Highlights

- After plummeting following President Donald Trump’s “Liberation Day” tariff hikes, U.S. stocks subsequently rallied to new highs as reciprocal tariffs were rescinded for 90 days and the U.S. and China settled their trade dispute.

- While recession risks have lessened, the U.S. economy slowed in the first half of this year, and growth in 2025 is expected to be about a full percentage point below last year’s pace of 2.5%. Although the impact of tariffs on consumer prices has not materialized yet, price increases are anticipated in the second half.

- The Federal Reserve (Fed) is keeping interest rates on hold until it has a clearer read on the economy and inflation. Meanwhile, Congress enacted President Trump’s “Big, Beautiful Budget,” but it is not expected to produce as big an economic boost as the Tax Cuts and Jobs Act did in Trump’s first term.

- Amid this, we are positioning portfolios with a modest overweight to risk. Valuations are back to levels comfortably above long-term averages despite elevated uncertainty.

Investment Returns: Mixed for Stocks and Bonds, While the Dollar Sells Off

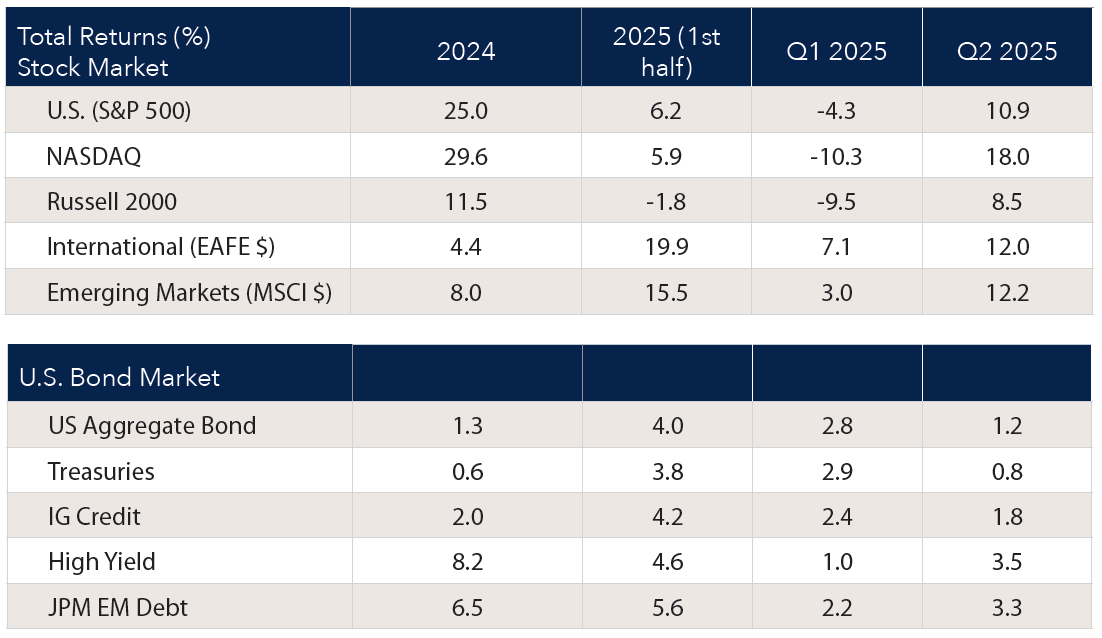

After posting stellar returns in both 2023 and 2024, the U.S. stock market returned 6.2% in the first half of this year (see Figure 1). This masks large market swings in the second quarter. Worries about a recession linked to tariffs sent the S&P 500 Index tumbling by 20% from its February peak in early April. However, the market then rebounded through the end of the quarter to close at an all-time high amid investor optimism that the global trade conflict would not be as bad as was previously feared.

In comparison, U.S. bond yields have fluctuated in a trading range for most of this year, except for a brief period immediately following the April 2 announcement. Consequently, bond returns for the first half of the year were close to their respective coupon yields.

Figure 1. Investment Returns 2025 vs. 2024 (in percent)

Source: Bloomberg.

Source: Bloomberg.

One clear trend this year is the U.S. dollar, which weakened by nearly 11% on a trade-weighted basis, marking the worst start since 1973. The dollar depreciated by 13% against the euro, even though the European Central Bank has lowered interest rates from 4% to 2% over the past 12 months, while the Fed has kept rates on hold. This indicates that global investors now require a greater interest-rate premium to hold the dollar.

