Highlights

- Historic Move: The S&P 500 entered bear market territory in April but rebounded after the White House announced a pause of reciprocal tariffs, resulting in one of the largest one-day jumps in history (+9.5%).

- Tariffs in Focus: U.S. trade policy has been the center of global focus and will keep markets volatile until more clarity is articulated from the current administration.

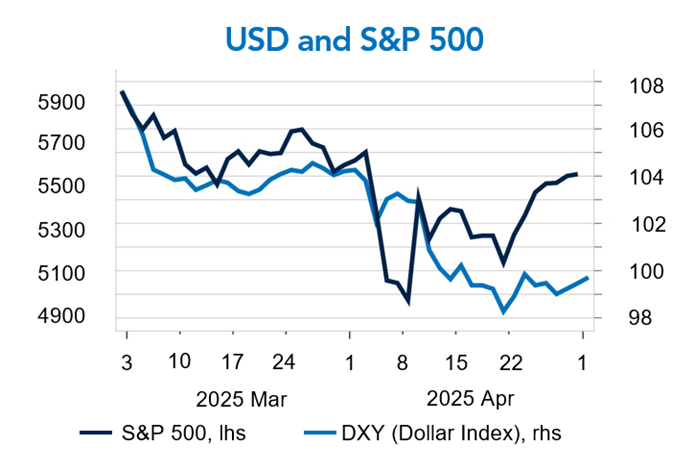

- Selling America: The U.S. dollar is typically a safe haven during times of volatility but deviated from this status, as global investors recently rotated out of U.S. stocks and bonds. We take a deeper dive in this month’s Spotlight.

Table of Contents

Macro Insights

Roller Coaster Ends Nearly Where it Started

After falling as much as 11% in the first two weeks of April, the S&P 500 ended the month down less than 1%. The administration’s so-called “Liberation Day” shook markets with the breadth and magnitude of its announced “reciprocal tariffs.” In response, equities suffered their worst two-day performance since March 2020. While country reactions varied, China’s retaliation triggered a sharp escalation, culminating in a 145% tariff on goods imported from China. The resulting weakness in equity markets—coupled with atypical behavior in Treasury and currency markets—prompted a 90-day “pause” on reciprocal tariffs with all countries except China, triggering a rebound in stocks and narrowing of credit spreads (which had moved notably wider as stocks fell).

The U.S. benefits from many well-earned advantages: an entrepreneurial culture rooted in its universities and businesses, a strong rule of law, reserve currency status, deep and flexible capital markets, abundant natural resources, and significant military and geopolitical influence. However, as we explore in this month’s Spotlight, recent developments have led to cracks in the foundation of some of these advantages. The simultaneous selling of both U.S. equities and Treasuries has been highly unusual. Likewise, rising interest rates coinciding with a weaker dollar runs counter to conventional wisdom and past risk-off experiences.

While the U.S. has legitimate grievances regarding global trade, such sweeping—and arguably mathematically dubious—tariffs have threatened confidence in the checks and balances that underpin the stability of the U.S. system. That said, we do not foresee an erosion of the structural advantages outlined above, nor do we view the U.S. dollar as facing a credible medium-term threat. The 90-day pause, reported progress in trade negotiations with key allies, and signals of a desire to de-escalate tensions with China have, for now, taken worst-case scenarios off the table.

The administration’s willingness to respond to financial market dislocations is a constructive signal regarding the degree to which near-term pain will be acceptable to achieve long-term reforms. Much remains uncertain, however. As we await further developments from Washington, the consequences of eroding consumer and business confidence will likely begin playing out in economic data. Although equity market valuations and credit spreads suggest a limited risk of a significant recession, markets remain vulnerable to negative surprises. Recession is not yet our base case, and even if a shallow “technical” recession materializes, the implications for corporate profits could prove somewhat modest.

Tariff Rates at 80-year Highs

The below effective tariff rate accounts for changing behavior due to price increases, the applied rate is above 25%.

Source: Fort Washington, Tax Foundation.

Source: Fort Washington, Tax Foundation.

What to Watch

The outlook for the U.S. continues to soften across consumers and businesses amid tariff uncertainty. Investors will monitor incoming sentiment and indications for potential impacts to economic activity. Markets will also pay close attention to any tariff impacts on inflation as well as the Federal Reserve’s (Fed) guidance.

|

Monthly Spotlight

What's Going on With the U.S. Dollar?

Since March, markets have faced an unusual set of dynamics: U.S. equities have sold off, Treasury yields have been pressured higher, and yet the dollar has weakened. Normally, a risk-off environment would drive demand for Treasuries and strengthen the dollar as global investors seek safe assets. Currently, the opposite has played out. Selling pressure from foreign investors, rising inflation concerns, and growing political uncertainty have combined to weaken the dollar, even as recession fears grow. Understanding these dynamics requires examining both structural factors and risk-driven reactions.

Historically, the U.S. has been a global safe haven during periods of stress. Recently, however, the U.S. itself has become a major source of volatility. Shifting trade policies and tariff threats have led to elevated uncertainty, prompting investors to seek safety elsewhere—notably in gold, the Japanese yen, the Swiss franc, and even the euro.

This shift appears to have led foreign investors not just to avoid new U.S. investments, but also to sell existing ones. The S&P 500 is down roughly 5% year-to-date, while European indices and the Hang Seng Index (China) have posted strong gains, with some up double digits YTD. This suggests a rotation out of U.S. equities and into other regions. However, it’s worth noting that after years of American exceptionalism, global investors had become overweight U.S. assets. Some of the recent selling may simply reflect rebalancing back toward more traditional global allocations.

In fixed income, the term premium—the extra yield investors demand for holding longer-dated Treasuries—has risen. Part of this move was fueled by hedge funds using leverage and piling into crowded trades like basis trades and Treasury swap spreads, which have come under pressure as volatility increased. This forced unwinding likely contributed to some of the rise in long-term rates.

Adding to the selling pressure, large foreign holders of Treasuries, notably China and Japan, are rumored to be reducing their holdings. Even without hard confirmation, the perception alone may have encouraged other market participants to preemptively sell. Meanwhile, concerns over inflation, especially from new tariffs, have pushed long-term inflation expectations up by about 20 basis points in recent weeks—a meaningful move, even if not yet alarming.

The combination of a weaker dollar, falling equities, and rising yields reflects the collision of these structural and risk-driven forces. For now, a weaker dollar has been the outcome of selling in U.S. stocks and bonds. Whether this episode marks a temporary dislocation, or the beginning of a longer-term rotation out of U.S. assets, remains an open question. As investing is a relative process, a key consideration for a more pronounced rotation is where the marginal dollar would be invested if not in the U.S. If policy uncertainty persists, we believe the odds of a sustained, strategic shift by global investors—and continued pressure on the dollar—will rise.

Source: Fort Washington, U.S. Treasury, Bloomberg

Current Outlook

Market Data & Performance

As of 04/30/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.