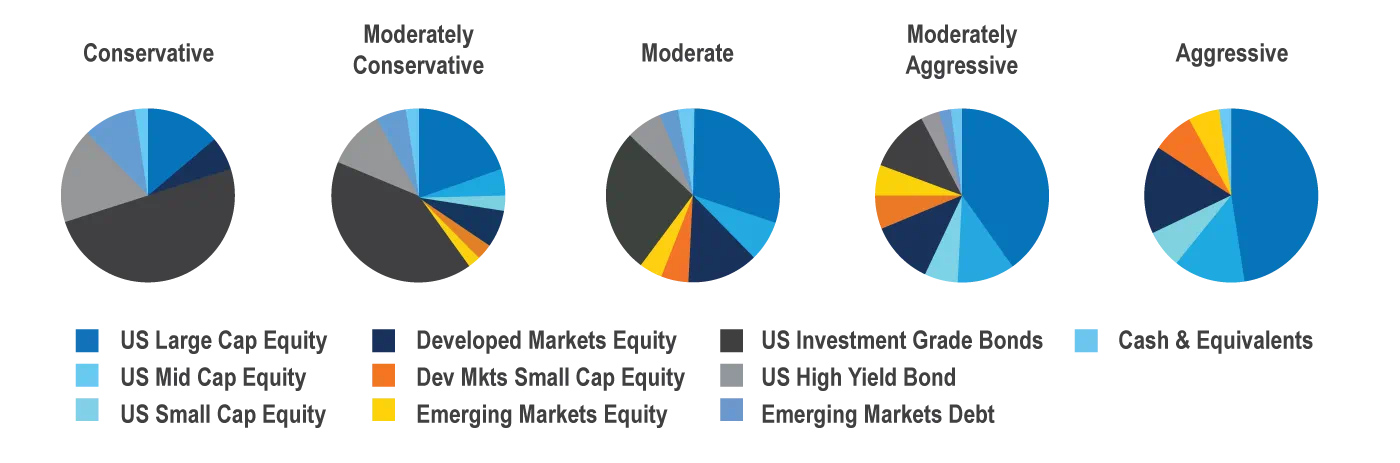

We Tailor a Diversification Strategy According to Your Risk Tolerance

We know that when it comes to risk, one size doesn’t fit all. We tailor a diversified strategy that is designed around your specific risk tolerance, which can range along a continuum from conservative to aggressive. With W&S Wealth Solutions, you’ll have access to a wide variety of asset classes:

Portfolio attribution and allocation is subject to change without notice. The investment allocations are the result of analysis was based on current market conditions and bond offerings.