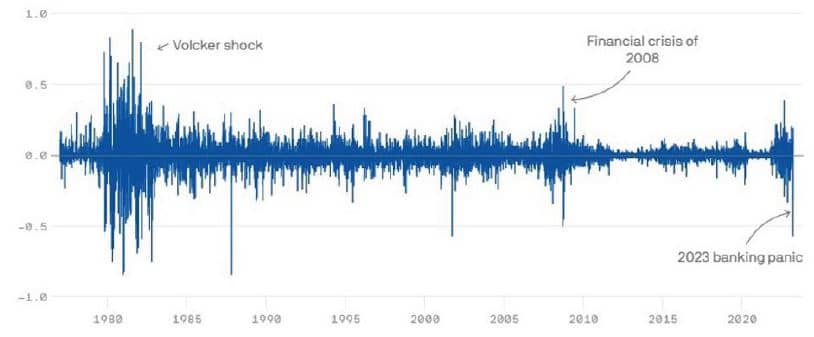

Figure 1. Change in Two-year Treasury Note Yields, in basis points, Dec. 31, 1976 - Mar. 21, 2023

Data source: FactSet; Chart source: Nicki Camberg/Axios

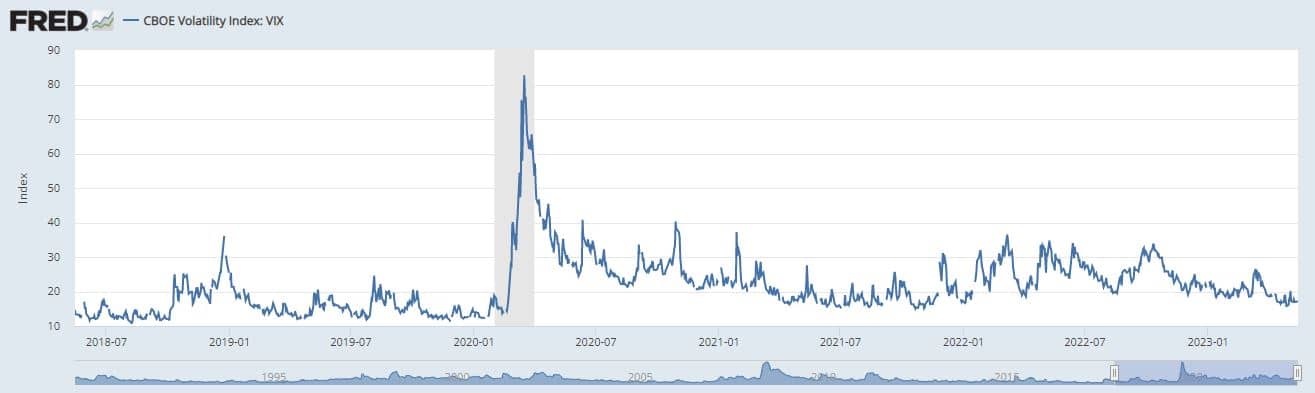

Figure 2. The VIX Index

Source: Chicago Board Options Exchange's CBOE Volatility Index, FRED

The yield on the two-year Treasury note surged to 5% on March 7, the highest level since 2007, when Jerome Powell signaled that the Fed could raise interest rates by 50 basis points in his congressional testimony. According to an Axios report, global macro hedge funds were overwhelmingly positioned for the Fed to keep raising rates aggressively until inflation was brought under control.

Will Bank Failures Tip the Economy into Recession?

As the shock over deposit flight from banks has sunk in, investors are now focusing on whether problems with regional banks will tip the economy into recession. At the press conference following the March FOMC meeting, Jerome Powell acknowledged that banking problems could reduce lending, but he maintained the Fed’s paramount goal is to reduce inflation. The Fed wound up raising rates by a quarter point, followed by another 25 basis point hike on May 3.

Amid this, the stock market has taken developments in stride: The year-to-date return for S&P 500 is more than 9%, although much of the increase is accounted for by a handful of tech stocks. The principal reason is that investors believe the Fed will now pause in raising interest rates and that it will lower rates in the second half—the so-called “Fed put.” Indeed, there is now about a 75 basis point difference between where the Fed believes rates will end this year and where the market does.

One development supporting this view is that in the wake of the regional bank problems the Fed added to its holdings of bonds to help drive yields down. This could be a precursor of how it will behave if the problem spreads.

What May Cause the Stock Market to Break Out of Its Narrow Trading Range and Sell Off?

One possibility is that inflation could turn out stickier than investors perceive. If so, even if the Fed pauses, it would only be temporary because the Fed wants to retain its credibility as an inflation fighter. If it were to raise the funds rate to 6%, for example, this would add to bond market volatility and likely spill over to the stock market.

Another possibility is that corporate profits will weaken by more than what is priced in to the stock market. The impact of slower economic growth on corporate profits was evident last year, when the S&P 500 operating earnings per share slowed to 5% and declined by 3% in the fourth quarter. The consensus view among Wall Street analysts this year is that EPS will level off. However, firms that are forecasting a recession such as Morgan Stanley and Bank of America have called for a decline in EPS of about 10%.

High Inflation is Still the Worst Outcome

By comparison, a mild recession would likely have only a temporary adverse impact on the stock market, because investors already appear prepared for one. If history is any guide, the stock market typically rallies once the trough of a recession has been reached. This reflects the effects of both lower interest rates and an improved earnings outlook.

What Investment Strategy Makes Sense in These Circumstances?

A version of this article was posted to Forbes.com on May 1, 2023.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Opinions expressed in this commentary reflect subjective judgments of the author based on the current market conditions at the time of writing and are subject to change without notice. Information and statistics contained herein have been obtained from sources believed to reliable but are not guaranteed to be accurate or complete. Past performance is not indicative of future results. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington Investment Advisors, Inc.