Transcript

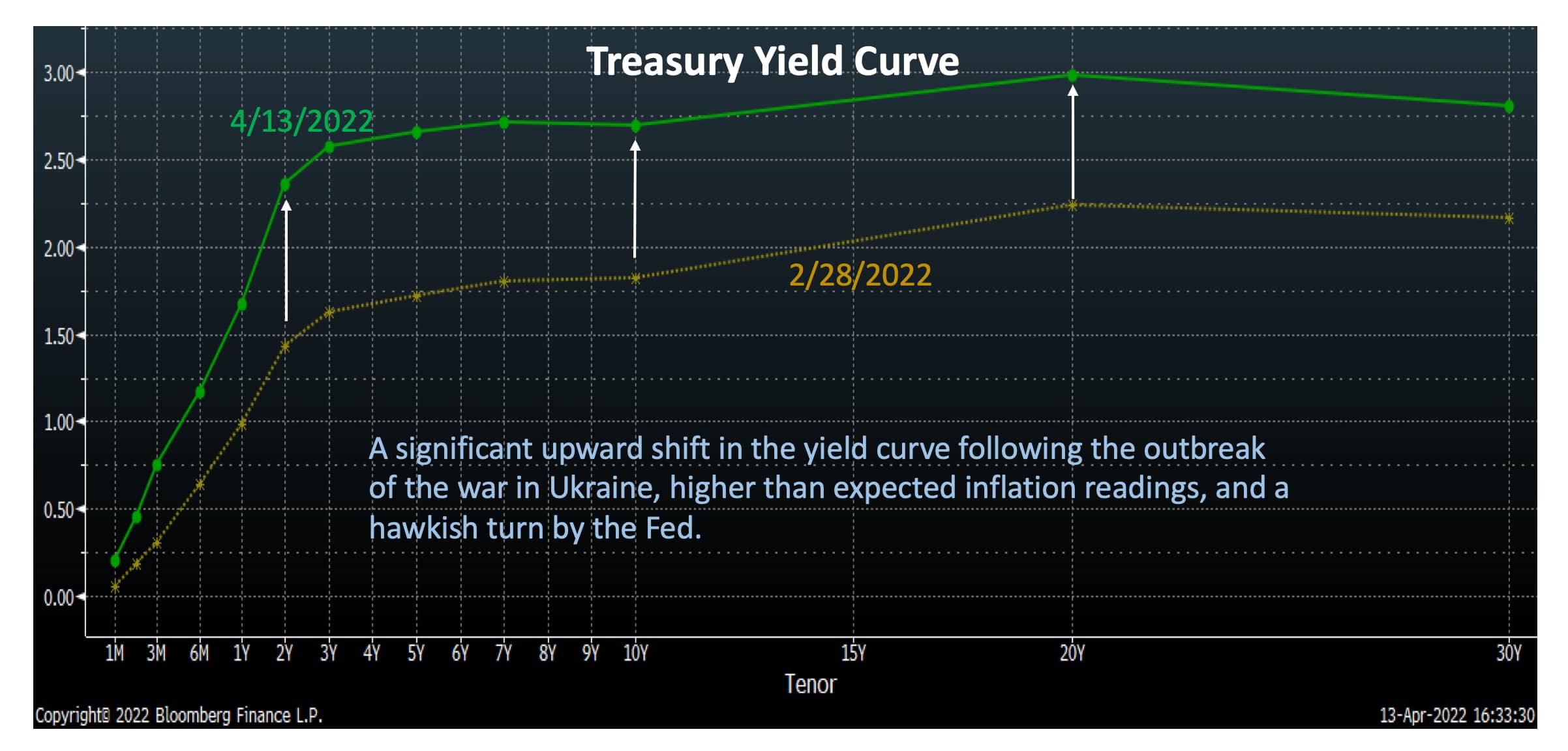

There's been a pretty big move in interest rates over the last six months, about 100 basis points across the curve, except for the very short end.

Source: Bloomberg

And I kind of wanted to sort of give an update on our thoughts on the market as result of that, because it's more than we had anticipated. I think the rise in interest rates is a function of higher than expected inflation, which the Fed admittedly says they're behind the curve, they're losing some credibility, and I think that brought about some change in tone, much more hawkish tone, and that also had an impact on the markets. But certainly year to date has been a brutal period for fixed income, and bonds have really sold off, but that selling off is adjusting to new conditions, and I think that we're arriving at a place that's more reasonable. We've taken up our duration outlook.

