Key Takeaways

- Whole life insurance provides permanent coverage with a guaranteed death benefit.

- Policies build tax-deferred cash value, which can be borrowed or withdrawn but should only be done in emergency situations.

- Premiums remain fixed for the life of the policy, offering long-term predictability.

- High costs and slow early cash value growth are significant drawbacks. Keep in mind cash value may take years to accumulate unless a large premium is paid up front.

- Best suited for estate planning, business succession, and those wanting guaranteed outcomes rather than market-based investments.

What Exactly Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance designed to last for your entire life, as long as you continue to pay the premiums. Unlike term life insurance, which only covers you for a specific period (like 10, 20, or 30 years), a whole life insurance policy doesn't expire.

But it's more than just a death benefit. A key feature is its cash value component. A portion of your premium payments is allocated to this cash value account, which grows at a guaranteed rate, tax-deferred. It's this dual nature, protection and savings, that makes understanding the whole life insurance pros and cons so crucial.

How It Differs from Other Policies

- Term Life Insurance (Term): Purely insurance. You pay for a death benefit and nothing more. It’s significantly cheaper, but it offers no cash value, and coverage is temporary.

- Universal Life Insurance (UL): Another type of permanent life. A universal life policy offers more flexibility than a whole life policy. You can often adjust your premium payments and death benefit. However, the cash value growth is tied to interest rates, which can fluctuate.

- Indexed Universal Life Insurance (IUL): A type of permanent life insurance policy that provides lifelong coverage and a cash value component, which grows based on the performance of a selected stock market index. IULs offer flexibility in premium payments, death benefits, and tax-deferred cash value growth.

Key Takeaway

Whole life is the most straightforward type of permanent life insurance, offering fixed premiums, a guaranteed death benefit, and guaranteed cash value growth.

The Core Benefits: Exploring the Pros of Whole Life Insurance

Why do people choose whole life? The advantages center on predictability, guarantees, and unique financial features that can be leveraged during your lifetime.

1. Lifelong Protection and a Guaranteed Death Benefit

The most significant advantage is its permanence. As long as the policy is in force, your beneficiaries will receive an income tax-free death benefit.

This guarantee is a cornerstone of the insurance policy, ensuring your financial legacy and protecting your dependents, regardless of when you pass away.

2. Guaranteed Cash Value Accumulation

The cash value is the living benefit of your policy. It’s a liquid asset you can access for various needs.

- Guaranteed Growth: The insurance company provides a guaranteed minimum interest rate on your cash value growth. This growth creates a stable, predictable asset.

- Tax-Deferred Growth: The money in your cash value account grows without being taxed annually. This tax-deferral allows your savings to compound more efficiently over time.

3. Access to Your Money Through Loans and Withdrawals

Life is unpredictable. You might need funds for a down payment, a child’s education, or an emergency. You can borrow against your cash value, often at a lower interest rate than a personal loan.

4. Potential for Dividends

Many whole life policies are offered by mutual companies, which their policyholders own. When the life insurance company performs well, it may pay out annual dividends. While dividends are not guaranteed, they can be used in several ways:

- Receive them as cash.

- Reduce your premium payments.

- Leave them to accumulate interest.

- Purchase paid-up additions, which are small, fully paid-up blocks of life insurance that increase both your death benefit and your cash value. PUAs are a powerful way to accelerate your policy's growth.

5. Predictable, Fixed Premiums

Your premium payments are fixed for the duration of your life. They will never increase, regardless of your age or changes in your health. This predictability makes budgeting much easier compared to other types of permanent life insurance, where costs can fluctuate.

6. Customizable Coverage with Riders

You can often tailor a whole life insurance policy to your specific needs by adding riders. These are optional provisions that offer extra benefits or coverage, although an additional cost is usually associated with them. Common riders include:

- Accelerated Death Benefit: Allows you to access a portion of your death benefit while you are still alive if you are diagnosed with a terminal illness.

- Waiver of Premium: If you become totally disabled and unable to work, this rider waives your premium payments while keeping the policy in force.

- Long-Term Care Rider: Enables you to use your death benefit to pay for long-term care expenses.

These riders add a layer of flexibility and protection, allowing the policy to serve multiple purposes beyond just a death benefit. Payment of Accelerated Death Benefits, if not repaid, will reduce the Death Benefit and affect the available loan amount and other policy values.

