After decades of relative calm, electricity demand in the U.S. is rising rapidly—and consumers are beginning to feel the impact. The growth of AI and data center activity is a significant part of the story, but it is not the only driver. This surge in demand is prompting substantial capital investment by utilities, with implications for bond markets and the broader energy landscape.

For much of the past 25 years, U.S. electricity demand was largely stagnant. Growth slowed in the mid-1990s and then effectively flatlined from roughly 2007 to 2020, despite steady population increases and nearly 30% growth in real GDP. The primary drivers of this stagnation were improvements in energy efficiency and a shift toward a service-based economy, away from energy-intensive manufacturing. During this period, utilities prioritized system reliability, regulatory compliance, and asset replacement over network expansion.

That paradigm has changed. The U.S. power sector is entering its first sustained demand growth cycle in more than two decades. Utility consultant ICF forecasts total U.S. electricity demand to increase by 25% by 2030 relative to 2023 levels. BloombergNEF estimated in December 2025 that U.S. data center power demand could reach 106 GW (gigawatts) by 2035, compared with 25 GW in 2024. This increase is being driven by new data center announcements, many of which exceed 500 MW (megawatts) per facility—enough to power roughly 400,000 U.S. homes on an annual-average basis.

While data centers and AI are the largest contributors—expected to drive roughly half of incremental demand growth over the next five years—other trends are also adding meaningful pressure, albeit with regional variation.

Building electrification, spurred by decarbonization mandates in states such as California and New York, is expected to contribute 15% to 25% of incremental demand growth as businesses and households move away from fossil-fuel-based heating and appliances. Electric vehicles could account for an additional 10% to 20% as adoption accelerates and charging infrastructure expands. Meanwhile, industrial reshoring, the growth of advanced manufacturing, and the electrification of hydraulic fracturing equipment are projected to drive another 10% to 15% of demand growth, concentrated in regions such as PJM (Pennsylvania, Ohio, New Jersey, Maryland, Virginia, Chicago, and Washington, D.C.) and Texas (ERCOT).

This surge in demand is prompting utilities to respond with historic increases in capital spending, most of which is flowing into transmission and distribution. The Edison Electric Institute (EEI), which represents U.S. investor-owned utilities, expects its members to invest $1.1–$1.4 trillion between 2025 and 2029—roughly matching the total spent over the previous decade. Generation investment is also rising but remains uneven and is increasingly driven by independent power producers. This shift is fueling M&A activity, as well as a surprising revival of three nuclear power plants that were deemed uneconomic just a few years ago.

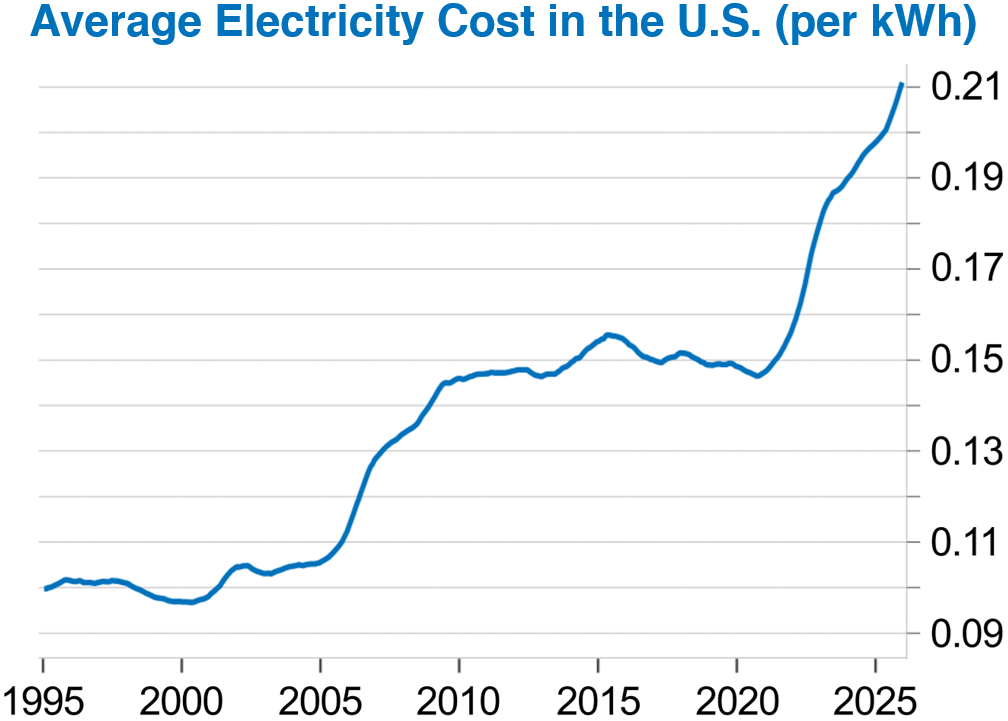

The combination of accelerating demand, sharply higher grid capital expenditures, and rising wholesale prices points to sustained upward pressure on retail electricity rates. That said, efforts are underway to mitigate the impact on consumers. At the federal level, the Administration has urged PJM, the nation’s largest grid operator, to hold dedicated auctions that would require technology firms to finance new power plants and commit to long-term contracts. States are also adopting targeted policies, such as requiring large energy users to cover the cost of the infrastructure they require. Microsoft, for its part, has pledged to do exactly that through its “Community-First AI Infrastructure” initiative. Even so, this dynamic warrants close monitoring, both for its potential effect on household electricity costs and its broader implications for fixed income and equity markets.

Chart sources: BLS and Macrobond.