Highlights

- Like It Never Happened: The S&P 500 has completely erased the losses following April 2nd (Liberation Day) and is now in positive territory for the year.

- Tariff Block: Trade uncertainty remains elevated as the U.S. Court of International Trade recently blocked the President’s reciprocal tariffs. However, the decision was appealed and is likely to go to the Supreme Court.

- America’s Debt Dilemma: The U.S. has been on an unsustainable path regarding government spending and deficits. The One, Big Beautiful Bill is adding to the problem, and we take a deeper dive in this month’s Spotlight below.

Table of Contents

Macro Insights

Fiscal Concerns & Lower Recession Risk Prompt Rate Rise

Equities extended their rebound in May, building on the late-April rally as investor optimism grew that U.S. trade policy would remain aggressive in tone but ultimately fall short of triggering a recession. As recession fears receded, risk assets rallied. The S&P 500 rose more than 6% for the month, led by tech and growth stocks, with the Nasdaq climbing 9.5%. The market priced in a lower probability of Federal Reserve (Fed) rate cuts, lifting 2-year yields by over 30 basis points, while concerns over fiscal sustainability contributed to a rise in long-end rates of 25 basis points (see this month’s Spotlight for details).

The U.S. trade policy backdrop remains volatile, yet a pattern appears to be emerging: initial announcements of sweeping tariffs are quickly followed by delayed implementation timelines, signaling a preference for negotiation over confrontation. Last week, the Court of International Trade temporarily blocked the administration’s “Liberation Day” tariffs, reinforcing the view that trade actions may be moderated by legal and institutional checks. While the ruling is under appeal and alternative mechanisms may be pursued, markets are increasingly discounting the risk that trade policy alone could derail the economic expansion.

Last month, we flagged concerns that unilateral executive actions were undermining confidence in the U.S. system of checks and balances. With the judiciary now weighing in on the legality of emergency powers, some of that institutional confidence may begin to recover. However, the ongoing legal process, including potential Supreme Court involvement, will likely delay the resolution of trade negotiations as counterparties adopt a wait-and-see approach.

With trade developments in a holding pattern, investor focus is shifting back to macro and company-level fundamentals. First-quarter earnings came in ahead of expectations and printed their second consecutive quarter of double-digit growth, although corporate guidance was limited, given ongoing policy uncertainty. Consumer spending has remained solid based on credit and debit card activity, and sentiment surveys improved in May. However, signs of cooling are emerging in areas like travel, and the housing market remains weak under the weight of elevated mortgage rates. Corporate commentary on tariff pass-through to consumers has been mixed, raising concerns that recent progress on inflation and sentiment could be at risk if prices rise.