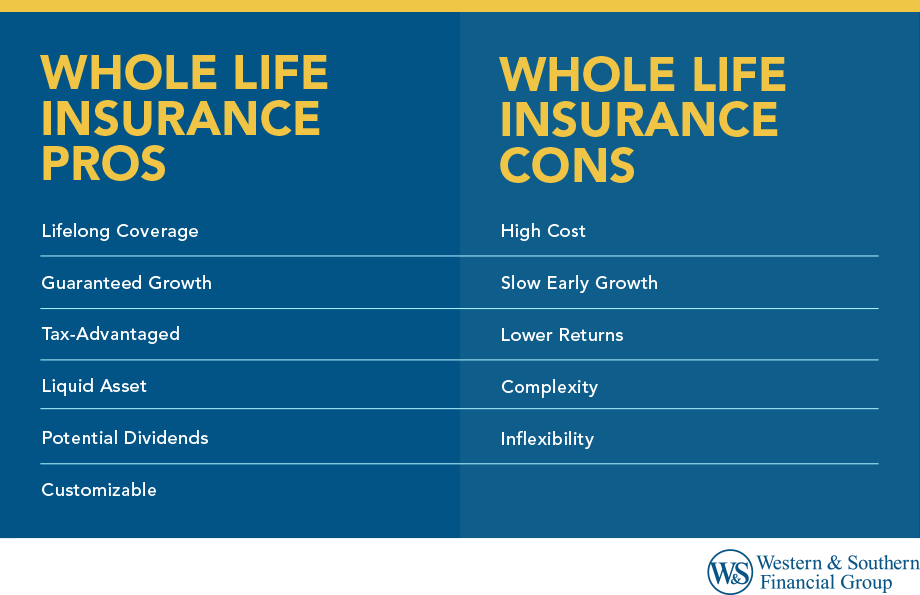

| Pros of Whole Life Insurance |

|---|

| ✅ Lifelong Coverage: Coverage continues as long as the policy is in force and premiums are paid. |

| ✅ Guaranteed Growth: Fixed premiums and guaranteed cash value growth. |

| ✅ Tax-Advantaged: Cash value grows tax-deferred; death benefit is tax-free. |

| ✅ Liquid Asset: Access cash value via loans or withdrawals for life's needs, if needed. |

| ✅ Potential Dividends: Can be used to increase policy value or reduce premiums. |

| ✅ Customizable: Riders can be added for additional benefits. |

The Drawbacks: Acknowledging the Cons of Whole Life Insurance

While the benefits are compelling, whole life insurance may not be the right fit for everyone. The disadvantages primarily revolve around cost and complexity.

1. Higher Premiums

High premiums are the biggest hurdle for most people. Whole life policy premiums are more expensive than term life insurance for the same death benefit. This high cost is because you're funding the cash value account and paying for a lifetime of coverage, not just a specific term.

2. Slow Cash Value Growth in Early Years

The cash value builds very slowly, especially in the first 10-15 years. Slow growth is because a large portion of your early premium payments goes toward the agent's commission and the insurer's administrative fees.

If you need to surrender the policy in its early stages, you may receive back less than you initially invested, highlighting its nature as a long commitment.

3. Lower Returns Compared to Traditional Investing

The guaranteed rate of return on a whole life policy's cash value is typically conservative; however, dividends can increase this rate. You could likely achieve higher returns over the long term by purchasing a cheaper term life policy and investing the difference in a diversified brokerage account. However, this approach lacks the guarantees and tax benefits of whole life.

A Note on MECs

Be aware of the Modified Endowment Contract (MEC). If you fund your policy too quickly (e.g., with a single premium life insurance payment), it can be reclassified as an MEC by the IRS. This classification changes the tax rules, making loans and withdrawals taxable and subject to penalties if taken before age 59½.

