Highlights

- All-Time Highs: The S&P 500 is back to all-time highs, following optimism around trade negotiations and the Big, Beautiful Bill.

- Tariff Deadline: U.S. trade partners received a 90-day delay on reciprocal tariffs (“Liberation Day”), and the July 9th deadline is approaching; however, investors are largely regarding it as a non-event.

- Oil and Middle East Conflict: Oil prices are off their recent highs, but we expect continued volatility as the commodity moves along the ‘arc of fear.’ We analyze oil’s fundamentals in this month’s Spotlight below.

Table of Contents

Macro Insights

Temps Not the Only Thing Hot in JuneAfter a 6% gain in May, the S&P 500 added another 5% in June, closing at a fresh record high and now up 25% from the early April lows. While headline volatility remained elevated—most notably surrounding the strikes on Iran and the subsequent cease-fire—equities benefited from progress in U.S.–China trade negotiations, a contained inflation backdrop, and only modest softening in economic data. Growth stocks led for the month, and the U.S. gained ground versus non-U.S. equities. |

The Federal Reserve (Fed) remained on hold in June, signaling that current rate levels remain appropriate given the inflationary risks tied to trade policy. Chair Jerome Powell acknowledged that, if not for concerns about tariffs, policy rates would likely be lower. While predicting the future path of tariffs remains difficult, the administration has so far opted for de-escalation, taking “off-ramps” when available. Attention now turns to July 9th, the deadline for the delayed implementation of “Liberation Day” tariffs. Most expect a deal, either formalized at lower tariff levels or with enough progress to justify another extension. Markets appear to agree, pricing in 65 basis points of Fed rate cuts by year-end, suggesting a view that tariffs will not prove meaningfully inflationary. Treasury yields responded accordingly, with 2-year and 10-year yields each falling roughly 20 basis points in June.

Geopolitical tensions spiked early in the month following U.S. strikes on Iran’s heavily fortified nuclear sites in the wake of Israel’s initial offensive. Despite widespread media coverage of the historic exchange, financial markets remained notably composed. Investors, seasoned by decades of Middle East tensions, focused on the transmission mechanism into the global economy: oil. We explore the fundamental drivers of oil in this month’s Spotlight, but markets quickly determined Iran’s options to retaliate via the Strait of Hormuz were constrained by China’s dependence on those shipping lanes. The subsequent cease-fire quickly unwound the (fairly modest) geopolitical risk premium in commodity prices, helping ease concerns around both inflation and growth.

Beneath the surface of new equity highs, some economic data showed signs of cooling. Consumer spending disappointed, labor market momentum slowed, and business confidence slipped. With valuations extended and macro risks still unresolved—including tariff uncertainty, the Fed’s reaction function, and unpredictable policy shifts from Washington—the margin of safety for equity investors has narrowed. The July 1st passage of the “Big, Beautiful Bill” in the Senate offers some short-term clarity on taxes; however, it also raises longer-term fiscal concerns that bear watching, especially given how rate volatility unfolded earlier this year.