Tariffs Heighten Economic Uncertainty

Investors were upbeat about the prospects for the U.S. economy at the start of this year in anticipation that President Trump would pursue pro-growth policies of tax cuts and deregulation, as he did during his first term. However, sentiment changed following Trump’s April 2 “Liberation Day” announcement that called for the largest tariff hikes in 100 years.

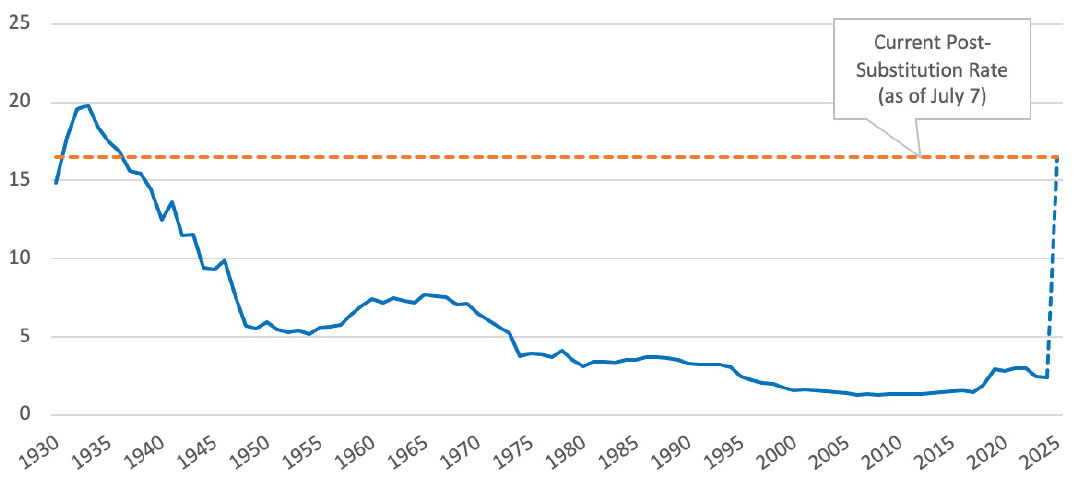

Figure 2. Effective U.S. Tariff Rate

Source: Bloomberg.

When U.S. financial markets sold off and the dollar plummeted, President Trump shifted his stance by announcing that the reciprocal tariffs would be suspended for 90 days to allow countries to negotiate the rates. He also put Treasury Secretary Scott Bessent in charge of the trade negotiations, which helped to reassure investors. A key turning point occurred in May, when the U.S. and China agreed to a framework in which tariffs for China would be lowered to 30% from 145%. This lessened fears about an all-out trade war between the world’s two largest economies that could have spawned a global recession.

At that time, trade deals had only been announced for the U.K. and Vietnam, with the U.S. reaching a tentative truce with China in May. Meanwhile, President Trump has hardened his threat to raise tariffs on certain countries, while Scott Bessent has signaled there may be extensions to wrap up major pacts by Labor Day. The latest Yale Budget Lab estimate of the U.S. effective tariff rate stands at nearly 16%, up from 3% at the start of this year.

The Fed Stays on Hold for Now

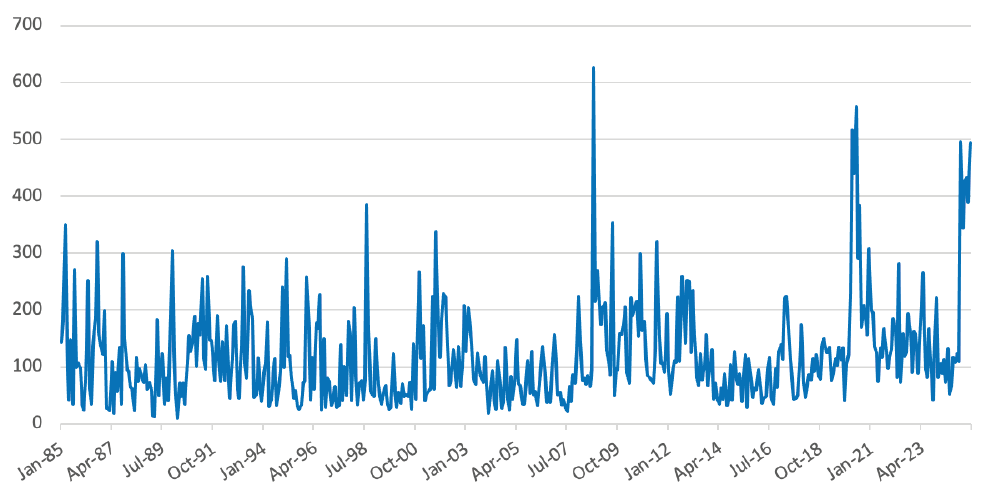

Amid this, the Fed has kept interest rates on hold, and it has not signaled any imminent moves despite vocal criticism from President Trump that it should lower rates. The decision reflects the Fed’s assessment that the economy is in good shape with the labor market close to maximum employment at 4.1%. Like most observers, Fed officials are also highly uncertain how the situation will unfold (see Figure 3).