4. Lack of Flexibility

The fixed premiums and rigid structure can be a disadvantage if your financial situation changes. A job loss or unexpected expense could make it challenging to keep up with payments.

| Cons of Whole Life Insurance |

|---|

| ❌ High Cost: Premium rates are more expensive than term life insurance. |

| ❌ Slow Early Growth: Cash value accumulation is very slow in the first decade. |

| ❌ Lower Returns: Growth may not keep pace with traditional market investments. |

| ❌ Complexity: Policies can be complex and difficult to understand without guidance. |

| ❌ Inflexibility: Fixed premiums can be a burden if your income changes. |

Who Is Whole Life Insurance Best For? A Real-World Case Study

Consider Sarah, a 45-year-old small business owner. She wants to ensure her business can continue if she passes away and wants a stable, tax-advantaged way to save for retirement outside of the stock market. She also wants to leave a legacy for her children.

- Problem: Sarah needs permanent coverage and a conservative savings tool.

- Solution: Sarah works with a financial advisor she trusts to analyze her options. After reviewing several life insurance quotes from providers with strong financial strength ratings, she decides on a whole life policy.

- Outcome: She secures a guaranteed death benefit to protect her business and family. Her cash value grows predictably, and she plans to use it to supplement her retirement income through tax-free loans. The policy becomes a foundational part of her diversified financial portfolio.

This type of profile, characterized by someone with a high income, long-term financial goals, and a need for the guarantees that whole life insurance provides, is often the ideal candidate. It can also serve as a powerful estate planning tool for individuals seeking to pass on their wealth efficiently.

Conclusion: Making an Informed Decision

Ultimately, the choice between whole life and other options comes down to your personal financial goals.

- Assess Your Primary Need: If your only goal is to provide income replacement for your family for a specific period (e.g., until the kids graduate college, duration of a mortgage), a term life insurance policy is likely the most cost-effective solution.

- Evaluate Your Budget: Can you comfortably afford the high premiums of whole life without sacrificing other financial goals, like retirement savings or emergency funds? Don't stretch your budget too thin for a policy you might not be able to afford or maintain.

- Consult a Professional: The complexities of a whole life insurance policy are best navigated with a qualified financial professional. They can help you compare quotes from companies like Fidelity Life and others.

Whole life insurance is not inherently "good" or "bad." It is a specialized financial product that offers a unique combination of guarantees and benefits. By carefully weighing the pros and cons of whole life insurance, you can determine if it's the right anchor for your financial plan.

Explore the whole life insurance pros and cons for your financial future. Request a Free Life Insurance Quote

Frequently Asked Questions

What is the main disadvantage of whole life insurance?

The primary disadvantage is its high cost. Premiums are more expensive than term life policies for the same death benefit amount, which can make them unaffordable for many families and potentially divert funds from other critical financial goals, such as retirement investing.

Can I cancel my whole life insurance and get money back?

Yes, you can cancel, or "surrender," your policy at any time. If you do, you will receive the policy's cash surrender value, which is the accumulated cash value minus any outstanding loans and surrender charges. Keep in mind that in the early years of the policy, the surrender value may be less than the total premiums you've paid.

What are the tax implications of whole life?

Whole life insurance has several tax advantages. The death benefit paid to beneficiaries is typically income tax-free, the cash value grows on a tax-deferred basis, and policy loans are usually not considered taxable income.

However, if you surrender the policy for a gain (receiving more cash than you paid in premiums), that gain is subject to ordinary income tax. Also, if your policy becomes a Modified Endowment Contract (MEC), withdrawals and loans are taxed less favorably.

Can you lose money on a whole life insurance policy?

Yes, it is possible to lose money, especially if you surrender the policy in the early years. Due to high upfront commissions and administrative fees, the cash surrender value is often less than the total premiums paid for the first 10-15 years.

What age should you stop whole life insurance?

You generally don't "stop" a whole life policy in the way you would a term policy. It's designed to last your entire life. However, you can use the cash value to pay the premiums after a certain point or surrender the policy for its cash value if you no longer need the death benefit, though there may be tax implications.

Sources

- Whole life insurance - Legal Information Institute, Cornell Law School. https://www.law.cornell.edu/wex/whole_life_insurance

- Revenue Procedure 2001-42 (Modified Endowment Contract Regulations) - Internal Revenue Service. https://www.irs.gov/pub/irs-drop/rp-01-42.pdf

Footnotes

- Withdrawals may be subject to charges, withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty. Interest is charged on loans, they may generate an income tax liability, reduce the Account Value and the Death Benefit, and may cause the policy to lapse.