Key Takeaways

- 63.6% of Americans surveyed have never discussed debt with their spouse.

- Credit card debt is the biggest financial deal breaker for millennials surveyed.

- Couples with joint checking accounts were the most likely to fight about spending habits among all couples surveyed.

Finance and Relationships

Before settling down for life with your partner, there are some critical conversations to be had. While agreeing on whether or not to have children can end a relationship in its tracks, the same can be said about each partner’s financial situation and habits. To learn about the financially driven deal breakers according to American couples, we surveyed over 1,000 married Americans about their finances, the money issues that can make or break their relationships and the topics that trigger the most arguments between partners.

For our study, financial and relationship information was self-reported and then compared across the following age groups:

- Baby boomers born 1955-1964

- Gen X born 1965-1980

- Millennials born 1981-1996

- Gen Z born 1997-2004

Read on to learn about the most pressing financial issues and how they might impact your romantic prospects.

Important Conversations

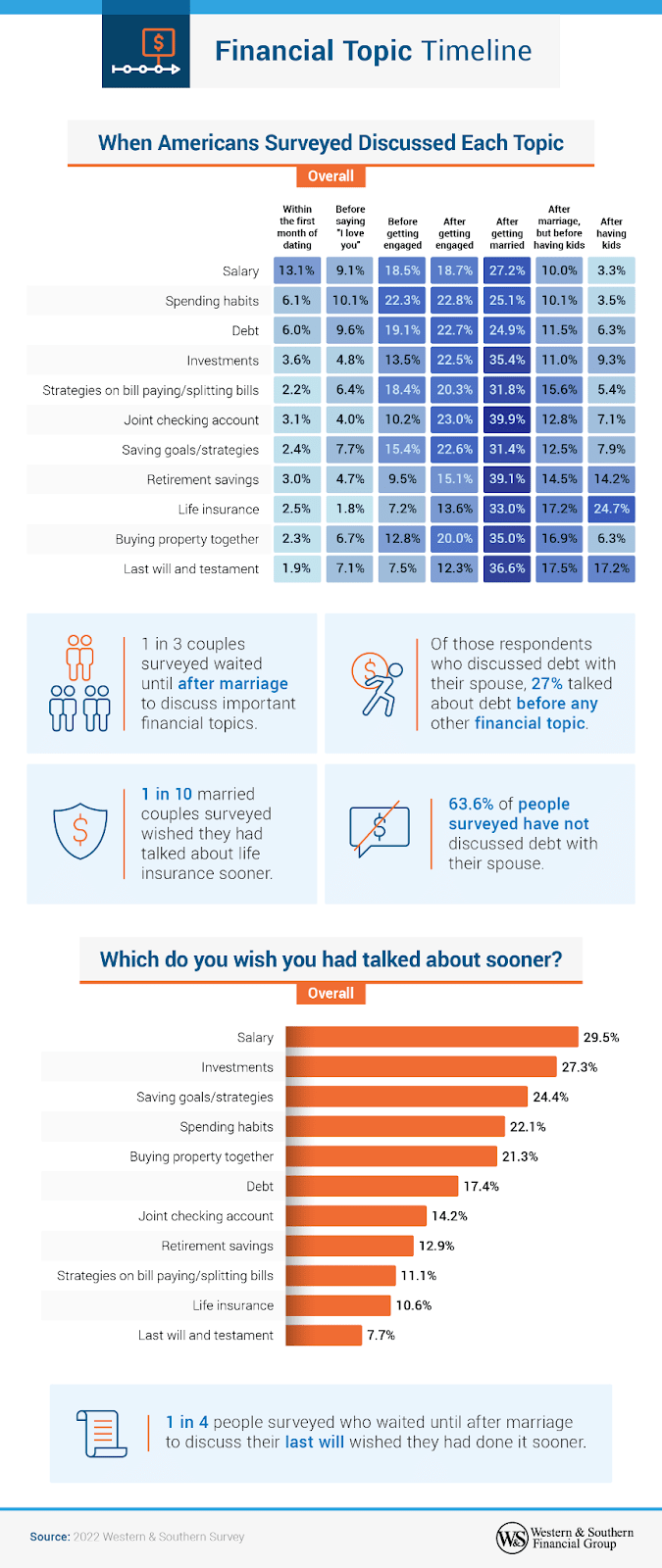

Talking about money can be difficult (even embarrassing), but some things need to be brought to light before tying the knot or starting a family together. Let’s see when respondents felt it was necessary to discuss each financial topic.

