- With the passage of a Senate version of a tax bill that is close to the House bill, the stage is set for the biggest overhaul of the U.S. tax code since the Reagan era. The final bill will combine tax cuts to give the economy a short-term boost with tax reforms designed to have a more lasting impact. The U.S. stock market has rallied in anticipation that it will bolster corporate profits and the economy.

- One of the key uncertainties is the extent to which the legislation will boost business investment and long-term growth. Views on this matter vary widely. Optimists envision an increase in annual growth of 0.4% - 0.5%, while the consensus among economists is 0.1%-0.2%, most of which is front-end loaded.

- Another uncertainty is the impact on U.S. interest rates. The pending tax bill is expected to boost the federal budget deficit by $1 trillion over the next ten years. The bond market has not reacted yet, but it could in coming years when the deficit is set to balloon as baby boomers retire and medical costs continue to surge.

- 2017 was an outstanding year for the stock market in part owing to expectations of corporate tax cuts. Prospects for 2018 and beyond depend in part on whether the tax bill delivers the goods, but it is too early to tell.

A Comprehensive Tax Bill

Passage of the Senate tax reform bill earlier this month has paved the way for a joint House-Senate conference to reconcile differences and agree on a unified bill that the full Senate and House must approve by simple majorities. It combines tax cuts for businesses and individuals with reforms to broaden the tax base. The stock market has rallied in anticipation that a final bill will be enacted soon. While there are important differences in the two versions, the speed with which congressional Republicans have acted indicates their desire to have a major legislative achievement before year’s end.

The centerpiece of the pending legislation is changes to the corporate tax code. Common elements of the two bills relating to businesses include the following provisions:

- Corporate tax cuts – Both the House and Senate propose a permanent reduction in the marginal tax rate to 20% from 35%, but the Senate version would delay implementation until 2018. (Note: recent press reports indicate the final bill could set the rate at 21% to lessen the budgetary impact.)

- Pass-throughs – The House proposes a 25% top tax rate, while the Senate lowers the effective tax rate by allowing individuals to deduct 23% of domestic qualified business income.

- Expensing – The House would allow full immediate expensing of new equipment investment until 2022, while the Senate version would phase it out after 2022.

- Interest deductibility – The House and Senate cap interest deductions at 30% of EBITDA and EBIT, respectively.

- One-time tax on accumulated foreign profits – The House and Senate would tax cash held abroad at 14% and 14.5%, respectively. For illiquid assets, the rates are 7% and 7.5%.

- International income – Both versions move toward a territorial tax system for corporate international income, where US companies will not pay taxes on their overseas operations.

Some of the more controversial aspects of the respective bills relate to tax treatment for individuals. For example, the Senate version repeals the individual mandate of the Affordable Care Act that critics contend will weaken it. The House version eliminates the student-loan interest deduction, while the Senate bill preserves it. Both the Senate and House versions eliminate the state income and local sales tax deductions and cap property tax deductions at $10,000.

The legislation that is ultimately enacted promises to be highly political, as it will be passed without any Democrat support. One of the criticisms levied by Democrats is it favors the wealthy, who stand to gain from the expansion of the estate tax to $11 million per person, the elimination or amelioration of the alternative minimum tax, and the favorable impact of corporate tax cuts on stock prices. President Trump and Congressional Republicans contend it benefits the middle class by doubling the standard deduction for individual taxpayers, as well as by boosting wages as the economy expands.

Impact on Corporate Profits & Economic Growth

For equity investors the key issues are the impact that tax cuts and incentives will have on corporate profits, business investment, and long-term economic growth. To a large extent, the recent surge in the stock market reflects the impact they will have in boosting after-tax corporate profits. Goldman Sachs, for example, forecasts 2018 S&P 500 EPS will jump by 14% to $150, of which 5% is the estimated impact of corporate tax cuts.1 Beyond this, the long-term effects hinge on the degree to which tax incentives boost business capital spending and potential growth.

Views on this matter vary widely among economists. Among the most optimistic are Martin Feldstein, the chair of the Council of Economic Advisers in the Reagan years, and Kevin Hassett, the current chair. Feldstein, for example, has claimed that corporate tax reform could increase the U.S. capital stock by $5 trillion and cause a $500 billion rise in annual income, while Hassett contends the expansion in business investment will boost average wage incomes by at least $4,000 a year and possibly by as much as $9,000 annually.2 The leading critics on the Democratic side are Larry Summers and Paul Krugman, who counter that these claims are gross exaggerations and maintain the Republican tax plan is a serious policy error.3

The consensus among economic forecasters is the legislation will have a moderate impact on boosting long-term growth in the vicinity of 0.1%-0.2% annually, with most of the effects being front-loaded. One of the main challenges in trying to determine the economic impact is there have been only a few instances of comprehensive tax reform in the post war era. The most significant were the Kennedy tax cuts in the mid-1960s and two rounds of tax changes during the Reagan years.

