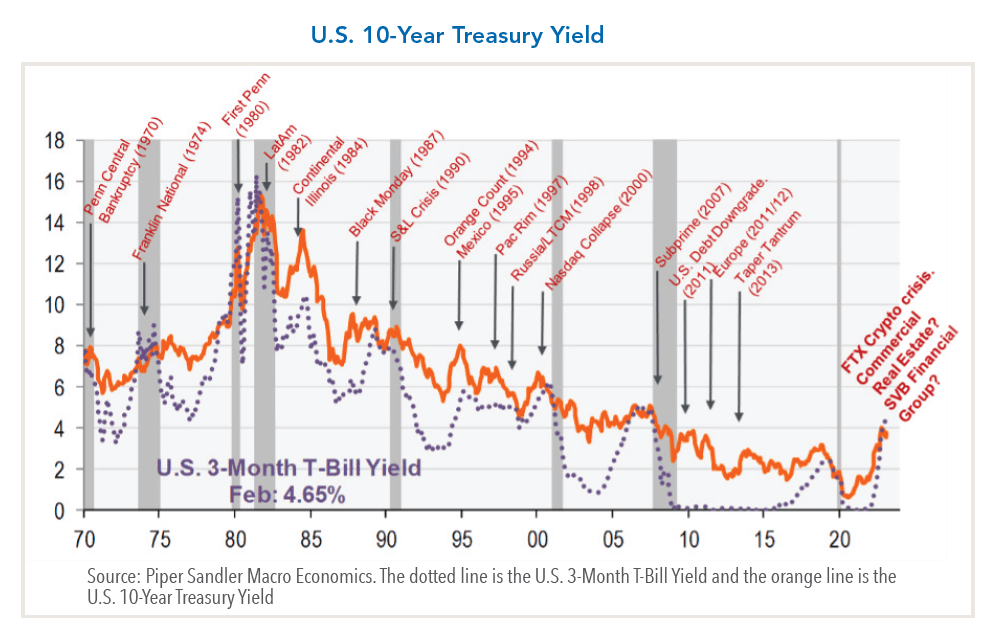

There is a famous quote from Warren Buffett, “When the tide goes out, you find out who has been swimming naked.” The tide has gone out recently in the form of sharply rising interest rates over a relatively short time. The chart below demonstrates these moves can have consequences.

Rapid interest rate increases caused problems for UK pension funds several months ago and had a negative impact on long duration equity prices last year. Now, banks are being impacted. Notably, the demise of the Silicon Valley Bank (SVB) serves as a reminder that policy effects are cumulative and work with a long lag.

A Breakdown of Recent Bank Failures

Silicon Valley Bank’s failure marks the first time since 2009 a large U.S. bank failed. It was the second largest bank failure in U.S. history and was caused by a deposit run, which was precipitated by several factors including the following:

- Elevated pandemic-driven deposit growth

- Securities duration extension leading to material unrealized losses when the Federal Reserve increased interest rates

- Deposit outflows and earnings pressure that led management to sell some securities at a loss in order to reinvest the proceeds at higher current interest rates

- SVB’s failed capital raise

In addition to this surprising outcome, regulators also took the extraordinary action of closing SVB while markets were open. Capital markets were further unsettled by Signature Bank’s (SBNY) failure, the third largest ever, just two days later on Sunday evening, another historically atypical time for such an event. While SBNY engaged in some of the same businesses as SVB, developments in the former’s digital asset (cryptocurrency) business likely drove the loss of depositor confidence. In comparing these two failures, the most important similarity was a very high level of deposits above FDIC insurance limits – nearly 90% of total deposits at each bank were uninsured. Combined with large average account sizes, their respective customers withdrew funds to maintain access to their cash.

In response to these extraordinary developments, the Federal Reserve announced plans to institute a lending facility under which banks can borrow cash collateralized by their treasury, agency and MBS securities. This facility will be exceptional in that it will lend to banks based on the par value of the securities, not their current market value. While we are hopeful this might assuage markets more than recent stock price reactions in the financial sector would suggest, we remain concerned about follow-on impacts.

Last Year's Tightening Has Not Been Digested

As it applies to the economy, the impact of recent bank failures is unclear at this point as we are still in the early days. Financial conditions are tighter, and bank lending conditions will continue to tighten. Bank lending conditions were already in recession territory before the recent turmoil, and this situation likely further shifts the balance of risks for the economy to the downside. Fed rate expectations have changed significantly, but the inflation data complicates the path forward for the Fed in the near term. We will become more concerned about the economic outlook the longer this uncertainty persists. Notably, the impact from higher rates is mainly being reflected in situations affected directly by security prices. However, in our view, much of last year’s tightening has not yet been digested by the real economy. What is important to understand is soft landings are typically preceded by the easing of lending standards versus hard landings which are preceded by the tightening of lending standards, which is what we are experiencing in the current cycle. Who knows where a problem will show up next, but we feel it will most likely be in a deteriorating labor market.

The Current Situation Resembles the "Panic of 1907"

Historically, we believe the current situation is reasonably similar to the “Panic of 1907” in which several banks entered bankruptcy due to a retraction of market liquidity and loss of confidence among depositors. Subsequently, a significant number of people withdrew deposits from their regional banks. The panic ended when JP Morgan intervened by pledging large sums of his own money and convincing other New York bankers to do the same to shore up the banking system. This sounds like what the state banking regulators/Federal Reserve/FDIC had to manage with regard to Silicon Valley Bank/Signature Bank and the group of banks that banded together to deal with First Republic. The “Panic of 1907,” lasted about three weeks, was addressed without a Federal Reserve/FDIC and occurred during an economic contraction. Throughout history, banking crises typically occur when the economy is already in a recession. Currently, we are not in a recession. Going forward, the questions to ask are: (1) will there be a recession (2) if there is a recession, will it be a soft or hard landing (3) will a liquidity event turn into a credit issue. We would be glad to discuss our views on these topics with clients directly.

Fort Washington's Focused Equity Portfolio Positioning

As far as it pertains to our portfolios, we have been de-risking for a while based on our belief that higher interest rates and inflation would cause problems over time. We believe the impact is being felt currently. Last year, for example, we sold one of the two recently failed banks (Signature Bank) due to our concerns about its performance in a de-risking market resulting from higher interest rates. In addition, we have moved the portfolios into higher return on capital and higher barrier to entry businesses with pricing power, increased our defensive exposure and increased our cash position.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Opinions expressed in this commentary reflect subjective judgments of the author based on the current market conditions at the time of writing and are subject to change without notice. Information and statistics contained herein have been obtained from sources believed to reliable but are not guaranteed to be accurate or complete. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Past performance is not indicative of future results.