Table of Contents

Table of Contents

Key Takeaways

- Start saving for retirement early and take advantage of compound interest. The earlier you start saving, the more your money can grow over time.

- Don't neglect employer matching contributions to your 401(k) or similar retirement account. Make sure you contribute enough to get the full match.

- Plan for potential healthcare costs in retirement, including what Medicare may not cover. Health expenses can eat into retirement savings.

- Rebalance your investment portfolio over time to reduce risk as you near retirement. Don't just set it and forget it.

- Pay down debt before retiring to preserve savings. Entering retirement with a lot of debt can strain your fixed income.

Saving for retirement is a journey — you spend decades making plans and contributions hoping to enjoy a comfortable lifestyle after you finish working. While you always hope you're making the right decisions along the way, retirement planning mistakes can happen sometimes. It's actually pretty common.

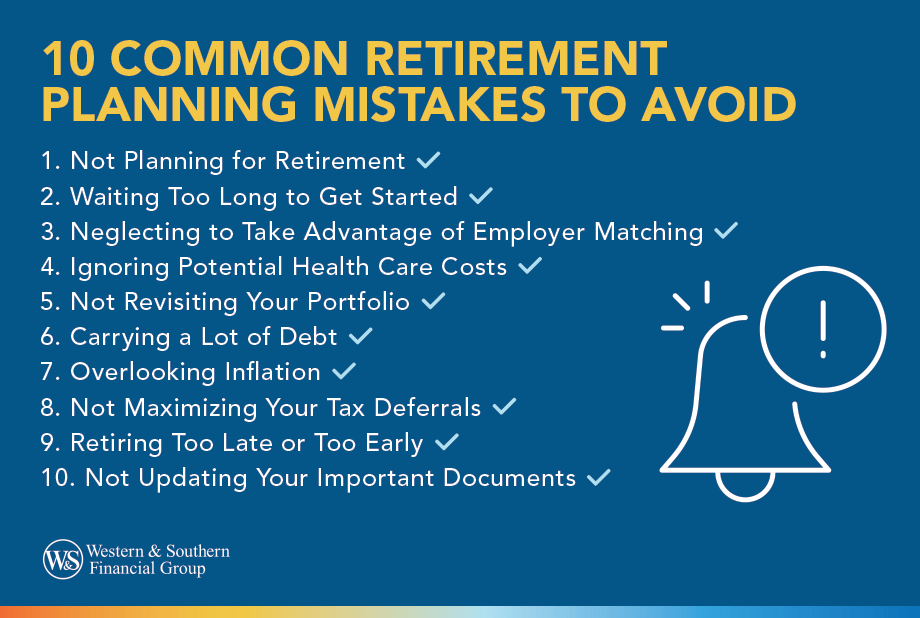

If you've made missteps or faced setbacks, it's important to remember that financial planning for retirement is a long-term process. It's more like a marathon than a sprint, and you likely still have time to adjust and aim to get back on track. Of course, it's wise to try and make the most of your retirement planning along the way, so here are 10 common mistakes to heed.

1. Not Planning for Retirement

Today, Americans spend longer than ever in retirement. According to the Social Security Administration (SSA), the average woman turning 67 this year can expect to spend two decades enjoying her retirement.1 Accordingly, it's important to think about what you can do now to ensure you have enough money to last through your golden years.

Speaking of Social Security, you may think it will be enough to cover your needs, but it may not be. The average benefit for retired workers is approximately $1,844 a month.2 You may need more than this to cover your expenses and health care costs. If you don't have retirement savings, you may struggle to make ends meet or keep up with your current quality of life as you age.

An excellent place to start is thinking about your retirement goals. You don't have to get specific, but having general ideas about when you plan to retire and how you'll want to spend your time — traveling the world or volunteering in your community — can help you get a ballpark idea about your potential needs. That can help you begin the planning process.

Retirement Savings Calculator

Using a retirement savings calculator can help you determine how much you'll need before you leave the workforce.

2. Waiting Too Long to Get Started

You may think you still have decades to worry about your retirement plans, so why start now? The reality is the earlier you begin saving for retirement, the easier it is to absorb potential risks and mistakes. Using compound interest to your advantage can also help. When you begin financial planning for retirement at a younger age, your money has more time to grow.

