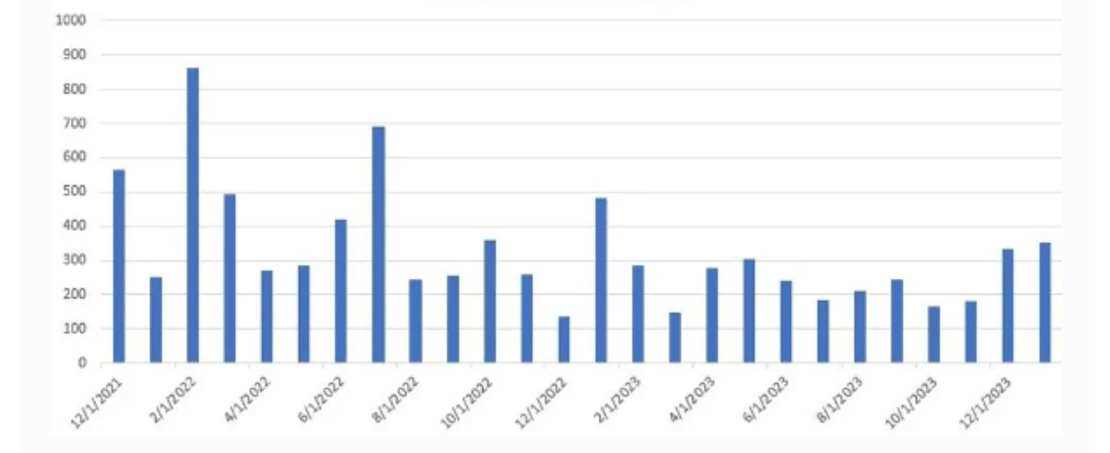

The surprising strong jobs report for January left investors stunned by the resilience of the U.S. economy. The establishment survey showed nonfarm payrolls rose by 353,000 while revisions for December boosted the previous tally by 115,000 (see chart below). Monthly change-figures for last year were also revised up in 9 out of 12 months, undermining the prior narrative that downward revisions pointed to labor market weakness.

Figure 1. Change in Nonfarm Payrolls

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

While the household survey reported employment falling by 31,000, annual adjustments to population controls show employment actually grew by 239,000 according to Don Luskin of Trend Macro. Thus, the two surveys showed that job growth far exceeded expectations.

One potential concern is that average hourly earnings rose by 0.55% in the month. However, economist Jim Glassman points out in a recent commentary that the figure was exaggerated by a shift in the composition of hiring by industry. Also, other reports including Q4 productivity estimates indicate that businesses are experiencing a boost in labor productivity. This has allowed companies to increase pay without adding to unit costs or eroding profit margins.

The markets’ response to the news was mixed: Ten-year Treasury yields surged by 17 basis points to close at 4.03%, while the stock market closed at a record high in response to the solid economic news and strong earnings reports for tech companies.

How Does the Strength of the Economy Alter the Economic Outlook?

My take is that the debate about whether the economy is headed for recession is effectively over.

The Atlanta Federal Reserve’s GDPNow model is calling for growth of 4.2 percent in the current quarter, up from 3.0 percent previously. If so, it would mean that growth averaged about 4 percent in the last three quarters.

Even if growth moderates in the remainder of the year, there are few signs of fundamental imbalances in the economy. Moreover, the manufacturing sector, which has been a weak spot, is showing signs of stabilizing. The ISM index for January rose to 49.1 from 47.1, reaching its highest level since 2022. The housing market has also stabilized as mortgage rates have fallen by about a full percentage point since October.

Strong jobs growth, coupled with low inflation, should also help to bolster consumer spending, which accounts for nearly 70 percent of aggregate demand. The increase in real disposable income will help to offset the decline in household savings in the past two years as pandemic relief payments ended.

Accordingly, the Federal Reserve is not compelled to ease monetary policy any time soon, and it left rates unchanged at last week’s FOMC meeting.

Bond investors, however, have been pricing in 5 or 6 quarter point cuts in the fed funds rate this year, which I argued was highly unlikely in my previous Forbes commentary. The more likely outcome is the Fed will wait until May to contemplate lowering rates and then possibly make 3 rate cuts in the balance of this year.

