Global equity markets have generally provided positive returns in 2023, a sharp reversal relative to this time last year. However, there are significant variances between the stronger and weaker performers. Many investors are asking if this is the start of a new bull market. At this point we are more cautious than optimistic.

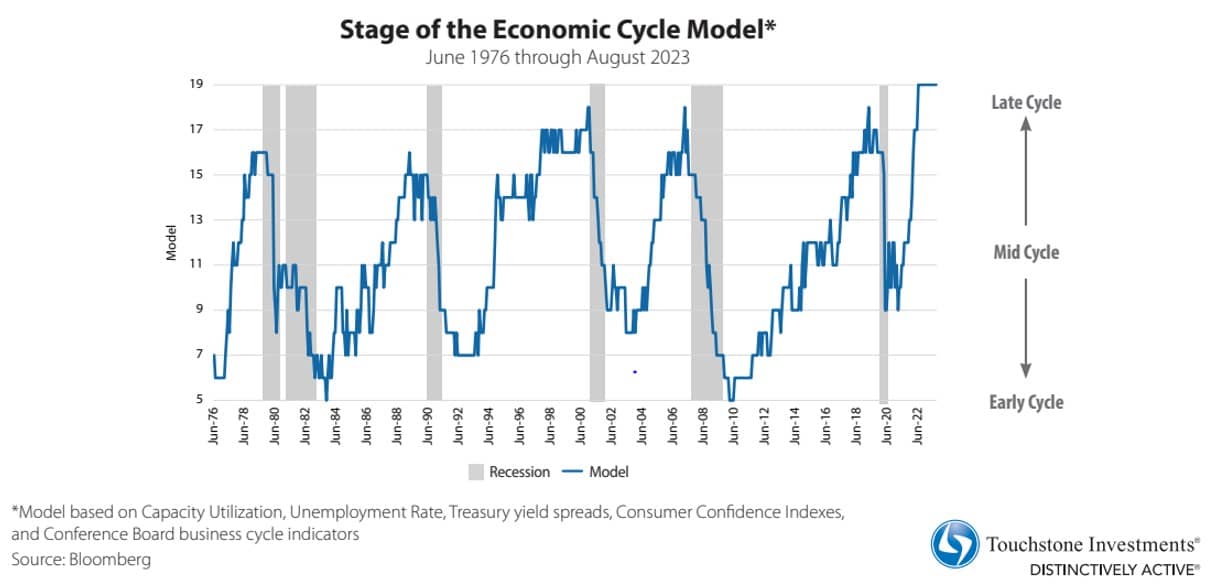

In the U.S. we believe the signs are indicative of a late-cycle market. Classic indicators of an early-cycle or recovery include value stocks outperforming growth, small-caps beating large caps, and strong performance from a broad portion of equities. We just are not seeing that at this point. For example, through September 14 the 10 largest stocks of the S&P 500 have outperformed the overall index by more than 30 percentage points.

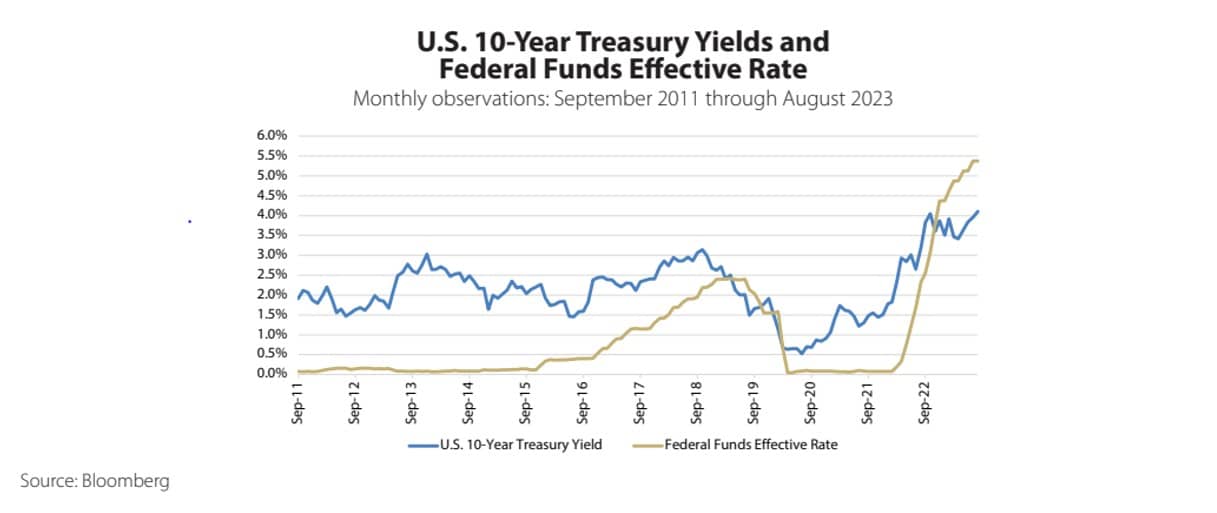

In the spring of 2022 the Federal Reserve began an aggressive interest rate hiking cycle.

In fact, they raised rates about as much as in prior cycles but did so in approximately half the time. Due to lag effects we do not believe the full impact of the Fed’s actions have been realized. The U.S. labor market and consumer spending has remained positive so far this year, likely counterbalancing some of the Fed’s interest rate moves. However, hairline fractures in the strength of the consumer are starting to emerge. Job growth is slowing, wage growth is slowing, and credit card and auto loan delinquencies are on the rise.

Our base case continues to be that the economy falls into a mild recession likely starting in 2024, which has become an out of consensus call.

We see small- and mid-cap stocks valuations at the low end of their historical range. In other words, priced as if a recession has already materialized. However, large cap stocks are trading at the higher end of their historical range. If our view of a 2024 recession plays out, we believe the low relative valuations for small and mid cap stocks create a foundation for stronger returns relative to large caps when the recovery begins.

We see small- and mid-cap stocks valuations at the low end of their historical range. In other words, priced as if a recession has already materialized. However, large cap stocks are trading at the higher end of their historical range. If our view of a 2024 recession plays out, we believe the low relative valuations for small and mid cap stocks create a foundation for stronger returns relative to large caps when the recovery begins.

As with the U.S., international stocks have generally been positive this year. Valuations for broad market indices are largely lower than the U.S., but we lack the confidence that business fundamentals will improve sufficiently to maintain or increase asset prices. We came into 2023 optimistic China would provide leadership for emerging markets. That view has faded as the country deals with numerous economic headwinds.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy or a recommendation to buy, sell or hold any security. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

Please consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Funds. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one at TouchstoneInvestments.com/literature-center or call Touchstone at 800.638.8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Touchstone is a member of Western & Southern Financial Group

©2023, Touchstone Securities, Inc.

TSF-2630-E-2309