Highlights

- Investors are increasingly turning to non-traditional fixed income strategies as a way to complement their traditional Core and Core Plus portfolios.

- Non-traditional approaches, such as Multi-Sector and Unconstrained Fixed Income, may provide investors with enhanced returns, higher yield, diversification, flexibility, and exposure to unique asset classes.

- Non-traditional strategies can be wide-ranging in scope, resulting in a high degree of uncertainty around their risk and return profile. Investors must be prudent when allocating to the space and should understand the risks associated with the different non-traditional fixed income approaches.

- A well-managed Multi-Sector approach with a focus on risk management that balances interest rate risk with credit risk can be well-suited for investors seeking to enhance risk-adjusted returns and income over the long run.

Common Multi-Asset Fixed Income Approaches

Traditional

Core Fixed Income

Core fixed income strategies are often managed against a common benchmark, such as the Bloomberg US Aggregate Index. The opportunity set is often constrained to index-only constituents, which includes a meaningful allocation to U.S. Government securities and excludes non-investment grade rated securities. Duration is typically managed close to the benchmark, resulting in moderate interest rate exposure that approximates the overall fixed income market. The result is a lower risk strategy that can provide modest outperformance vs. the Bloomberg US Aggregate Index (~0.50% to 0.75%).

Core Plus Fixed Income

Core Plus strategies are similar to Core mandates but include “plus” sectors. Plus sectors are out of index sectors and often incorporate non-investment grade securities. Two common examples of plus sectors are High Yield Corporates and Emerging Market Debt, with most strategies allowing up to 40% of their portfolio in plus sectors. Core Plus strategies often employ derivatives and modest leverage, and duration is managed relative to the benchmark, similar to Core mandates. Core Plus strategies have a higher risk compared to Core but have provided excess returns over time that have been almost double that of Core strategies (~1.5%) (Figure 1).

