This issue has become relevant as the Biden administration embarks on the biggest expansion in the federal government since LBJ’s “Great Society”. Biden’s agenda to “Build Back Better” offers a stark contrast with Donald Trump’s plan to “Make America Great Again”.

The policy shift that is occurring is an opportunity to test the precepts of Keynesian economics that embrace the government’s role in the economy versus supply side policies that favor tax cuts and deregulation.

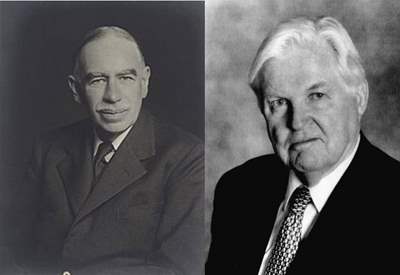

(Pictured here is John Maynard Keynes (left) who was an English economist and Robert Mundell (right), a Canadian economist who is considered the founder of supply side economics.)

Following Trump’s surprise victory in November of 2016, the stock market went on a tear as the S&P 500 Index posted a 28% annualized return through the end of January 2018. Commentators at the time claimed that Trump’s victory had unleashed “animal spirts”. The rally subsequently stalled over the next 18 months, however, when investors became concerned about a looming U.S.-China trade war and business capital spending faded.

By comparison, the S&P 500 Index is up by about 17% following Biden’s election last November. This pace is even faster than the comparable period (150 days) following Trump’s election (see chart below).

The Stock Market’s Initial Response to Trump’s and Biden’s Elections (first 150 days)

Source: Bloomberg.

Source: Bloomberg.

The Biden rally, however, can be viewed as an extension of the strong upward trend that began in late March of 2020 when the $2.2 trillion CARES Act was enacted. Going forward, the key test is whether the stock market will continue its ascent as Biden’s agenda to undertake structural economic reform comes into focus.

The unveiling began last week with the announcement of a federal spending plan of $2.3 trillion to build out public infrastructure, green energy, and other projects this decade. Next on the horizon is a program to improve “human infrastructure” that will boost the combined tally of these two proposals to $3 trillion to $4 trillion over this decade.

With the federal budget deficit already at a post-war record of 14% of GDP, Biden’s proposal to finance the public infrastructure program would raise the marginal corporate tax rate from 21% to 28%, mandate a 15% minimum tax on book income, and impose additional taxes on overseas earnings of U.S. multinationals. If enacted, it would reverse a good part of the Tax Cuts and Jobs Act that was the signature legislation of the Trump Administration.

Investors responded favorably to the announcement of Biden’s program, with the S&P 500 Index topping the 4,000 threshold last week. The stock market’s resilience mainly reflects growing optimism about the economy. In late 2020, for example, most forecasts envisioned real GDP growth would be in the vicinity of 4% this year. Now the consensus is growth will be between 6%-7%, which would be one of the highest rates in the post-war era.

Meanwhile, Wall Street analysts are beginning to update their estimates of EPS growth in 2021 and 2022 as details of Biden’s infrastructure plan are released. Goldman Sachs’ top down estimate for 2021 calls for S&P 500 EPS growth to be 27% after it declined by 17% last year. It then estimates that, if fully implemented, Biden’s corporate tax proposal could lower its 2022 EPS forecast by 10% from $197 per share to $185 per share. This would leave it only marginally higher than this year’s estimate of $181.

Investors will also have to weigh the impact of Biden’s program on bond yields as they discount future earnings. Ten year Treasury yields already have risen about 80 basis points this year to 1.7%, reflecting both an improved economic outlook and the prospect of higher inflation. And a test of the 2% level seems likely later this year, with further increases to come in 2022. At some point, a further significant rise could impact equity valuations, which are high now.

Thus far, the increase in bond yields has not halted the stock market’s rise mainly because the Federal Reserve has been steadfast that it will leave short term interest rates unchanged for the next few years. The reason: With nearly 8.5 million people having lost their jobs since the pandemic struck in February of 2020, Fed officials believes any rise in inflation above its 2% target will be temporary.

Nonetheless, while most investors appear sanguine about the prospects for the economy and stock market this year, there is greater uncertainty about what will follow. It is too early to be confident of the outcome, because the legislation that is ultimately enacted may differ considerably from what the Biden administration is proposing.

In the end, my take is that most equity investors are pragmatic and results oriented. As the last twelve months attest, they are comfortable with demand-oriented policies that boost economic growth and corporate profits materially without rekindling inflation.

The big unknown is whether Biden’s plans to reform the American economy will boost the economy’s productive potential to offset the impact of tax hikes. Meanwhile, the fate of the stock market hangs in the balance.

A version of this article was posted to Forbes.com on April 7, 2021.