- Measures taken by the Federal Reserve to tame inflation in the United States have further perpetuated feelings of a looming recession for many investors.

- Combining past data on post-war recessions, inflationary numbers, and federal funds rates with today’s statistics shows the possibility of continued lower stock market returns.

- We believe that as a result of rising interest rates without many other recessionary factors in place currently, the downturn should remain a market event rather than an economic event.

The Federal Reserve’s actions to accelerate the pace of interest rate hikes in the past quarter has had a notable impact on financial markets. Treasury yields have doubled since the start of this year, and the bond market posted the first negative double-digit returns in four decades. Meanwhile, both the Nasdaq composite and Russell 2000 indexes have fallen decidedly into bear territory while the S&P 500 index is hovering near it.

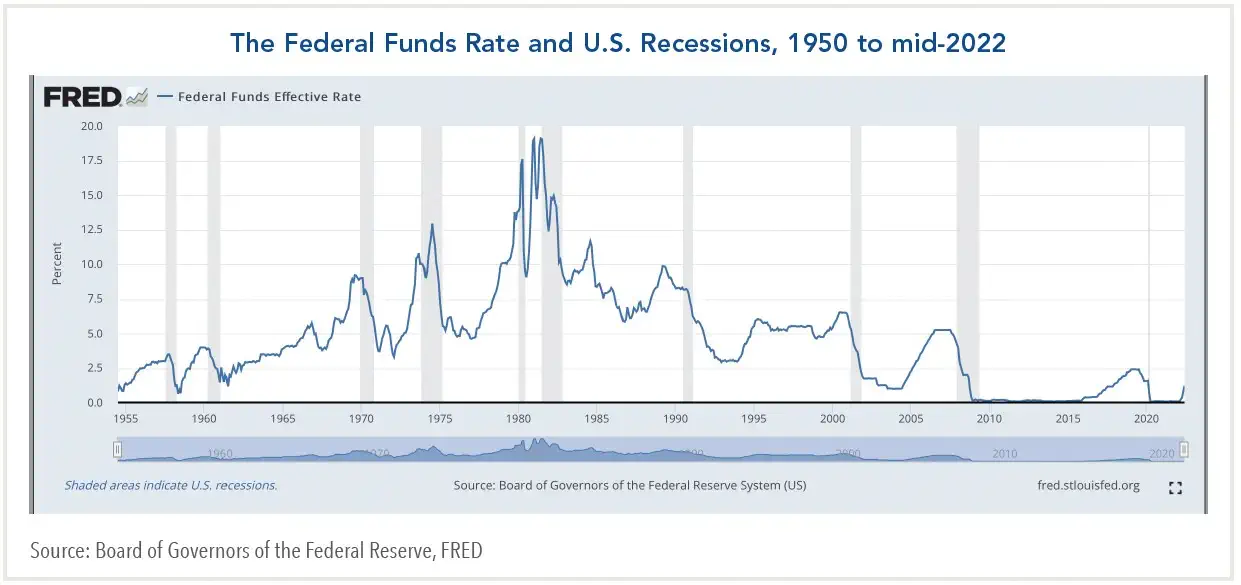

From this perspective, it is clear that Fed tightening is an event with which investors must contend, but it remains to be seen whether a U.S. recession will ensue. The chart below shows the close association between increases in the federal funds rate and recessions as depicted in the shaded areas.

https://fred.stlouisfed.org/series/FEDFUNDS

The Paradigm of Post-war Recessions

Amid the current debate about a “hard” or “soft” landing for the economy, it is useful to consider the post-war experience with bear markets. One of the most famous quotes about the stock market being a predictor of U.S. recessions is by Paul Samuelson, who in 1966 facetiously quipped that it had predicted nine of the past five recessions.

In 2016, Steve Liesman of CNBC updated the findings and found that Samuelson’s quip still held: There had been 13 bear markets in the postwar era then and seven recessions within twelve months, with bear markets giving investors about eight months lead time before a recession began. Assuming this pattern still holds, one might infer there is a 50:50 chance of a recession beginning by early next year.

To drill down further, one should also consider how the current environment compares with others.

The closest context is the recession that began in December 1969 and which ended in November 1970. It marked the end of a decade-long expansion that saw inflation rise from 1% in the early 1960s to 5% at the end. The Fed responded to the inflation buildup by raising the funds rate from 6.5% in mid-1968 to a peak of 9.0% by late 1969. It resulted in a mild decline in real output of less than 1% and an increase in the unemployment rate from 3.5% to 6.0%. This experience illustrates how high rates had to rise both in nominal and real terms to induce a mild recession.

The main difference today is that CPI inflation has spiked to a forty-year high of 8.6% (6% ex food and energy). This reflects supply-chain shortages linked to the COVID-19 pandemic as well as highly accommodative fiscal and monetary policies to counter it. Investors are now worried that because the Fed was slow to respond to the pickup in inflation, it may over-react.

These concerns appear premature: The funds rate currently is only 1.75%-2.0%, and the Fed is signaling that it could reach 3.5% by next year. If so, it would mean that interest rates are still likely to be negative in real terms then. Investors should keep in mind that no recession has begun with real rates that are negative.

Interest rates, therefore, would likely have to rise more to spawn a recession. The main risk would occur if core inflation stayed elevated in the vicinity of 4%-5% next year. If so, the Fed would be compelled to engage in another round of tightening in which the funds rate winds up in this range or higher. Because this is not yet priced into markets, it would likely trigger additional market declines.

Using the Past to Glimpse into the Future – Duration & Severity

Should a recession ensue next year, investors would also need to assess whether it would be severe and protracted or short and mild. Those calling for a steep recession believe that the bursting of the bubble in asset markets—stocks, bonds, and real estate—and the associated loss in wealth will cause households to curtail spending and firms to lay off workers.

Yet, this did not happen during the bursting of the tech bubble, in which the S&P 500 index plummeted by nearly 50% over two and one half years. The collapse of the dot com bubble was accompanied by one of the mildest recessions on record—with real GDP falling by less than 1% from March 2001 to November 2001 while the unemployment rate rose from 4% to 6%. The Federal Reserve raised the funds rate from 4.75% to 6.5% by mid-2000, and subsequently lowered the benchmark rate to 1% by mid-2003.

By comparison, the collapse of the U.S. housing market in 2007-2008 and the subsequent spill-over to financial institutions resulted in a credit crunch that produced the most severe recession in the post-war era. This illustrates how the U.S. economy is more sensitive to the availability of credit than to the cost of credit.

Viewed from this perspective, there are several reasons to believe that if a recession unfolds next year, it is likely to be on the mild side. One is that U.S. banks are well capitalized today and have recently passed recession stress tests. Another is that the U.S. economy does not face major imbalances that typically appear when recessions are severe.

For these reasons, my conclusion is that Fed tightening is likely to be more of a market event than an economic event in which there is a prolonged recession.

A version of this article was posted to Forbes.com on July 5, 2022.

Past performance is not indicative of future results. This publication contains the current opinions of Fort Washington Investment Advisors, Inc. Such opinions are subject to change without notice. This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information and statistics contained herein have been obtained from sources believed to be reliable and are accurate to the best of our knowledge. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington Investment Advisors, Inc.