- OPEC is being reborn.

- Projections for tight oil production in the U.S. (light crude oil contained in petroleum-bearing formations of low permeability) were drastically overstated, even before impacts from COVID-19.

- The “Age of Abundance” has ended and an “Age of Scarcity” is upon us.

- The one-two-punch from the OPEC price war and COVID-19 has massively impacted oil and oil-related products, hastening the Age of Scarcity.

- Despite the tremendous drop in demand for oil and oil products (e.g. gasoline and jet fuel), long-term fundamentals for oil have improved as the price of the commodity has collapsed.

- Allocating to high quality oil-exposed equities is beginning to look very compelling for long-term investors.

- Companies with high implied default risk and significant exposure to U.S. tight oil should still be avoided.

OPEC Is Reborn, Its Relevance Reasserted

“When a cartel-like organization breaks down, the result is usually lower and more volatile prices.”

During times of great market turmoil, it’s convenient to find solace in historical analysis. History might not repeat itself but it rhymes as the saying goes. The quote above is from a 1993 report1 from Philip K. Verleger, an energy economist and market observer.

While Mr. Verleger’s quote came during a time of global recession, the thought was on the minds of investors more recently as tight oil boomed and as some in the U.S. considered itself energy independent (which it was not). We do not foresee the collapse of the cartel as was feared in the 1990’s; instead, we believe we are observing the cartel reasserting itself. OPEC is being reborn. Instead of trying to push prices up, the cartel is slamming prices to the floor as its largest member produces at levels at, or very near, cash costs. OPEC is relevant. Questions remain—how relevant will it be post-2020, and will we return to a cartel-like management of oil prices? Are we on the cusp of a déjà vu moment in more ways than one? Does OPEC bring other nations into the tent, that otherwise might not have joined, but don’t necessarily have a legal reason why they couldn’t?

“Born out of the boom and bust of the 1920s, the oil industry—with the help of Texas and the officials of other states—had fashioned an expansive system of ‘evening and adjusting.’ The TRC [Texas Railroad Commission] and sister agencies implemented quotas to force low-cost U.S. oil off the market, supporting higher but stable prices. Majors haunted by the specter of familiar ruinous global price wars erected an extensive cartel system to maintain market shares, pool facilities, limit the flow of crude from massive new discoveries, and set high and stable prices for crude and refined products in consuming markets that generated large profits.”2

In the coming months, supply destruction—barring unwarranted government intervention—should take out the most inefficient producers in the market. It is like “keeping the taps on in a flooded bathtub,” according to RBC’s Dr. Helima Croft.3 Eventually people will start shutting off the taps. This is typically how commodity markets become more efficient and must be allowed to play out. The result will likely be more efficient businesses, hopefully with more capital discipline (if they aren’t bailed out), and—yes—perhaps a stronger cartel, which isn’t necessarily a bad thing for the oil and product markets.

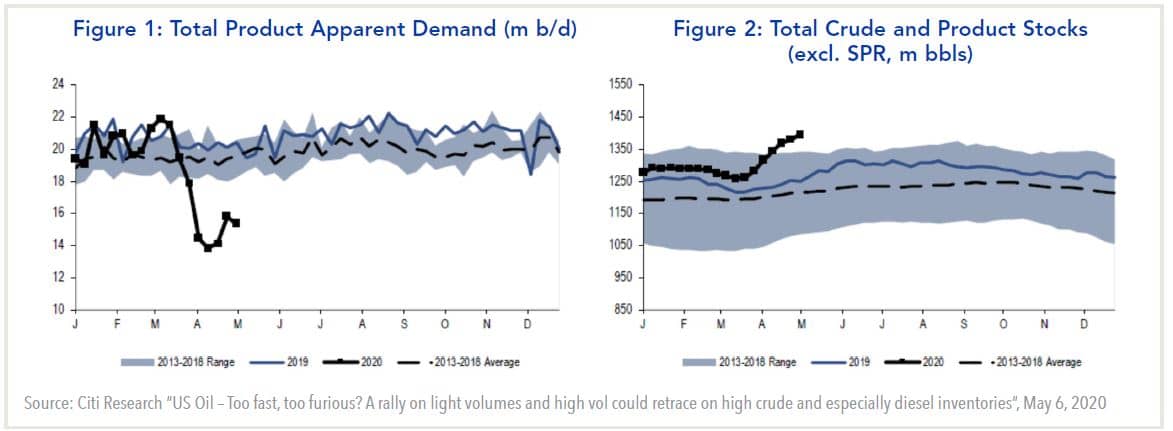

Improving consumption should come once we see a return to “normal life” around the world, and air and auto travel resumes. To what degree consumption improves is, however, an open question. A resumption to normalcy isn’t likely to happen, in our opinion, until we have a vaccine or reliable treatment for COVID-19. When life resumes, demand elasticity would imply that we see an increase in consumption4 (vs. pre COVID-19) if oil and product prices remain weak.5 How consumption patterns change, globally, is a matter of debate and will take time to see how, and if, behaviors change as a result of the pandemic.

