Key Takeaways

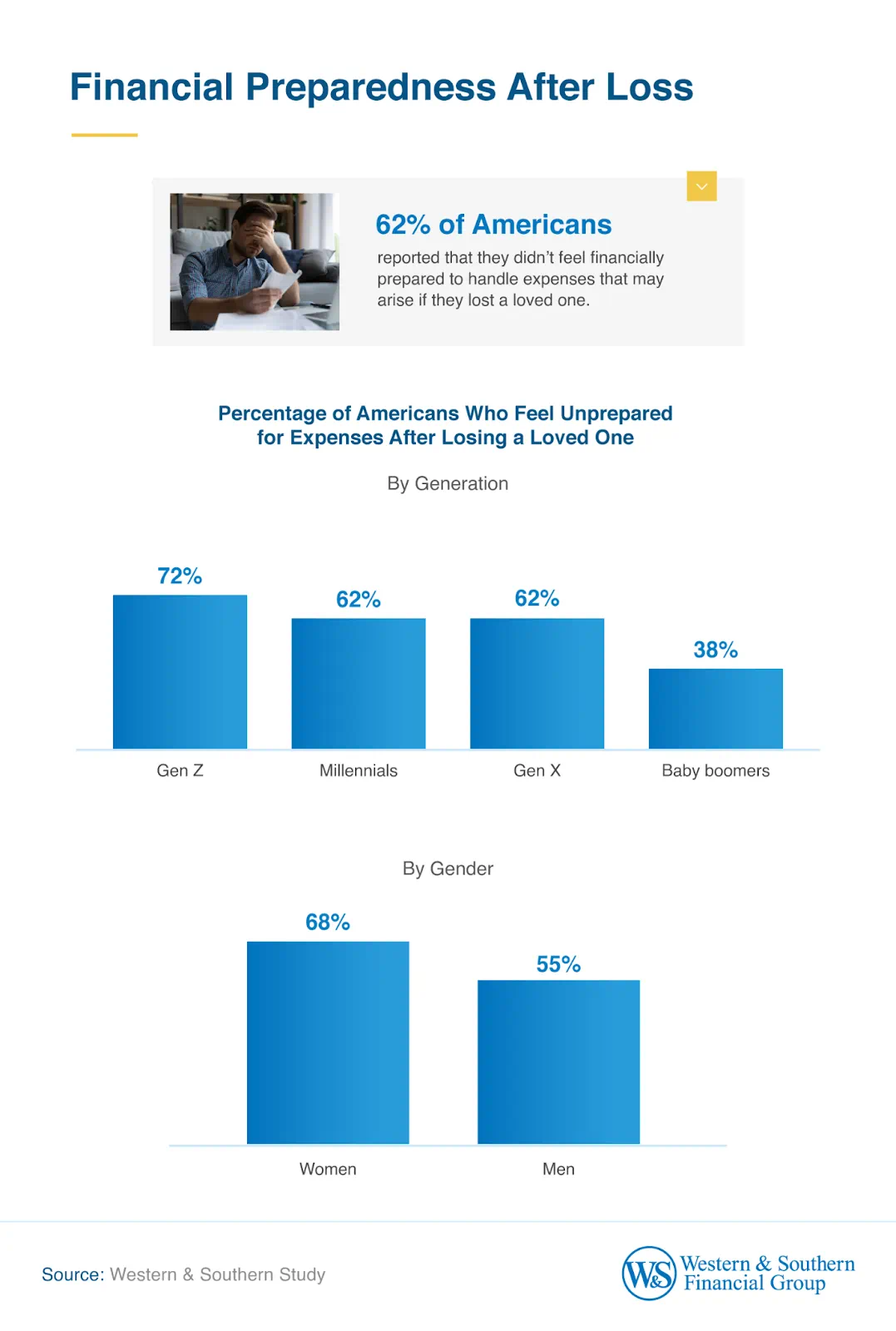

- 62% of Americans don't feel financially prepared to handle expenses that may arise if they lose a loved one, with Gen Z (72%) being the most likely to say so.

