Proceeding With Caution

We approach 2025 with cautious optimism due to expected Fed rate cuts and resilient economic conditions. We had been in the soft-landing camp, but now we are questioning whether the landing gear even needs to come down. The U.S. election outcome adds some uncertainties though generally appears to be domestically risk-asset friendly, though internationally less friendly.

Key Points

Touchstone 2025 Investment Letter

Video Transcript

The best way to summarize our thoughts about 2025 is that it will be interesting. We are biased toward domestic equities, even more so with the

GOP sweep, but we want to be careful with valuations. Unlike 2024, we believe income will play a bigger role in returns, though we remain slightly overweight equities.

We approach 2025 with cautious optimism due to expected fed rate cuts and resilient economic conditions. The US election outcome adds some uncertainty, though generally appears to be domestically risk asset friendly, though internationally less friendly. A resilient US economy and a monetary policy pivot are expected to support risk assets despite uncertainties. We favor domestic equities, especially smaller cap stocks, while underweight international equities. Credit sensitive bonds look attractive given total return potential as the fed cuts rates into a growing economy.

Market cycles follow earnings and economic cycles. The S&P 500’s 36% rise in the past year implies a rebound from a deep recession, a rare occurrence

in the last 50 years. Despite US economic resilience, S&P 500 valuations seem excessive. To navigate this, strategies include focusing on smaller market caps and U.S. fixed income. International equities have a less favorable outlook, with weak earnings growth in developed markets and risks and opportunities in emerging markets.

Thank you for joining us. We hope this analysis provides valuable insights for your investment decisions. For more information, please contact your Touchstone representative or visit our website.

The U.S. Economy: More of the Same?

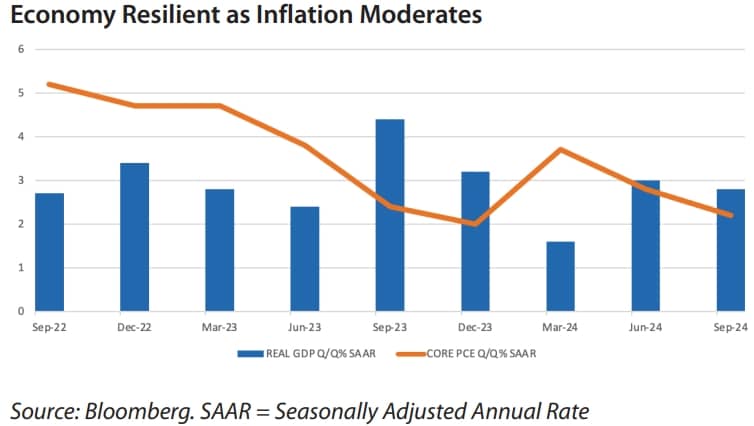

The U.S. economy in 2025 will likely echo the trends of the last two years. We anticipate economic growth to slow but still surpass current expectations of 1.9%. Inflation is expected to moderate, though the pace of moderation may frustrate those expecting significant rate cuts.

We had been in the soft-landing camp, but now we are questioning whether the landing gear even needs to come down.

This backdrop appears favorable for U.S. risk assets, as it depicts economic resilience amid normalizing monetary conditions. Not only is the U.S. Federal Reserve (Fed) expected to reduce rates, the majority of global central banks are also expected to be in easing mode. The other likely positive for U.S. risk assets may come from the new President-elect Donald Trump administration which is likely to loosen the regulatory constraints on U.S. businesses and potentially lower corporate taxes.

However, several factors temper our enthusiasm: the unique nature of this economic cycle makes forecasting challenging, risk assets are already discounting a very optimistic outlook, some policy initiatives may not be business friendly such as tariffs (and likely retaliatory tariffs) and deportations, and lastly, we still face numerous geopolitical uncertainties.

Positioning Summary: Cautious Optimism

Looking ahead, we approach 2025 with cautious optimism, though we are not expecting a smooth ride. We currently have a slight equity overweight that favors U.S. stocks. We are overweight small and mid cap stocks and high yield bonds which we believe are better positioned to benefit from Fed rate cuts. We maintain an underweight in large cap Growth stocks due to rising stock concentration and high valuations which introduce significant stock-specific risk. We are underweight international equities as relative earnings growth prospects remain elusive, especially with an expected tariff war.