Outlook Remains Uncertain

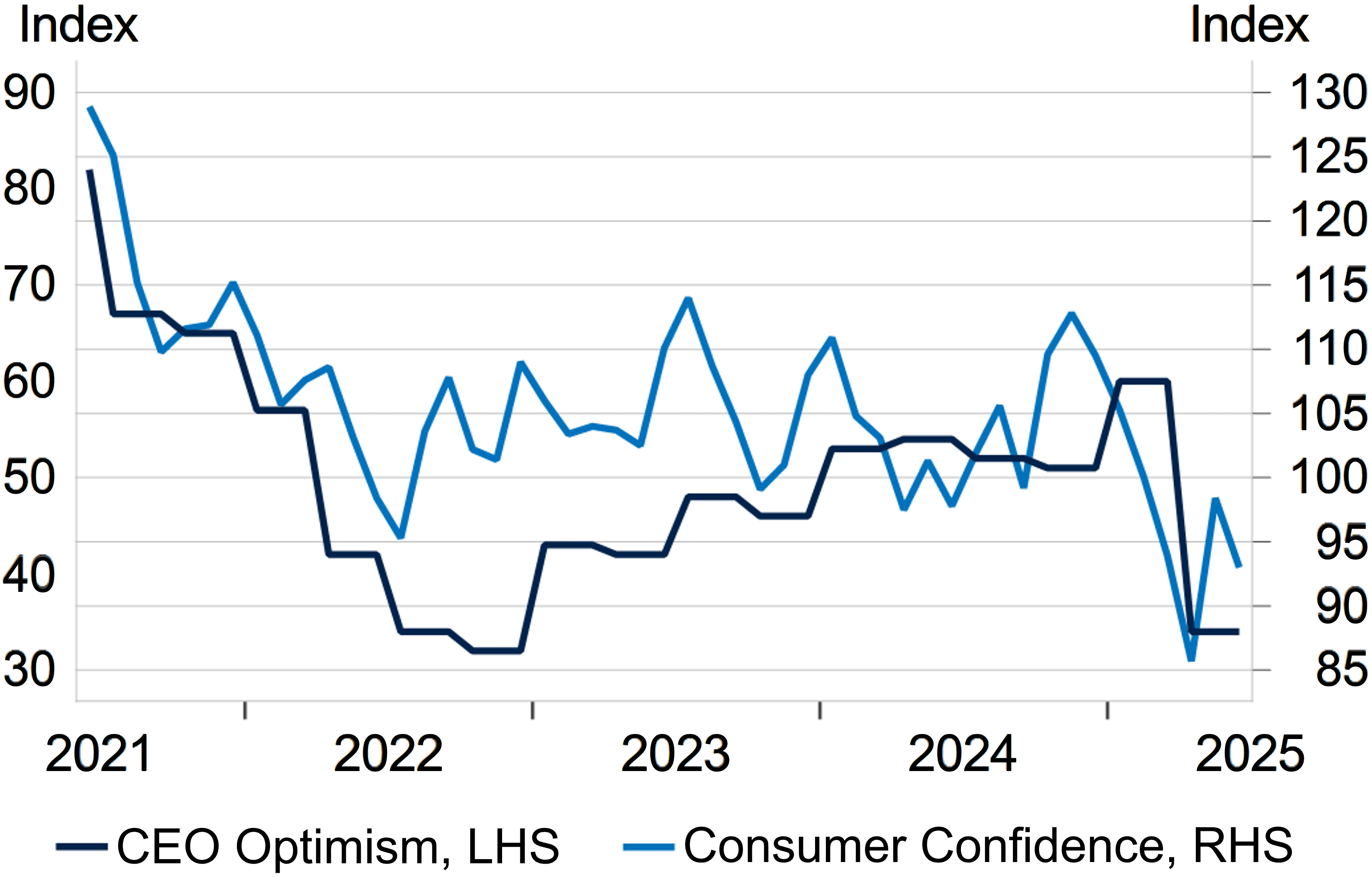

Markets have soared given optimism around trade negotiations and geopolitical de-escalation, but these have done little to provide clarity for consumers and businesses looking to spend or hire.

Consumer & Business Outlook

What to Watch

U.S. consumer and business outlook remains uncertain given the overhang of tariffs and potential price increases. Investors will monitor incoming inflation figures and the impact on Federal Open Market Committee (FOMC) decisions. In addition, indicators that provide insight into the state of the U.S. consumer will be in focus.

|

Monthly Spotlight

Oil Prices and the Arc of Fear

Oil is well known for its volatility, and ongoing conflicts in the Middle East often contribute to these price moves, given that the region accounts for about a third of global oil supply. In light of the recent missile exchanges between Israel and Iran—and the U.S. involvement—we believe it is important to remain mindful of the potential upside risks to oil. However, and perhaps more importantly, given the unpredictability of these events, we examine the fundamental supply-and-demand economics shaping oil’s trajectory.

Oil prices typically move along a familiar “arc of fear,” as the pendulum swings between concerns over supply deficits and fears of oversupply, often overshooting the equilibrium (or fair value) price. Over the past 60 to 90 days, prices have moved sharply along this arc: falling to the mid-$50s as fears of excess supply gripped the market, then rebounding to $80 amid renewed concerns over supply shortages driven by conflict in the Middle East.

There are several reasons why the market has been concerned about potential supply shocks, such as Iran blocking the Strait of Hormuz or attacking oil production in neighboring countries. While we continue to view any disruption of flows through the Strait as extremely unlikely, the potential for sanctions is more difficult to assess. Aggressive sanction enforcement appears plausible; however, recent comments from President Trump reinforce our view that he is content with Iranian exports, as long as they help contain prices.

Enforced sanctions could remove almost 2 million barrels per day (mb/d) from the global oil market, reducing OPEC’s spare capacity to 4 mb/d. However, this would still be sufficient to keep a lid on prices, especially when considering the broader supply chain. We expect OPEC supply growth of 1.0-1.5 mb/d for 2025, and non-OPEC supply growth of around 1 mb/d. With demand expected to remain largely flat, this increase in supply would result in a surplus of approximately 1 mb/d, allowing inventories to build. As a result of non-OPEC producers expanding both onshore and offshore production, as well as substantial strategic oil reserves, there is a sizeable buffer in place should we experience a prolonged supply shock.

With inventories building, we expect oil prices to move lower, potentially bottoming around $55 a barrel (WTI) by year-end. Higher prices would require a material upward demand revision (specifically in China), with no positive supply response, in addition to a resumption of OPEC cuts, which we view as unlikely.

Despite our expectation that oil prices will overshoot fair value as they move along the “arc of fear” over the next couple of quarters, a steady decline in prices should bode well for inflation. This trajectory is likely to help pull headline inflation down over the coming months, offsetting potential goods inflation driven by tariffs. Consequentially, this trend should also place downward pressure on rates.

Source: Fort Washington, BLS, and Bloomberg.

Current Outlook

Market Data & Performance

As of 06/30/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – July 2025

Download Monthly Market Pulse – July 2025