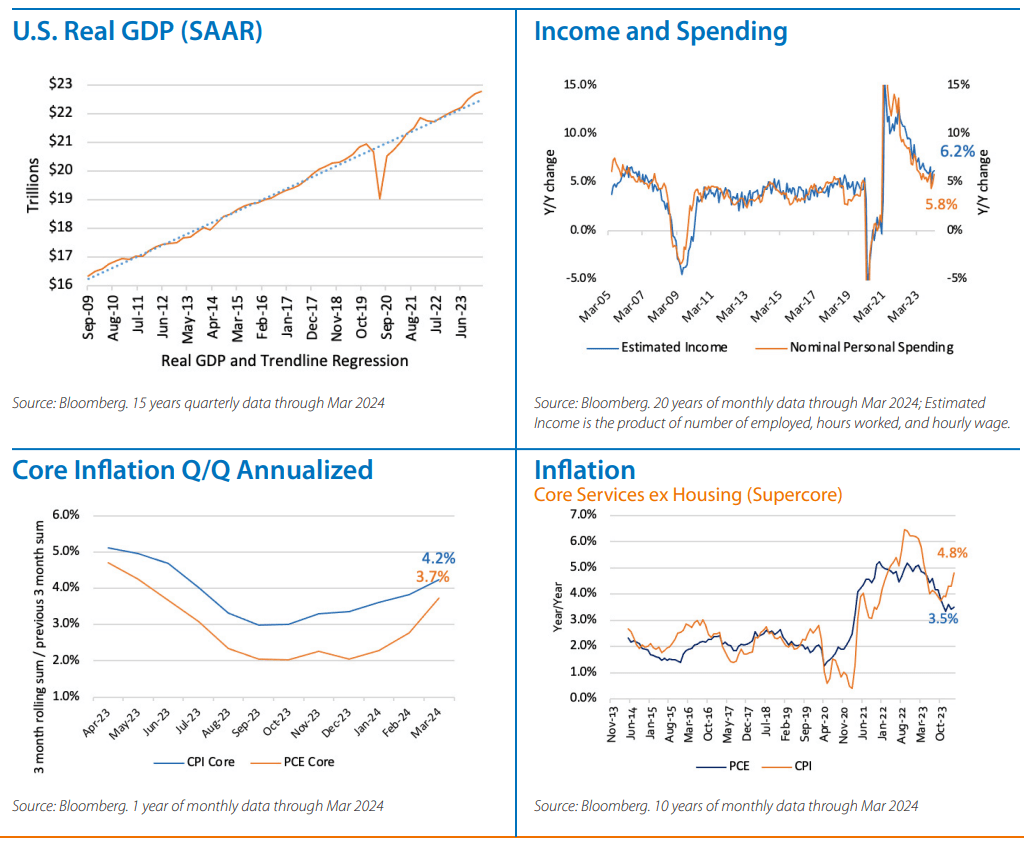

- The 1Q GDP report came in weaker than expected. Yet the underlying composition indicated continued strength, with positive contributions from consumption, capex, housing, and government spending offsetting negative inventory growth and net exports. The economy remains resilient for now.

- We previously suggested last month's inflation data would help determine if prices were in a short-term patch of stickiness or something more severe. It seems we have a problem. Both CPI and the PCE deflator disappointed again.