Not many couples we surveyed held financially charged talks within the first month of a relationship, aside from salary (13.1%). But older respondents showed a different tendency: 28% of baby boomers (born 1955-1964) didn’t discuss their salaries until after marriage. While most other respondents discussed their debts before getting engaged, over 10% of millennials (born 1981-1996) did so before they even said, “I love you.”

Life insurance is another topic to discuss with your partner, especially if they’re family. Only one-quarter of respondent we surveyed waited to talk about it until after having kids, hopefully, because most of them spoke about it beforehand: 33% of respondents reported discussing life insurance after getting married.

Yet again, baby boomers were the last to bring a financial subject up with their partners. When we asked them, an alarming number — 67% — had not discussed life insurance with their spouses at all.

Although the life insurance talk was a source of regret, with over 10% of married couples surveyed wishing they had discussed it sooner, nearly 30% felt the same about salaries. That information must be important to couples since it was also the most common financial topic discussed in the early stages of dating. The subject of each partner’s last will and testament was less of a concern, with less than 8% of respondents wishing they had discussed it sooner than they did. Most couples surveyed brought it up after marriage, and very few broached the topic within the first month of dating.

Financial Turn-Offs

Poor communication and mismatched values can result in couples splitting ways. But these areas often encompass finances as well. Which topics resulted in the most significant issues for married Americans?