For example, say two people make the same $50,000 income, contribute to their 401(k) at the same rate (4%) and have the same employer match. Using a 401(k) calculator , you'll find that a person in their mid-20s who has 40 years to save could potentially have a balance of nearly $1.5 million by the time they reach retirement age. By comparison, someone starting to save in their mid-40s still has 20 years before retirement age, but their potential balance may only end up around $225,000.*

It's never too late to start contributing to your retirement savings. If you have a 401(k) through work, look to enroll. You might consider opening an individual retirement account (IRA) as well. It's also wise to revisit your budget and think about how you could set something aside each month for retirement.

3. Neglecting to Take Advantage of Employer Matching

A lot of people get their retirement savings accounts through their employers in the form of 401(k) and 403(b) plans. Currently, about 67% of employees at private companies have access to these retirement plans.3 If your employer has one of these and you aren't yet contributing, you may want to start — and ask if they match your contributions.

When an employer offers this benefit, they often will match your 401(k) contributions to a certain percentage. For example, if your employer offers matching up to 3%, they will put money into your 401(k) equal to up to 3% of your pre-tax income as long as you contribute 3% too. If you contribute less than that, they'll only match to your level, so you could be leaving essentially free money on the table if you aren't contributing up to the match limit.

If you currently have a 401(k), revisit your contributions, especially if your employer offers matching. If you can, consider increasing your contributions to at least the employer match to take advantage of it.

4. Ignoring Potential Health Care Costs

Once you turn 65, you can start taking advantage of Medicare, a government program that helps subsidize medical costs. While Original Medicare and Medicare Advantage plans help pay for a wide variety of health care needs, you'll still need to pay for it and plan for how you'll pay for what isn't covered.4

Even with Medicare, you'll still need to pay for about 20% of your medical expenses and potentially more if you end up getting sick or needing long-term care. As people age, the chances of needing medical care increase. So even if you are healthy right now, the cost of care is something you'll want to include in your retirement planning. The Department of Health and Human Services estimates that 69% of people will need some form of long-term care,5 and Medicare won't cover most of it.6

While you can't predict your health care needs, you can aim to lead a healthy lifestyle. Eating well, keeping your mind sharp and getting regular exercise can help you live healthier in retirement. You're never too old to start getting active.

5. Not Revisiting Your Portfolio

When you first start financial planning for retirement, your needs — not to mention your risk level — are usually much different than when you're closer to actually retiring. Your investments need to reflect that change over time. Otherwise, you may leave your savings open to risk as you near retirement, when you won't have much time to recoup any damages.

Your retirement savings portfolio isn't something you want to set and forget. That could lead to some significant retirement planning mistakes, such as picking risky investments that sink the value of your savings over time. While the market is never predictable, and past earnings don't reflect future ones, you want to consider your savings' preservation and longevity as you get closer to retirement.

This is where working with a financial professional can help. They can review and diversify your portfolio on a regular basis and advise you on the adjustments you may need to make over time to help you get the most out of your financial preparations. Keep in mind that diversification cannot guarantee success or prevent losses in a declining market.

6. Carrying a Lot of Debt

Having a lot of debt is another common retirement planning mistake you need to keep in mind. While minimizing debt is always a good goal, it becomes even more critical as you approach retirement because that debt can eat into your savings.

Remember that once you retire, you may be on a fixed income, so any unexpected or significant expenses, including debt, can reduce your savings and disrupt your plans. However, that doesn't mean you should entirely forgo saving for retirement to pay down debt. Instead, review your budget and work with a financial professional to help develop a plan that lets you do both. Tackling debt may be scary, but facing it now can help you avoid it later.

Before retirement, try to pay down your debt, including reducing spending on your credit cards. Work on building an emergency savings account that you can dip into if you need to pay for something unexpected so you won't need to borrow or use a credit card to cover it.

7. Overlooking Inflation

Inflation has been a hot topic, with 2022 rates reaching some of their highest levels since the early 1980s.7 However, even in the best of times, the Federal Reserve expects inflation to rise at about 2% per year, so that's a number you need to remember as you get into financial planning for retirement.8

Why does inflation matter? Because it reduces your purchasing power. When inflation increases, your money doesn't stretch as far as it used to. Over the course of your retirement, that inflation rate will slowly eat into your savings.