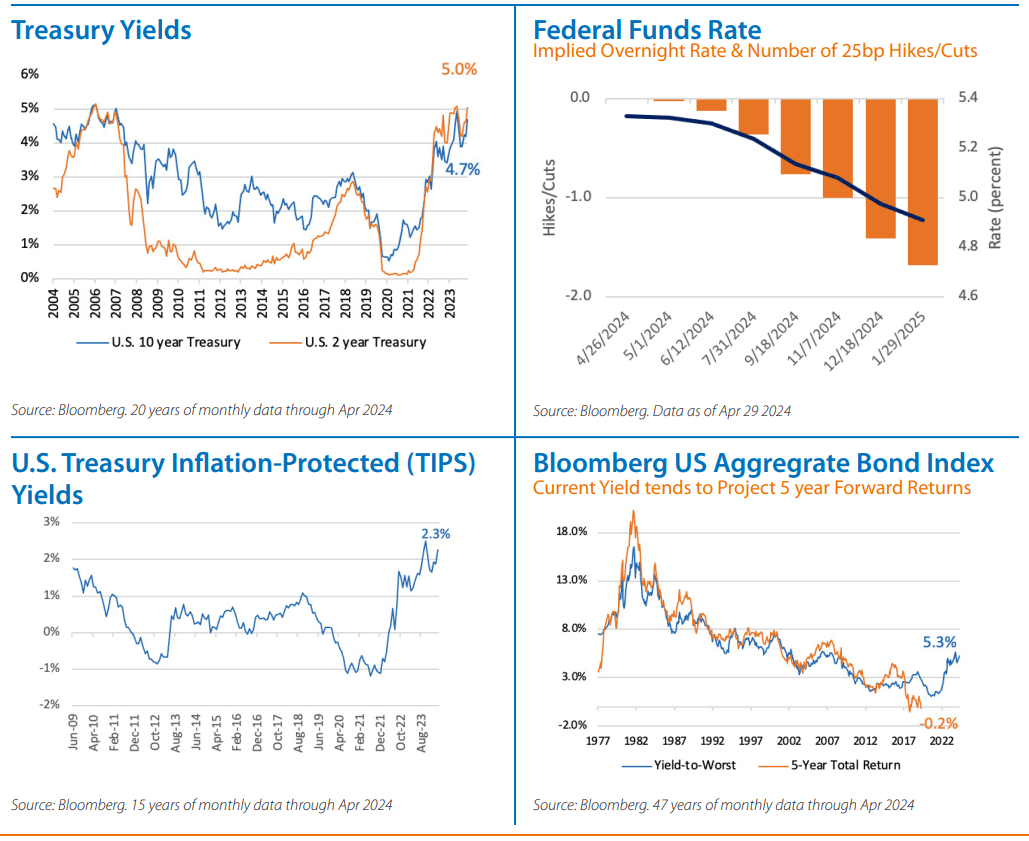

- As a result, Chair Powell suggested that "it is appropriate to allow restrictive policy further time to work." In response, the markets have pushed out the timing of the first rate cut to December.

- Weaker growth and stubborn inflation have increased chatter that the economy may enter a period of stagflation. We disagree. The unemployment rate remains too low and consumption too strong for that outcome.

- Others suggest that higher rates may be supporting growth as higher rates create interest income which allows consumption to persist. While a reasonable idea, falling net real interest income does not seem to support the notion.

- We believe it will be difficult for the economy to remain resilient with current rates holding at these levels for the next six months and expect some slowing in growth to pave the way for inflation to come down enough to allow the Fed to begin lowering rates before the end of the year.

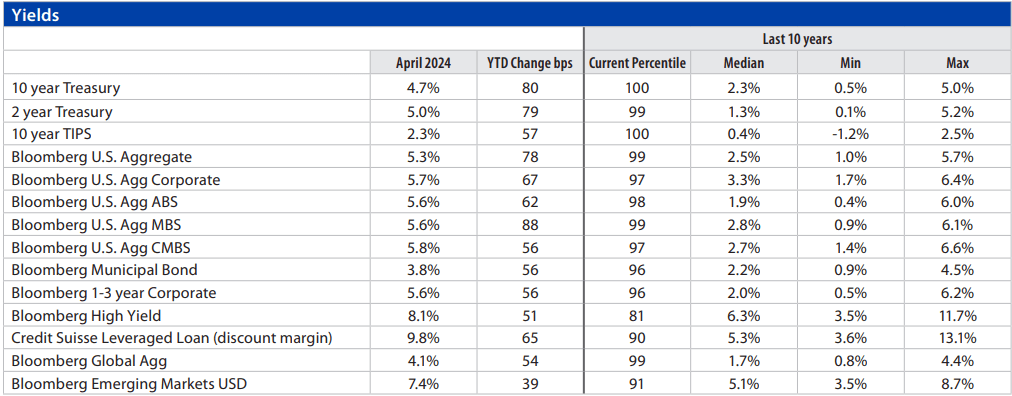

- Yields rose and prices fell in April, reversing March's gains, as bad inflation news and an even more patient Fed weighed on fixed income. The 2-year Treasury yield, a bell weather for rate expectations, surged back above 5%.

