Highlights

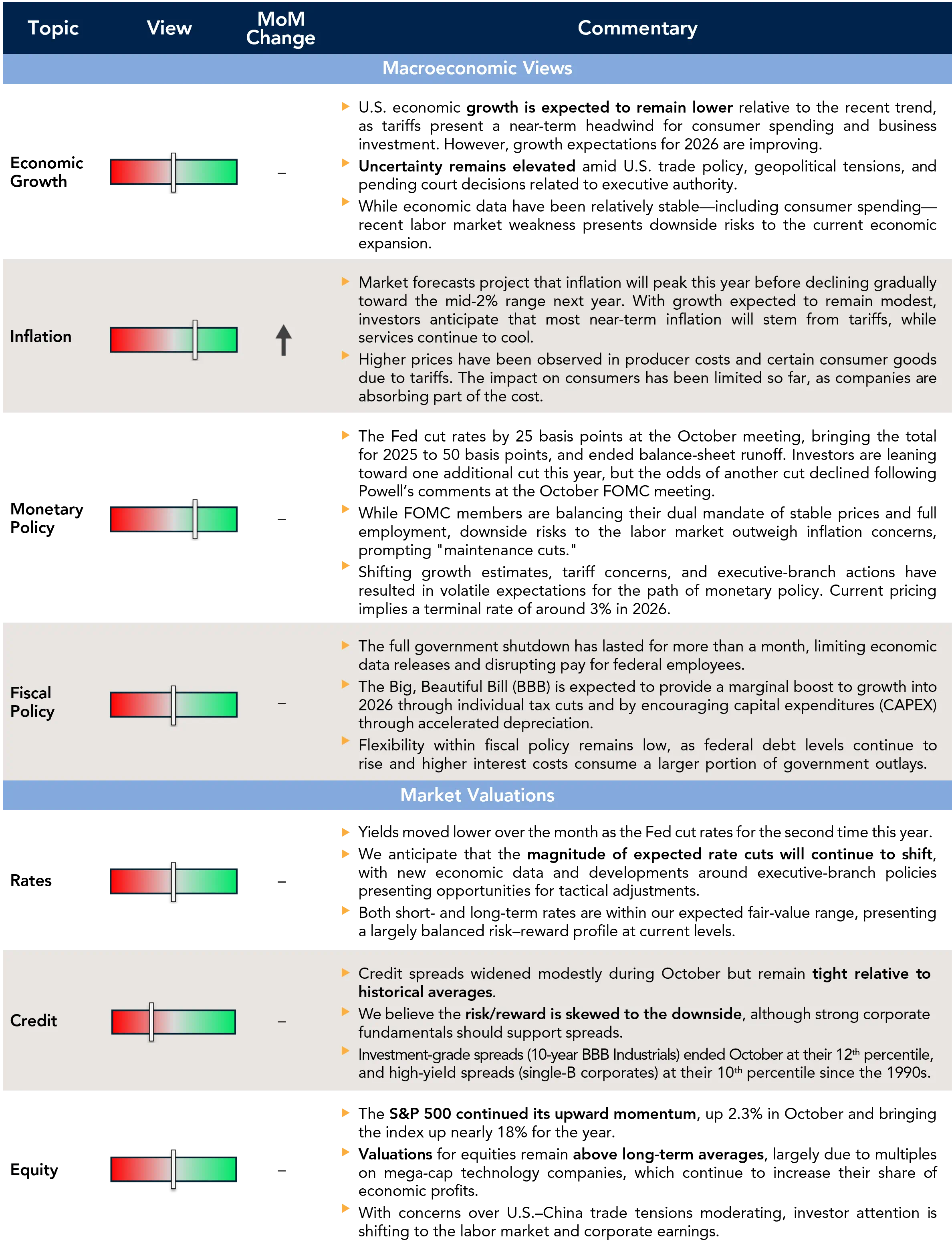

- Rate Cuts: The Federal Reserve (Fed) cut rates by another 25 basis points in October and ended its balance-sheet runoff. However, divisions within the Federal Open Market Committee (FOMC) leave the future path of rates uncertain.

- Easing China Tension: The Trump–Xi meeting was a political success for both sides, but fundamental differences remain between the two largest economies.

