Highlights

- Market's AI Exuberance: The S&P 500 is near all-time highs, recently led by the Magnificent Seven, as optimism around AI productivity and spending drove markets higher.

- Economic Data Bumpy: While the Q2 GDP print showed a rebound from the negative print in Q1, overall growth has slowed in 2025 and is likely to remain sluggish.

- The Fed Doesn't Control Long Rates: There has been a significant amount of political pressure to lower Fed Funds, but what does that mean for longer rates? We analyze this dynamic in this month's Spotlight below.

Table of Contents

Macro Insights

New Record Highs as Growth Stocks Regain the LeadStocks extended their gains in July, with the S&P 500 rising 2.2% for the month and bringing its year-to-date return to 8.6%. Resilient economic activity, a flurry of trade agreements, a limited inflationary response to tariff policies, and earnings that reinforced confidence in the AI supercycle all supported market sentiment. Mega-cap tech and the "Magnificent Seven" led performance, driving growth's outperformance over value and U.S. equities' outperformance versus international peers. The U.S. dollar rose 3% on the month, trimming year-to-date losses, while interest rates remained relatively stable. |

The Federal Reserve (Fed) held rates steady again in July, although two governors dissented in favor of a 25-basis-point cut. Despite the dissents, Chair Jerome Powell struck a somewhat hawkish tone in his press conference, citing uncertainty around inflation stemming from trade policy. While market expectations for rate cuts later this year moderated, investors took the news in stride, focusing on solid economic fundamentals. This resilience supports the notion that rate cuts aren’t essential to sustaining the soft-landing narrative. We explore the implications of Fed policy for longer-term rates in this month’s Spotlight.

As the August 1 trade deadline (postponed from early July) approached, several deals were announced with key partners. U.S.-aligned nations such as Japan, South Korea, and the EU will face tariffs of 15%, while negotiations continue with others—China, India, Mexico, and Canada—who currently face higher rates. Thus far, tariff-driven inflation has been less severe than many economists anticipated. While some effects may still be forthcoming, the negotiated levels suggest inflationary and growth impacts will remain modest in the near term. We are closely watching the pending appeal of a court ruling that challenged the Administration’s use of the International Emergency Economic Powers Act (IEEPA)—the legal basis for the recent trade deals. If the lower court decision is upheld and ultimately reaches the Supreme Court, congressional intervention may be required to preserve these agreements.

Corporate fundamentals remain solid. With two-thirds of companies having reported Q2 results, both revenue and earnings have broadly exceeded expectations. Big Tech delivered strong results, with signs that AI-related capital expenditures will remain elevated. Consumer strength remains intact, with financial firms reporting steady debit and credit spending, alongside improving consumer credit metrics. While some sectors—notably autos—cited margin pressure from tariffs, the overall impact on S&P 500 earnings appears limited.

Despite healthy corporate earnings and consumer resilience, a slowing labor market (the August 1 report highlighted additional weakness) and uncertainty around trade-driven inflation have led us to maintain a largely neutral risk stance.