Even when consumption normalizes and ticks higher, it could take years for inventory levels to return to normal as crude and product prices could be range bound as the cartel exercises better control over the market. We won’t know how long it could take until we have a handle on when the pandemic ends, and if OPEC+ cuts and by how much. We believe this is good for refined product demand.

OPEC appears to be back with a vengeance.

Global Oil & Product Consumption Shock as 2 Billion People Are Under Lockdown

Consumption / Demand Shock

“Citi expects the global demand collapse to reach ~18-mmbpd for at least 2 months in the base case but ~23-mmbpd in the bear case, equivalent to losing ~20% of global demand all of a sudden.”8

The worst case scenarios we have seen project an increase to almost 35 mmbpd. It is important to note that this is not demand destruction in the classic sense; rather, we believe it is a temporary shock to consumption as barrels of refined and unrefined products move into storage (demand), of which there is plenty (if it can be accessed). The numbers are being revised weekly. We should also note that while gasoline and jet fuel demand are both down significantly, diesel demand is holding up relatively well since there remains a need to move goods to end users.

Trafigura, one of the largest crude oil traders, said “now we are actually trying to estimate where the demand is. Using a bottom-up approach to actual consumption. That’s a very interesting exercise, and when we do it, we cannot arrive at 70 million barrels a day of consumption.” This implies that at least 25 mmbpd of consumption has gone offline, ahead of Citi’s bear case. As lock downs continue, the situation will likely become worse, and estimates could continue to be revised downward. The situation is extremely fluid, and the only certainty that we have in the market is that consumption has been, and continues to be, severely impacted. We strongly believe that consumption will rebound sharply when the virus passes; however, a rebound in prices is an entirely different matter.

“Demand losses are so large that any Saudi-Russia agreement to curtail output wouldn’t impact the market. ‘We have no hope of production cuts matching the demand destruction.”9

Put differently, irrespective of the ongoing price war, production cuts likely will not keep pace with the decline in demand. As a result, crude and refined products could continue to move into storage and keep a lid on near-term oil prices. We believe this is the inevitable outcome of the virus and any proposed production cuts from OPEC+ and other participants in the global oil industry.

Framing the 2020 Oil Price War - Give Me Sanction Relief & I'll Give Texas Relief

We don’t believe the price war is a result of one issue or data point. Instead, it is the culmination of years of data, incidents, and frustration within and outside of OPEC. No doubt part of the war stems from a disagreement over how much production to cut and why OPEC+ members should bear the brunt while some of the most inefficient producers get to benefit from the cut. When the price war ends it will likely be sudden, and we strongly believe it will end prior to the 2020 U.S. election but not before sufficient pain has been exacted on high cost producers. Early indications are pointing to a thawing of the price war as OPEC has started to cut production and reduce the price discount of Arab Light barrels. However production cuts and price hikes need to be managed to avoid a resurgence in tight oil production and a collapse in prices.

We believe that a large part of the willingness for Russia to join the price war may stem from the financial war that the U.S. has been waging against Russian companies and citizens, most of which have very close ties to the administration in Moscow, as Russian oil and gas companies, projects, and some of their executives have been sanctioned by the U.S. government. Ending the price war will require a large number of global producers to join in production cuts, for an extended period of time. This is already happening as low prices force non-OPEC producers to curtail production.

COVID-19 is clearly part of the reason why the price war has happened, but we think the war was imminent, and COVID-19 provided an opportunistic catalyst. We would suggest that this is the first time since the oil embargoes of the 1970’s that oil has been used as a weapon. The effectiveness of this weapon may depend on whether or not the U.S. yields on Russian sanctions. We imagine many policy makers in D.C. are deeply concerned with the prospects of oil being used to exact such a policy response.