We're basically moved to be in line with the Bloomberg Aggregate benchmark as we see the risk more balanced at this point. As we look forward, economic growth is expected to slow. As a matter of fact, the amount of growth has kept been revised down, inflation is expected to slow, and at the same time we see a more aggressive Fed in terms of removing stimulus, and certainly fiscal stimulus has already been removed. So really as we look forward, we see an environment that's much more different than we have seen up to now. And I think that's going to have an impact on interest rates.

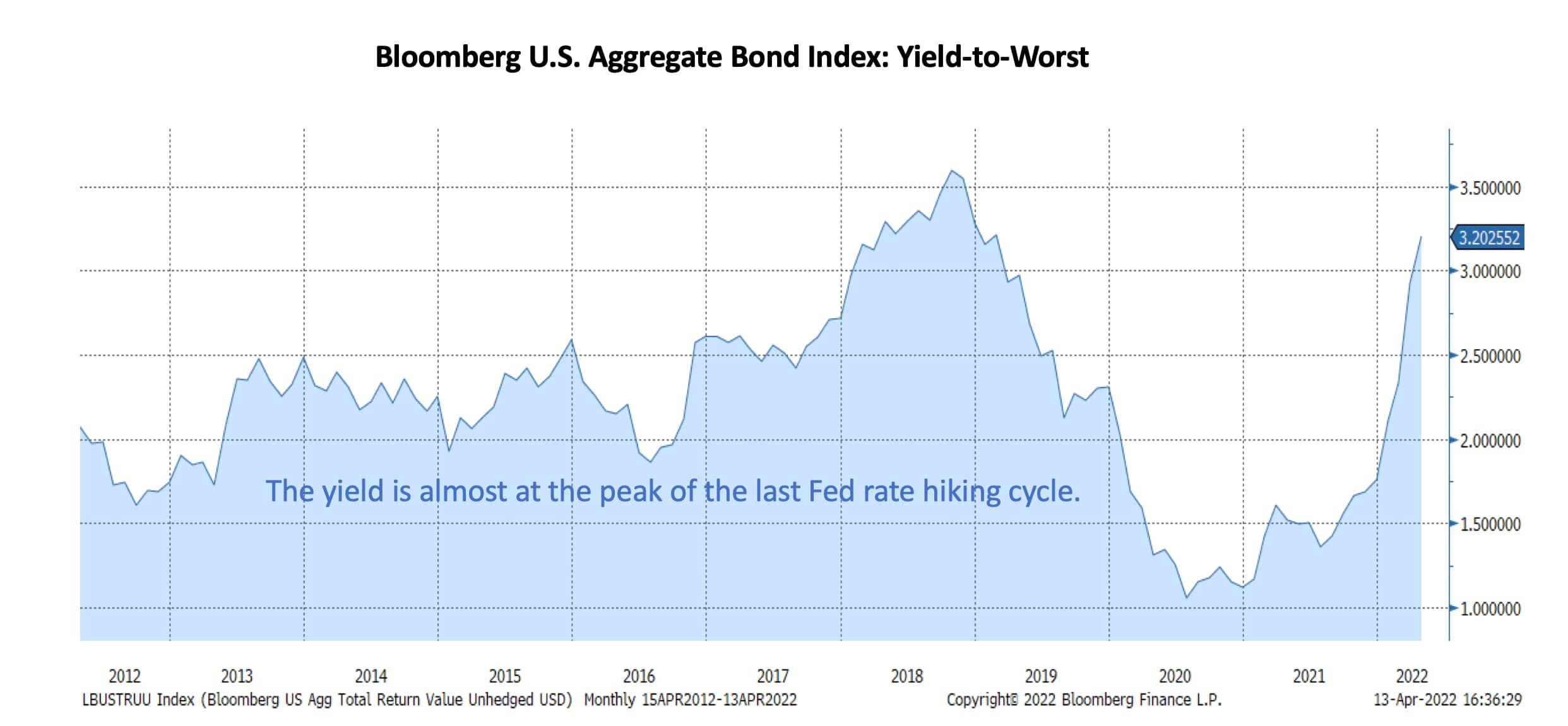

Source: Bloomberg

And some of the movement in interest rates is already starting to feed through into the economy. I mean, if you look at the housing sector, builder sentiment is starting to really fall as these higher interest rates really start to impact buying decisions. So that is what we changed within our fixed income outlook. On the equity side, we haven't made changes, although I think we're feeling a bit more cautious. We still have a more domestic bias just because we think that there's more risk internationally right now, just given the war that's going on, the fact that the Fed is getting a bit more hawkish and the Fed is the central bank to the world.

