Market Update

The news of this bankruptcy has heightened concern around the financial health of U.S. consumers, particularly those in the deep subprime cohort. The now-bankrupt lender has securitized its loan portfolio in the ABS market since 2017.

While available data suggested the company’s auto loan portfolio was performing as expected, allegations of fraud cast doubt on the reliability of that information. Uncertainty around the timing and recovery value for bondholders has pushed the company’s ABS, originally rated AAA, to trade as low as 84 cents on the dollar before being downgraded to CCC. Meanwhile, the company’s BB and B rated bonds fell in value, trading as low as 12 cents on the dollar before being downgraded to C.

At the forefront of the situation are two topics we will address:

1. How concerned should we be about the financial health of the subprime consumer?

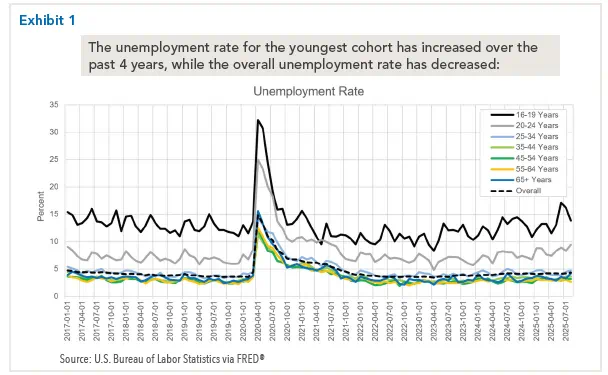

Several data sets indicate that the U.S. consumer is becoming increasingly bifurcated. The Bureau of Labor Statistics shows that younger consumers ages 16-19 are experiencing an unemployment rate of 13.8%, more than three times that of the overall labor market at 4.3% (see Exhibit 1). While this age cohort has traditionally experienced a higher unemployment rate than older groups, the gap has been trending wider post-Covid. The Federal Reserve Bank of Atlanta reports that the lowest-income cohorts are also experiencing the weakest wage growth compared with higher-income cohorts (see Exhibit 2). Furthermore, consumer loan delinquency and charge-off data reflect stabilization or improvement in prime consumer loan types, while their subprime counterparts lag (see Exhibit 3).

While income level and credit quality are not necessarily perfectly correlated, it is intuitive that lower-income and subprime consumers are more financially vulnerable than higher-income and prime consumers. It is concerning that we are observing weakness in these segments during an environment where overall unemployment remains low, and the costs of higher tariffs have yet to be fully passed through to consumers. Spending by higher-income consumers, on the other hand, is likely to be resilient in the face of tariff-driven price increases. This support for elevated prices could further pressure the bifurcation between higher-income/prime consumers and lower-income/subprime consumers. In our view, these factors merit caution regarding the overall health of the subprime consumer on a forward-looking basis.

Even with these risks in mind, it is important to note that the overall health of the consumer—including those in the subprime segment—does not translate directly into the expected performance of every security backed by such assets. In fact, one could argue that the nominal level of collateral defaults, by itself, is less relevant to the credit quality of an asset-backed security than whether the originator accurately underwrote and efficiently priced the loans, and whether the securitization was appropriately structured to handle collateral losses—regardless of their magnitude.

In other words, which of these two lenders’ loan portfolios would you rather have invested in:

Lender A:

Whose prime auto loan performance experiences cumulative net losses of 3%, but who had underwritten and priced those loans with a loss assumption of only 1%?

or

Lender B:

Whose subprime auto loan portfolio experiences cumulative net losses of 20%, but who had underwritten and priced those loans expecting losses of 22%?

This illustration, while simplified, shows that absolute loss levels alone are inadequate to assess the health of a lender’s portfolio, or a securitization backed by it. To choose between Lender A and Lender B, we need considerably more information to understand each investment’s sensitivity to deviation in loss rates. Even a variable such as the number of high-APR loans paying off earlier than scheduled can have an impact on the portfolio’s return profile if the lender collects less total interest cashflow than expected over the life of the loans.

Consumer finance, and the securitization market that helps fund it, represent a broad spectrum of risk profiles and return opportunities. While aggregate consumer data and trends are important to watch, they do not paint a complete picture of individual lenders or portfolios. A more granular analysis is needed to uncover the risks and opportunities that are unique to each lender and each securitization.

2. How can investors avoid the type of risk we're seeing play out with the buy-here-pay-here lender?

Thus far, we have focused primarily on the health of the consumer which, ironically, may not be the main driver of financial loss in the case of the bankrupt buy-here-pay-here lender. While it is too early in the investigation to know with certainty, the evidence suggests that fraud—rather than subprime consumer underperformance—may have been the primary issue. If that proves to be the case, how can investors protect themselves from this type of risk?

There is no infallible way to fully insulate a portfolio from outright fraud, however, there are many steps investors can take to help identify potential red flags. Issuer underwriting should involve quantitative analysis of financial metrics and portfolio health as well as a thorough qualitative assessment of the company’s business model, management team, and financial and operational controls, among other factors. Ideally, meeting with company management in person can help with this type of analysis while also establishing a direct line of communication between investor and issuer.

Fort Washington places tremendous emphasis on in-depth issuer due diligence, which is a critical layer of our underwriting and surveillance processes. We have reviewed more than 100 auto finance programs over the past two decades, approving only around one quarter of those for investment. Prior to approval, we require a direct one-on-one diligence discussion with each issuer’s management team, which provides an opportunity to identify potential red flags or areas of concern. We also hold issuers to a high standard of consumer-facing propriety—which is critical when the borrowers they serve are particularly vulnerable.

Closing Summary

Ultimately, legal proceedings will determine whether the downfall of the buy-here-pay-here lender is rooted in subprime consumer weakness, fraud, or both. And while the pain felt by those with exposure looks to be meaningful, we do not believe the situation reflects systemic risk to the ABS market or the consumer more broadly. Consumer access to borrowing is a critical component of the U.S. economy and GDP, helping facilitate the affordability of reliable transportation for consumers of a wide range of age, income level, and credit quality. While it may not always be possible for investors to avoid situations of fraud, strong underwriting and surveillance practices can help mitigate the risk of exposure.

For additional reading, please refer to the Subprime Auto Asset-Backed Securities White Paper.

Download Subprime Auto Asset-Backed Securities Market Update

Download Subprime Auto Asset-Backed Securities Market Update