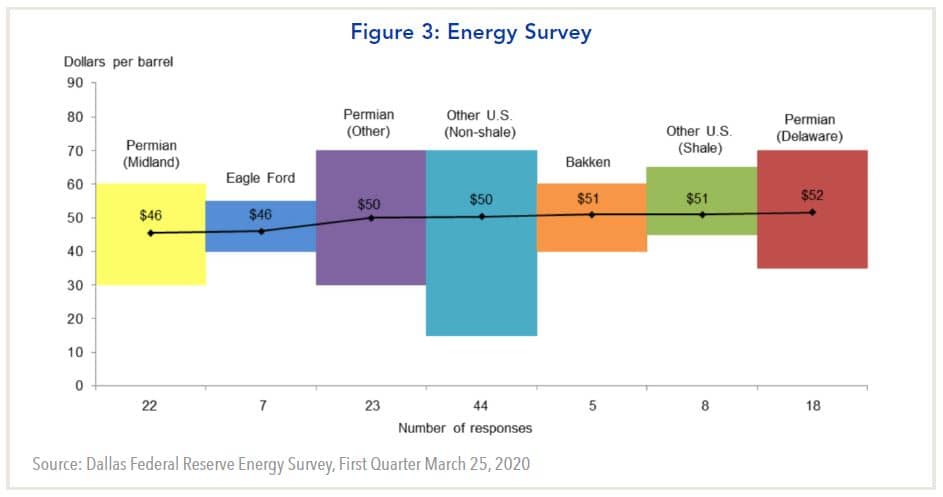

By collapsing the price of oil during a period of surging inventories, maximum pressure has been put on the commodity. Excluding the COVID-19 impact, the question that we will attempt to answer is what price does a barrel of West Texas crude settle at when the price war ends? While a simple question, it is very complicated to answer and nearly impossible to get right. We think a way to provide guidance is to look at the March energy survey from the Federal Reserve Bank of Dallas. In order for producers in the Permian to profitably drill a well, oil prices need to be above $30/bbl with an average price (from respondents) at $49/bbl outside the Midland and Delaware. We think the forward price curve is reflecting this nicely, and $30 becomes a floor once we see prices settle for a while. It allows OPEC+ to coexist with tight oil, but it doesn’t provide tight oil with enough support that they can materially grow.

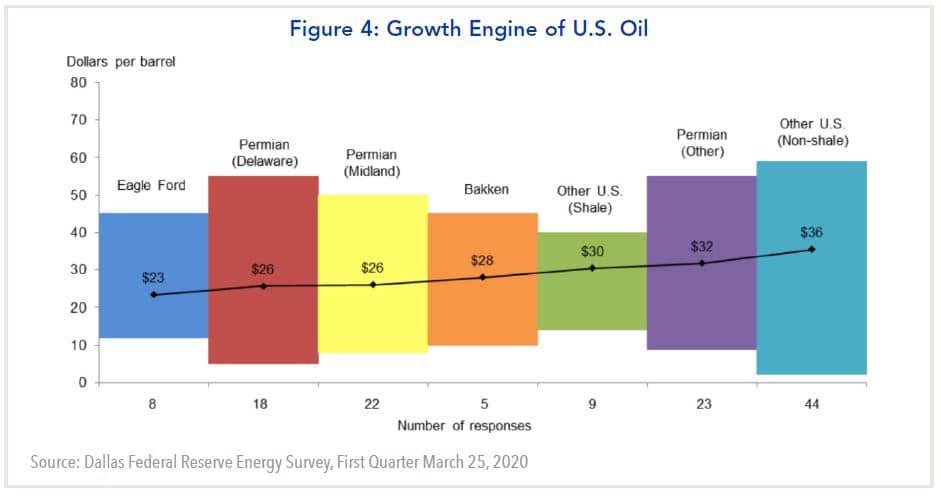

The near-term floor for WTI was negative. At current prices we think that many producers in North America are facing negative netbacks when we take into account transportation and operating costs. Shut-ins are already happening. That being said, the Dallas Fed survey provides a marker at which to look. It relates to the question of what WTI price is needed to cover operating expenses for existing wells. We view this as the price that decimates tight oil producers, the growth engine of U.S. oil. As shown below, it is low single digits with low 20’s impacting the average respondent. Therefore, at current prices most producers cannot cover operating expense, let alone drill new wells.

Permian Was Weak Heading Into COVID-19 & Declines Were Accelerating

Production gains in 2019 were nothing like those seen in prior years when they were driven by efficiency gains and an emphasis on high-grading that started in 2015-16 and continues to this day. We believe the Permian has shifted from late mature stage production to late stage production, where sweet spots are saturated and production starts to fall as infill drilling is unable to offset declines from the highest quality wells. The last vestige of U.S. oil growth appears to be quickly moving into the rearview mirror.