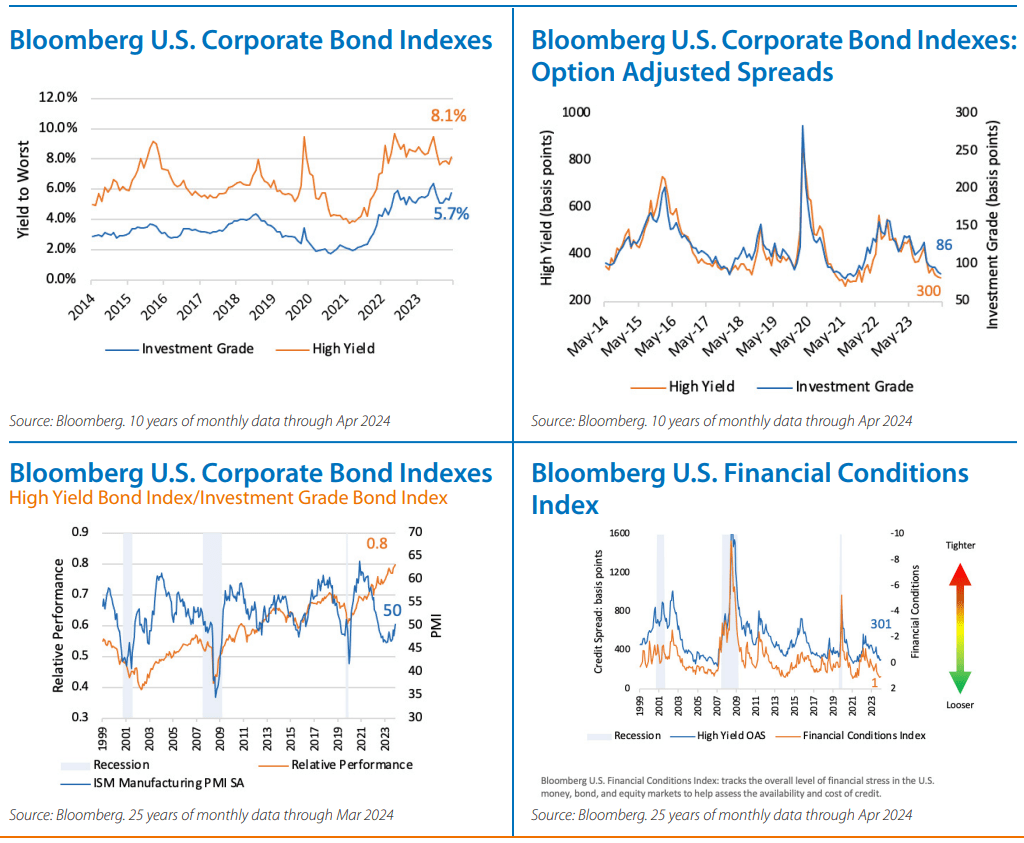

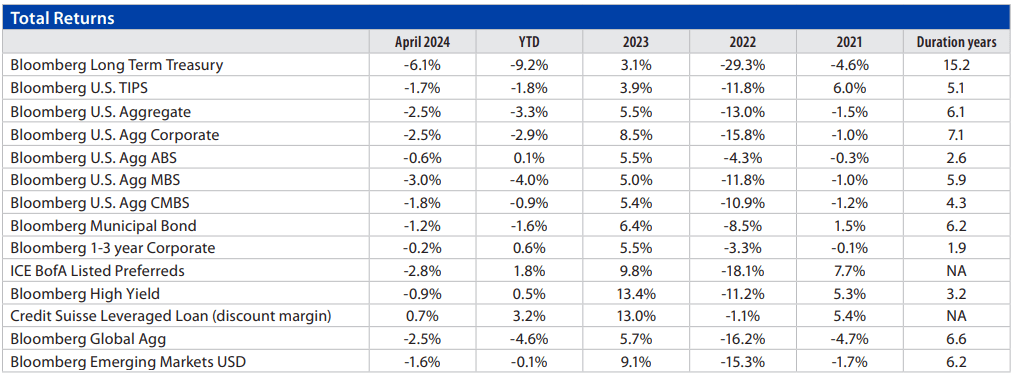

- Most sectors of the bond market posted negative returns, with longer-duration selling off more than shorter-duration, and lower credit quality generally outperformed higher quality.

- Concern is mounting that the Fed will need to continue to back away from its intention to ease this year in order to tighten financial conditions and get inflation moving back toward goal. We expect the data dependent Fed will remain hawkish for now but think the hurdle for the Fed to consider additional rate hikes is high.

- Stubborn inflation has pushed us to reduce our slight overweight to investment grade fixed income and move to a neutral position. Should the Fed continue to retreat from its stated desire to cut rates we would expect bond yields to move higher and we would consider increasing our duration posture.

- In a tumultuous start to the year, bond market yields in general have surged to six-month highs. The Bloomberg Aggregate Bond Index yield ended the month at 5.3%. Renewed price declines are uncomfortable but do offer investors yet another chance to lock in better starting yields and improved forward return potential.

- Credit sensitive sectors of the bond market sold off in sympathy with high quality bonds in April. Both corporate and securitized credit were down for the month. High yield corporate credit posted modest negative returns as well.

