Key Takeaways

- IRAs provide individual control since they’re owned by the account holder, allowing flexible investment choices regardless of age or employer status.

- Traditional IRA contributions may be tax-deductible, though deductibility can depend on income and workplace retirement plan coverage.

- Early IRA withdrawals before age 59½ often incur a 10% penalty, with limited exceptions for specific expenses like high medical costs.

- 401(k) plans have higher contribution limits and potential employer matches, helping you build retirement savings faster.

- Both IRAs and 401(k)s defer taxes on investment growth, but Roth versions offer tax-free withdrawals in retirement.

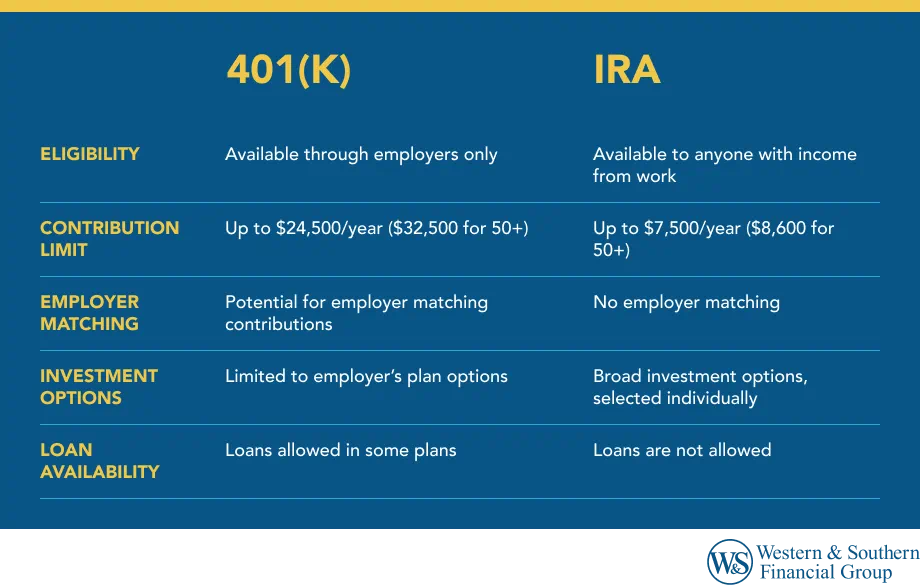

Are you considering opening an individual retirement account (IRA) to either replace or supplement your employer-sponsored plan? If so, it can help to know the difference between 401(k) and IRA plans. The good news is that these differences are fairly easy to understand.

What Are an IRA's Unique Features?

Anyone with earned income, at any age, can open and contribute to a traditional IRAs. These accounts are owned by the individual - not an employer -and give you control over how your money is invested. You can choose an investment approach that’s as aggressive or conservative as you prefer.

You can open a traditional IRA through many types of financial institutions, including:

- Life insurance companies

- Banks

- Brokerage firms

Contribution Limits and Deductibility

- Annual Contribution Limit: $7,500 (or $8,600 for those age 50 and older)1

- Tax Deductibility: Contributions may be tax-deductible.

- If you or your spouse is covered by a retirement plan at work, your deduction may be limited depending on your income.

- If you’re not covered by a workplace plan, there’s no income limit for deducting IRA contributions.

You can make contributions for each tax year up until that year’s tax-filing deadline. As long as you earn compensation, you can keep contributing, no matter your age.

Early Withdrawal Rules

Taking money out of your IRA before age 59½ typically results in a 10% early withdrawal penalty from the IRS. There are, however, exceptions, such as withdrawals used to pay medical expenses that eExceed 10% of your gross income and are not covered by a health plan.²

How Is a 401(k) Different?

Unlike an IRA, a 401(k) is available only through an employer. While these plans are very common, employers aren’t required to offer them.

A 401(k) allows you to save much more of your own earnings each year than an IRA does:

- Annual contribution limit: $24,500

- Catch-up contribution (age 50 and older): $32,500¹

Some employers offer matching contributions, adding extra money to your account based on how much you contribute.

Loan Provisions

Certain 401(k) plans allow you to borrow from your own account and repay the loan - with interest - typically within five years. Key loan details include:

- Loan limit: The smaller of $50,000 or half of your vested balance

- Tax implications: You may owe taxes on borrowed funds

- Repayment: Must include interest paid back into your account

Total Savings Potential and Deadlines

With a 401(k), your total potential annual savings - including your contributions and employer contributions - can reach up to $72,000. Keep in mind that the contribution deadline is December 31 each year. By comparison, IRA contributions can be made up to the tax-filing deadline for that year.

Taxes on Withdrawals

Both traditional 401(k) and IRA withdrawals are taxed as ordinary income once you begin taking money out, even if part of your savings came from capital gains (which are usually taxed at a lower rate outside of retirement accounts). As with any investment growth is not guaranteed the value can fluctuate or decline.

Still, both plans offer the advantage of deferring taxes until you start withdrawing funds, depending on the specific terms of your plan documentation..

Making Sense of the Roth Option

There's another category of IRA and 401(k) known as Roth plans. With Roth retirement accounts, you pay taxes on your contributions as you make them. You don't take a tax deduction for the money you put into a Roth plan each year, but the contributions you make can be taken out at retirement without being subject to income tax, since you've already paid. (You must have had the Roth account for at least ten years, though).

Final Thoughts

If you're eligible to participate in a 401(k) plan and your employer makes matching contributions, you might consider contributing enough to be eligible for the full match. If your employer's plan doesn't offer the investment choices you're looking for, however, you could always consider looking for an IRA better suited to your personal financial goals. You could also consider meeting with a qualified financial adviser to help determine whether an IRA, a 401(k) or a balance of both plan types will fit best into your overall financial strategy.

Find 401(k) and IRA options to find the best fit for your retirement goals. Start Your Free Plan

Sources

- 401(k) limit increases to $24,500 for 2026, IRA limit increases to $7,500. https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500.

- Retirement Topics - Exceptions to Tax on Early Distributions. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions.