Key Takeaways

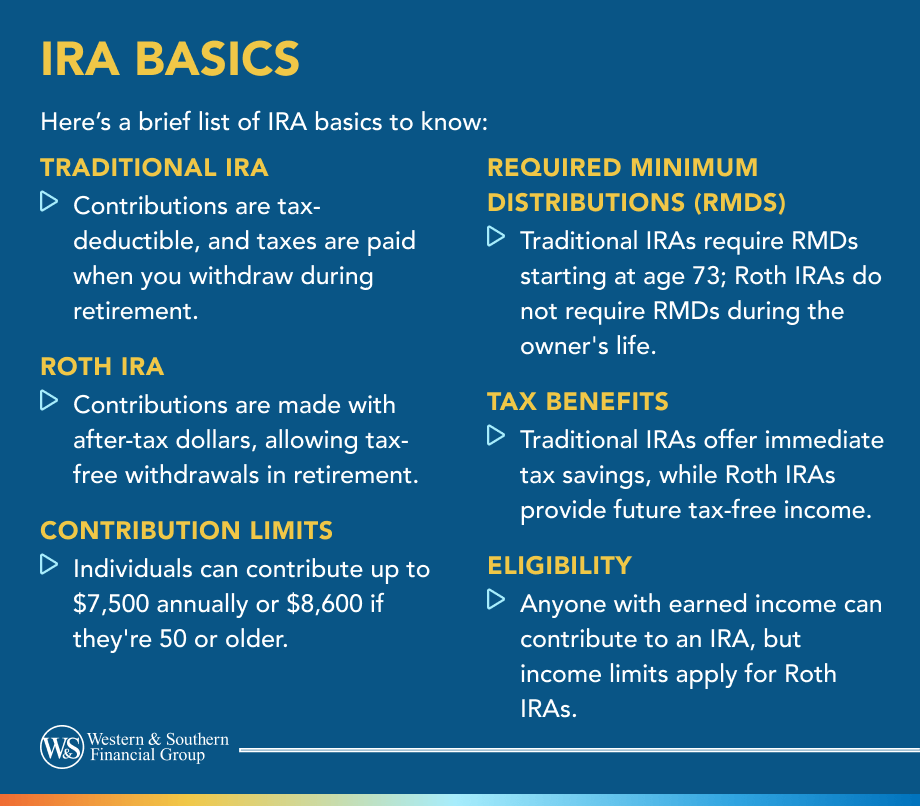

- IRAs are tax-advantaged retirement savings accounts that allow you to contribute either pretax or post-tax dollars, depending on the type.

- Traditional and Roth IRAs differ in taxes, with one offering tax-deferred growth and the other tax-free withdrawals.

- Different IRA types serve unique needs, including options for employees, the self-employed, spouses, and minors.

- IRAs offer more investment flexibility than employer-sponsored plans like 401(k)s, letting you choose how your money is invested.

- Contribution limits and withdrawal rules vary by age and income, so understanding them helps you maximize tax benefits and avoid penalties.

Whether your golden years are just around the corner or far off in the distance, retirement planning often revolves around effective ways of saving for the future. One popular option is an individual retirement account (IRA). IRAs provide a tax-advantaged way for individual investors to save for retirement.

If you're ready to learn more about your options for retirement savings or simply are curious about IRA basics, this guide is for you.

What Is an IRA?

Individual retirement accounts are retirement investment savings vehicles with some tax advantages. Depending on the type of IRA, you can contribute either pretax or post-tax dollars. If you meet certain qualifications, you may not owe taxes on the earnings until you withdraw the money in retirement.

IRAs can provide more options and greater flexibility compared to an employer-sponsored 401(k). And many earners like to contribute to an IRA in addition to their retirement accounts through their jobs.

An IRA may fit your needs if you can't enroll in a 401(k) through work, are self-employed or want to save beyond your employer-sponsored options.

Benefits of an Individual Retirement Account

These tax-advantaged retirement savings accounts have various benefits.

More Access to Savings Options

IRAs help expand the number of people with access to retirement savings accounts. There's no age limit on having an IRA, and if you're a younger worker, contributing early can help you take advantage of compound interest.

Traditional IRA Tax Advantages

Traditional IRAs offer tax-deferred growth. Contributing to this type of IRA may help reduce your taxable income each year. You pay taxes on the money when you make withdrawals, typically in retirement.

Roth IRA Tax Advantages

A Roth IRA takes contributions from post-tax dollars. Because you've already paid taxes on this money, you may not owe taxes on your withdrawals if you meet certain qualifications.