Restrictive Monetary Policy Stance No Longer Needed

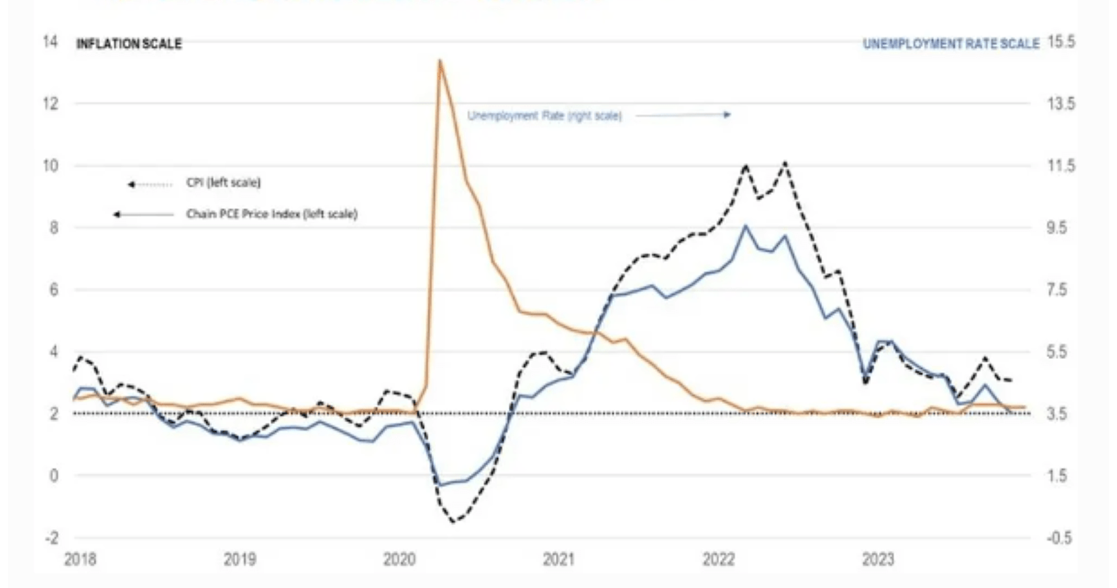

The case for easing policy is predicated on inflation continuing to ebb closer to the Fed’s 2 percent average annual target. With the dual mandates of low inflation and low unemployment more secure (see chart below) and real interest rates in the vicinity of 2.5 percent, a restrictive monetary policy stance no longer is needed.

Figure 2. The Fed's Dual Mandate is in Reach

Source: FRED, Bureau of Labor Statistics, Bureau of Economic Analysis.

Source: FRED, Bureau of Labor Statistics, Bureau of Economic Analysis.

The Fed will also take into account that fiscal policy is still expansionary. The federal budget deficit in fiscal 2023 reached 6.3 percent of GDP, which is more common with a high unemployment rate rather than the current low rate of 3.7 percent.

Meanwhile, the House of Representatives recently passed a bipartisan bill by a vote of 357-70 to enhance child tax credits, while also reviving key tax breaks for businesses. Households benefitting from the change would see an average tax reduction of $680 in the first year, according to the nonpartisan Tax Policy Center. Daniel Clifton of Strategas estimates that fiscal policy actions on taxes, Ukraine, and discretionary spending could surpass $300 billion this year.

Strength of the Economy Could Have Important Implications for 2024 Elections

Thus far, President Biden’s handling of the economy and concerns about border security have been two of the weakest areas for him in public opinion polls. However, there are indications that households’ perception about the economy is improving: In January, the University of Michigan’s survey of household sentiment posted the largest one-month increase – 9.3 points – in 18 years. The index is now close to its normal level around 80 versus a low of 40 in 2022, when inflation spiked.

Even Larry Kudlow, Trump’s White House economic advisor, conceded that his predictions of a recession under Biden had been wrong and that the “entire forecasting community” had been incorrect. Kudlow also stated that Biden has grounds to brag about the economy, including 14.8 million jobs that have been created during his tenure.

The big unknown, of course, is how quickly public perception of the economy will match the reality of what the economic data reveal.

A version of the article was posted on Forbes.com on February 6, 2024.

This publication contains the current opinions of the author but not necessarily those of Fort Washington Investment Advisors, Inc. Such opinions are subject to change without notice. This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information and statistics contained herein have been obtained from sources believed to be reliable and are accurate to the best of our knowledge. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington Investment Advisors, Inc. Past performance is not indicative of future results.