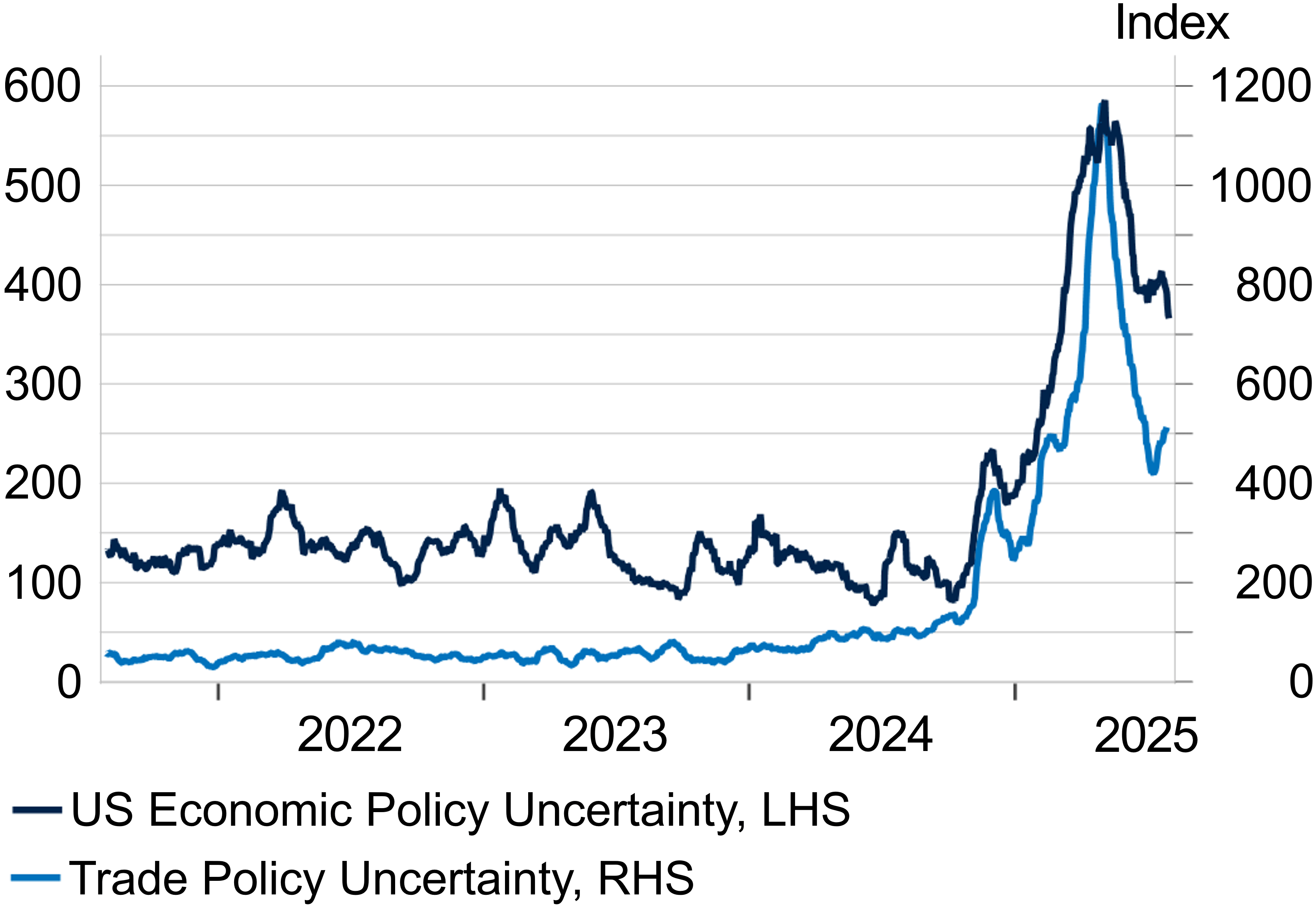

Economic and Trade Policy Uncertainty

Although uncertainty has eased in recent weeks, it remains elevated.

What to Watch

Tariffs and broader trade policy uncertainty continue to hang over the U.S. consumer and business outlook. As a result, investors will focus on indicators that provide insight into the state of the U.S. consumer and corporate investment. In addition, new inflation data and its implications for Federal Open Market Committee (FOMC) decisions will be closely watched.

