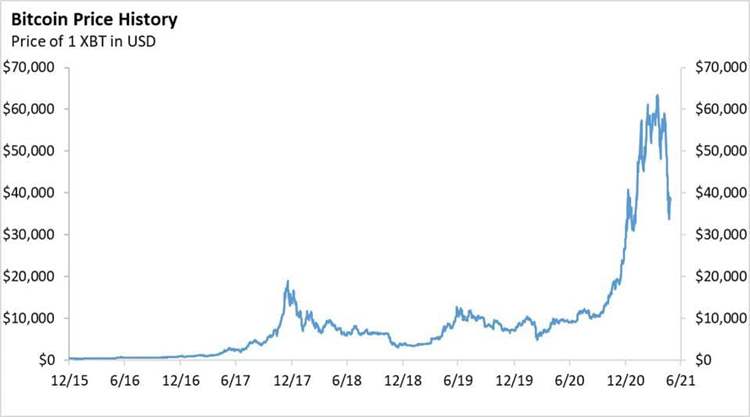

After posting staggering returns from mid-2020, prices of Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies have fallen by about one third in recent weeks. The price declines have resulted in more than $1 trillion in market value being wiped out in just two weeks.

The sell-off began with Elon Musk’s remark on SNL that Dogecoin was a “hustle” and was followed by Tesla TSLA +0.4% suspending purchases of its vehicles by Bitcoin due to environmental concerns. Soon after, selling pressures intensified and Bitcoin plummeted briefly to a low of $32,000 when China’s Vice Premier Liu He pledged that the authorities would crack down on Bitcoin mining and trading.

Bitcoin’s price has subsequently stabilized near $40,000, as holders have stepped up purchases. According to a Wall Street Journal report, a group of “fugitive” traders convened in Hong Kong to discuss ways to circumvent the controls. The report quotes John McAfee, founder of the namesake antivirus company, concluding: “The creators, designers and innovators will find a way around it. They always do and always will.”

History is not on the side of the “fugitives,” however. What put Bitcoin on the investment map were large price increases in 2017. As Kim Schoenholtz of NYU observes, these increases were accompanied by a surge in its weekly trading volumes during a period of high capital outflows from China, and 97% of Bitcoin exchange transactions at that time took place in China. This suggests that many of the transactions may have been a means to avoid capital controls. In January 2017, the People’s Bank of China (PBoC) took measures to slow activity on the country’s three major cryptocurrency exchanges. Thereafter, the price of Bitcoin plummeted in 2018 and 2019.

By comparison, the crackdown this time has more to do with plans by the PBoC to roll out its own digital currency that will compete with privately-issued ones. Some of the motivation is the Chinese authorities view privately-issued digital currencies as a risk to the stability of the country’s financial system. The Chinese government also wants to shut down Bitcoin mining due to concerns about the environment and the massive amounts of coal-powered electricity generation it requires.

The timing of China’s latest crackdown occurred as officials gathered to assess the country’s economic and financial landscape. The main conclusion of Vice Premier Liu was that China needed to strengthen risk management amid huge fiscal and monetary stimulus in the U.S., which has created concerns about inflation and asset bubbles. The risks that China confronts include imported inflation, cryptocurrency instability, and upward pressure on the RMB versus the U.S. dollar.

In this regard, it is apparent that the resurgence of demand for cryptocurrencies in the spring of 2020 coincided with the Federal Reserve lowering U.S. interest rates to zero and doubling its balance sheet. These actions caused retail investors to believe Bitcoin and other cryptocurrencies could be a potential hedge against inflation.

Skeptics, however, are quick to point out that digital currencies lack several attributes that are associated with traditional currencies. Most notably, because they fluctuate wildly in value and lack any backing, they cannot function as a medium of exchange or a unit of account.

The verdict is out as to whether digital currencies are a good store of value. While they experienced explosive price appreciation in the past year, they have also been subject to steep price declines. Moreover, demand for digital currencies could erode further if the Fed were to shorten its timetable for raising interest rates from 2024 to as soon as next year. The reason: Cryptocurrencies do not pay interest and they are subject to taxes on capital gains.

In the meantime, Fed Chair Jerome Powell announced that the Fed’s staff is preparing a discussion paper that will outline the benefits and risks of creating a central bank digital currency (CBDC).

Lael Brainard, a Federal Reserve governor who focuses on payments issues, also warned about the risks of digital currencies in an address before CoinDesk’s Consensus. Her message was that “the widespread use of private monies for consumer payments could fragment parts of the U.S payments system in ways that impose burdens and raise costs for households and businesses.”1 She commented that so-called stablecoins such as Facebook’s Diem (formerly known as Libra) that seek to tie their offerings to the value of the U.S. dollar do not carry the same level of protection as bank deposits or fiat currency.

White House officials were also briefed by staff members of the U.S. Treasury. Administration officials reportedly are studying potential “gaps” in oversight of digital currencies, such as whether they can be used to finance illicit or terrorist activities, or are used to avoid tax payments.

The bottom line is that in addition to the inherent risks of cryptocurrencies — high price volatility and lack of transparency and financial backing — buyers now face the added risk of increased regulatory oversight in China, the U.S. and other financial centers. For these reasons, privately issued digital currencies should be considered a speculative trading tool rather than a legitimate asset class for investors.

A version of this article was posted to Forbes.com on May 27, 2021.

1"Private Money and Central Bank Money as Payments Go Digital: an Update on CBDCs." Governor Lael Brainard at the Consensus by CoinDesk 2021 Conference, May 24, 2021.