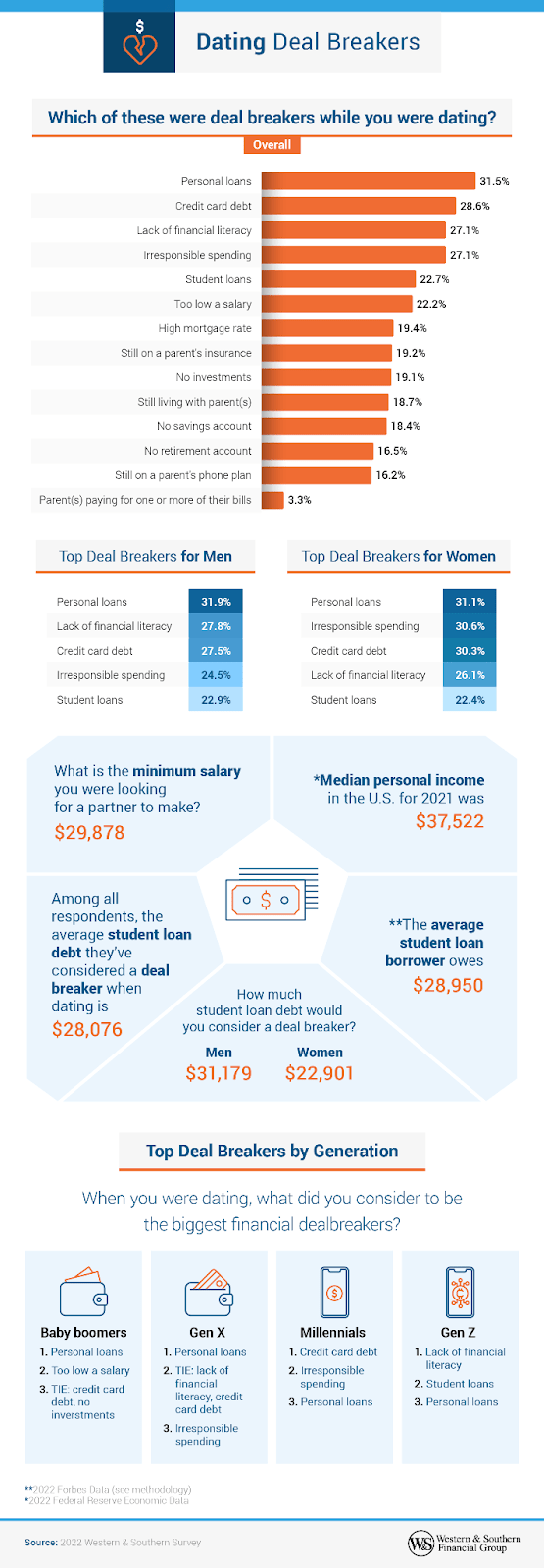

Personal loans were the most prominent financial deal breaker overall in this study, followed by credit card debt, lack of financial literacy, irresponsible spending and student loans. Considering the average student loan borrower owes $28,950, and our respondents considered a lesser amount than that to be a relationship deal breaker ($28,076, on average), borrowers with a solid repayment plan may instill more confidence in their partner.

In any event, student loans weren’t a top deal breaker for any generation surveyed. Personal loans turned off baby boomers (born 1955-1964) and Gen Xers (born 1965-1980) the most, and millennials (born 1981-1996) saw credit card debt as the biggest red flag. Meanwhile, Gen Zers (born 1997-2004) wouldn’t put up with a financially illiterate partner.

Breaking Down Disagreements

Finances can strain relationships, sometimes damaging them beyond repair. While the occasional argument can be healthy, it’s essential to avoid heated discussions. Let’s see which financial topics have caused the most spirited bouts among our respondents.