More Flexibility

With employer-sponsored retirement plans, such as a 401(k), you can only choose the investment options from a selected group. However, an IRA allows you to pick your investments since you're in charge of the account.

Types of Individual Retirement Accounts

There are a few different types of IRAs. Depending on your needs and potential advantages, review each carefully to determine the best fit for your needs.

Traditional IRA

A traditional IRA is a retirement savings tool that allows you to save for the future while also helping you reduce your taxable income today. There are no age limits to opening a traditional IRA. As long as you have earned income, you can contribute.

With traditional IRAs, you contribute pretax dollars, which can help lower your income by decreasing your tax liability.

Maximum Traditional IRA Contributions

You pay taxes on your contributions and account earnings (if any) when you withdraw them. You're eligible to withdraw money once you turn 59½. However, if you do so before, you may have to pay a 10% penalty in addition to taxes. Traditional IRAs also have required minimum distributions (RMDs) beginning at age 73 or later (exact age varies by birth year).

Roth IRA

A Roth IRA is a retirement savings account with some tax benefits. You fund it with post-tax money. Because you already paid taxes on the money you contributed to your Roth IRA, you may not owe taxes on your withdrawals if you meet certain qualifications.

Like traditional IRAs, Roth IRAs have the same maximum contribution limit and withdrawal rules - except if you're a higher earner. In that case, the IRS may reduce your maximum Roth IRA contribution based on your adjusted gross income.1Roth IRAs don't have RMDs. Even though taxes are owed when converting, the ability to make tax-free withdrawals in retirement makes Roth conversions a useful part of an overall retirement strategy.

SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE) IRA allows small business owners with fewer than 100 employees to offer retirement savings plans. Both employees and employers can contribute to a SIMPLE IRA. As with traditional IRAs, employees can contribute to this plan. You may not owe taxes on withdrawals in retirement if you meet certain qualifications.

The IRS sets limits for SIMPLE IRA contributions. You can contribute up to $17,000 with a $4,000 catch-up if you're over 50 in 2026.1 Employers must make matching contributions of up to 3% of compensation. And if employees don't contribute to their accounts, employers must contribute 2% for each eligible employee, using only the first $350,000 in salary.

Additionally, SIMPLE IRAs allow employers to claim some tax incentives.

SEP IRAs

A simplified employee pension (SEP) IRA is available to self-employed individuals and organizations. Businesses of any size can administer SEP IRAs. With a SEP IRA, the employer contributes to retirement savings accounts for themselves and their employees. Employees don't contribute, and each employee is 100% vested in their money right away.

Contributions to a SEP IRA cannot exceed the lesser of 25% of your business profit or $72,000 for 2026.2 Contributions are tax-deferred until withdrawn in retirement. Workers such as freelancers and consultants may also decide to open a SEP IRA.

Custodial IRA

A custodial IRA is an account you open that names your child (or grandchild) the beneficial owner. With this type of IRA, you're the custodian responsible for investment decisions until the minor beneficiary reaches 18 (in most states). It has all the tax advantages of other IRAs.

A custodial IRA has the same contribution limits as other IRAs. The maximum is $7,500, or their total earned income for the year if it's less than that amount.1 So, if your child earned $1,500 babysitting throughout the summer, that's the maximum amount they could put in the IRA.

One of the benefits of compound interest is the earlier you begin accumulating money, the greater the potential to grow wealth. So, for many parents and grandparents, helping children start saving early and teaching them good financial habits is important.

Spousal IRA

A spousal IRA is for a spouse who doesn't work outside the home. It's an exception to the rule that anyone opening an IRA must have earned income. It helps provide another path for retirement savings for those who may lack the opportunity for employer-sponsored retirement options. The working spouse contributes to the nonworking spouse's IRA. You must be married and file jointly on your tax returns to take advantage of a spousal IRA.

What Is a Rollover IRA?

A rollover IRA is created when you move money from a retirement account with a previous employer, such as a 401(k), into a new IRA.

For example, say you have a 401(k) with a previous employer, but you can't roll it over to another 401(k) at your new job. Rather than cashing out the account or leaving it with your old employer, where you may not be able to contribute to it anymore, you can move it to an IRA.

You can roll over the money in your account into an existing IRA or open a new rollover IRA specifically for the money. And the money from a rollover into an IRA doesn't count toward your maximum yearly contributions, so it may not impact IRS limits.

Roth IRA vs. Traditional IRA

While a Roth IRA and a traditional IRA share many similarities, there are some key differences to consider.

Contribution Limits

Both types of IRAs have the same contribution limits, which the IRS determines each year.