Even producers and industry experts seem to have accepted the reality that the days of robust production growth are behind the U.S. tight oil industry.

Even producers and industry experts seem to have accepted the reality that the days of robust production growth are behind the U.S. tight oil industry.

“The rate of improvement in well productivity has steadily slowed since 2016. After selecting only oil wells and normalizing for the increase in lateral length, we see no improvements in initial well results in the past 3 years, on average.”11

“As we progress through 2020, the retrenchment of drilling activity [i.e. reduced rig count], combined with the inability for drilling productivity to rise because of “high grading” will produce the potential for a significant disappointment in oil production.”12

“We’re seeing a lot of difficulties in growing U.S. oil production.”13

“…the 2020 year-over-year oil growth will be roughly 400,000 barrels per day… Most people will ascribe the low U.S. growth to capital discipline, but I think the larger reason is… The shift to Tier 2 and Tier 3 drilling locations in all shale plays and increasing parent-child issues in the Permian.”14

CLB (Core Laboratories NV) is saying that there is probably a bigger drop in productivity from Tier 1 to Tier 2 than many expect, and that parent-child is more pronounced.15

Production from U.S. tight oil, in particular the Permian, was already charging towards the proverbial cliff where new wells are unable to offset declines from older wells. The stage was set for production to roll over by the end of 2020. We believe the price war will accelerate this to a mid-year event, and the accelerated roll over might even be a number that producers can toss out as a “contribution” to OPEC+ production cuts that are needed for the market to rebalance.

OPEC+ struck tight oil at the perfect time. Now producers and politicians that, for years, complained about the cartel are now begging for a cartel to come to the rescue.

We believe the necessary conditions to end the price war are for non-OPEC+ independent producers to contribute meaningful cuts to production (as is already happening), and for U.S. tight oil to suffer irreparable harm, such that the declines from existing wells and a lack of new drilling makes it nearly impossible for future wells to achieve production levels on par with the past. This could happen when the rig count drops below 500. As of May 1, 2020, the rig count was 408, with active rigs at 325.16 To be clear, it isn’t just tight oil that will suffer. Stripper wells, Canadian oil sands and heavy oil, offshore, and other high cost production will also come offline and in some cases it could be very meaningful. We just believe that tight oil is next for investors to watch given that it has been a tremendous engine of growth for upstream, midstream, and oil field services. This engine is barely sputtering right now and it is ready to seize up. Once sufficient damage has been done, it will make sense for OPEC+ to make a symbolic cut in production. We say symbolic because it will not cut enough to give non-OPEC+, in particular tight oil, the chance for a resurgence in 2020. Hence, our view that $30 oil is a reasonable floor with a ceiling of $40 heading into the 2020 Presidential election. That doesn’t knock the North American and offshore industry out, but it backs the industry up against the ropes while keeping gasoline prices low for U.S. consumers.

Coming Off the Ropes - From the Age of Abundance to Scarcity

During periods of extreme volatility in markets, it is all too easy to become myopic with an investment thesis and focus exclusively on the here and now. While we can’t lose sight of the here and now, especially for overly levered companies, we must maintain an eye on the future. Storage levels indicate to us that low oil and refined product prices could be here for a while. However, on the distant horizon we see the Age of Scarcity returning to the oil market. High inventory levels can result in low oil prices in a price regime where scarcity is on the horizon, simply put, markets are not efficient.

The near-term view is negative for valuations vs. pre-COVID-19 levels. The low oil and product prices will remain because of elevated inventory levels that could take years to burn off. Low prices will be crucial for many developed economies that are going to be saddled with extraordinarily high levels of government debt that will require difficult decisions about subsidies, taxes, and consumption. This could be a new golden age for OPEC as prices need to be managed to help economies recover.

For a moment let’s take a step back from all the noise around COVID-19 and the 2020 price war. Let’s remember that the oil world is one that oscillates between periods of great scarcity and abundance, between periods of great price volatility and the relative stability managed by cartels.17 For the past decade, we have been in a world with a very weak cartel. Rockefeller brought stability to the markets during the Kerosene Era (1859-1911). Following the bust of that cartel (Standard Oil), the oil and product markets were in disarray until the Texas cartel came to fruition (1934-72), albeit with mixed success and a plethora of problems. OPEC managed to exert considerable influence and control over prices (1973-2008), until the rampant fear of peak oil caused prices to rip higher and, combined with technology advancements, unlocked tight oil. Thus began the age that we are in today, the Age of Abundance (2009-2020), an Age that is coming to an end sooner than we think most investors realize.