Figure 3. Economic Policy Uncertainty Index for the U.S., 1985-2025

Source: CBO.

The latest FOMC projections anticipate real growth will slow to 1.4% this year and 1.6% next year from 2.5% in 2024. The principal factor contributing to the slowdown has been consumer spending, which accounts for 68% of total spending. It grew at only a 0.5% annualized rate in the first quarter and fell by 0.3% in May, marking the first decline since the start of this year.

The unemployment rate eased to 4.1% in June from 4.2%, but the headline increase in jobs of 147,000 masks a slowdown in the private sector, as government jobs accounted for about half of the overall increase. The Fed envisions that unemployment will rise gradually and end the year at 4.5%.

One surprise is that there has been little impact of tariffs on consumer prices thus far. However, the Fed and most economic forecasters believe this mainly reflects a buildup in inventories ahead of the tariffs. As they are depleted, price increases are likely to follow. The Fed’s latest projections call for core PCE inflation to reach 3.1% by year’s end.

At the press conference following the June FOMC meeting, Chair Jerome Powell stated that due to uncertainty about the impact of tariffs, “We may find ourselves in the challenging scenario in which our dual mandate goals are in tension…For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

The bond market anticipates that the Fed will leave rates on hold through summer, and then ease policy gradually in the fall as the economy softens and unemployment edges up. If so, the federal funds rate could end the year around 3.75%-4.0%.

Congress Enacts Trump's "Big, Beautiful Bill"

With regard to fiscal policy, the Republican-controlled Congress enacted an all-encompassing budget bill that President Trump signed on July 4. It represents the signature legislation of Trump’s second term just as the Tax Cuts and Jobs Act (TCJA) of 2017 was in his first term.

One of the major accomplishments of the TCJA was to make the U.S. corporate tax code competitive with the rest of the world by lowering the marginal tax rate from 35% to 21%. It did so by making the corporate rate cuts permanent, which succeeded in boosting business capital spending and ending large exoduses of multinational headquarters to overseas jurisdictions.

In comparison, the budget bill that was just enacted extended cuts in personal tax rates that were set to expire at the end of this year. Proponents claim that if the personal tax rates expired, most Americans would face tax increases that could weaken the economy.

One challenge is that the extension of the TCJA tax cuts coupled with new tax initiatives that Trump campaigned on are estimated to cost the federal government about $4.5 trillion in revenues over the next ten years. Republicans sought to close the gap by cutting more than $1 trillion from Medicaid and the Food Stamp Program. Nonetheless, there is little chance that the budget deficit will be brought under control. The Congressional Budget Office estimates that the bill will increase federal deficits over the next 10 years by nearly $3.3 trillion.

Another concern had been that the tax cuts in the House version of the bill were not oriented to promote long-term growth: The Tax Foundation estimated that they would increase long-term GDP by only 0.8% (not annualized). However, Senate Republicans addressed this concern by including more permanent business tax cuts and full expensing for equipment and R&D in their version of the bill that was ultimately enacted.

The bottom line is that the “Big, Beautiful Bill” is unlikely to boost the economy as much as the TCJA did, or to lower future budget imbalances. At the same time, the legislation is the most regressive since the federal income tax was enacted in 1913.

How Will the Federal Reserve Respond?

While the Federal Reserve’s dual mandate is to aim for full employment and price stability, it now faces the added challenge of assessing the impact of a global trade conflict. At the press conference following the March FOMC meeting, Fed Chair Jerome Powell indicated that President Trump’s trade agenda would likely drive up prices, although there was considerable uncertainty about the magnitude of price hikes and whether they would be temporary. He said that while inflation had previously neared the Fed’s goal of 2% inflation, “I do think with the arrival of tariff inflation, further progress may be delayed.”

The economic projections that accompanied the FOMC meeting showed respondents lowered their forecasts of growth in 2025 to 1.7% from 2.1% previously, while they raised projections for core PCE inflation to 2.8% from 2.5%. Despite this, the projection for the federal funds rate was not changed, with the majority of respondents expecting two rate cuts of 25 basis points later this year.