Please read further for deeper insights on asset classes.

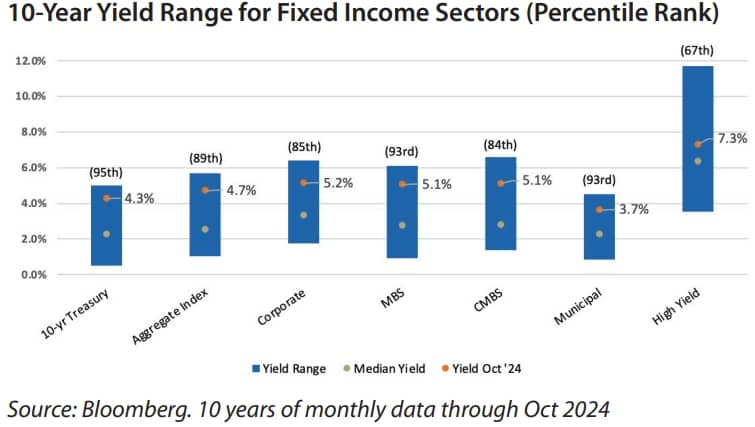

Fixed Income: Appealing Yields

With bond market yields near the upper end of their 10-year range, we see income opportunities for 2025. Historically, bond returns have often been positive during easing cycles, even after the 1995 soft landing. It’s also common for bond yields to rise at the start of an easing cycle, only to decline as cuts continue. For now, we’re cautious about interest rate risk but plan to capitalize on attractive long-term yields as macroeconomic or fiscal conditions shift.

81% of bonds in the world trade below a 5% yield. However, we see numerous avenues to find higher yields without taking significant risk. We have a slight preference for high yield bonds, as corporate credit remains stable, supported by solid earnings growth expectations, strong balance sheets, and minimal refinancing pressure. Admittedly credit spreads are tight, leaving little room for further compression. However, the total return potential looks appealing given a yield-to-worst of over 7% for the Bloomberg U.S. Corporate High Yield Index. We also note that recent data on defaults suggest they have peaked.

Beyond high yield, with a low unemployment rate and solid wage growth consumer-oriented securitized credit remains an attractive option. Even investment-grade corporates and asset-backed securities have relatively attractive yields.

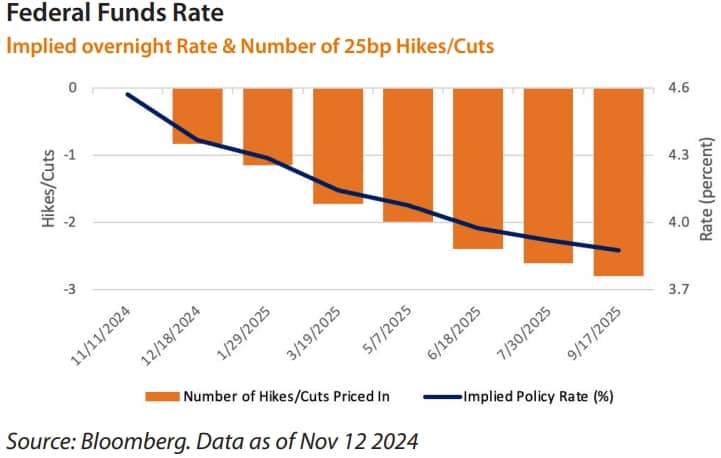

Our fixed income underweight is only slight given high current yields and its defensive characteristics amid the potential volatility we expect for equities in 2025. Although the Fed has begun to reduce rates, questions remain about the pace of rate cuts and their eventual stopping point. We don’t envy the Fed’s job. Given the unique nature of this economy, it is difficult to read through to the monetary impact. After cutting 75 basis points in less than two months we expect the pace of cuts to slow dramatically in 2025.

The recent GOP victory introduces more uncertainty given several of its policy proposals. Ironically, while the election was viewed as a referendum on inflation, immigration and trade policies - if fully implemented - could create labor shortages and higher import taxes, potentially triggering a second wave of inflation and slow economic growth. Additionally, GOP tax cut proposals for individuals and corporations may contribute to already unsustainable federal deficits, potentially raising government borrowing costs as Treasury investors demand a higher yield premium. This environment presents a risk that rates stay higher for longer.