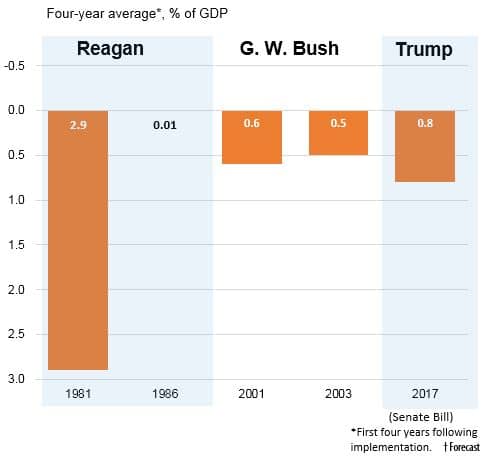

Of these, the most stimulative was the 1981 tax cuts, which reduced tax revenues by nearly 3% of GDP on average over the first four years, and which caused the federal budget deficit to rise to more than 5% of GDP. By comparison, the current tax bill is estimated to reduce tax revenues by about 0.8% of GDP over the next four years (Figure 1). While the Reagan tax cuts were accompanied by an acceleration of economic growth, they occurred in an environment in which interest rates declined from record high levels as inflation and inflation expectations receded. Consequently, it is difficult to disentangle the effects of tax rate changes and interest rate changes on the economy.

Figure 1: Revenue Effects of U.S. Tax Cuts (% of GDP)

Source: The Economist.

Impact on the Budget Deficit & Interest Rates

Another issue investors need to weigh is the impact that the tax bill will have on the federal budget deficit and interest rates. Following the 2016 elections, it was unclear whether changes in the tax code would be designed to stimulate the economy as President Trump favored, or whether they would be part of broader reforms that would eliminate distortions and broaden the tax base, which House Republican leaders favored. Today, it is evident that a compromise was worked out, in which the net tax cut over the next ten years is targeted to be $1.4 trillion. This increase is considered to be moderate, as it is equivalent to 0.4% of GDP annually and well below estimates of proposals Donald Trump put forth during the presidential campaign.

Thus far, the bond market has not responded to the pending legislation. However, the risk is that bond yields will rise in the future, as the federal budget deficit is expected to rise materially in the coming decade as baby boomers retire and place increased burdens on entitlement programs. According to the CBO projections, the budget deficit is likely to double to more than 5% of GDP over the coming decade in the absence of any policy changes. With the passage of the GOP tax plan, the deficit could expand by an additional $1 trillion according to the Joint Committee on Taxation. Consequently, the timing of the tax cut is being called into question, as it occurs when the economy is close to full employment and also when the budget picture is expected to worsen in future years.

Investment Implications

Throughout this year, the U.S. stock market has been buoyed by improved performance of the economy and corporate profits, as well as by the prospect that changes in the tax code will provide an added boost. With the recent surge in stock prices, passage of a tax bill now appears to be mostly priced into the broad market, although the impact on specific firms and industries is more difficult to assess. Going forward, therefore, the prospect for additional market gains hinges on whether it will provide the added lift that investors are expecting. An encouraging development in this regard is that business capital spending has accelerated this year, and business and consumer confidence readings are upbeat.

Meanwhile, we will be monitoring the situation closely to ascertain how businesses are responding to the new tax incentives. Amid all the political controversy over the tax bill, our view is that investors should have an open mind about its prospects for boosting capital spending, and then decide whether or not it is achieving its intended objective as new information unfolds. At this juncture, it is simply too early to tell.

1Goldman Sachs Portfolio Research Strategy, “2018 US Equity Outlook: Rational Exuberance,” November 21, 2017.

2Martin Feldstein, “Corporate Tax Reform Is the Key to Growth,” Wall Street Journal, November 5, 2017, and Kevin Hassett, “Remarks Before the Tax Policy Center-Tax Foundation,” October 5, 2017 and “White House economic analysis of GOP tax reform plan — CNBC.com,” October 16, 2017.

3Lawrence H. Summers, “The Trump administration’s tax plan is an atrocity,” Washington Post, October 8, 2017 and Paul Krugman, “The Biggest Tax Scam in History,” The New York Times, November 27, 2017.