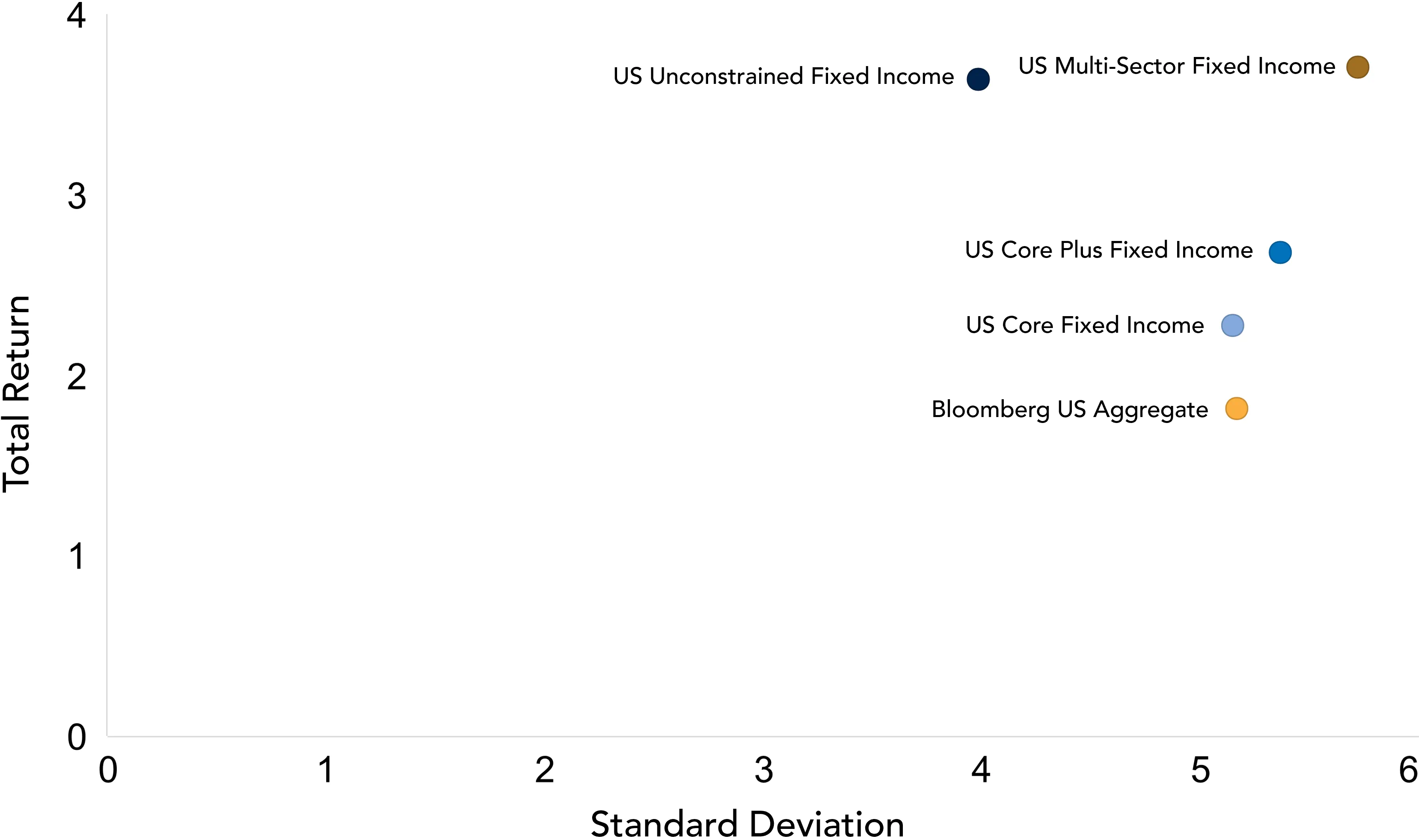

Figure 1. 10 Year Risk/Reward | as of 09/30/2024

Source: Fort Washington and Nasdaq eVestment. Date range: 09/30/2014–09/30/2024.

Non-Traditional

Multi-Sector Fixed Income

Multi-Sector fixed income strategies provide investors with non-traditional exposure to fixed income markets with enhanced and differentiated returns compared to traditional fixed income. Multi-Sector strategies are similar to Core Plus approaches but often have dedicated Plus exposures that can make up the majority of the portfolio at times, and with much less exposure to U.S. Government securities. As a result, multi-sector strategies are generally shorter duration than traditional mandates as shown below (Figure 3). Multi-Sector approaches also have more discretion over duration exposure compared to traditional approaches but typically don’t take active duration positions. Although Multi-Sector strategies have broad flexibility in management of the portfolio, they often have clearly defined objectives that mainly focus on credit risk. As a result, Multi-Sector strategies are higher yielding compared to more traditional strategies, with the median fund yielding 5.7% compared to 4.2% for the Bloomberg US Aggregate Index1 (Figure 2). Multi-Sector funds may generate excess returns of 2% to 4% compared to the Bloomberg US Aggregate Index.

Unconstrained Fixed Income

Unconstrained fixed income strategies are often labeled "go-anywhere" funds. Due to the manager's full discretion over exposures in these strategies, they involve added risks that can deviate significantly from traditional fixed income strategies. These strategies can take large positions in credit, currency, and equity markets and are typically managed on an absolute basis, not relative to a universal benchmark. A common feature of unconstrained strategies is their ability to take large duration bets, including negative duration. Figure 3 illustrates the wide duration ranges of Unconstrained strategies compared to common multi-asset fixed income strategies.