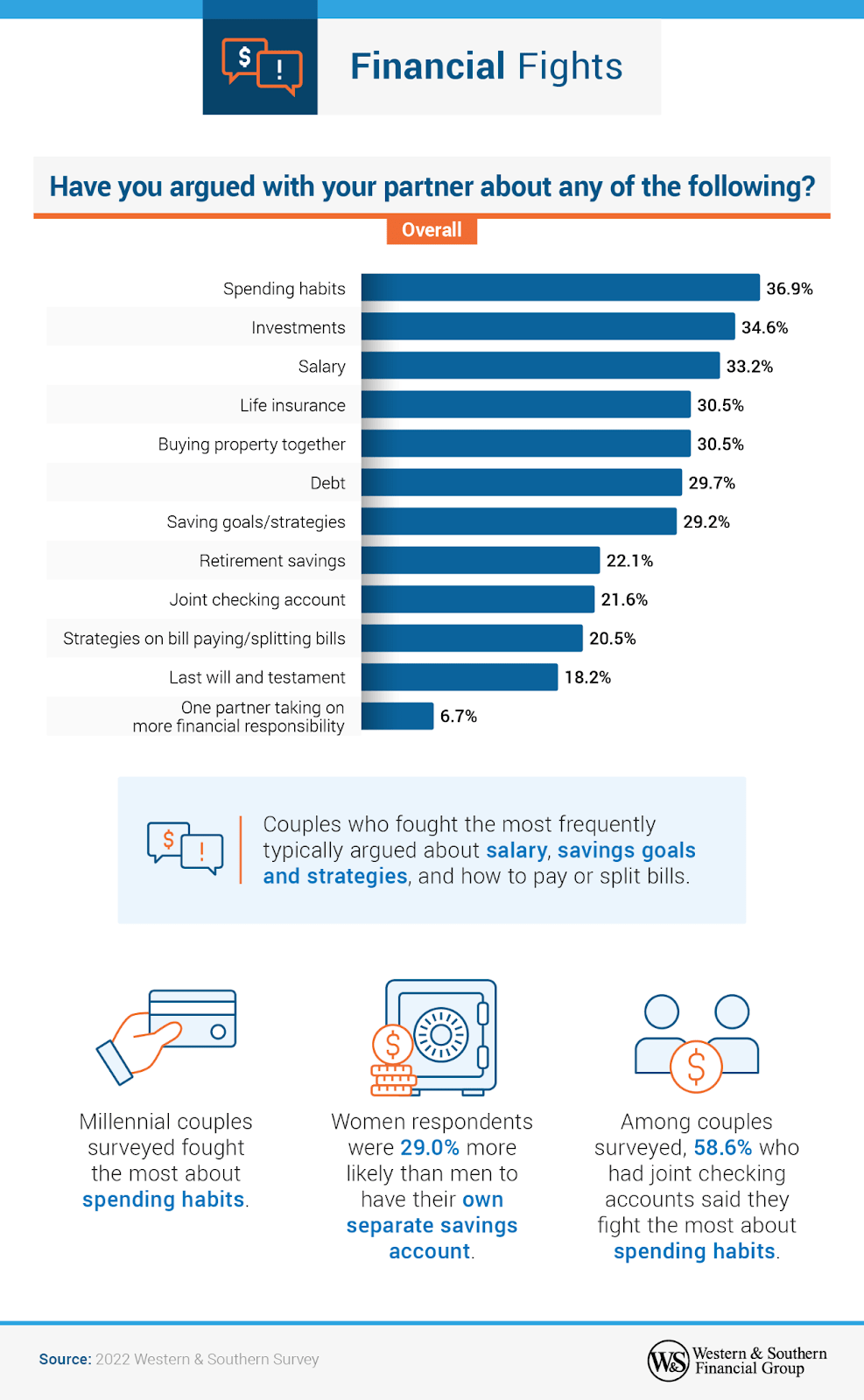

Partners’ spending habits were the cause of most arguments for those we surveyed — particularly among millennials (born 1980-1996). Now that pandemic restrictions have loosened, perhaps “revenge spending” (intense buying habits after being cooped up at home) has gotten the better of some. Whatever the reason for overspending, becoming more prudent with your money may save both your bank account and your relationship.

Sharing finances is likely the source of spending-related disagreements. More than half of couples with a joint checking account said most of their fights are about what each partner is spending money on. Many women surveyed would prefer to keep money aside on their own rather than fight about it: They were 29% more likely than men to have their own savings account separate from their partner.

Eliminate Your Red Flags

Before getting married, couples didn’t talk much about finances. But afterward, conversations around investments, joint checking and retirement savings started picking up steam. Now that they’re married, couples might feel they have all the time in the world to tackle these topics. But in reality, you might regret it if you wait too long to go over these things together.

If you’re still dating or looking for a partner, your best bet will be to get your personal loans and credit card debt out of the way, based on the sentiments of our respondents. Whether you’re in a relationship or not, making sure you’re financially literate will prepare you for money-planning conversations when they arise. The more informed you are, the less likely those chats will become quarrels.

Methodology

Western & Southern surveyed 1,008 married Americans about their finances. Of these adult respondents, 585 were men, 422 were women and one identified as nonbinary. Respondents included 118 baby boomers, 277 Gen Xers, 468 millennials, and 145 Gen Zers. Baby boomers were born 1955-1964, Gen Xers were born 1965-1980, Millennials were born 1981-1996, and Gen Zers were born 1997-2004. We also used these additional data sources for median personal income and average student loan debt.

About Western & Southern Financial Group

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500 company, is the parent company of a group of diversified financial services businesses. Its assets owned ($66 billion) and managed ($35 billion) totaled $101 billion as of June 30, 2022. Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company, Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fort Washington Investment Advisors, Inc.;1 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;1 Touchstone Securities, Inc.;2 W&S Brokerage Services, Inc.;1,2 and W&S Financial Group Distributors, Inc.

1 A registered investment adviser.

2 A registered broker-dealer and member FINRA/SIPC.

Review our current financial ratings.

Fair Use Statement

Find something useful in our study? Website may contain copyrighted material, the use of which may not have been specifically authorized by the copyright owner. This material is available in an effort to explain issues relevant to financial education, financial literacy and understanding. The material contained in this website is distributed without profit for educational purposes. Feel free to share it for any noncommercial purpose, but please link back to this page when doing so. This should constitute a “fair use” of any such copyrighted material (referenced and provided for in section 107 of the U.S. Copyright Law). If you wish to use any copyrighted material from this site for purposes of your own that do beyond “fair use,” you must obtain expressed permission from the copyright owner.