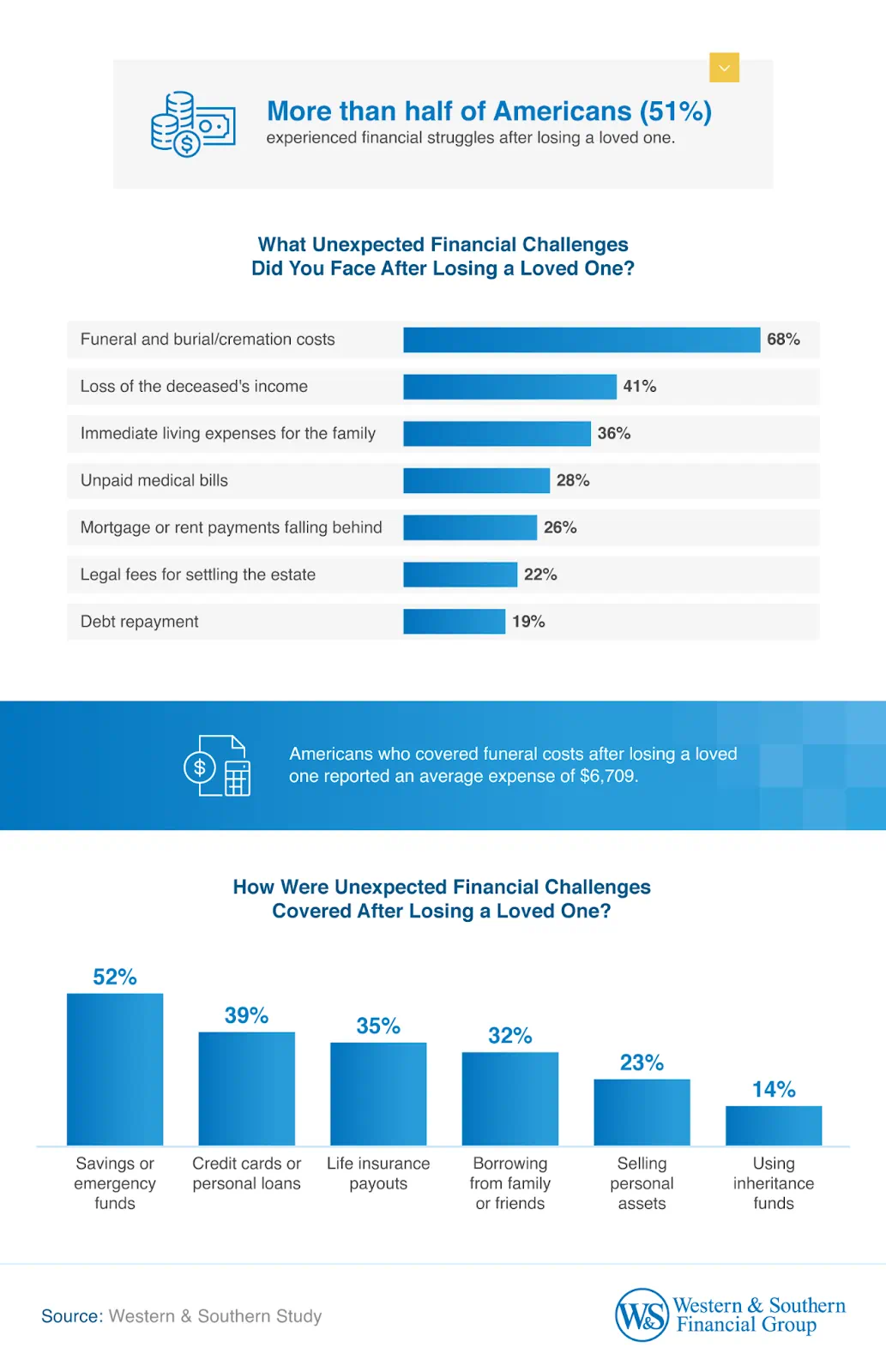

- Over half of Americans (51%) experienced financial struggles after losing a loved one.

- 39% turned to credit cards or personal loans to cover unexpected expenses after the loss of a loved one. Gen Z (47%) was the most likely to do so.

- 7% used crowdfunding platforms like GoFundMe for unexpected expenses after losing a loved one, with Gen Z (11%) being the most likely to do so.

- 35% used life insurance payouts to manage unexpected expenses after losing a loved one.

- 26% had difficulties accessing life insurance payouts or other critical funds after losing a loved one.

- Nearly 1 in 3 Americans (30%) have never discussed end-of-life financial plans with their family or loved ones, with Gen Z (38%) being the least likely to have done so.

The Financial Toll of Loss

Many Americans believe they are financially unprepared for the expenses associated with the loss of a loved one. According to the survey, 62% felt ill-equipped to handle such costs — with Gen Z respondents (72%) being the most likely to feel unprepared. Women (68%) expressed more financial concern than men (55%), highlighting a gender gap in perceived readiness.

Over half of Americans (51%) have struggled financially after losing a loved one, with 14% describing their challenges as significant and 37% saying they were manageable.