- Watching Private Credit: Recent high-profile bankruptcies have raised concerns about quality and underwriting standards within the growing private credit space. Are these isolated events? We take a closer look in this month’s Spotlight below.

Table of Contents

Macro Insights

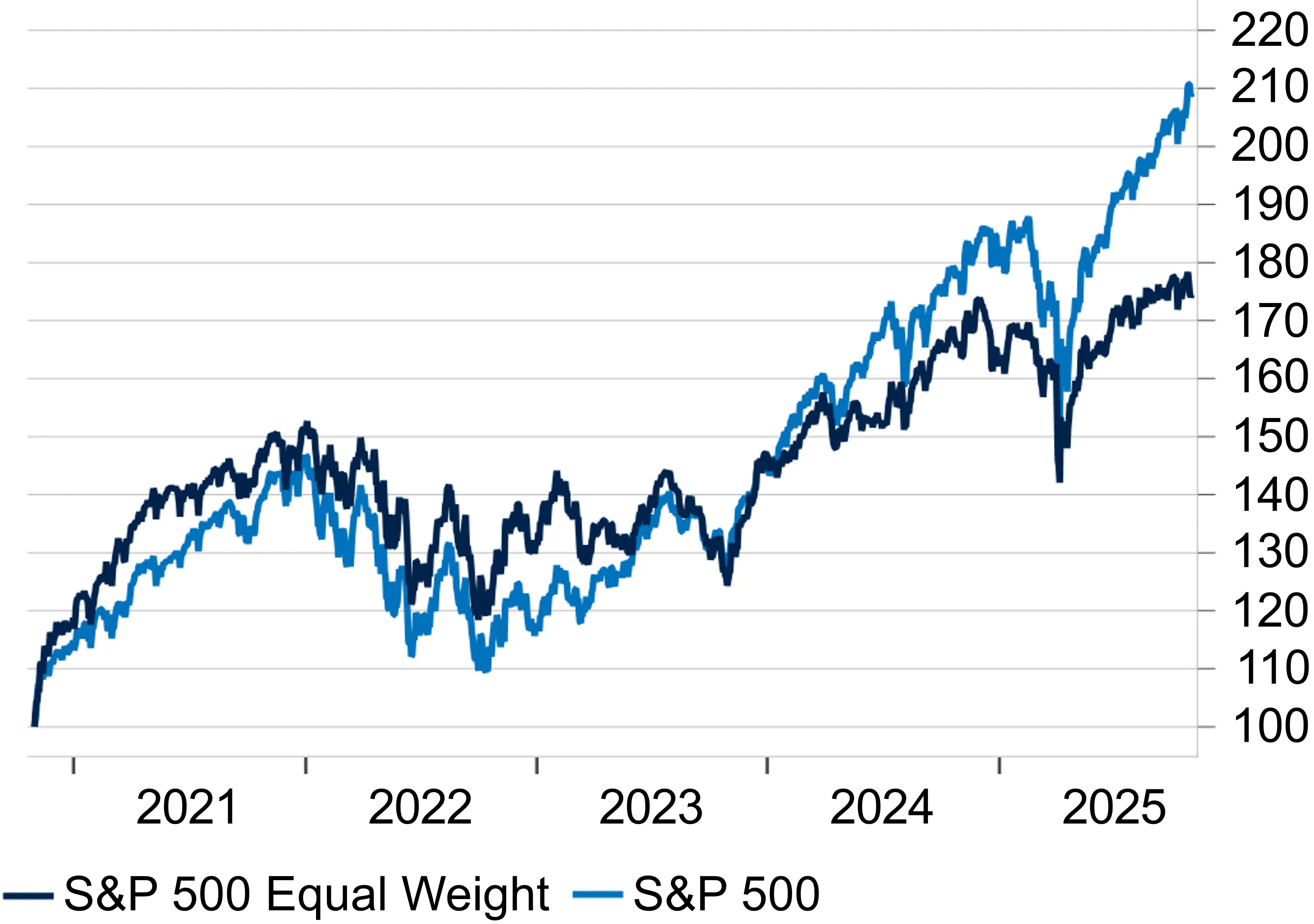

The Big Get BiggerU.S. equities extended their winning streak in October, with the S&P 500 marking a sixth consecutive monthly gain and the Nasdaq its seventh. Gains remained narrowly driven by large-cap names, as the equal-weight S&P 500 trailed the headline index and finished modestly lower for the month. The market-cap-weighted index now leads its equal-weight counterpart by nearly 9% year to date. |