|

Monthly Spotlight

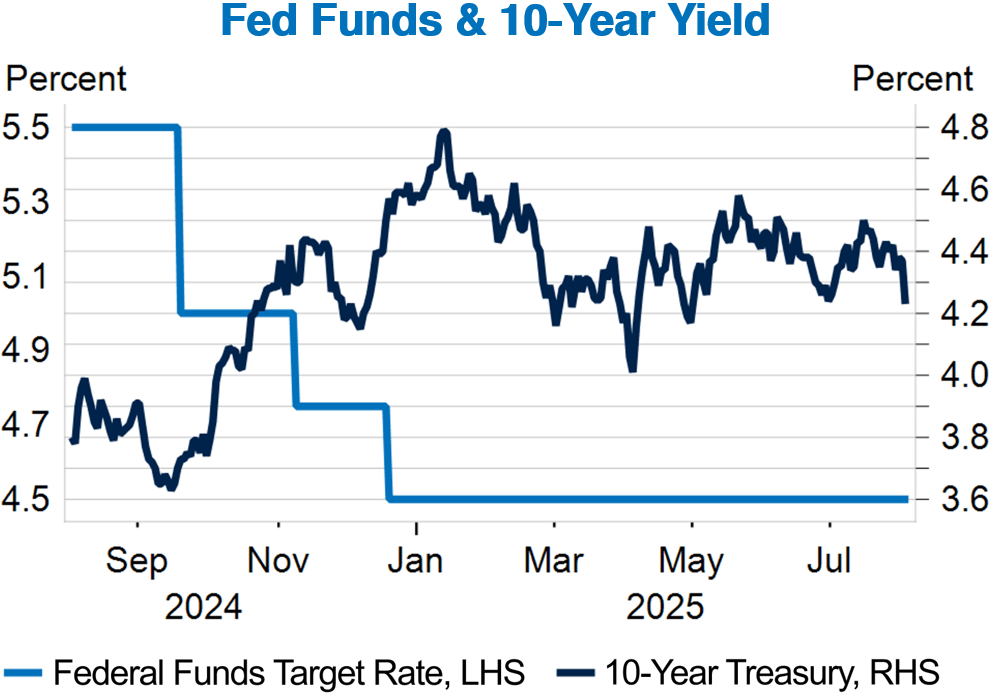

The Fed Doesn't Control Long Rates

There has been increasing political pressure for lower interest rates from both members of Congress and the White House, with the president calling for a significant 3% cut in the fed funds rate. While it’s tempting to expect long-term yields to fall in response, the relationship between the fed funds rate and the 10-year Treasury yield is far more intricate.

The fed funds rate is an overnight lending rate between banks and therefore directly influences the very short end of the yield curve. In contrast, the 10-year yield is influenced by a number of market forces. While it does reflect the current fed funds rate, it also factors in market expectations for the future path of monetary policy, as well as economic growth and inflation over the next decade. Even if we view the 10-year yield as a rolling projection of short-term rates over ten years, investors constantly reassess their outlook as new information about growth, inflation, and policy emerges. As a result, the current fed funds rate has only a limited impact on where investors value the 10-year yield.

As a result of longer yields being impacted by expectations, it's important to keep in mind that investors already anticipate multiple rate cuts through 2026 (roughly 100 basis points). However, if the FOMC were to slash rates by three times that amount at their next meeting, it would cause a significant recalibration of growth and inflation expectations. Easier financial conditions, due to cheaper borrowing rates for consumers and corporations, would spur stronger economic activity and likely raise inflation expectations. Since the 10-year yield incorporates expected real growth and inflation, these increases would drive the longer part of the yield curve higher—not lower—despite short rates declining.

We experienced this dynamic just last year. In September, the Fed surprised markets with a 50-basis-point cut—more than expected—and the 10-year yield actually rose by about 100 basis points in the following weeks.

So, what might actually lead to a lower 10-year yield? First, a continued cooling in inflation. Inflation has come down significantly over the past few years and is now only marginally above the Fed’s target. While goods inflation is likely to remain bumpy given tariffs, service inflation—namely housing—continuing to trend lower would be welcomed by Fed officials looking for a reason to cut. In addition, evidence of slower economic growth and consumer demand, which many economists are expecting, would give the Fed more room to ease policy without stoking fears of overheating the economy.

Outside of a recession or significant shock to growth, our view is that the best path to sustainably lower long-term rates is a steady, data-driven approach that the Fed is currently utilizing. Any meaningful disruptions—such as removing Jerome Powell as chairman (which we view as a low probability)—would likely not be taken well by the market. If the current disinflation trend continues and growth slows modestly, we see a path for the 10-year yield to drift toward 4% by year-end.

Source: Fort Washington, Federal Reserve, and U.S. Department of Treasury.

Current Outlook

Market Data & Performance

As of 07/31/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – August 2025

Download Monthly Market Pulse – August 2025