The loss of the deceased's income was particularly difficult for baby boomers (60%) compared to Gen X (51%), millennials (33%), and Gen Z (39%). Affording immediate living expenses posed a challenge, especially for Gen Z (41%) and millennials (34%). Additionally, 26% of Americans said falling behind on mortgage or rent payments was an unexpected financial burden after a loss.

To cover unexpected costs after losing a loved one, 52% relied on savings or emergency funds, with Gen Z leading at 57%. Credit cards or personal loans were used by 39%, and Gen Z (47%) was again the most likely to rely on this method. Life insurance payouts were used by 35%, and 7% turned to crowdfunding platforms, with the highest participation among Gen Z (11%).

Accessing monetary funds following a loved one's death was a challenge for 26% of the Americans surveyed. Financial disagreements among family members were a frequent issue, with 48% reporting conflicts. Gen Z experienced this the most (53%) suggesting that younger generations may face greater challenges in managing finances after a loss.

Accessing monetary funds following a loved one's death was a challenge for 26% of the Americans surveyed. Financial disagreements among family members were a frequent issue, with 48% reporting conflicts. Gen Z experienced this the most (53%) suggesting that younger generations may face greater challenges in managing finances after a loss.

On average, the general public has been able to access life insurance payouts or other critical funds within 6 weeks after losing a loved one. However, those who faced difficulties accessing resources experienced longer delays, with an average wait time of 7 weeks compared to 5 weeks for those who faced no issues.

These delays often stem from processing requirements like verifying policy details, obtaining a death certificate, or resolving beneficiary disputes. To help expedite access to funds, beneficiaries can take proactive steps such as submitting accurate claim forms promptly and communicating regularly with the insurer.

Why Financial Conversations Are Avoided

Some families avoid discussing end-of-life financial planning, leaving gaps in preparedness. Nearly 1 in 3 Americans (30%) have never had these conversations, with Gen Z (38%) being the least likely to address the topic. Among those who have discussed end-of-life plans, only 17% reported having in-depth discussions, while 53% admitted to only brief conversations.

While feeling uncomfortable about discussing end-of-life plans is the top barrier to these meaningful discussions, a lack of financial knowledge is also a common hindrance. Younger generations reported this issue most often, with 30% of Gen Z and 22% of millennials identifying it as a challenge, compared to 17% of Gen X and 7% of baby boomers.

Many Americans also felt uncertain about their family's end-of-life financial arrangements. In fact, 38% were not confident in their understanding of their parents' finances, with Gen Z showing the highest level of doubt at 42%. Uncertainty was even greater when it came to siblings' financial arrangements — 55% of Americans felt uninformed, with millennials and Gen Z leading at 57% each.