Large Cap U.S. Equities: A Bit Stretched

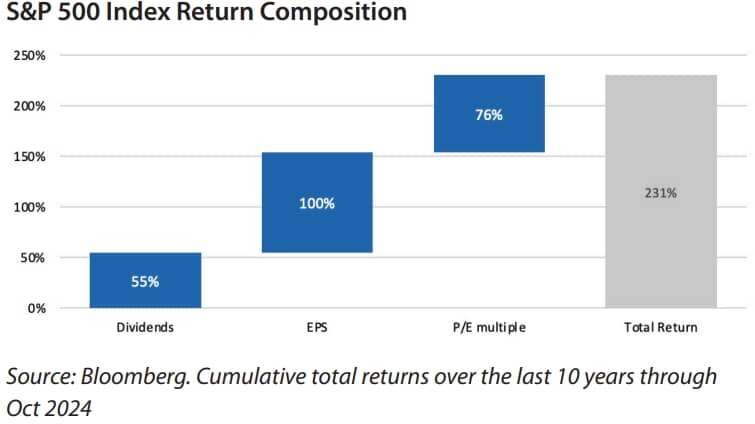

We currently hold a tactical neutral position in large cap equities with a slight bias toward Value. The S&P 500 has benefited significantly from multiple expansion, particularly among mega-cap technology companies due to stronger relative earnings growth and expectations for better earnings growth to continue well into the future, the latter of which has driven P/E ratios higher.

Based on analyst estimates, S&P 500 earnings are projected to be in the low teens for 2025, with profit margins anticipated to expand by nearly 1 percentage point to an all-time high. Typically, in economic recoveries, markets anticipate earnings growth, followed by actual earnings catching up. However, we do not foresee an economic recovery; instead, we expect a moderate slowing in economic growth and inflation. We believe that earnings may fall slightly short of 2025 expectations but not significantly. Should earnings be the performance driver next year, that would suggest an expected price return of 5-10% for the S&P 500.

Based on analyst estimates, S&P 500 earnings are projected to be in the low teens for 2025, with profit margins anticipated to expand by nearly 1 percentage point to an all-time high. Typically, in economic recoveries, markets anticipate earnings growth, followed by actual earnings catching up. However, we do not foresee an economic recovery; instead, we expect a moderate slowing in economic growth and inflation. We believe that earnings may fall slightly short of 2025 expectations but not significantly. Should earnings be the performance driver next year, that would suggest an expected price return of 5-10% for the S&P 500.

Value and Growth: The Conundrum

Our Value bias is grounded in relative valuation, though we acknowledge valuation is not a good timing tool. While earnings growth in 2024 has been led by Growth stocks, Value stocks may drive earnings growth in 2025, at least at the margin. S&P 500 Value Index earnings are anticipated to grow 11% after no earnings growth in 2024. Value stocks could also benefit from further easing in financial conditions.

However, our preference for Value is less about its outlook and more about our concerns regarding Growth stocks. The Growth index has become highly concentrated, with the top 5 stocks in the Russell 1000 Growth Index comprising 45% of the market cap, and valuations have expanded significantly. This combination brings considerable stock-specific risk. While these stocks have shown solid earnings growth, the rate of growth is expected to halve in 2025 compared to 2024. These stocks may need to pause and allow earnings to catch up with valuations.

