Highlights

- December Rate Cut? The Federal Reserve (Fed) has cut rates by 50 basis points over the past two months, but expectations for a December cut have shifted meaningfully over the past month.

- AI Misstep: Information technology underperformed during the month following shifting sentiment around artificial intelligence valuations.

- K-Shaped Economy: Bifurcation is evident throughout macroeconomic data and across different areas of the investment landscape. We take a look at how the current environment is affecting certain securitizations in this month’s Spotlight below.

Table of Contents

Macro Insights

Mixed Month as Tech Sentiment WaversU.S. equities delivered a mixed performance in November, with the S&P 500 rising 0.2% and extending its winning streak to seven consecutive months despite sharp mid-month volatility. The equal-weight S&P 500 outperformed with a gain of nearly 2%, while the Nasdaq fell 1.5%, breaking its own run. Leadership rotated away from the AI and mega-cap tech trade, as several large names—including Nvidia, Tesla, Microsoft, and Amazon—posted declines. Google and Apple were notable exceptions, helped in part by enthusiasm around Google’s Gemini 3 launch. |

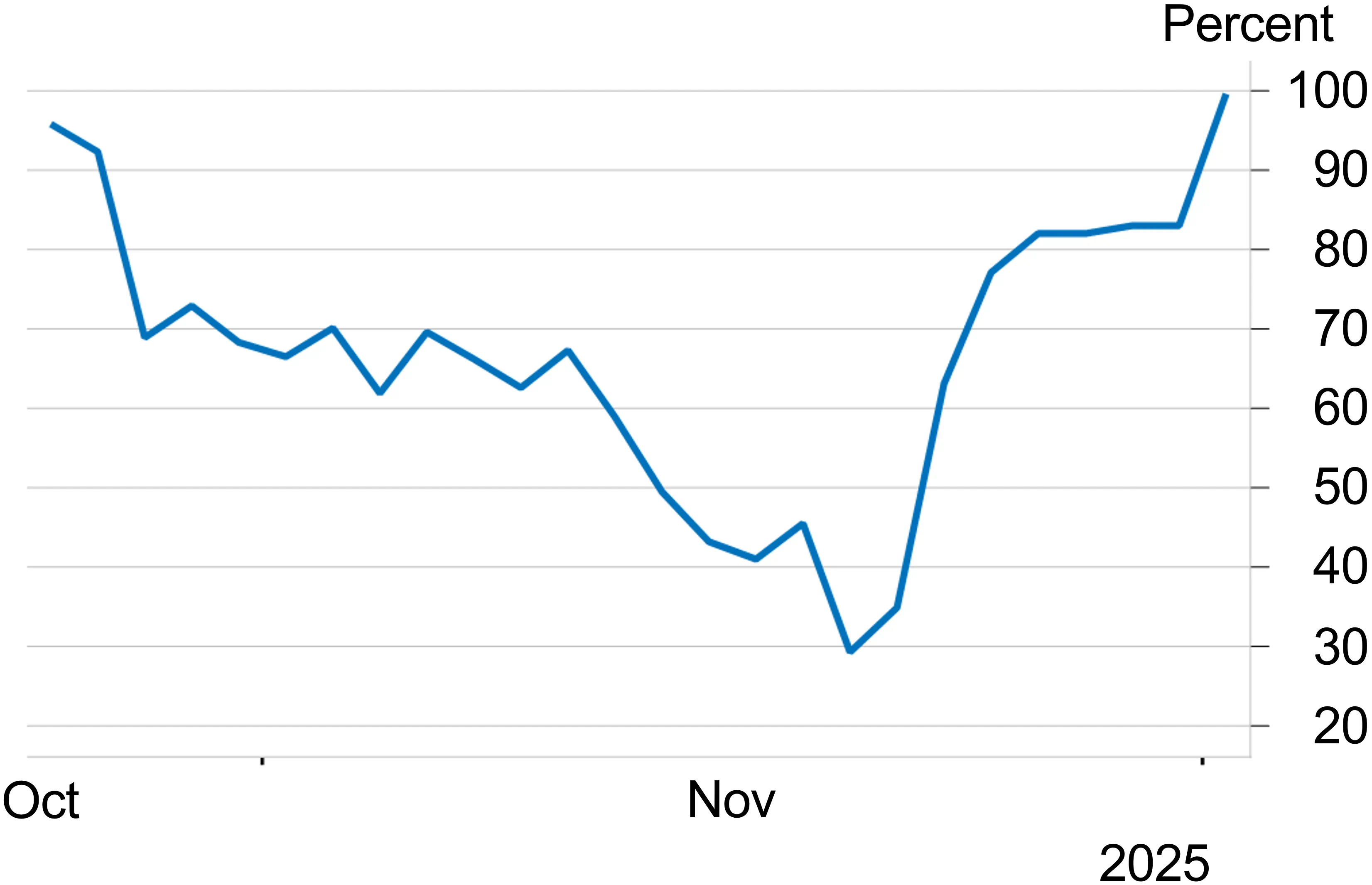

Macro drivers were similarly uneven. Expectations for a December Fed cut swung widely during the month, with odds falling below 30% after cautious Fed commentary early on, before climbing to 100% following remarks from New York Fed President John Williams. Treasury yields edged lower as the curve steepened, and oil recorded its fourth monthly decline. AI remained in focus, with growing scrutiny around the sustainability of hyperscaler spending, financing structures, and competitive dynamics—particularly following Google’s advances in its custom-chip roadmap.

The early-month pullback reflected weakness across popular thematic areas—including AI and unprofitable tech—before a broad rebound late in the month as Fed expectations shifted and market sentiment steadied. Underlying fundamentals continued to provide support. With the Q3 reporting season nearly complete, S&P 500 earnings were up roughly 13.5% year over year, outpacing expectations, and demand for AI compute remained exceptionally strong, underscored by Nvidia’s revenue beat and raised guidance. At the same time, consumer signals remain bifurcated, with strength at the upper end contrasting with pressures elsewhere—a dynamic we explore more fully in this month’s Spotlight on the “K-shaped” economy.

Sector performance showed notable dispersion. Health care led the market with strong gains across pharmaceuticals, while materials, consumer staples, and financials also outperformed. More cyclical and growth-oriented sectors—including technology, consumer discretionary, and industrials—lagged amid the rotation away from crowded leadership.

Overall, with expectations for Fed easing, firm earnings, and resilient AI investment continue to support equities, November’s crosscurrents and narrowing leadership argue for maintaining balance in positioning and keeping us close to neutral.

Market Pricing of December 2025 Rate Cut

Commentary from Federal Open Market Committee (FOMC) officials has led to volatility in the market’s expectations for a rate cut in December.