Figure 2. Yield to Worst |

Figure 3. Effective Duration |

|

[AWAITING CHART] |

| Source: Fort Washington and Nasdaq eVestment. Data is as of 09/30/2024. |

Risks & Benefits Associated With Non-Traditional Approaches

Benefits

Portfolio Diversification |

|

Enhanced Return |

|

Higher Yield |

|

Flexibility |

|

Expanded Opportunity Set |

|

Risks

Interest Rate Risk |

|

Credit Risk |

|

Diversification |

|

Risk/Reward Uncertainty |

|

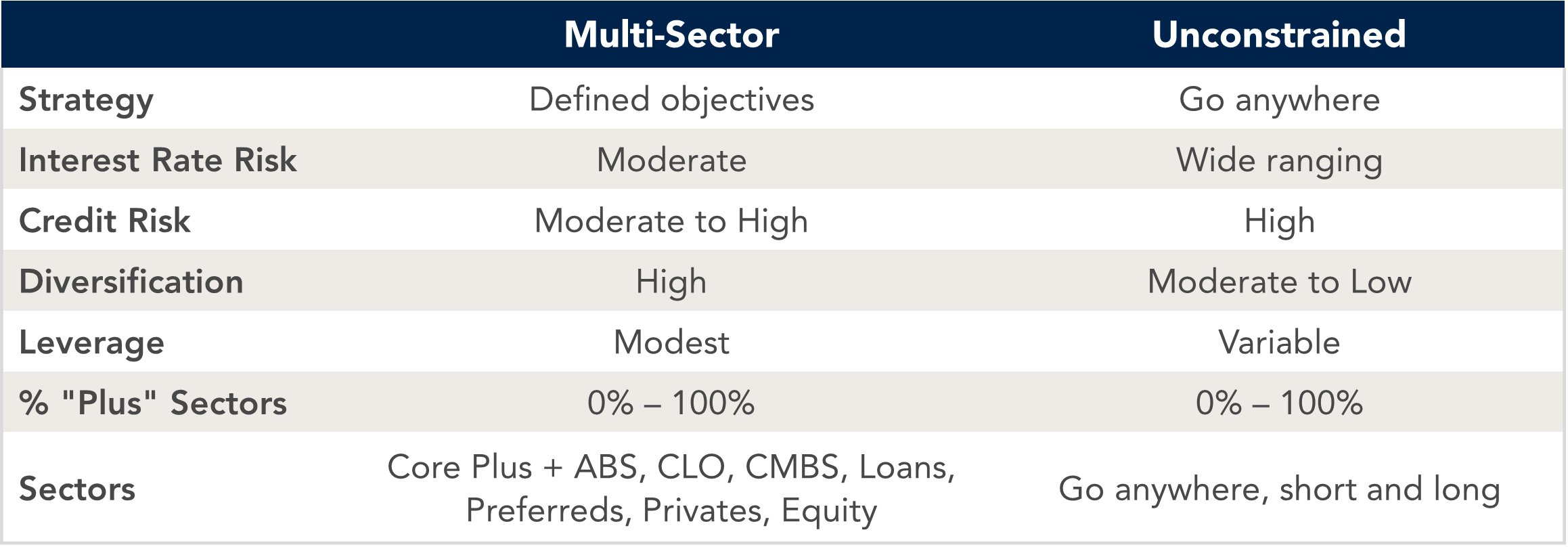

Summary of Non-Traditional Approaches

Where Do Non-Traditional Approaches Fit In an Investor's Portfolio?

Non-traditional fixed income can complement Core and Core Plus strategies. Traditional strategies have clearly defined objectives, and their risk/return profiles come with a higher degree of expectation. An allocation to non-traditional fixed income can provide valuable benefits to a fixed income portfolio, including enhanced returns, higher yields, and uncorrelated returns while only increasing risk marginally.

A non-traditional fixed income allocation can also serve as a standalone fixed income solution for investors. Those looking to add more risk to their portfolio while maintaining the traditional benefits of fixed income can make non-traditional fixed income a principal component of their overall fixed income allocation. The flexibility and agility allowed within non-traditional approaches take the place of asset allocation decisions by investors, becoming an all-in-one fixed income solution.

Finally, investors can use non-traditional fixed income as a substitute for equity strategies. Investors hesitant to allocate to equity late in the cycle, but in search of higher returns, can turn to non-traditional fixed income as a possible solution.