- The bond market gyrated in the first quarter as yields surged amid strong job growth and elevated inflation before plummeting in the wake of runs on several regional banks.

- There is uncertainty about how widespread problems are and how they could impact the economy because regulators were not required to conduct stress tests for regional banks.

- Meanwhile, the Fed raised the federal funds rate by 25 basis points at the March FOMC meeting, but the bond market is pricing in a rate at the end of this year that is well below the Fed’s median forecast.

- If there is a recession, it will likely be mild, as the largest banks are sound and the risk of a 2008 style “credit crunch” is low. Accordingly, we have reduced risk within investment portfolios but maintain a modest overweight exposure to equity and credit sectors

A Wild Quarter for the Bond Market

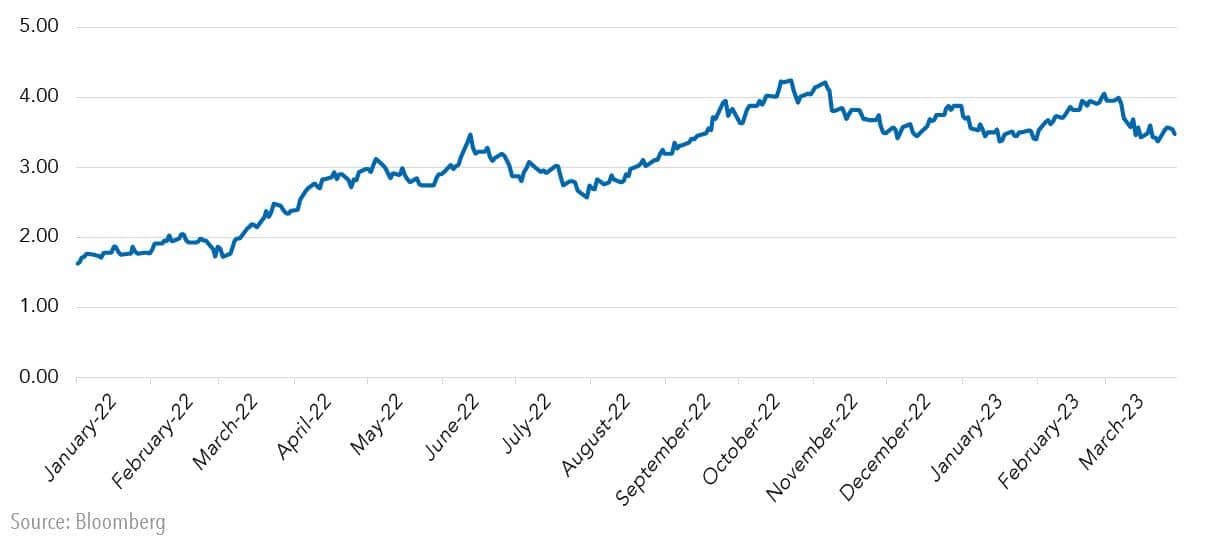

The first quarter will go down as one of the most volatile on record for U.S. bonds. Treasury yields fluctuated over broad ranges in response to strong jobs reports and high inflation readings before plummeting in March in the wake of problems with Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank (Figure 1).

Figure 1. Ten-year Treasury Yields, 2022 to March 31, 2023

What transpired then was truly exceptional. When Jerome Powell testified before Congress on March 7-8, he stated that the Fed’s over-arching goal was to bring inflation back down to its 2% target. Investors took note and priced in a 50 basis point rate hike at the March FOMC meeting. Then, two days later when SVB failed, investors weighed the possibility the Fed might pause. This showed up as a flight to quality in which short-dated Treasury yields fell by more than 100 basis points and 10-year Treasuries by 50 basis points.

The rally resulted in positive returns for bonds of 3.5% during the quarter, after the bond market posted its worst returns on record last year (Figure 2). By comparison, the stock market as measured by the S&P 500 posted a 7.5% return, after fluctuating in a relatively tight range in the second of 2022.

Figure 2. Investment Returns by Asset Class, 2002 to Q12023

| STOCK MARKET | 2022 | H1 2022 | H2 2022 | Q1 2023 |

|---|---|---|---|---|

| U.S. (S&P 500) | -18.1 | -20.0 | 2.3 | 7.5 |

| NASDAQ | -32.5 | -29.2 | -4.7 | 17.0 |

| Russell 2000 | -20.5 | -23.4 | 3.9 | 2.7 |

| International (EAFE $) | -13.9 | -19.2 | 6.6 | 8.6 |

| Emerging Markets (MSCI $) | -19.8 | -17.5 | -2.8 | 4.0 |

| U.S. BOND MARKET | 2022 | H1 2022 | H2 2022 | Q1 2023 |

|---|---|---|---|---|

| Treasuries | -12.5 | -9.1 | -3.7 | 3.0 |

| IG Credit | -15.3 | -13.8 | -1.7 | 3.5 |

| High Yield | -11.2 | -14.2 | 3.5 | 3.6 |

| JPM EM Debt | -17.8 | -20.3 | 3.2 | 1.9 |

Source: Bloomberg. For informational purposes only. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information pertaining to FRC and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a Fort Washington Investment Advisors, Inc. presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in Fort Washington’s presentation thereof. You cannot invest directly in an index.