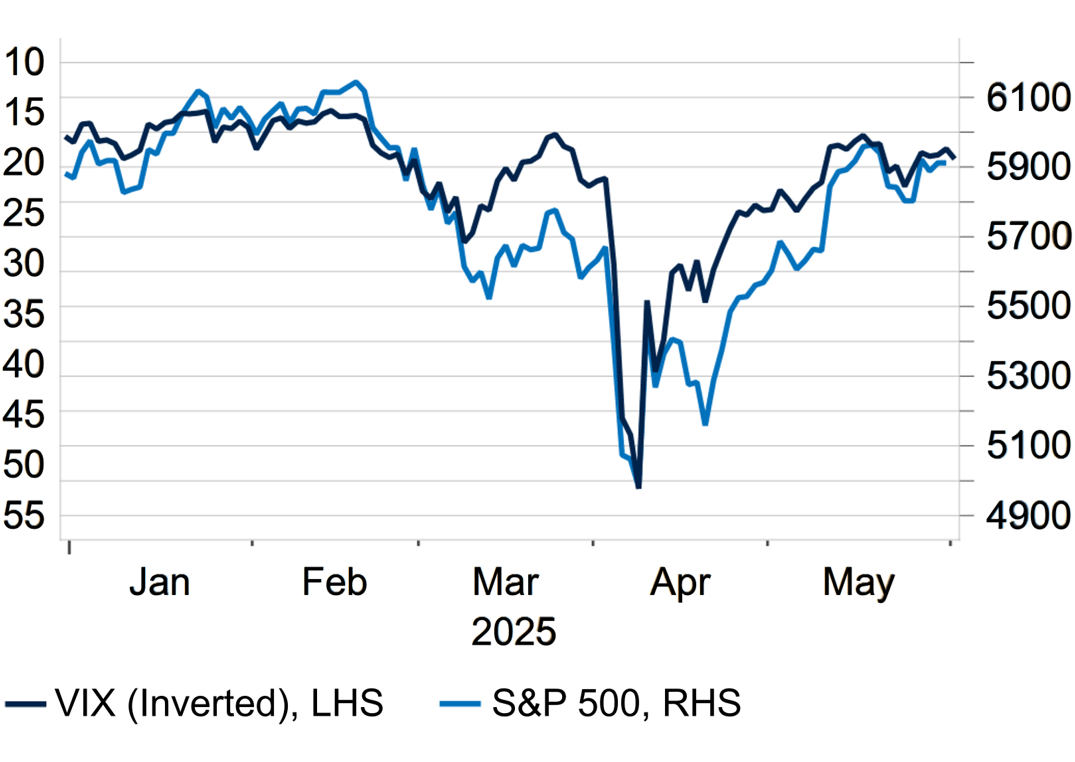

With the S&P 500 only 4% below all-time highs and the VIX notably lower, markets reflect confidence that trade tensions will remain manageable and that recession risk is low. Still, with the index trading near 22x forward earnings—a valuation that offers limited cushion—we view the risk/reward as less compelling. Elevated rates and unresolved policy uncertainty leave the market vulnerable to negative surprises.

S&P 500 Nearing Highs as VIX Falls

As volatility due to trade uncertainty has subsided, equities have rebounded quickly.

S&P 500 & VIX

What to Watch

U.S. consumer and business outlook has softened amid tariff uncertainty. As a result, social media posts and headlines out of the White House are likely to continue driving market volatility. Investors will monitor incoming sentiment and indications for potential impacts on economic activity.

|

Monthly Spotlight

A Fraying Fiscal Foundation

Despite a growing and resilient economy, the United States’ fiscal foundation is quietly eroding. The country has been running deficits at a scale rarely seen outside of recessions, and interest costs are becoming an outsized component of the federal budget. Layered onto this are fresh spending proposals, a rating agency downgrade, and deepening political dysfunction—all of which signal that fiscal sustainability is sliding down Washington’s priority list. Although these issues are not all new, we anticipate their importance to grow as we approach a tipping point.

