International Developed (EAFE) vs. U.S.

Investing in developed international stocks has historically provided investors with:

- Diversification: portfolios that included international stocks have historically produced higher risk-adjusted returns (Flavin and Panopoulou).

- Opportunity: 76% of publicly traded companies are not U.S.-based (Source: MSCI) and 40% of the global market cap resides outside of the U.S. (Source: Bloomberg). Why limit equity exposure to just a fraction of the total market opportunity set?

But why now...

Conclusion: We moved to an EAFE underweight at the start of Russia’s invasion of Ukraine. While relative valuation remains attractive, we see near-term risk to relative earnings prospects. We are also concerned about tighter monetary conditions in Europe as core inflation remains high, while economic growth slows.

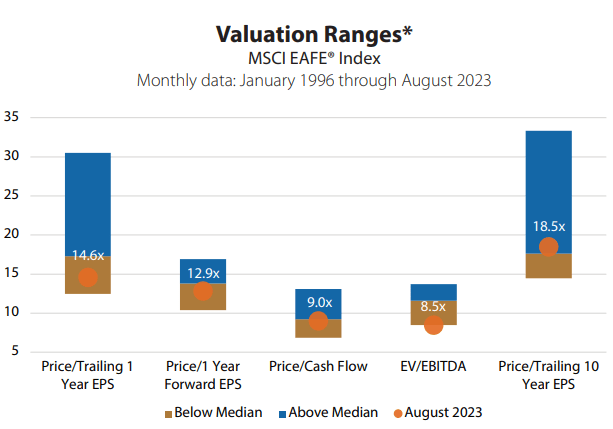

Relative Valuation

Relative valuation in a historical perspective clearly favors EAFE, and versus its own history, our combined valuation measures rank the MSCI EAFE Index in the bottom third. For the active manager, we believe there may be opportunities to uncover, but we also recognize that the risk profile has also increased, partly offsetting the valuation differential.

*Valuation ranges date back to 1996. The

minimum and maximum ranges are set to the 5th and 95th percentiles,

respectively, to remove outliers.

Sources: Bloomberg, MSCI

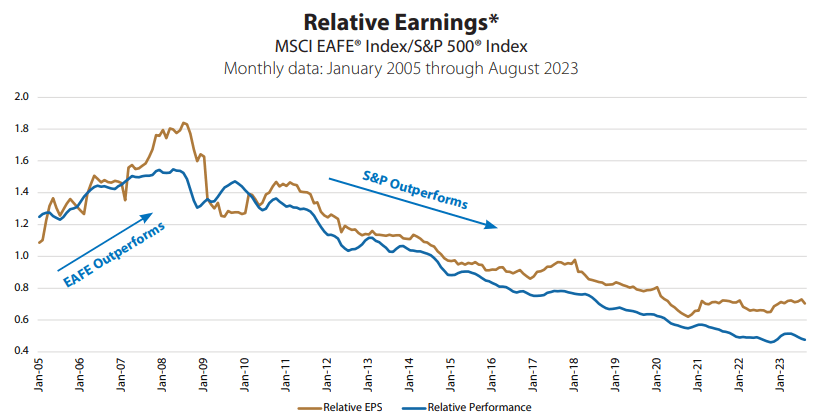

Relative Earnings Prospects

- Relative price performance and relative earnings growth have historically followed a similar path. Relative earnings growth since mid-2008 has favored the S&P 500® Index versus the MSCI EAFE® Index.

- After some relative gains in 2022, MSCI EAFE forward earnings have simply kept pace with the S&P 500®. These earnings measures, though, are in U.S. dollars. In local currency terms, MSCI EAFE earnings have done slightly better, namely due to stronger growth out of Japanese equities. European equities have benefited from price increases, though we question the sustainability of these gains, especially given signs of economic weakness.

*In U.S. dollars.

Sources: Bloomberg, MSCI

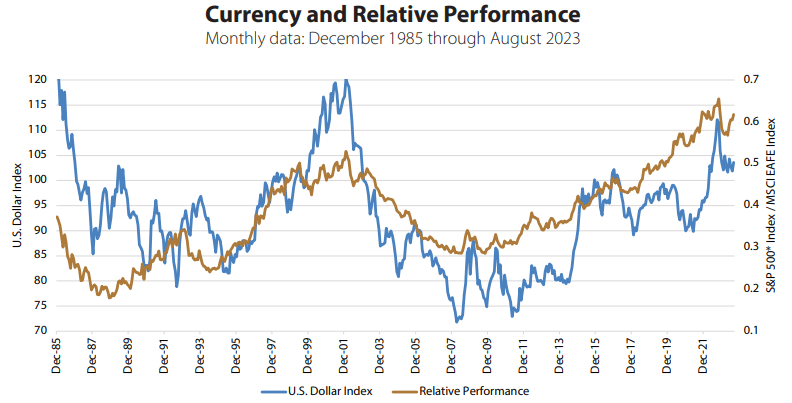

Monetary Policy/Currency

- Historically the U.S. dollar typically moves directionally with U.S. stock relative performance. A sustained period of U.S. dollar weakness would provide a tailwind for international stocks.

- The dollar has been relatively stable this year versus the pound and euro. This is mainly due to similar monetary policy tightening paths. The inflation picture in the U.S. looks better than for Europe, which is helping the dollar.

- The yen, though, has been quite weak as the Japanese central bank has been maintaining a much looser policy stance. The Bank of Japan has started a measured relaxing of its yield curve control policy.

Sources: Bloomberg, Intercontinental Exchange

Glossary of Investment Terms and Index Definitions

Thomas J. Flavin, Ekaterinin Panopoulou, “On the robustness of international portfolio diversification benefits to regime-switching volatility,” Journal of International Financial Markets, Institutions and Money, 2009.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security. There is no guarantee that the information is complete or timely. Past performance is no guarantee of future results. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Please visit touchstoneinvestments.com for performance information current to the most recent month-end.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Not FDIC Insured | No Bank Guarantee | May Lose Value