The main driver was a renewed wave of AI enthusiasm following new partnerships and capital commitments that reinforced confidence in the durability of the investment cycle. Semiconductor and technology shares led the market, while more defensive and rate-sensitive sectors underperformed. Nvidia briefly crossed $5 trillion in market capitalization late in the month—a first for any company—and is now larger than the aggregate market capitalization of any country apart from the U.S., China, or Japan.

Macro developments were mixed. The Federal Reserve delivered a widely expected 25-basis-point rate cut and announced it would end balance-sheet runoff in December. Chair Jerome Powell’s cautious tone, however, tempered expectations for another move this year, flattening the yield curve as Treasuries rallied and the dollar strengthened. Gold rose for a fourth straight month, while oil declined for a third consecutive month amid easing geopolitical tensions and expectations of increased output.

Trade news also supported risk assets. The Trump–Xi meeting yielded a modest tariff reduction and a temporary pause in China’s planned export controls for rare earths—a step toward de-escalation, though underlying tensions remain unresolved. Meanwhile, inflation data surprised modestly to the downside, led by easing shelter costs, while consumer and labor indicators softened further, suggesting a gradual cooling rather than a sharp slowdown. Several large layoff announcements have shaken confidence somewhat, however—something we will be watching closely.

With 65% of companies having reported third-quarter results, corporate earnings broadly validated the resilience of profit growth, with results exceeding expectations across most sectors and year-over-year S&P 500 earnings up double digits. Still, management commentary pointed to early signs of consumer fatigue and pricing resistance.

With policy easing underway, trade risks receding, and AI investment remaining robust, the market’s momentum appears intact. Yet narrow leadership, extended valuations, and softer consumer signals argue for balance. For now, we maintain a neutral stance on risk.

Market Cap vs. Equal-Weight Indices

The S&P 500 market-cap-weighted index has pulled away from the equal-weight index over the past two years, reflecting the influence of mega-cap technology stocks.

What to Watch

The government shutdown is affecting the amount and quality of economic data available to investors. Arguments related to the legality of tariffs imposed under the International Emergency Economic Powers Act (IEEPA) will be heard in November, but a final Supreme Court decision might not be until 2026. Consumer sentiment surveys and Institute for Supply Management (ISM) releases will remain a focus for insights into business conditions and consumer spending.