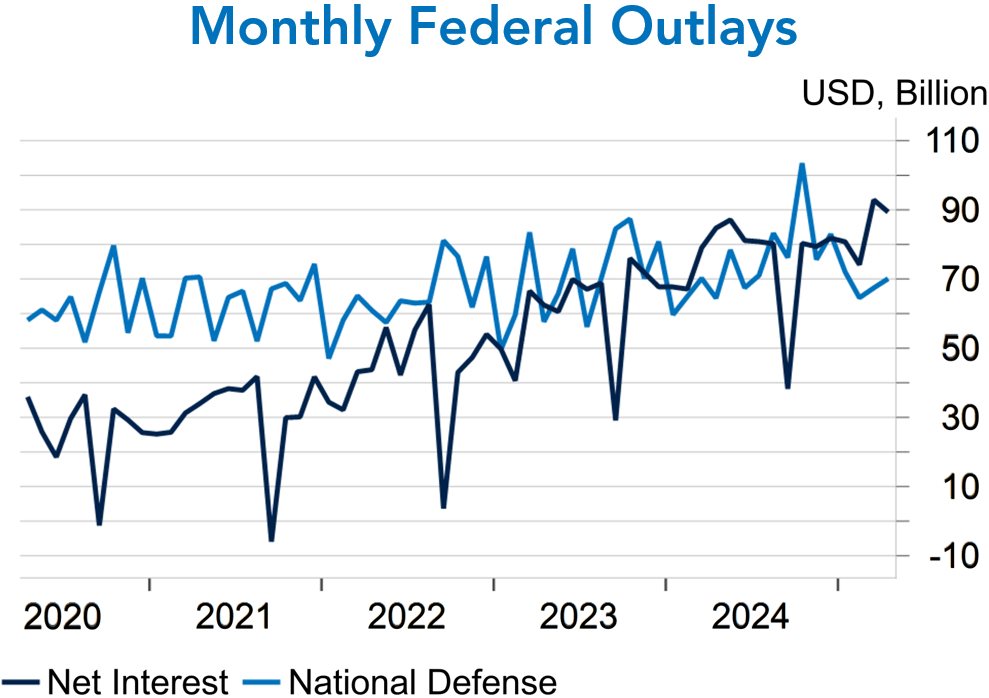

At the heart of the U.S. fiscal outlook is the inherent structural deficit. The U.S. is projected to run annual deficits of $2 trillion or more over the next decade before accounting for current proposals, according to the Congressional Budget Office. Importantly, this is occurring without the pressures of war or economic crisis when large fiscal deficits would be expected. Typically, we would expect deficits to shrink while the economy is strong and doesn’t require fiscal intervention; however, the U.S. government has been doing the opposite. A key problem is that the drivers of our current situation are largely cemented: demographic trends are pushing entitlement spending higher, and interest payments to service current debt are growing. Furthermore, the government now spends more on interest than it does on national defense—a shift that underscores how past borrowing is impacting future discretionary spending.

At the heart of the U.S. fiscal outlook is the inherent structural deficit. The U.S. is projected to run annual deficits of $2 trillion or more over the next decade before accounting for current proposals, according to the Congressional Budget Office. Importantly, this is occurring without the pressures of war or economic crisis when large fiscal deficits would be expected. Typically, we would expect deficits to shrink while the economy is strong and doesn’t require fiscal intervention; however, the U.S. government has been doing the opposite. A key problem is that the drivers of our current situation are largely cemented: demographic trends are pushing entitlement spending higher, and interest payments to service current debt are growing. Furthermore, the government now spends more on interest than it does on national defense—a shift that underscores how past borrowing is impacting future discretionary spending.

The current reconciliation bill going through Congress highlights the prevailing mindset. While the bill touches a range of topics, at a high level, it reduces potential income by extending expiring tax cuts and increases discretionary spending without a budget offset. It’s emblematic of the broader fiscal posture: continued incremental spending without an emphasis on long-term sustainability. Even where there is bipartisan agreement, such as strengthening critical industrial supply chains, for example—it is rare to find a balanced approach. However, we acknowledge that tariffs and DOGE (Department of Government Efficiency) cuts have the potential to offset some of the proposed imbalance, which is not factored into the CBO’s (Congressional Budget Office) forecast.

This backdrop was most recently vocalized by Moody’s, which stripped the U.S. of its last AAA rating, citing rising interest burden, persistent deficits, and repeated debt ceiling brinksmanship. While mostly symbolic, following downgrades by S&P in 2011 and Fitch in 2023, it emphasizes the problem is not improving and reflects a broader erosion of confidence in the U.S. political system’s capacity to manage long-term fiscal risks.

We don’t believe the U.S. is on the brink of a fiscal calamity. However, absent meaningful reform—or perhaps the monetization of national assets—the current trajectory points toward an eventual reckoning. The country’s ability to respond to future shocks is already limited. For the past decade, markets absorbed rising debt levels because borrowing costs were negligible. That dynamic is gone. If fiscal uncertainty persists, the U.S. risks weakening the very credibility that underpins the dollar’s global role and could keep rates higher, furthering the negative feedback loop.

Source: Fort Washington, U.S. Treasury, and Bloomberg.

Current Outlook

Market Data & Performance

As of 05/31/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.