Highlights

- The surge in gold to a record high above $4,000 per ounce is a response to growing demand from central banks, heightened economic uncertainty, and concerns about the dollar and inflation.

- Foreign central banks began adding gold to their portfolios after the U.S. imposed sanctions on Russia in 2022, and their gold holdings now exceed U.S. Treasuries.

- Gold also appeals to investors who are worried that the purchasing power of the dollar and other currencies will be eroded by the expansion of government debt in the major industrial economies.

- While gold is not cheap today, it provides diversification benefits for investors who are seeking to hedge against a sell-off in U.S. equities and the dollar.

Gold Price Swings Since the Breakdown of Bretton Woods

The standard arguments for holding gold are that it offers protection against inflation and a weak dollar, and it also does well during periods of heightened uncertainty.

This thesis could not be tested during the Bretton Woods era, because the price of gold was fixed by central banks relative to their respective currencies. However, when the link between the official price of gold and the U.S. dollar was severed in the early 1970s, gold was free to fluctuate in the open market.

Since 1973, gold has been subject to periods in which it has surged considerably and that have been followed by long periods in which it has been relatively flat. As summarized in Figure 1, there are four distinct periods prior to the latest run-up in gold.

Figure 1. Gold and the S&P 500, Returns and Correlations

| Date | Gold | S&P 500 | Correlation* |

|---|---|---|---|

| 1971 – 1981 | 962% | 33% | 0.04 |

| 1982 – 2002 | -12% | 618% | -0.07 |

| 2003 – 2012 | 381% | 62% | 0.12 |

| 2013 – 2022 | 9% | 169% | 0.05 |

| 2025 – September 2025 | 112% | 74% | 0.01 |

*Correlation calculation is based on monthly returns.

The first period was the 1970s, when the major central banks pursued easy monetary policies and fiscal policies were highly expansionary. These policies contributed to high inflation in the U.S. and other industrial countries, and gold far outperformed other financial assets, including U.S. equities.

In comparison, during 1982 to 2002, the Federal Reserve (Fed) and other central banks tightened monetary policies to bring inflation under control. During this period of disinflation, the price of gold was flat while the S&P 500 generated high returns fueled by rapid economic growth and declining inflation.

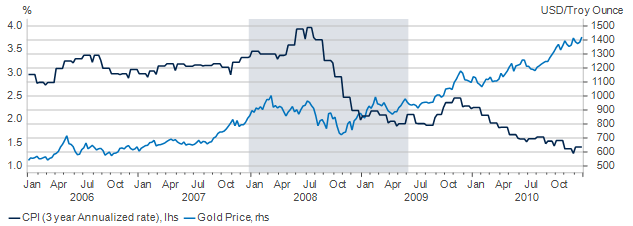

During the third period, from 2003 to 2012, the price of gold nearly quadrupled while U.S. stocks generated subpar returns. The gold price surge was not linked to a spike in inflation or inflation expectations (see Figure 2). Rather, the key factor was heightened uncertainty associated with the bursting of the U.S. housing bubble, the 2007-2008 Financial Crisis, and the fallout from the Great Recession.

Figure 2. Gold's Surge During the Financial Crisis Was Not Linked to Higher Inflation

Source: Macrobond, BLS.

The fourth period lasted from 2013 through 2022 and was marked by sub-par global economic growth and concerns that deflation in Japan and Europe could spread to the United States. The price of gold was relatively unchanged while the S&P 500 produced solid returns.

One characteristic each of these four periods has in common is that the correlation between returns on U.S. equities and gold was low or negative.

Forces Behind Gold's Surge Over the Past Three Years

This brings us to the current phase that spans the last three years. What makes it unusual is that both the price of gold and the S&P 500 have increased considerably – by more than 112% and 74%, respectively. However, the correlation of returns between the S&P 500 and gold remains low.

To a large extent, the strong showing of the S&P 500 reflects the resilience of the U.S. economy in response to economic policies to mitigate the adverse effects of the COVID-19 pandemic, as well as investor enthusiasm about the development of artificial intelligence.

In comparison, the rally in gold reflects an array of forces at play. It began after Russia invaded Ukraine in 2022, and the U.S., along with other Western nations, froze Russia’s foreign currency reserves. This caused some central banks and foreign governments to pile into gold, which gave rise to talk about “de-dollarization.”

The second development occurred in April of this year, when President Trump launched a global trade war. It caused investors to question the U.S. government’s commitment to preserving the postwar system of international trade. Amid this, gold surged while the U.S. dollar depreciated by about 10% on a trade-weighted basis.

The third phase began this summer, when President Trump began criticizing the Fed, suggesting they should lower interest rates significantly. The Trump administration subsequently considered ways that it might alter the governance of the Fed by replacing Fed Governors with Trump appointees. This caused some investors to worry that the independence of the Fed was now in question.

As a result of a massive buildup of government debt in the U.S. and other developed countries over the past decade, many investors believe that countries confront “fiscal dominance,” in which governments attempt to keep interest rates low to constrain debt-service costs.

Gold Is Not Cheap, But Further Upside is Possible

One of the challenges of investing in gold is that there is no way to calculate its intrinsic value. As the saying goes, “beauty is in the eye of the beholder.”

What is clear, however, is that gold is not cheap at current prices. For example, it has recently eclipsed its inflation-adjusted peak that was set in 1980, when the U.S. confronted high inflation, a weak dollar, and a looming recession due to record-high interest rates.

Nonetheless, this does not preclude the possibility that momentum could take gold considerably higher. For example, Goldman Sachs recently raised its 2026 gold forecast by $600 to $4,900 per ounce.1

Also, Bloomberg reports that central bankers have been a dominant force in the market, buying bullion in huge volumes that have prompted analysts and traders to build new models to track potential demand. It reports that the rally saw gold overtake the euro as the second-largest asset in the reserves of the world’s central banks, and their gold holdings now exceed U.S. Treasuries.

Finally, additional buying is expected to come from gold-backed exchange-traded funds that are one of the most popular ways for both institutional and retail investors to get exposure.

Benefits of Diversification

In these circumstances, we believe the principal reason to consider gold is the potential it offers to reduce portfolio risk, because it is not highly correlated with U.S. equities over the long run.

Throughout most of the period since the breakdown of Bretton Woods, the correlation between gold and the S&P 500 has been low or negative. In comparison, the correlation between U.S. and foreign equities has increased over time as a result of globalization, although the currency component reduces the correlation somewhat.

Finally, the last three years are a bit of an anomaly. Despite the prices of gold and the S&P 500 having a high correlation, as both have moved higher, the correlation of their returns remains extremely low (~0). As a result, gold continues to be an excellent diversifier and can reduce the downside risk to an investment portfolio that is heavily weighted in U.S. equities.

1Reuters, “Goldman hikes December 2026 gold price forecast to $4,900/oz,” Oct 6, 2025.