Odds of December 2025 Rate Cut

What to Watch

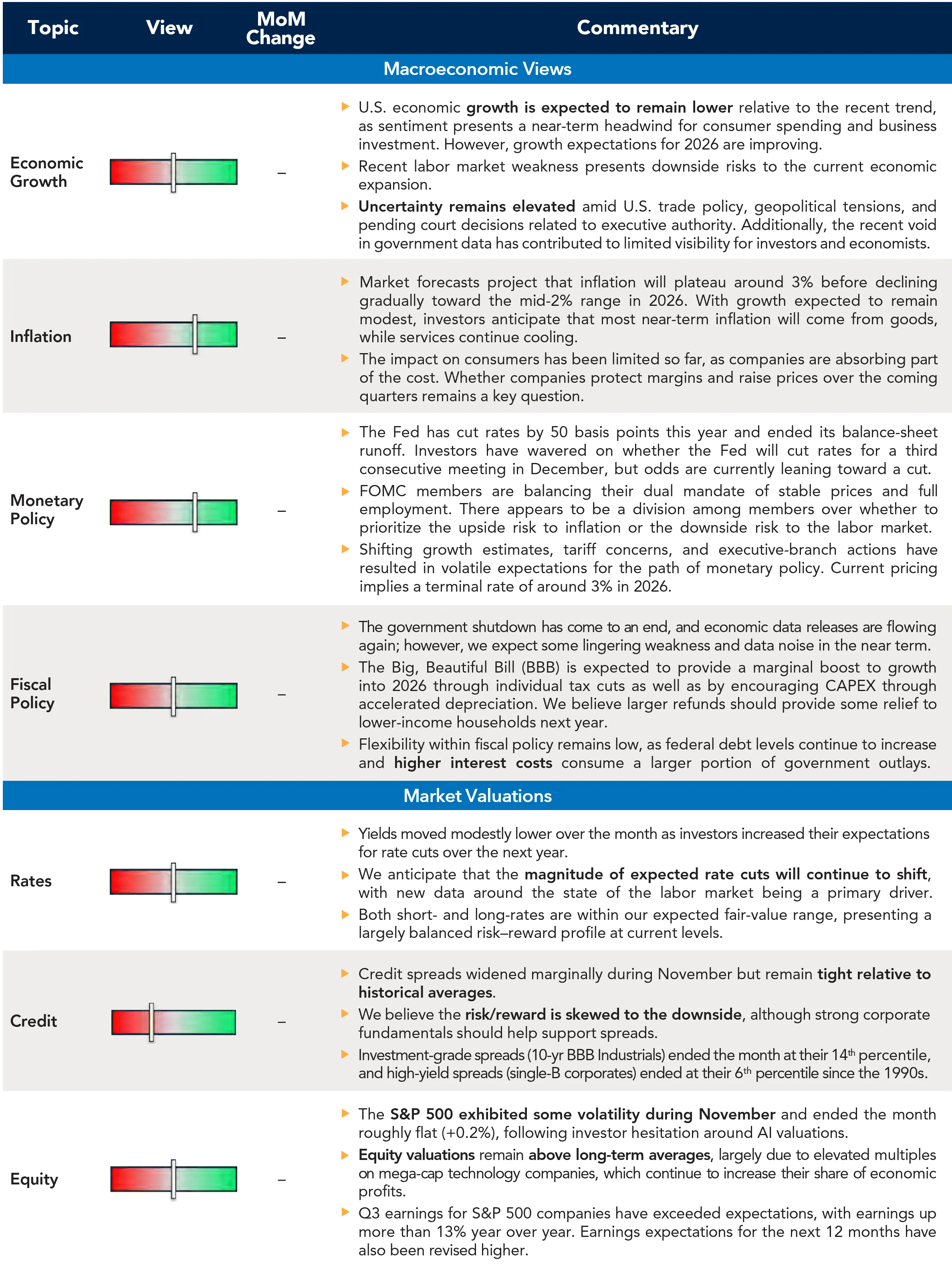

The government shutdown has ended, and economic data has begun to flow again; however, some releases—such as the October Consumer Price Index (CPI) and portions of the October Jobs Report—will not be published. Nevertheless, investors will continue to rely on government data to monitor trends in consumer activity and the labor market.