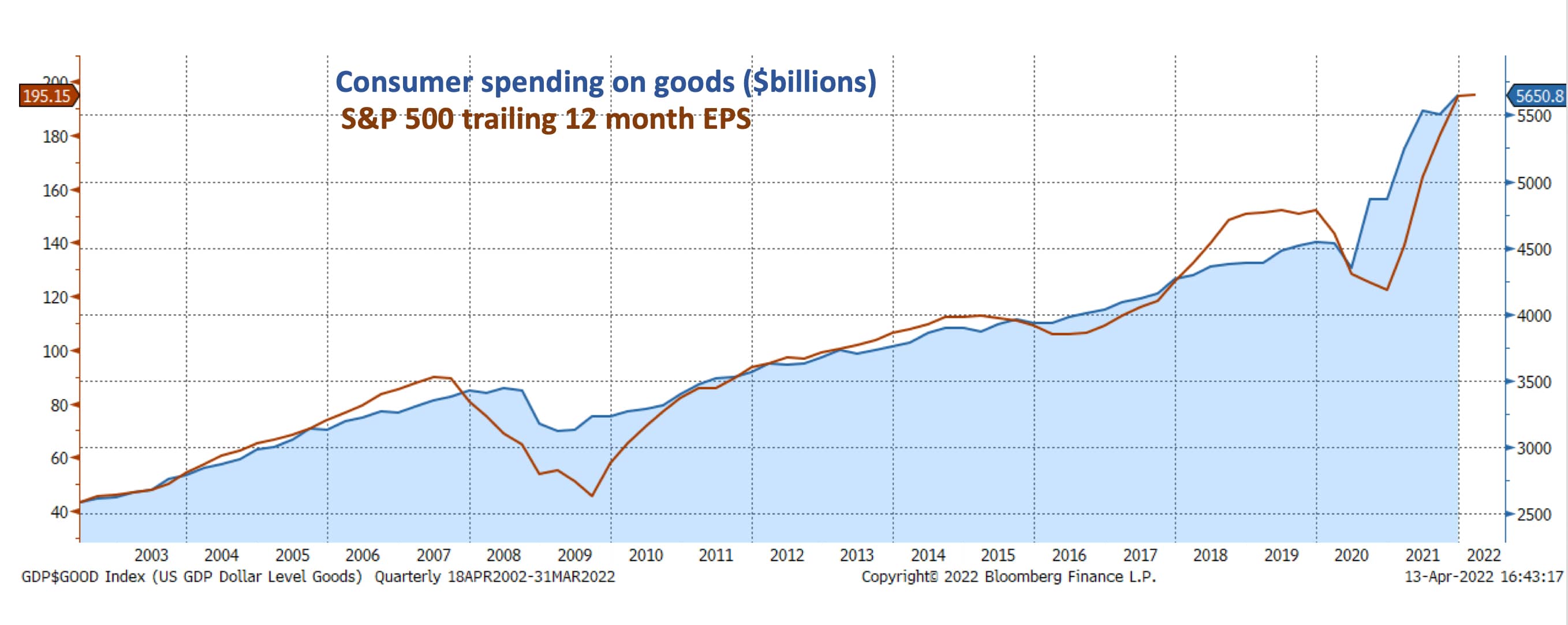

But within the domestic positioning, we recognize that the risk of recession is increasing, and we want to think about what could be happening with profit margins going forward. So far, they've been very healthy. Companies have been able to pass through price increases. This coming earnings season seems to look like it's going to be okay,

Source: Bloomberg

but I think it's going to get more and more difficult as we move through time, and that is why we are emphasizing a more active approach that looks at companies that have much better competitive profile, that should result in pricing power. And I think that's going to be a major differentiator within the marketplace going forward. And so that's what we're suggesting just in terms of positioning. Thank you.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security. There is no guarantee that the information is complete or timely. Past performance is no guarantee of future results. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Please visit touchstoneinvestments.com for performance information current to the most recent month-end.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.

*A registered broker-dealer and member FINRA/SIPC.

Not FDIC Insured | No Bank Guarantee | May Lose Value