|

Monthly Spotlight

Inside the Private Credit Boom

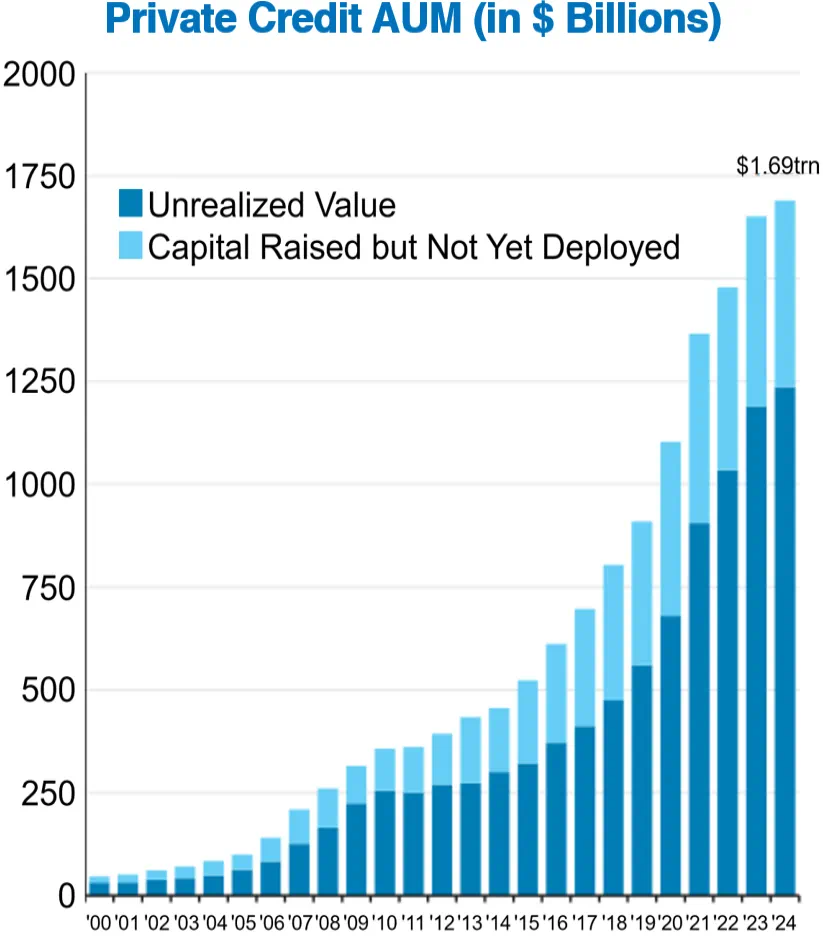

Private credit, along with asset-backed lending, has become a recent discussion point on Wall Street amid concerns of a brewing credit crisis following several high-profile bankruptcies. These developments, along with the rapid growth of private credit, have raised questions about potentially looser underwriting standards, which could signal emerging risks. While the space lacks the transparency and timely reporting of public markets, understanding its evolution and vulnerabilities is increasingly important given the strong demand for the flexibility and premium yields that private lending can offer.

At its core, private credit refers to lending by nonbank institutions directly to borrowers—often through negotiated bilateral or small club arrangements. These lenders structure and originate deals themselves, determining terms on a case-by-case basis. Because the market operates privately, it is inherently less transparent, less liquid, and more fragmented than the public credit universe. Yet despite these constraints, private credit has grown dramatically in recent years. As traditional banks have pulled back from lending in the wake of post-crisis regulation, private credit has stepped in to fill the void, offering customized financing to smaller companies that might otherwise struggle to access capital.

Today, the leveraged finance market—comprising non-investment-grade credit—is roughly divided three ways: about $1.4 trillion in high-yield bonds, $1.4 trillion in leveraged loans, and an estimated $1.3–$1.7 trillion in private credit. Borrowers in private credit are typically smaller, with average EBITDA of around $40 million, compared with more than $500 million for the typical high-yield issuer. Credit quality within private lending tends to be lower, with over 90% of loans rated B– or below. While these instruments historically featured tighter covenants, the influx of capital and competition among lenders have led some investors to question whether newer deals might have looser structures. In addition, most loans are floating-rate, leaving borrowers exposed to higher short-term rates. With short-term rates now well above their pre-2022 levels, interest coverage ratios have compressed, although they appear to have troughed recently. However, investors have been attracted to the space, as they receive compensation (excess yield) for the size, rating, and liquidity differences relative to public securities.

To us, none of this signals an imminent credit issue, but it does suggest rising fragility—particularly if the economy slows. The recent defaults among credit borrowers underscore potential cracks, and, given its rapid growth, private credit has become part of the broader narrative. Importantly, the shift of credit exposure from banks to institutional investors—pensions, endowments, and private funds—means that losses are likely to be more distributed than in the past, rather than concentrated on bank balance sheets, mitigating systemic risk.

Still, a concern remains: at its current size, the private credit market has yet to endure a full credit cycle, as the majority of private credit capital raised in North America has come in just the past five years. Nevertheless, we view these recent bankruptcies as largely idiosyncratic. Established lenders with long-standing experience in this space have been through a credit cycle (2008–2009) and appear to be maintaining underwriting standards. With this in mind, potential areas of concern are more likely to reside with new entrants into this competitive space, which could create pockets of weakness during an economic downturn.

Sources: Fitch, S&P, KBRA, Morgan Stanely Research, Deutsche Bank, Pitchbook LCD, and Barclays Research. Chart sources: Preqin and Barclays Research. Chart data is as of 3Q 2024.

Current Outlook

Market Data & Performance

As of 10/31/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – November 2025

Download Monthly Market Pulse – November 2025