Planning for Unexpected Losses

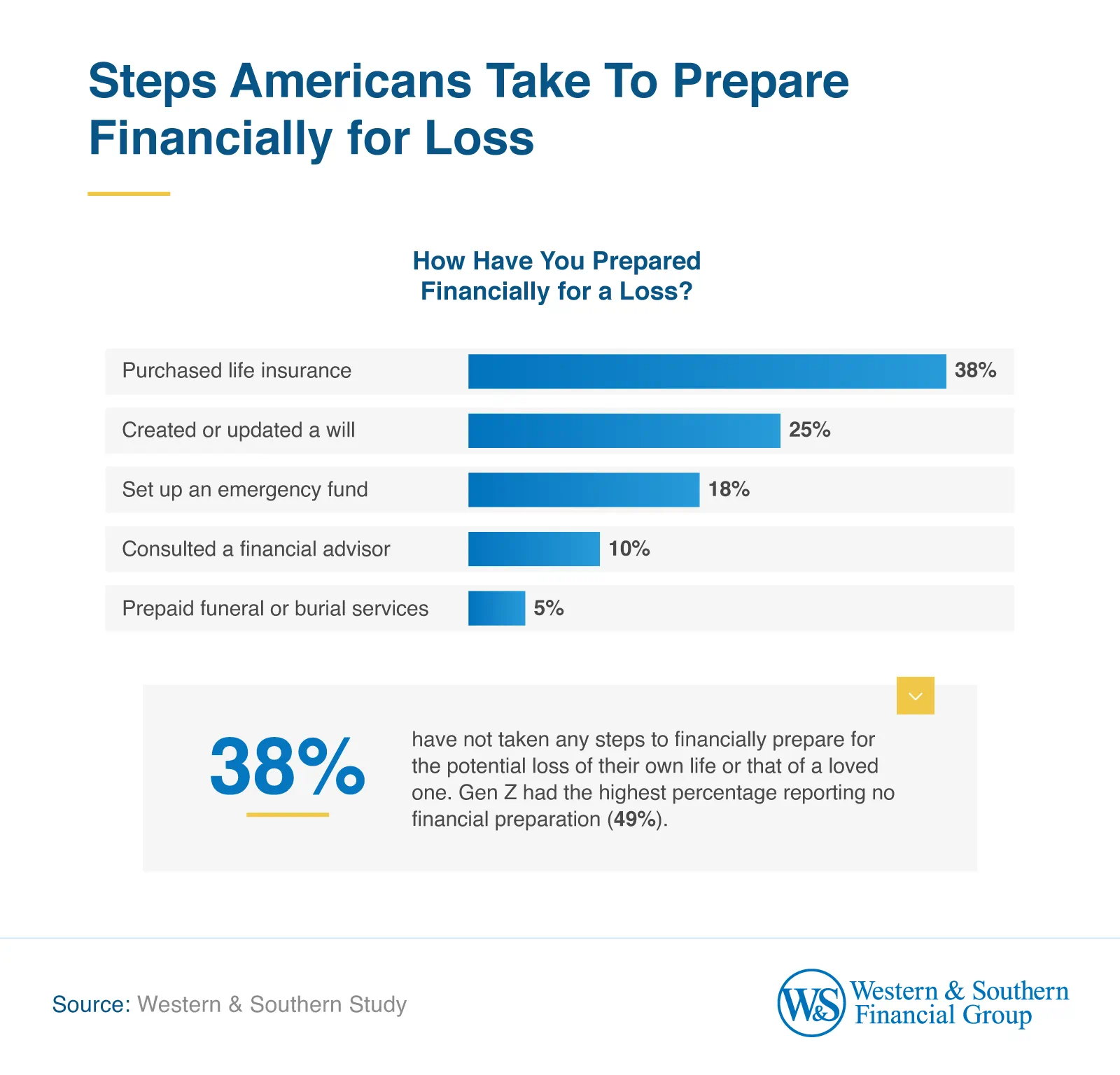

Life insurance and estate planning play critical roles in preparing for the unexpected. However, only 38% of respondents had purchased life insurance, and just 1 in 4 had created or recently updated a will. Baby boomers (47%) were the most prepared when it came to their wills, compared to millennials (23%) and Gen Z (20%).

Who's Financially Prepared for a Loss?

Preparing for the financial impact of losing a loved one is a step many Americans have yet to take. With significant gaps in life insurance coverage, will creation, and emergency savings, younger generations are particularly at risk of financial strain. These findings highlight the importance of early conversations and proactive planning to help individuals and families better navigate the uncertainties that follow a loss.

Methodology

Western & Southern surveyed 1,007 Americans to explore how they handle the financial challenges that arise after the loss of a loved one and their preparedness for such events.

Among them, 50% were women, and 50% were men. The generational breakdown was Gen Z (17%), millennials (50%), Gen X (25%), and baby boomers (8%). The data was collected in February 2025.

About Western & Southern Financial Group

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500® company at No. 284, is the parent company of a group of diversified financial services businesses. Its assets owned ($80 billion) and managed ($42 billion) totaled $122 billion as of Sept. 30, 2024.1 Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company,2 Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fabric by Gerber Life; Fort Washington Investment Advisors, Inc.;3 Gerber Life Agency;4 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;3 Touchstone Securities, Inc.;5 W&S Brokerage Services, Inc.;3,5 and W&S Financial Group Distributors, Inc.6 Western & Southern is a title sponsor of several major community events every year. From 2002 to 2023, it served as title sponsor of Cincinnati's longtime professional tennis tournament — now named the Cincinnati Open — an ATP Masters 1000 and WTA 1000 event and one of the world's largest tournaments. The company continues to serve as a major sponsor of the event.

1 The financial information presented here is preliminary and unaudited.

2 Gerber Life is a registered trademark. Used under license from Société des Produits Nestlé S.A. and Gerber Products Company.

3 A registered investment advisor.

4 In the State of California, Gerber Life Agency, LLC is known as and does business as Gerber Life Insurance Agency, LLC.

5 A registered broker-dealer and member FINRA / SIPC.

6 W&S Financial Group Distributors, Inc. (doing business as W&S Financial Insurance Services in CA).

Review our current financial ratings.

From Fortune ©2024 Fortune Media IP Limited. All rights reserved. Used under license. Fortune and Fortune 500 are registered trademarks of Fortune Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse the products or services of Western & Southern Financial Group.

Fair Use Statement

This content may be shared for non-commercial purposes only, with appropriate credit to Western & Southern and a direct link to the original study.