|

Monthly Spotlight

Impact of the K-Shaped Economy on Fixed Income Investors

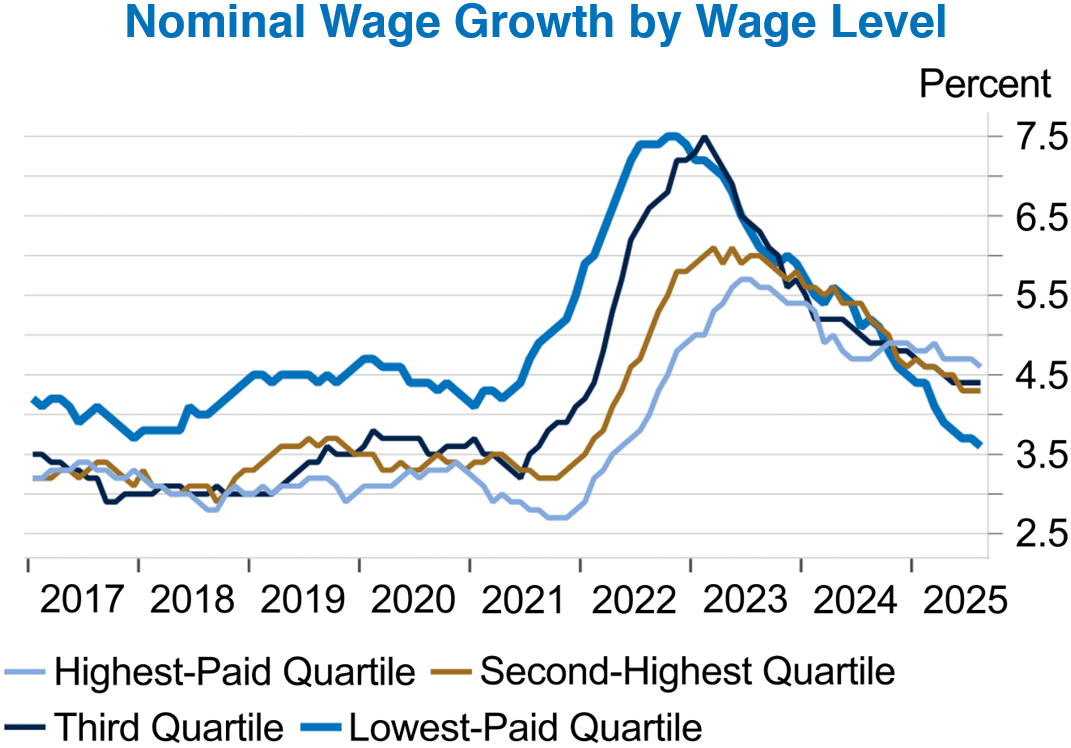

The state of the U.S. consumer has become a tale of two very different stories. On one side, the high-income consumer appears fundamentally solid. Rising stock and home prices, combined with steady income growth, have fueled a strong “wealth effect,” and these consumers have been the primary drivers of economic growth over the past few years. Conversely, lower-income households are under pressure as excess savings have largely dried up and wage growth has fallen behind that of higher earners. This divergence—often described as a “K-shaped” economy—has drawn attention from both Wall Street and Main Street, given that personal consumption accounts for nearly 70% of GDP.

Despite solid aggregate consumption data, consumer sentiment remains historically weak. Much of that pessimism stems from the large share of Americans who fall into the more financially strained category. Only about the top 10% of income earners own equities, meaning most households haven’t benefited from rising asset prices. Many of these consumers don’t own a home and instead have faced higher housing costs through rising rents, alongside elevated prices for groceries, cars, and other essentials. Access to credit has also dried up for these borrowers, widening the spending gap between the two consumer groups.

This bifurcation is also evident within consumer-oriented securitization markets. Subprime auto asset-backed securities (ABS)—pools of auto loans to lower-credit-quality borrowers (FICO below 620)—have seen delinquencies and losses rise meaningfully over the past few years. Interestingly, while delinquency rates now exceed those seen during the Global Financial Crisis, loss rates remain roughly in line with 2019 levels. This suggests borrowers are doing everything possible to avoid losing their vehicles even after missing payments—a sign of limited savings and very little margin for unexpected costs.

Also within the subprime auto space, issuer performance has diverged. Some issuers have proven adept at underwriting in this environment, effectively pricing and modeling expected losses—albeit at higher nominal levels. Other issuers, however, have struggled to manage loss rates within expectations despite progressively tightening credit standards over the past two to three years. This K-shaped trajectory in the market’s perception of issuers has driven wider spread tiering across the sector.

Bifurcation itself is not new, but it continues to permeate both the macroeconomic landscape and the investment environment. While we expect consumer spending to pick up in 2026 and support economic growth, this underlying divergence reinforces the importance of careful credit selection. For investors, it underscores why active management remains critical—particularly within securitized products, where dispersion among issuers and borrowers can be pronounced.

Chart sources: Federal Reserve Bank of Atlanta and Macrobond.

Current Outlook

Market Data & Performance

As of 11/30/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – December 2025

Download Monthly Market Pulse – December 2025