Credit Risk

Corporate bonds have a higher yield than duration-equivalent Treasuries, mainly to compensate investors for default risk. This difference in yield, termed the credit spread, fluctuates over time. Credit risk refers to the risk of rising (or widening) credit spreads. In the following pages we broadly evaluate credit spread drivers to help gauge where the opportunity lies across the quality spectrum.

Conclusion: Financial conditions moved swiftly toward being tight as the Fed shifted to a more aggressive approach to monetary tightening and suggested it was willing to sacrifice economic growth to tame inflation. The changed backdrop of a more aggressive Fed led us to shift toward higher quality exposure. Despite a pick-up in default rates, credit spreads have narrowed. Much higher yields across fixed income have us leaning toward investment grade where we can manage economic risk and earn a decent return.

Financial Conditions

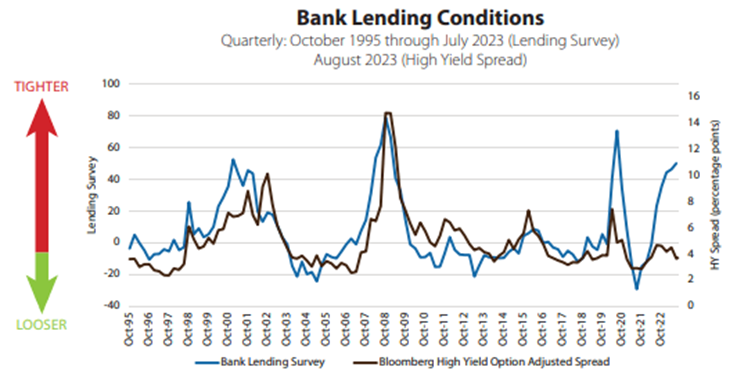

Financial conditions refers to how easy or difficult it is to access credit. We look at a number of indicators including monetary policy, lending surveys, financial condition indexes, and rating agency upgrades and downgrades. Tighter financial conditions historically have been accompanied by a widening in high yield spreads, and vice versa.

- There are a number of different ways to measure financial conditions. One way is through public markets looking at risk asset price trends and credit spreads. By this measure, financial conditions appear loose, but a low level of net issuance suggests otherwise. Also, private market conditions continue to tighten as can be seen in the bank lending survey below. Interest rates themselves have risen significantly, raising borrowing costs across the board, raising the cost of capital.

Sources: Bloomberg, Federal Reserve

Sources: Bloomberg, Federal Reserve

Degree of Speculation

The degree of speculation built up during an expansion can significantly compound the subsequent decline. It can also cause the universe to be more vulnerable to economic weakness and/or tighter financial conditions. We evaluate three broad areas: credit issuance, quality of debt outstanding, and debt coverage. We have seen some mixed results for these factors, with less speculation seen in the fixed high yield market and more speculation in leveraged loans.

Issuance: Both high yield bond and leverage loan new issuance remain depressed following a significant rise in rates.

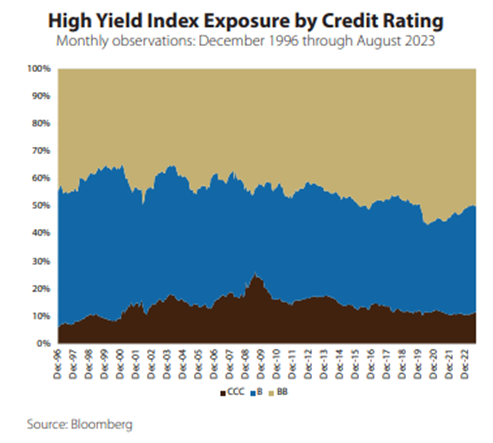

Quality: Exposure to the lowest tranche of credit quality for fixed high yield debt did not get extended as seen in past cycles and exposure to the highest tranche accounted for over half the index.

The story is just the opposite for floating rate debt, where the highest quality tranche has been shrinking. Additionally strong demand for loans has led to a significant deterioration in covenants.

Coverage: Coverage ratios have improved as a significant portion of issuance had been rolling older debt into lower interest rates and longer maturities. That also means there is a lower than typical percentage of bonds coming due in the next 12-18 months—this is often referred to as the maturity wall.

Economic Cycle

Credit spreads compensate investors for the risk of default. Default risks are cyclical. Credit spreads tend to narrow as the economy expands and widen as the economy contracts. The chart below looks at industrial production and profits growth. Defaults tend to rise when profits fall and vice versa. Profits are now down year-over-year and defaults have begun to rise. Current high yield credit spreads are not consistent with weakening economic conditions.

Sources: Bloomberg, U.S. Bureau of Labor Statistics

Relative Valuation

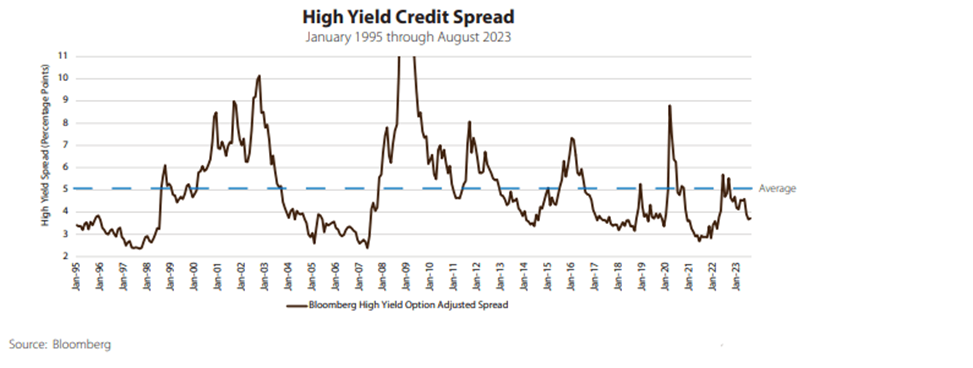

The previous sections covered fundamental considerations with respect to lending conditions, the economic backdrop, and the amount and quality of debt outstanding. We believe that the current valuation of debt (as measured by the credit spread) should be at least reflective of the underlying fundamentals to appropriately compensate investors for taking on additional credit risk.

- At the end of February, the high yield credit spread was 372 basis points above duration equivalent Treasury yields, putting it in the 35th percentile of historical monthly observations. These spreads are not indicating any signs of economic stress. We do acknowledge that many issuers have refinanced into lower coupon debt with longer maturities lessening default risks, but don’t believe that would fully insulate the sector from economic weakness.

Glossary of Investment Terms and Index Definitions

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security. There is no guarantee that the information is complete or timely. Past performance is no guarantee of future results. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Please visit touchstoneinvestments.com for performance information current to the most recent month-end.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Not FDIC Insured | No Bank Guarantee | May Lose Value