How Widespread are Banking Problems?

When SVB collapsed in just two days its problems appeared to be unique. It mainly failed due to a huge mismatch in the duration of its assets and liabilities in an environment of rising interest rates. SVB’s business model made it very unusual: Its ratio of loan and securities to deposits was extremely high; it had a very low ratio of retail deposits to institutional deposits; and its ratio of uninsured deposits was exceptionally high. These attributes left SVB vulnerable to a run.

As problems spread to other regional banks, however, there was concern that the bank run could spread. The Treasury, Federal Reserve, and FDIC responded by taking actions to protect the financial system. They include protecting all deposits of SVB and Signature Bank and establishing a program that allows banks to swap Treasuries and mortgage-backed securities at par values for cash. These actions did not calm markets, however, because investors did not believe there was a blanket guarantee on all bank deposits.

During the first two years of the COVID-19 pandemic, U.S. bank deposits increased by about $5 trillion, or 35%, as households and businesses placed the proceeds of government transfer payments into the banking system. Deposit growth subsequently plateaued last year, as banks did not increase deposit rates materially when the Federal Reserve tightened monetary policy. During the first three weeks of March, outflows from small banks totaled $250 billion.

Meanwhile, the FDIC estimates that the market value of U.S. bank securities declined by $620 billion last year as bond yields surged. This is substantial considering the total book capital of U.S. banks is $2.2 trillion. However, if banks designate that bonds are being held for maturity, they only have to realize losses on their balance sheets if they are sold before they mature.

It is unknown how much duration risk other banks took and how much they invested when bond yields were near record lows. The main reason is that regional banks are not subject to stress tests that apply to larger systemically important financial institutions (SIFIs). These would help to discern which institutions may be compelled to sell bonds that were under water.

In general, the more exposed banks are to interest rate risk, the more likely they are to curtail their lending. Small banks provide credit to many smaller businesses and start-ups that do not have access to larger banks, and also play an important role in funding commercial real estate. They had been expanding credit at a double digit pace over the past year. Meanwhile, large commercial banks have been tightening credit standards over the same period, which shows up in the Fed’s survey of senior loan officers shown below (Figure 3.)

Figure 3. Senior Loan Officer Survey

The Fed Perseveres in Fighting Inflation

Faced with this predicament, the Federal Reserve opted to raise the funds rate by 25 basis points to 4.75%-5.0% at the March FOMC meeting. The press release stated that “additional policy firming may be appropriate,” but the Fed did not commit to a future course of action and it acknowledged credit could become tighter.

The basis for its decision is that inflation is still well above the Fed’s 2% target while the labor market continues to be tight, with unemployment at the time at 3.6% and the latest JOLTS survey showing there are 1.8 openings for each available worker. Also, the Fed maintains that financial stability is not at risk, because the largest institutions are both well-capitalized and liquid, which makes them less vulnerable to runs.

That said, while the Fed left the door open for another 25 basis point rate hike, it could pause if the concerns about the banking system persist.

By comparison, bond investors are more optimistic that inflation will come down significantly and they are more concerned about problems in the banking sector. Accordingly, the bond market is pricing in that the federal funds will end the year at about 4.25%, well below the consensus view of the FOMC of 5.125%.

In these circumstances, data on banking flows is likely to take on added significance in addition to data on the economy.

Positioning Investment Portfolios

Weighing these considerations, we believe the risk of a recession has increased somewhat. However, we believe it will be mild, as household and business balance sheets are strong and the largest financial institutions do not face the same problems as regional banks.

Accordingly, we have recently reduced risk within investment portfolios but maintain a modest overweight to risk assets such as equities and credit.

In balanced portfolios, we favor a modest overweight to equities relative to fixed income. While acknowledging downside risks remain, equity valuations have adjusted to reflect increased economic risks and uncertainty, making the risk/reward more balanced. Should further weakness materialize, portfolios are positioned to prudently increase exposure if warranted.

In our fixed income portfolios, we are positioning portfolios with an overweight to credit sectors, focusing on investment grade corporate bonds, emerging markets debt, and securitized products (CMBS, ABS and MBS). If the economy slows more than expected, credit spreads are likely to widen from current levels. However, if a soft landing is achieved or a recession is shallow, credit spreads would likely narrow somewhat. Weighing these scenarios, we believe the risk/reward in credit spreads supports a modest overweight to risk in portfolios. With regard to interest rates, we are positioning portfolios with a slight long duration bias. We believe that the growth and inflation outlook will continue to bias interest rates lower over the next several months.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations have adjusted to more normalized levels and earnings expectations have fallen, but continued slowing in economic growth will weigh on both valuations and earnings. We are prioritizing high barrier to entry companies with high returns on capital and maintaining a defensive posture within portfolios.

Past performance is not indicative of future results. This publication contains the current opinions of the author but not necessarily those of Fort Washington Investment Advisors, Inc. Such opinions are subject to change without notice. This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information and statistics contained herein have been obtained from sources believed to be reliable and are accurate to the best of our knowledge. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington Investment Advisors, Inc.