The bottom line is that Fed officials, like market participants, are unsure about how conditions will play out. Therefore, the Fed is likely to stay on hold a while longer but ultimately may feel compelled to lower rates if the economy slows materially and unemployment increases.

However, the Fed may be constrained by lowering rates as quickly as it has in the past, because inflation is likely to increase temporarily due to the tariff increases. The bond market currently is pricing in cuts in the fed funds rate of 125 basis points this year ending the year at 3.0%-3.25%.

Pressures on the Dollar Likely to Persist

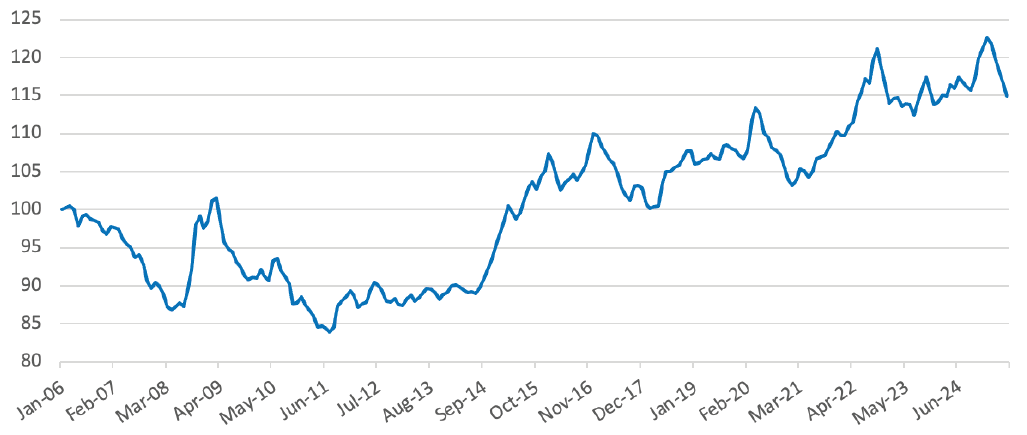

Faced with this situation, the likelihood is that the U.S. dollar will remain under pressure against the key currencies. Although the dollar fell significantly in the first half of this year, it is still very high after adjusting for inflation rate differentials versus U.S. trading partners (see Figure 4).

Figure 4. Real Broad Dollar Index, 2006-2025

Source: CBO.

The most likely outcome is that it will weaken further once the Fed eases monetary policy. While the dollar’s decline has been benign thus far, the risk is that global investors could require a greater premium for holding dollar assets, resulting in upward pressure on bond yields at some point. That said, we do not believe the status of the dollar as the world’s premier reserve currency is in jeopardy.

Positioning Investment Portfolios

The uncertainty that began unsettling investors in Q1 extended into the second quarter. Escalating tariff policy peaked with the announcement of reciprocal tariffs for all trading partners on April 2 (“Liberation Day”) before a reprieve was announced just a week later. While this delay provided markets relief and lowered the odds of an immediate shock to growth, it did little to clarify the outlook for consumers and businesses trying to plan spending, capex, or hiring.

In balanced portfolios, we favor a modest overweight to equities relative to fixed income. Equity valuations are elevated compared to long-term averages and offer limited margin of safety despite economic risks surrounding trade developments as well as fiscal and monetary policy. Full valuations, coupled with increased economic risks, support a cautious stance within bond/stock portfolios.

In fixed income, we are positioning portfolios with a slight overweight to credit risk. Credit spreads are only modestly wider over the year after tightening during the second quarter, ending June at levels tight compared to history. Portfolios are positioned with a high-quality bias and remain focused on compelling bottom-up opportunities given limited relative value opportunities across sectors. The yield curve steepened over the quarter as long interest rates increased while shorter rates declined amid subsiding near-term inflation concerns. The level of longer maturity interest rates is within our fair value range, but we anticipate volatility will present opportunities for tactical adjustments.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. The S&P 500 briefly entered a bear market in April before recovering back to all-time highs by the end of June as investors became more optimistic around trade negotiations. Given this sharp recovery in prices, valuations are back to levels comfortably above long-term averages. We are prioritizing high barrier-to-entry businesses with high returns on capital and maintaining a moderately defensive posture within portfolios.

Download 2Q 2025 Commentary: 2025 Midyear Update

Download 2Q 2025 Commentary: 2025 Midyear Update