Prior to COVID-19 and the price war, we believed that the oil industry was on the cusp of a new age, an Age of Scarcity. Another way to put this would be a return to scarcity akin to the early 2000’s before peak oil really took off. It looks like we could hit this point at the end of 2020 as production from the Permian rolls over and starts to decline. This view hasn’t changed much, tight oil will likely just roll sooner, but the price signals to the market are going to be clouded over by storage related impacts associated with COVID-19 and the 2020 oil price war. This is a time when investors need to see the forest for the trees.

While we don’t want to dwell on the topic of peak oil, we believe it is worth revisiting.

M. King Hubbert’s success in predicting peak oil in the 1970’s required an oil price regime that was relatively stable, i.e. controlled by a cartel. Throughout the history of the oil market, we have seen periods where the price regime changes, and these regimes help influence the value of the commodity at a given point in time since it reflects perceptions about abundance and scarcity. Changes in the regime can also support the development and adoption of new technologies, which can push back peak oil. This is also one reason why we can observe very different prices of oil for the same or similar levels of global storage. The Age of Abundance (2008-current), for example, saw storage levels of 24.5 days of supply have a price of $114/bbl (April 2011) and $65/bbl (July 2018). Price regimes also influence the value of equities where during the period of peak oil and scarcity (1999-2010), E&Ps outperformed the commodity by almost two times while in the age of peak demand and abundance (2016-2019) the commodity outperformed E&Ps by over 50%.

In 2003 “ominous warnings from market analysts have increased concerns about oil security… [and] the rate at which production is expected to decline following the peak.”18 This resulted in a slow change in the price regime from an area of scarcity to abundance as peak oil drove prices higher (to 2008) and unlocked new supplies.

The Age of Scarcity came to a crashing halt with the expectation of large scale production of tight oil, and to a lesser degree oil sands. This ushered in the current Age of Abundance. This age is characterized by a price regime that is well summarized by Oxford Energy in two excerpts from one of their reports:19

“Faced with the possibility that significant amounts of recoverable oil may never be extracted, low-cost producers have a strong incentive to use their comparative advantage to squeeze out high-cost producers and gain market share…a high reserves-to-production ratio is no longer a sign of strength… [producers will] need to adopt a ‘higher volume, lower price’ strategy.”

“… in an age of abundance, in which the world is likely to never run out of oil, the key assumptions underpinning this pricing approach [of oil] no longer hold. What will determine oil prices over the next 20-30 years as we move from (perceived) scarcity to abundance… the size and persistence of these social costs [i.e. OPEC]” over the next 20 to 30 years.

We have mixed feelings about the Oxford Energy report. We agree that producers are adopting a higher volume and lower price strategy. This is essentially what is happening with the current price war and what happened in 2014 when OPEC started a battle for market share. We disagree strongly, however, with the apparent view that oil will remain in an Age of Abundance for the next 20-30 years, a view that is largely predicated on the belief in U.S. tight oil as a source of growth for years to come.

We are not in the early years of an Age of Abundance, we are standing at a cliff to the Age of Scarcity:

- U.S. tight oil will likely peak March-June 2020

- Canadian conventional oil peaked in early 2010’s and unconventional is constrained by a lack of egress that might be temporarily resolved in the mid-2020’s.

- Norway production peaked in early 2000’s.

- UK North Sea peaked in late 1990’s.

- U.S. conventional peaked in the 1970’s.

At the end of 2019, somewhere between 60-80% of the conventional oil fields in the world are in terminal decline,20 with a decline rate somewhere between 5-7% per year. With 2019 production being approximately 95 mmbpd and demand expected to increase to 106 mmbpd by 2040, there is a significant supply gap that needs to be filled, and prices need to adjust to either fill the gap or cause demand destruction.21

If we focus on the 80% of fields that are in decline, then we could see just over 50 mmbpd of production disappear by 2040. This is on top of an estimated 10 mmbpd of incremental demand, so 60 mmbpd in total. This is 8 times the 2019 U.S. tight oil production, a resource in decline. To make up this difference, the industry would need to find another 15 Ghawar fields (Ghawar is a massive conventional field in Saudi Arabia that producers 4 mmbpd), or would need to permanently shut down twice the amount of oil consumption that is currently (and temporarily) offline.