You can help combat inflation by choosing retirement investments to keep up with or have rates of return that exceed inflation. These may include stocks, mutual funds and other securities. A financial professional can help you develop a strategy that accounts for inflation so that you're planning for it in the long term.

8. Not Maximizing Your Tax Deferrals

While many retirement savings plans have some tax advantages, a few offer greater benefits than others. To help encourage you to save for retirement, the Internal Revenue Service offers some tax breaks with retirement savings plans. You'll want to take advantage of them when you can.

For example, contributions to a traditional 401(k) are tax-deferred. That means you can lower your total income — and pay less in taxes — by putting more money into your 401(k). You also don't pay taxes while that money grows (instead, you pay taxes when you withdraw it later). Roth IRAs work the other way: You pay taxes on the money you put into them upfront, but once you reach age 59½, any withdrawals you make are tax-free. And with certain retirement accounts, the IRS allows people over age 50 to make tax-deductible catch-up contributions that may help boost your savings even more.9

Taking advantage of these types of retirement savings accounts can help you save on your taxes throughout your life. A tax or financial professional can help you understand the ins and outs of maximizing tax advantages with your retirement savings.

9. Retiring Too Late or Too Early

When retirement is still a little ways off, it's easy to imagine the perfect scenario when you retire at exactly the right time. However, the best-laid plans sometimes don't work out. You may need to retire earlier than expected or retire later because you don't have enough savings.

If you retire too early, then you may not have a chance to maximize your retirement savings. Plus, tapping into your Social Security benefits before you hit full retirement age can reduce the amount you get each month. If you want to keep working into your later years, make sure you understand the potential tax implications of having a higher income.

As part of your retirement planning, the goal is to step into this next phase of your life at a time that's just right for you. A financial professional can help you figure out when the best time is to retire and develop a few custom strategies to cover unexpected situations. That way, you'll have a plan regardless of your decision.

10. Not Updating Your Important Documents

As you age, you'll realize just how much paperwork you have to keep track of. From retirement and investment accounts to life insurance and estate planning documents, it's important to keep these documents accessible and up to date. If something happens to you, your wishes will be laid out, and you'll already have determined who can make decisions on your behalf.

Many retirement accounts and life insurance plans allow you to name a specific beneficiary, a person who the money in your account will go to when you pass. That may be your spouse, children or even a charity. But, if you don't name a beneficiary or forget to change the beneficiary, that money could get stuck in the probate process. You may also want to set up financial and medical durable powers of attorney to name the people who can make those decisions for you if you're not capable.

An estate planning attorney or professional can help ensure these documents are set up properly. You'll want to make sure you review them every so often, especially after big life changes such as a marriage, divorce or having a child.

Bottom Line

Retirement planning is easier than you think. It doesn't have to be an overwhelming process, but it's something you won't want to wait to start.

If you're ready for retirement planning, consider meeting with a financial professional. They'll review your income, debts and expenses, listen to your goals for retirement, and help you build a strategy that works within your budget. Then, you can start feeling even more confident about your retirement savings and future plans.

* This is a hypothetical example used for illustration purposes only. An investment in securities comes with market risk including the potential for loss of some or all of the principal amount invested.

Live More & Worry Less

Sources

- Retirement and survivors benefits: Life expectancy calculator. U.S. Social Security Administration. https://www.ssa.gov/oact/population/longevity.html.

- Monthly statistical snapshot, October 2023. U.S. Social Security Administration. https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/.

- Percent of private industry workers with access to retirement benefits: defined contribution plans. U.S. Bureau of Labor Statistics. https://data.bls.gov/timeseries/NBU22000000000000028312.

- Costs. Medicare. https://www.medicare.gov/basics/costs/medicare-costs.

- How much care will you need? U.S. Administration for Community Living. https://acl.gov/ltc/basic-needs/how-much-care-will-you-need.

- Long-term care. Medicare. https://www.medicare.gov/coverage/long-term-care.

- Consumer price index summary. U.S. Bureau of Labor Statistics. https://www.bls.gov/news.release/cpi.nr0.htm.

- Why does the Federal Reserve aim for inflation of 2 percent over the longer run? Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/faqs/economy_14400.htm.

- Retirement topics — catch-up contributions. Internal Revenue Service. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-catch-up-contributions.