Highlights

- Rate Cut: The Federal Reserve (Fed) cut rates by 25 basis points in September, aligning with market expectations, and forecast two more cuts this year.

- Government Shutdown: The U.S. government shut down on October 1, which is the first full U.S. government shutdown since 2013, when it lasted 16 days.

- What to Expect From the Fed: Soft job growth prompted the Federal Reserve to cut rates, but what can we expect moving forward, and who benefits from cuts? We analyze this dynamic in this month's Spotlight below.

Table of Contents

Macro Insights

The Path to NeutralStocks advanced for the fifth straight month, with the S&P 500 adding 3.6% in September and bringing year-to-date gains to 14.8%. Mega-cap tech continued to lead as AI sentiment remained strong, though the Russell 2000 small-cap index also hit a new record high. The major event of the month was the Federal Reserve resuming the easing it began a year ago. With the market and the Fed anticipating a gradual path toward a “neutral rate” of roughly 3% over the next year, we analyze what to expect from monetary policy in this month’s Spotlight. While not an economic cure-all, easier monetary policy improves sentiment toward risk assets and provides relief to smaller corporate borrowers and certain forms of consumer lending. |

The U.S. consumer remains resilient. Spending data for August came in better than expected, and retailers continue to point to durable demand. The market is watching closely for tariff pass-through to consumer prices, though the impact so far has been relatively modest. What remains to be seen is whether companies are testing demand elasticity with only small increases for now, and whether resilient activity to date will embolden larger price hikes in the months ahead. The latter could prove inflationary, potentially slowing the Fed’s path to lower rates or weighing on economic activity.

Labor market indicators have been mixed and continue to reflect softer conditions. Jobs grew by just 22,000 in August, below expectations, with negative revisions compounding the weakness. The unemployment rate, however, remained low at 4.3%, supported by slower labor supply growth due to reduced immigration. Job openings increased during the month, a possible signal of improving corporate confidence as tariff effects become clearer.

Meanwhile, the AI trade remains well supported. Nvidia’s investments in Intel and OpenAI, along with Oracle’s 25% monthly gain on the back of a strong cloud pipeline, added confidence in the durability of AI infrastructure spending. As we’ve discussed, the S&P 500 is increasingly levered to this broader trade, with the bulk of the top 10 names—together representing 40% of the index—tied directly to AI.

While the current government shutdown creates some noise and disruptions to economic data releases, investors generally look through these standoffs as temporary. With consumer activity holding up, inflation yet to show meaningful tariff headwinds, the Fed easing, and AI CAPEX remaining robust, it’s not surprising that the market continues to make new highs. From here, however, with valuations full and the margin of safety thin, we maintain our neutral risk stance.

10-Year Treasury and Fed Funds

The 10-year yield has increased since the Fed rate cut in September.

What to Watch

The Fed cut rates in September for the first time since 2024. Investors will be watching employment and inflation data closely to gauge whether the Fed can continue cutting or will need to pause. Consumers have remained resilient despite disruptions around Liberation Day, and markets will monitor indicators of consumer sentiment and corporate investment to assess the state of the economy.

|

Monthly Spotlight

Fed Cuts – What to Expect for This Cycle

The Fed’s cutting cycle in 2024 included three consecutive cuts totaling 100 basis points, followed by a pause that lasted several quarters. Following the Fed’s 25-basis-point cut in September, investors are asking what the path of rates will look like over the coming months and which parts of the economy will benefit from rate cuts.

The Fed’s recent 25-basis-point cut was driven primarily by its employment mandate. While inflation remains modestly above its 2% target, policymakers view part of the stickiness as tariff-related, considering it more of a one-time price level change than inflationary. For most of the year, inflation uncertainty dictated policy, but weaker job growth over the past two months, along with large downward revisions, highlighted downside risks to the labor market. This prompted the Fed, which believes its policy is moderately restrictive, to engage in a “risk management” cut.

Given that employment was the driver of this decision, can we expect employment will continue justifying cuts? We expect job growth to remain slow, but not weak enough to raise recession fears or force an aggressive cutting cycle. Fewer jobs are now needed to keep the unemployment rate steady due to factors such as lower immigration and a bifurcated corporate landscape, where small and mid-size businesses—responsible for 80% of employment—have lagged larger firms. On the inflation side, markets do not expect a return to 2% until 2027, limiting how quickly the Fed can ease. Taken together, this points to expected near-term cuts resembling those in 2024, when the Fed reduced its distance from neutral without aiming to stimulate the economy outright.