Mid and Small Caps: Attractive

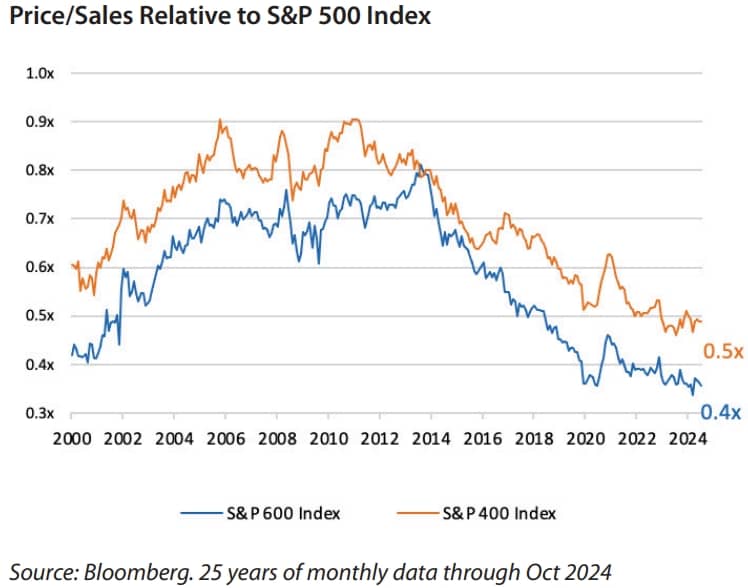

Nevertheless, we can’t ignore the generally favorable backdrop of a resilient economy, global central bank easing, and the potential for a corporate tax cut. To achieve our domestic equity overweight, we have opted to emphasize mid and small cap equities, which are historically inexpensive relative to large caps and more likely to benefit from the current backdrop.

Although higher rates did not significantly impact the broader economy, smaller companies have been more affected, thus a rate reversal could be positive for the asset class. Small cap earnings have been in a two-year recession. The projected 17% earnings growth for 2025 is encouraging, although not that much of a reach considering they would still be shy of the 2022 peak. Additionally, mid and small caps could benefit from less regulatory constraints and a potential surge in M&A, given less stringent antitrust policies. Unlike large caps, we believe mid and small cap stocks have the potential for both multiple expansion and earnings growth.

Domestic Equity Risks: Monitoring

- A scenario of a soft/no economic landing, Fed rate cuts, and excitement around a new technology sounds eerily similar to the late 1990s. While we don’t believe that AI-related stocks are currently in a bubble, we acknowledge the potential for one to develop. Our modest underweight to Growth means we are not avoiding the space entirely, though we could underperform if AI enthusiasm pushes these stocks significantly higher.

- Our pro-cyclical positioning in mid and small caps is partly based on the potential for lower interest rates. In our fixed income analysis, we highlight the risk of persistently higher long-term rates and a potential slowing in the pace of Fed rate cuts. Our economy is somewhat unbalanced, with higher-income consumers thriving while lower-income consumers face challenges. Higher rates for an extended period could exacerbate the stress points. Additionally, some of the new administration’s policy proposals may introduce economic headwinds. We will monitor these factors closely and have contingency plans in place should conditions deviate from our base case.

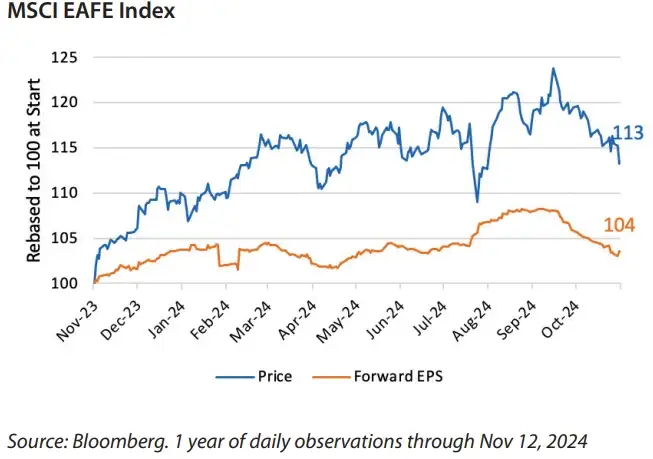

International Equities: Underweight

We have a slight tactical underweight in both developed and emerging market equities. In 2024, we began to reduce our developed international underweight, driven by our belief that the U.S. dollar had peaked and in anticipation of an economic recovery in greater Europe. However, that recovery has been slow to materialize, and earnings estimates continue to be revised downward. Reduced demand from China, a key export market for developed economies, has been a significant factor.

Analysts estimate that the MSCI EAFE Index will deliver just 5% earnings growth in 2025, following a modest 2% growth in 2024. It is hard to get excited about that rate of growth. We do expect continued monetary easing from the Bank of England and European Central Bank, which should alleviate some economic pressure. However, the incoming Trump administration creates further uncertainties with respect to tariffs.

