I want to talk about Dividend Yielding Stocks as an attractive investment opportunity.

Why?

Well not so much for the yield. At the end of August the yield for the S&P 500 was just 1.6%. Looking at dividend focused indexes, the S&P dividend aristocrats index had a yield of 2.5%, while the Dow Jones select dividend index had a yield of 4%. You could also buy the Bloomberg Agg and get a 4% yield. So the yields today are not necessarily that competitive with bonds, and they are also well below where inflation is running.

But maybe that’s not the way to look at it. History has shown that it is dividend growth that tends to be the more important driver of returns for dividend paying stocks.

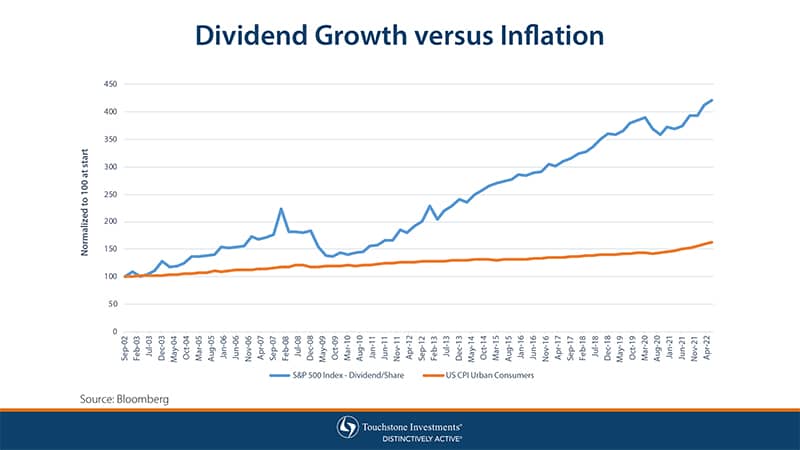

If we compare the growth of dividends per/share for the S&P 500 (where we have the most historical data) with headline CPI over the last 20 years a different and more attractive picture emerges.

All we are looking at is the growth in dividends/share – and it has significantly outpaced inflation. Now we are looking at the past, so we can’t assume this will continue, but digging into the data what I found was that cash flow growth was the main driver of this growth. It wasn’t a rise in the payout ratio, which is a positive. The payout ratio for the S&P 500, the dividend aristocrats and the dow jones select are all near their historic lows. In other words, there is room to grow.

All we are looking at is the growth in dividends/share – and it has significantly outpaced inflation. Now we are looking at the past, so we can’t assume this will continue, but digging into the data what I found was that cash flow growth was the main driver of this growth. It wasn’t a rise in the payout ratio, which is a positive. The payout ratio for the S&P 500, the dividend aristocrats and the dow jones select are all near their historic lows. In other words, there is room to grow.

Another way to look at this chart is through the eyes of a younger investor. Say you invested 20 years ago and assume the dividend yield at that time was 2%. You were young so you reinvested those dividends and there was likely price appreciation as well, but just on that original investment, due to dividend growth after 20 years you were getting 4x that 2% yield, so 8%. The idea here is that by the time one is ready to retire there exists a healthy dividend income stream that one could tap into.

So I believe dividend growth is important. But there are a few other things to mention:

Dividend yielding stocks have historically tended to be less volatile than the overall market. Part of this is due to the sector mix that includes the more defensive Utilities and Consumer staples sectors. There is also an argument that dividend payors tend to be well capitalized and more mature, though that is a generalization.

Another consideration is to think twice about reaching for yield with dividend paying stocks. A high dividend yield can be a sign of stress. Stressed companies typically underperform in down markets and higher dividend yielding stocks are less likely to deliver as fast a pace of dividend growth.

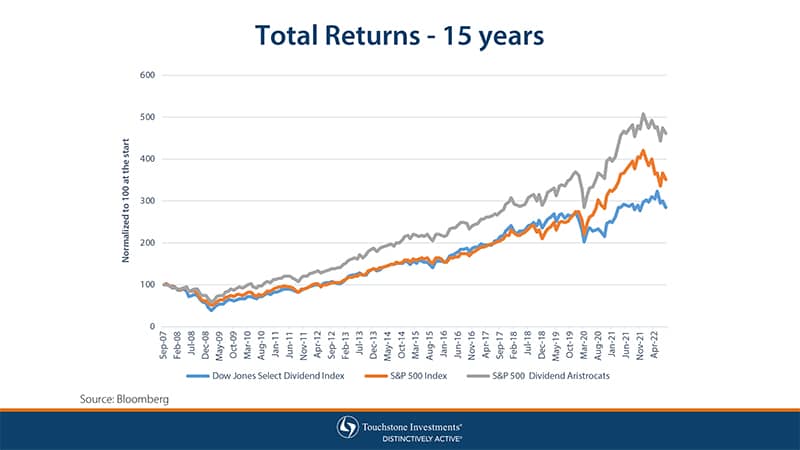

That leads to some thoughts about how to approach dividend investing. There are funds and ETFs that follow a number of different dividend indexes. One does need to be aware of how these indexes are constructed – it matters. The Dow Jones select dividend index is simply the top 100 stocks by dividend yield, so there is some reaching for yield in this index. The aristocrats uses a construction methodology that focuses on a history of past dividend increases.

As can be seen in this historical chart there can be big return differences between dividend indexes – dividend investing is not cookie cutter.

Another consideration is that dividend indexes can hold significant sector and/or single stock concentration risk. I would suggest a more diversified approach that typically cannot be found in an off the shelf dividend index to mitigate this risk. Also I am certainly partial to a focus on dividend growers.

The landscape today is an uncertain one, interest rates are rising, the Fed is tightening, the economy is slowing, and Markets are down. But these are near term issues – maybe it would be more prudent to look through this, maybe even take advantage of this market weakness and focus on the longer term. History would suggest that over the long term stocks with growing dividends can provide a more stable path to building wealth and income.

For more of our thoughts on U.S. equities please visit our website at Touchstone Funds.com

The expressed views and opinions contained in this material are those of Touchstone's Global Market Strategist based on current market conditions and are subject to change without prior notice. There is no assurance that the opinions contained in this material will occur, this information is offered as a broad range of possible outcomes. This information does not take into account the specific investment objectives, restrictions, tax and financial situation of any individual client. Performance statements are historical. None of the information contained herein should be construed as an offer to buy or sell securities as an investment recommendations. This material is not intended to serve as the primary or sole basis for any investment decision. This information represents general market activity or broad based economic, market or political conditions and should not be construed as research or investment advice.

Please consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Funds. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one at TouchstoneInvestments.com/literature-center or call Touchstone at 800.638.8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Touchstone is a member of Western & Southern Financial Group

©2022, Touchstone Securities, Inc.