Even if the current cycle doesn’t end with a terminal rate of 3% or lower, parts of the economy will benefit from cuts. Companies and consumers with floating rate debt will see lower interest costs as short rates move lower. However, this is only a portion of total consumer and corporate debt, meaning the impact will be limited. Housing is often seen as a beneficiary of lower rates; however, affordability remains the main issue for the industry, and reducing short rates doesn’t necessarily mean longer mortgage rates will fall as well. Even if the 30-year mortgage rate comes down to 5.5% (currently ~6.2%), that would still place affordability toward the higher end of the historical range.

In aggregate, rate cuts should help maintain economic momentum but are unlikely to drive a surge in activity. Some investors expect monetary policy to be the primary growth engine, but we believe other factors—such as deregulation and tax policy—will play a larger role. Against this backdrop, we view both long- and short-term rates as fairly valued at present but see room for moderately higher yields if growth firms.

Current Outlook

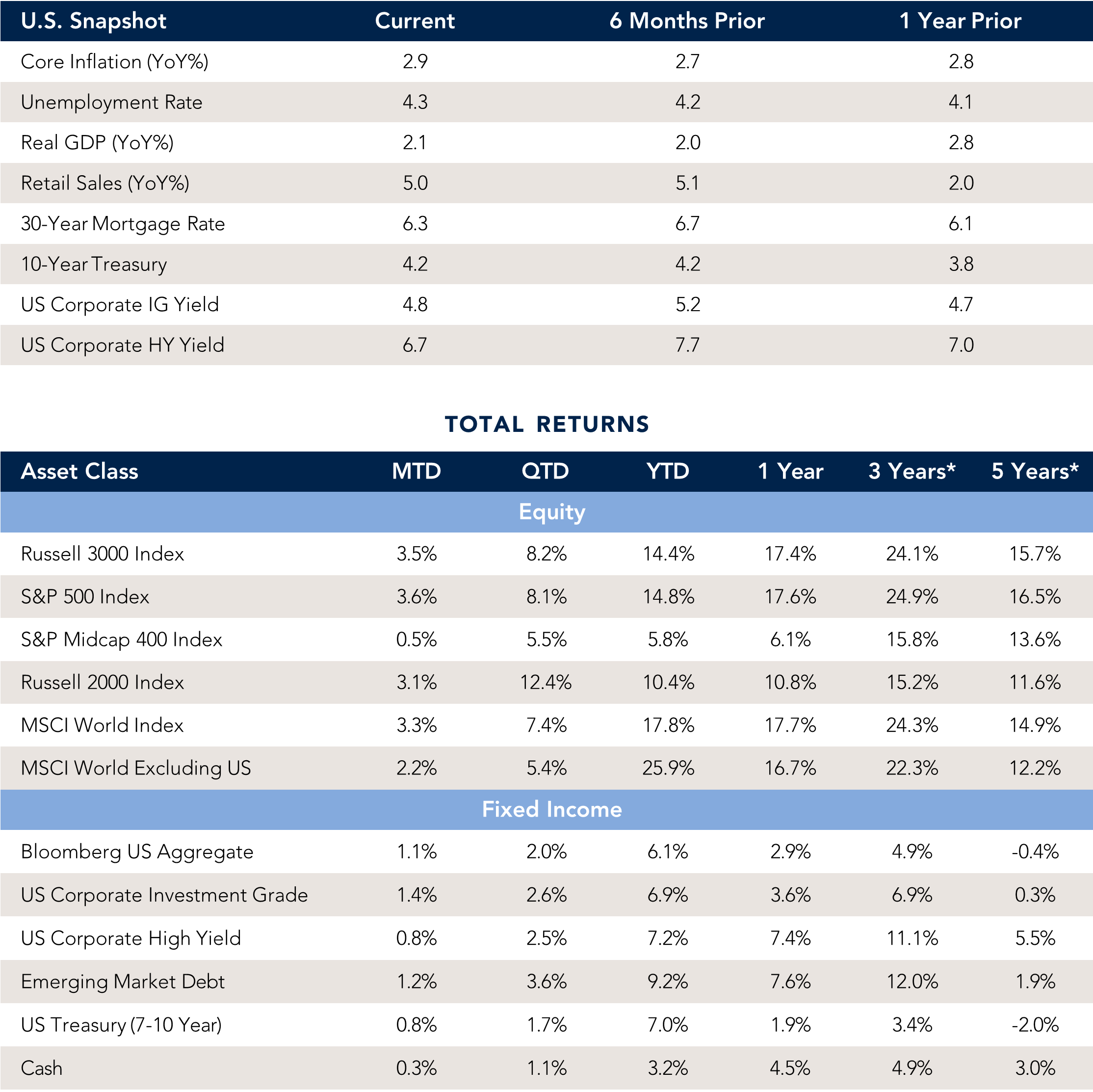

Market Data & Performance

As of 09/30/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – October 2025

Download Monthly Market Pulse – October 2025