Assessing emerging markets (EM) is always complex, as each country has unique strengths and weaknesses. In a broad sense, two primary factors will likely impact EM performance next year: U.S. monetary policy and the approach to tariffs under the Trump administration.

Emerging markets tend to benefit from looser U.S. monetary conditions. However, as discussed in our fixed income analysis, long-term rates may remain elevated, and the Fed could slow its pace of rate cutting. Additionally, the Trump administration’s stance on tariffs could impact EM growth. Many EM economies have benefited from the reshoring of Chinese manufacturing, but President-elect Trump aims to bring that production to the U.S., potentially redirecting foreign direct investment from EM to the U.S. During the previous Trump administration, EM underperformed, with tariffs and a trade war being significant factors.

There are potential offsets, as earnings growth in EM has been strong and is projected to remain in the teens in 2025. Additionally, China has started implementing more stimulus, which could stabilize this important EM economy. An active manager may be in a better position to manage through the cross currents.

Concluding Thoughts: Cautiously Optimistic

Market cycles tend to be a function of earnings cycles, which, in turn, track economic cycles. Our soft/no landing base case suggests the economy will not contract (that’s good), but it also suggests only a modest rebound, when it comes. However, with the S&P 500 up 36% in the past 12 months through October, it’s behaving as if we are rebounding from a deep recession. A review of the last 50 years shows that 12-month returns above 36% are rare, occurring only 22 times in 600 observations.

We are encouraged by U.S. economic resilience but concerned that the S&P 500 valuations have outpaced fundamentals. This has led us to find other ways to participate in this positive backdrop of economic resiliency and less restrictive monetary conditions, such as looking down in market cap. U.S. fixed income remains appealing with attractive yields, both absolute and inflation-adjusted. International equities present a less positive outlook with developed markets facing sub-par earnings growth and diverse emerging markets offering plenty of risk and opportunity.

The Touchstone Asset Allocation Committee

The Touchstone Asset Allocation Committee (TAAC) consisting of Crit Thomas, CFA, CAIA – Global Market Strategist, Erik M. Aarts, CIMA - Vice President and Senior Fixed Income Strategist, and Brian Cheyne, CFA, CIMA - Senior Investment Strategy Specialist, develops in-depth asset allocation guidance using established and evolving methodologies, inputs and analysis and communicates its methods, findings and guidance to stakeholders. TAAC uses different approaches in its development of Strategic Allocation and Tactical Allocation that are designed to add value for financial professionals and their clients. TAAC meets regularly to assess market conditions and conducts deep dive analyses on specific asset classes which are delivered via the Asset Allocation Summary document. Please contact your Touchstone representative or call 800-638-8194 for more information.

Word About Risk

Investing in Equities is subject to market volatility and loss. International and Emerging Markets equities also carry the associated risks of economic and political instability, market liquidity, currency volatility and differences in accounting standards. The risks associated with investing in international markets are magnified in Emerging Markets. Fixed Income/Debt securities can lose their value as interest rates rise and are subject to credit risk which is the risk of deterioration in the financial condition of an issuer and/ or general economic conditions that can cause the issuer to not make timely payments of principal and interest also causing the securities to decline in value and an investor can lose principal.

The information provided represents Touchstone’s views and observations regarding past and current market conditions and investor behaviors. The information and statements provided herein are believed to be true and accurate. There can be no assurance however that the beliefs expressed herein will be consistent with future market conditions and investor behaviors.

Investing in Equities is subject to market volatility and loss. International and Emerging Markets equities also carry the associated risks of economic and political instability, market liquidity, currency volatility and differences in accounting standards. The risks associated with investing in international markets are magnified in Emerging Markets. Fixed Income/Debt securities can lose their value as interest rates rise and are subject to credit risk which is the risk of deterioration in the financial condition of an issuer and/or general economic conditions that can cause the issuer to not make timely payments of principal and interest also causing the securities to decline in value and an investor can lose principal. Performance data quoted represents past performance, which is no guarantee of future results.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA and SIPC

Touchstone is a member of Western & Southern Financial Group

Not FDIC Insured | No Bank Guarantee | May Lose Value