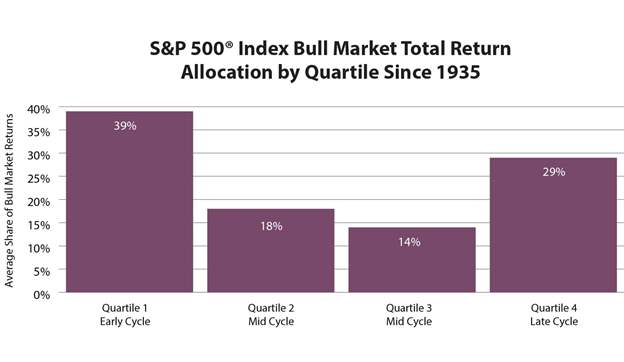

Why is market timing so hard? Maybe it is because the majority of bull market1 returns straddle bear markets. Market timers risk sacrificing the most beneficial portions of a bull market even if they slightly misjudge the market peak and trough. Getting in too late or getting out too early can leave a lot of return on the table.

1Our definition of a bull market is met when the market has produced a minimum return of 50% from the trough and is sustained for at least 6 months.

Sources: Bloomberg, Robert Shiller (Yale University)

There have been nine S&P 500 bull markets since 1935 (excluding the current one). The first started in March of 1935. The last ended in October of 2007. The chart above considers all nine, subdividing each into four equal time periods (e.g. a bull market that lasted four years would be divided into four separate periods of one year). We then determined what portion of the total bull market return occurred in each quartile. We found, on average, that over two-thirds of bull market returns have occurred in the first quarter (early cycle) and last quarter (late cycle) of bull markets.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security. There is no guarantee that the information is complete or timely. Past performance is no guarantee of future results. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Please visit touchstoneinvestments.com for performance information current to the most recent month-end.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Not FDIC Insured | No Bank Guarantee | May Lose Value