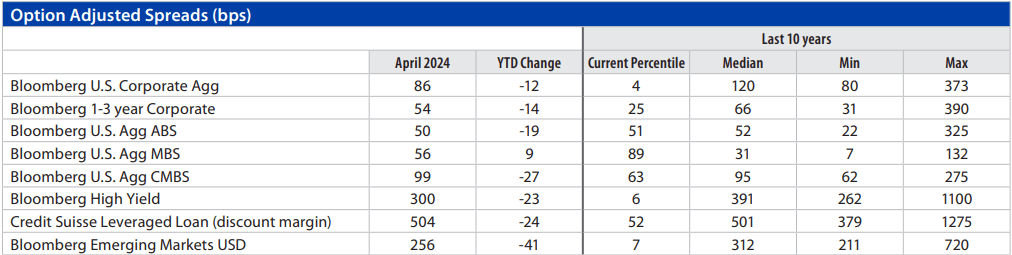

- Duration drove declines, as credit spreads remained little changed for the month. Notably, after declining for several months in a row, CMBS spreads widened modestly in April. HY corporate spreads did widen more than 30 bps during the month but settled back down by month end. Likewise, bank loan spreads remained stable.

- Yields across credit were up anywhere from 40-60 bps and are at the high end of their respective ten-year ranges.

- Resilient credit spreads continue to signal expectations for solid economic and corporate earnings growth. While we think higher for longer policy rates will eventually slow growth and earnings, and in turn likely affect credit spreads, we continue to expect the Fed to modestly cut rates eventually easing default concerns raised by slowing growth.

- Within HY it is key to recognize the index is higher in quality today versus history, supporting lower spreads today, and that strong demand for new issuance is reducing what little near-term refinancing needs exist.

- In our view attractive starting yields in the face of continued evidence of a resilient economy support solid potential returns from credit.

Fixed Income Indexes Characteristics

The Indexes mentioned are unmanaged statistical composites of stock market or bond market performance. Investing in an index is not possible.

For Index Definitions see: TouchstoneInvestments.com/insights/investment-terms-and-index-definitions

2021 – Pandemic continued in waves. Fed held rates near zero and continued to grow its balance sheet at a moderate pace. Long duration bonds sold off while Treasury Inflation Protected Securities rallied on inflation concerns. Exclusive of duration credit exposed securities generally earned their yield.

2022 – The Fed embarked on one of its most aggressive tightening paths seen in decades as the inflation rate surged well above their goal. Interest rates rose across all maturities leading to one of the worst years for fixed income returns.

2023 – Inflation fell broadly while the economy grew with the labor market and consumer spending resilient. The Fed paused midyear helping rates and credit spreads fall late in the year and turning returns positive for the year.

The Touchstone Asset Allocation Committee

The Touchstone Asset Allocation Committee (TAAC) consisting of Crit Thomas, CFA, CAIA – Global Market Strategist, Erik M. Aarts, CIMA - Vice President and Senior Fixed Income Strategist, and Brian Cheyne, CFA, CIMA - Senior Investment Strategy Specialist, develops in-depth asset allocation guidance using established and evolving methodologies, inputs and analysis and communicates its methods, findings and guidance to stakeholders. TAAC uses different approaches in its development of Strategic Allocation and Tactical Allocation that are designed to add value for financial professionals and their clients. TAAC meets regularly to assess market conditions and conducts deep dive analyses on specific asset classes which are delivered via the Asset Allocation Summary document. Please contact your Touchstone representative or call 800-638-8194 for more information.

A Word About Risk

Investing in fixed-income securities which can experience reduced liquidity during certain market events, lose their value as interest rates rise and are subject to credit risk which is the risk of deterioration in the financial condition of an issuer and/or general economic conditions that can cause the issuer to not make timely payments of principal and interest also causing the securities to decline in value and an investor can lose principal. When interest rates rise, the price of debt securities generally falls. Longer term securities are generally more volatile. Investment grade debt securities which may be downgraded by a Nationally Recognized Statistical Rating Organization (NRSRO) to below investment grade status. U.S. government agency securities which are neither issued nor guaranteed by the U.S. Treasury and are not guaranteed against price movements due to changing interest rates. Mortgage-backed securities and asset-backed securities are subject to the risks of prepayment, defaults, changing interest rates and at times, the financial condition of the issuer. Foreign securities carry the associated risks of economic and political instability, market liquidity, currency volatility and accounting standards that differ from those of U.S. markets and may offer less protection to investors. Emerging markets securities which are more likely to experience turmoil or rapid changes in market or economic conditions than developed countries.

Performance data quoted represents past performance, which is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance data given. For performance information current to the most recent month-end, visit TouchstoneInvestments.com/mutual-funds.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Touchstone is a member of Western & Southern Financial Group

Not FDIC Insured | No Bank Guarantee | May Lose Value