While investors currently are focused on the near-term impact of the invasion on the global economy and markets, the experience of the Cold War suggests it will also have significant long-term repercussions.

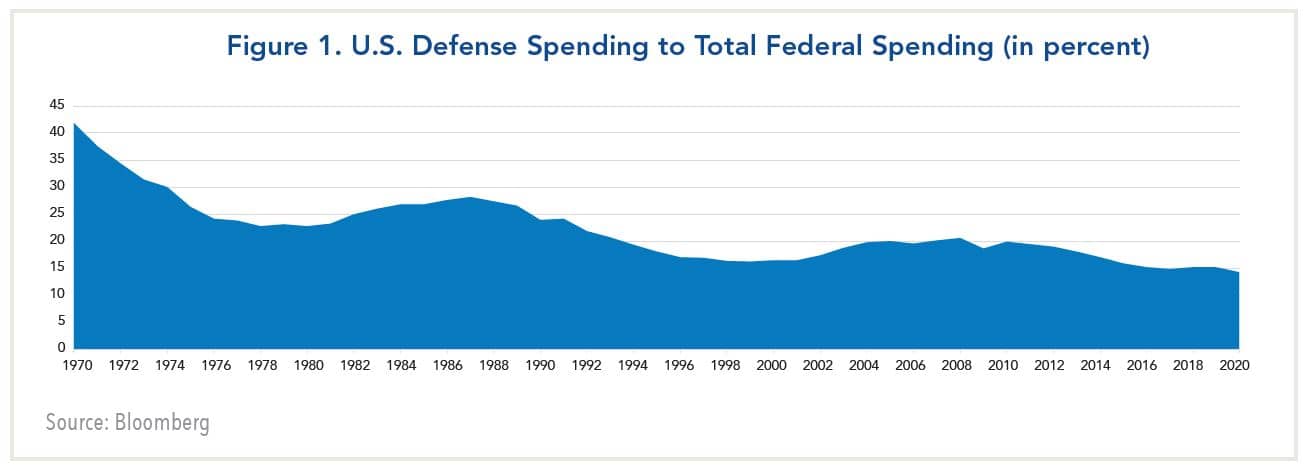

During the 1980s, President Reagan built up America’s defense capabilities to deter the threat of Soviet expansion. His goal was to outspend the USSR militarily knowing that its economy could not match the prowess of the United States. The result was a steady expansion in U.S. military spending relative to total federal outlays throughout the decade. Reagan was able to do so because the Federal Reserve under Paul Volcker succeeded in bringing inflation under control.

This strategy ultimately paid off when the Berlin Wall collapsed in November of 1989. President George H.W. Bush and Prime Minister Margaret Thatcher declared the collapse of the Soviet Union would result in a “peace dividend” that would enable defense spending to be decreased relative to domestic priorities.

This strategy ultimately paid off when the Berlin Wall collapsed in November of 1989. President George H.W. Bush and Prime Minister Margaret Thatcher declared the collapse of the Soviet Union would result in a “peace dividend” that would enable defense spending to be decreased relative to domestic priorities.

This assessment proved to be accurate, as defense outlays as a share of total federal spending declined thereafter. The decade of the 1990s, in turn, was marked by above-average economic growth of more than 3.5% per annum, low inflation, and a federal budget surplus by the end of the decade.

By comparison, the situation today is much more challenging. The U.S. long-term growth potential has slowed to less than 2% per annum largely due to demographic factors. Meanwhile, the U.S. budget deficit and federal debt outstanding are at or near all-time highs in relation to GDP, and inflation has surged to a four decade high.

Accordingly, if the U.S. seeks to rebuild defense capabilities to thwart Russian aggression, it means that resources will have to be diverted from domestic priorities. Thus far, however, President Biden has not made his priorities clear.

In December, he signed a $768 billion defense policy bill that represented a 5% increase in military spending. However, it was nearly $50 billion larger than his original request, as both Democrats and Republicans believed Biden’s proposal was insufficient to counter military advances by China and Russia. Now, in the wake of Russia’s invasion of Ukraine, Republicans and some Democrats are likely to call for a larger allocation.

As regards domestic spending, Biden did not specifically mention the Build Back Better program in his State of the Union address, although many observers now believe it is all but dead. Rather, he talked about increasing the productive capacity of the economy by rebuilding the nation’s infrastructure. However, this will not provide immediate relief to the economy.

Biden is not alone in facing tough choices. The challenge the Federal Reserve faces in reining in inflation without jeopardizing the economic expansion is even more complicated now.

In his congressional testimony this week, Fed chair Jerome Powell said the central bank was prepared to raise interest rates at the upcoming FOMC meeting with inflation high and the labor market tight. He also said it was too early to tell how Russia’s invasion of Ukraine and the economic sanctions imposed by the West would impact the U.S. economy. Powell added that the Fed would need to be “nimble” in responding to incoming data and the evolving outlook.

For their part, bond investors are now pricing in a 25 basis point hike this month rather than a 50 basis point increase. For the balance of this year, they see the federal funds rate ending the year around 1.25%-1.50%.

The main complicating factor would be a further significant increase in energy prices if Russian shipments of natural gas and oil are cut off from Europe. The price for WTI is now approaching $110 per barrel, and it could escalate further if the U.S. and its allies impose sanctions on them. Thus far, they have opted not to do so. However, sanctions have been imposed that limit access of seven Russian banks to SWIFT, which affects energy prices indirectly.

If oil prices were to spike to $125-$150 per barrel, the U.S. economy would likely slow, but not slip into recession because it is self-sufficient in energy. By comparison, Europe would face a greater risk, because it is heavily dependent on Russia for energy.

For the Fed, the most likely response is that it would view the energy price increases as an exogenous shock that has both deflationary and inflationary consequences. Accordingly, it would likely ignore a spike in the headline rate of inflation while focusing on core inflation readings that exclude food and energy.

The Fed would face a dilemma, however, if rising energy prices impacted a broad range of goods and services, and core inflation stayed well above its long-term 2% target. In that event, it might be compelled to tighten policy further, which could cause growth to moderate.

The bottom line is that a renewed Cold War would have two adverse consequences for Americans. First, it would heighten the need to scale back social programs in order to fund increased military outlays. Second, it would make it more difficult to rein in inflation and would ultimately imply higher interest rates.