This marks the first time the global economy has been buffeted by simultaneous supply shocks. The two are related. The conflict among oil producers was spawned by a slump in oil demand caused by the spread of coronavirus worldwide and its impact on the global economy.

The combined shocks have sent treasury yields close to zero and the U.S. stock market near bear territory on the eleventh anniversary of a record bull run. The 7.8% sell-off of the Dow Jones on Monday marked the worst day since the 2008 Global Financial Crisis. Markets are now signaling a tipping point has been reached with the global economy on the cusp of recession.

Last week, the Organization for Economic Cooperation and Development (OECD) already had lowered its projection of 2020 global growth to 2.4%, just below the threshold it uses to gauge worldwide recession.1 (Figure 2) This projection assumes the coronavirus epidemic peaks in China this quarter and outbreaks in other countries are mild and contained. The OECD anticipates global growth could drop to 1.5% in 2020 if the outbreak is not contained.

Figure 2: OECD Interim Economic Outlook Forecasts, March 2, 2020

(Real GDP Growth, year-on-year % change)

| 2019 | 2020 PROJECTIONS |

|---|

| Latest (Mar 2) |

Reductions from Nov. Projections |

||

|---|---|---|---|

| World | 2.9 | 2.4 | -0.5 |

| United States | 2.3 | 1.9 | -0.1 |

| Euro area | 1.2 | 0.8 | -0.3 |

| Germany | 0.6 | 0.3 | -0.1 |

| France | 1.3 | 0.9 | -0.3 |

| Italy | 0.2 | 0.0 | -0.4 |

| Japan | 0.7 | 0.2 | -0.4 |

| Korea | 2.0 | 2.0 | -0.3 |

| China | 6.1 | 4.9 | -0.8 |

Prior to this weekend’s developments, most forecasts for the U.S. economy called for growth to slow this year but for it to avert recession. One reason is the economy gained momentum in the latter part of 2019 in response to Fed easing and the phase one trade deal with China. Also, recent jobs growth has been solid and consumer confidence has stayed high.

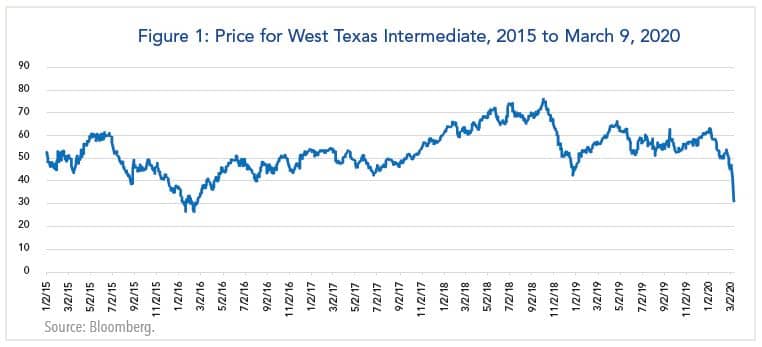

Yet, investors now fear a U.S. recession. One reason is a growing number of industries are feeling the fallout of coronavirus including airlines, cruise lines, transport, hotels, restaurants and other services. With oil prices plummeting, moreover, U.S. shale oil producers once again confront price levels close to break-evens for them, just as they did in 2015.

The situation in financial markets is extremely fluid. While the media has focused on the sell-off in equities, the corporate bond market is critical because it is the principal source of finance for many businesses.

One concern is liquidity in the corporate bond market has dried up. And credit spreads for corporate borrowers have widened considerably, especially for lower quality issuers. Looking ahead, their access to credit is likely to become limited.

The current situation, however, is not as bleak as it was in the fall of 2008. The main difference today is financial institutions are better capitalized and less vulnerable to runs.

By now, the Federal Reserve is widely expected to lower interest rates further and ultimately bring them closer to zero. However, the impact of Fed rate cuts on the economy will be limited considering how low they are.

It remains to be seen whether investor confidence will be bolstered by further expansion of the Fed’s balance sheet. Some commentators have mentioned the possibility of the Fed purchasing corporate securities. However, even if the Secretary of Treasury were to sanction it, the feasibility is questionable because the corporate bond market is less liquid than treasuries or agencies.

For these reasons, most economists believe the more effective channel to combat fear of the coronavirus is via fiscal policy and informed health care policy. The Trump administration reportedly is considering a payroll tax cut that could elicit bipartisan support. Beyond this, however, it will be tougher for the two parties to find common ground.

Where Does This Leave Investors?

My take is they should keep several considerations in mind.

First, the fallout from the coronavirus and plummeting oil prices will be temporary, not permanent. In this regard, it is clearly easier for oil producers to reach a compromise that will stabilize prices than it is to halt the spread of coronavirus. But the virus will be contained at some point, hopefully by late spring or summer.

Second, the U.S. economy has proved to be highly resilient to shocks in the past because it is well diversified, both in terms of industries and geographic location of businesses. Even during the 2008 financial crisis, which was the worst the country experienced since the Great Depression, it subsequently went on to experience an enduring recovery and financial prosperity.

The big unknown today is whether policymakers will craft policies that can bolster investor confidence and aid the natural adjustment process.

While the stock market rallied on Tuesday’s open, it is likely to remain highly volatile until there is greater clarity on the impact of the coronavirus spread.

Source of Figure 2: OECD.

1 OECD Interim Economic Assessment, “Coronavirus: The World Economy at Risk,” March 2, 2020.