Income Limits

Traditional IRAs don't have income limits but Roth IRAs do. Therefore, you may have reduced contribution limits if you're a higher earner.

Taxes

With a Roth IRA, you contribute post-tax dollars. You may not owe taxes on withdrawals in retirement if you meet certain qualifications. Traditional IRAs use pretax dollars, potentially lowering your tax burden now, but you have to pay taxes on withdrawals later.

Withdrawals

Both Roth and traditional IRAs have a withdrawal age of 59½. If you take out money before then, you generally have to pay a penalty and associated taxes, though there are a few exceptions.

RMDs

Traditional IRAs require you to take minimum distributions each year starting at age 73 in 2023. Roth IRAs don't have RMDs.

When choosing between these types of IRAs, understand their features and rules to pick the option that best fits your financial situation and future needs.

401(k) vs. IRA

A 401(k) is an employer-sponsored retirement plan, and it differs from an IRA in a few key areas. First, a 401(k) isn't available to everyone because you can only get it through work, whereas anyone can open an IRA.

Another difference is who manages each account. Your employer managers your 401(k). It chooses the investment options, so you have little flexibility in picking your investments. Your contributions come directly from your paycheck. Since you control your IRA, you have a wider range of investment options and flexibility.

As with a traditional IRA, you fund 401(k)s with pretax dollars, and you may not own taxes on earnings if you meet certain qualifications. You pay income tax on your withdrawals at your tax rate at the time. And both traditional IRAs and 401(k)s have RMDs.

Finally, 401(k)s have much larger contribution limits than IRAs. For example, in 2026, the 401(k) limit is $24,500, with an additional $8,000 in catch-up contributions.1

IRA Contribution Limits

The IRS sets annual contribution limits for individual retirement accounts. For 2026, the maximum limit is $7,500 for contributions across all your IRAs.1

Maximum Over 50 Contribution Limits

If you contribute to a Roth IRA and are a high earner, the IRS modifies your maximum contributions based on your adjusted gross income for the tax year. The deadline for contributing to an IRA is on the tax day of the following year. So, for example, April 15, 2026, was the deadline to make contributions for the 2025 tax year.

Opening an IRA

Anyone can own an IRA. They're relatively straightforward to open and have no age restrictions to make contributions. You just need to have earned income to contribute. It can be from full-time employment or a summer job.

Many financial institutions offer IRAs. To start, you provide personal details, such as your Social Security number, pick the type of IRA you wish to open and fund the account.

You can typically deposit money into your new IRA by transferring money from your checking or savings account, moving money from another retirement account or rolling over a 401(k).

IRA Withdrawal Rules

Depending on which type of IRA you have, there are different rules for withdrawals. If you have a traditional IRA, you can begin taking penalty-free withdrawals at 59½. If you withdraw money before then, you generally have to pay a 10% penalty plus income taxes on the money. Traditional IRAs are also subject to RMDs set by the IRS. The timing of RMDs is based on age.

For Roth IRAs, you can withdraw money equal to your contributions at any time without penalty. However, if you take out any earnings before 59½, you typically pay a penalty on the money.

Passing Your IRA on to Future Generations

It's not uncommon to want to pass on potential leftover retirement money to the next generation. IRAs allow you to pass on the assets in your account to beneficiaries without going through the probate process.

When you open your IRA, you can name a beneficiary to it, and when you pass, they inherit any money left in the account. The person who inherits your IRA typically needs to open an account, known as an inherited or legacy IRA. These IRAs are slightly different than other types of IRAs.

How your beneficiary proceeds with the money, including RMDs, differs if they're your spouse or a non-spouse beneficiary. New regulations also mean your beneficiaries generally have to withdraw all the money from the account within 10 years of inheritance unless they meet certain exceptions.

You may want to work with a financial professional to review the rules and discuss them with your beneficiary.

Bottom Line

IRAs provide another way to save for retirement, offering some tax advantages, investment options and flexibility compared to other options. If you're planning for retirement and want to learn more about IRA basics, consider meeting with a financial professional. They can help you develop a personalized savings strategy on your way to a secure retirement.

An IRA gives you control over how you invest and manage your retirement funds. Start Your Free Plan

Frequently Asked Questions

When should I open an IRA?

Can I have multiple IRAs?

Can I contribute to a 401(k) & IRAs?

Can I use an IRA to buy my first home?

What common IRA terms should I know?

Sources

- 401(k) limit increases to $24,500 for 2026, IRA limit increases to $7,500. https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500.

- The 2026 Retirement Plan Contribution Limits. https://www.whitecoatinvestor.com/retirement-plan-contribution-limits/.