Can I Retire Comfortably With $1 Million?

Few things are more financially concerning for retirement than high inflation and a volatile stock market, yet today’s retirees face both. With inflation reaching a four-decade high in 2022, how secure do Americans feel about retirement? To answer this question, we pulled current numbers on gas prices, utilities, mortgage payments and food costs. We also surveyed more than 1,000 people across the U.S.

Respondents and data analysis painted an unexpected picture of what retirement realities look like in 2022. How confident might the average American be about their retirement, and which strategies might they be using to make retirement a reality? How long could $1 million worth of retirement savings last in your state? Keep reading to find out.

Key Takeaways

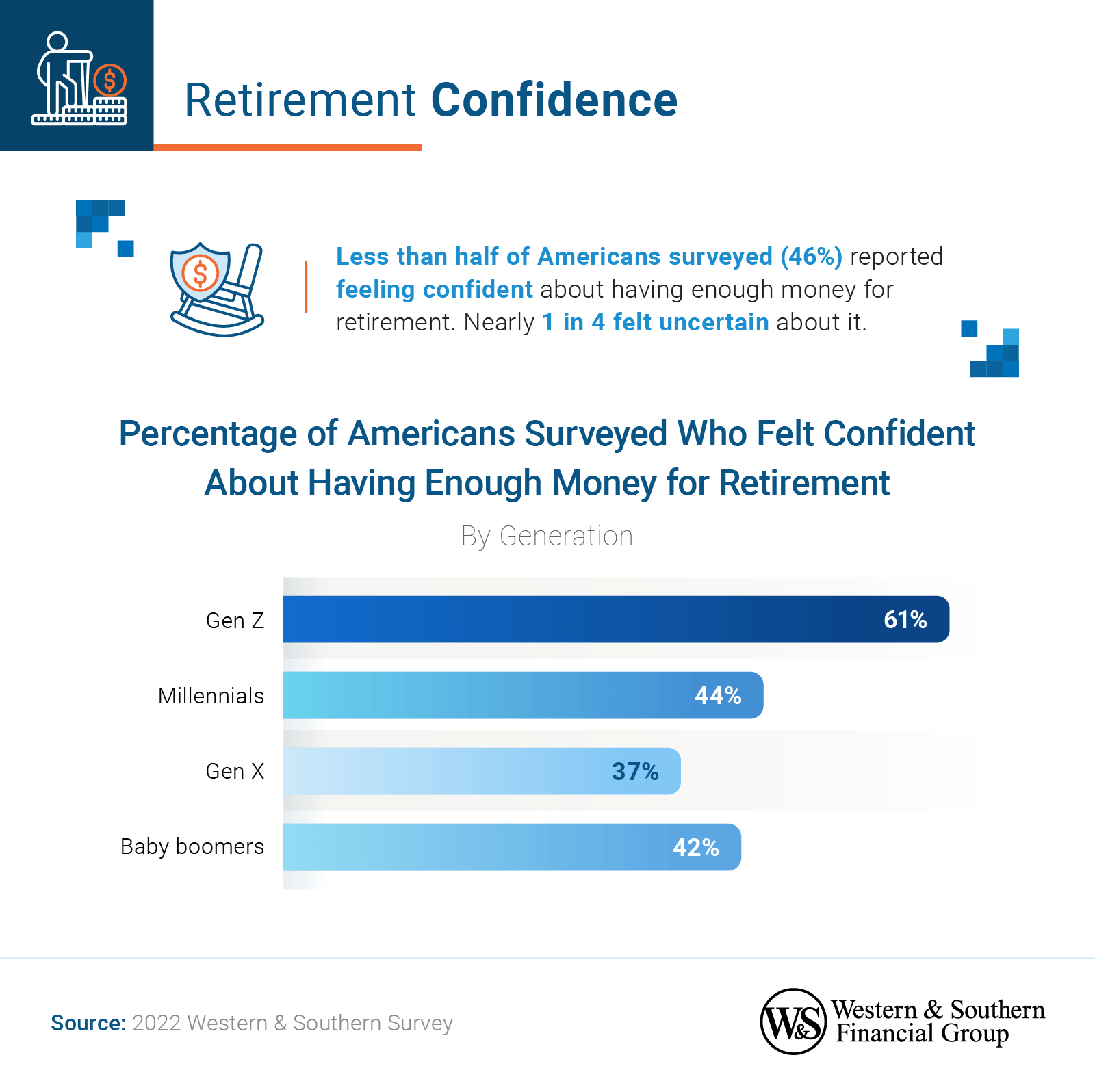

- Gen X respondents are the least confident about having enough money for retirement.

- Nearly 1 in 4 Americans surveyed aren’t confident that they can have a sustainable retirement.

- Americans surveyed believe they need $1 million to retire; however, most aren’t near their goals.

- $1 million in retirement savings could last the longest in Wyoming and South Dakota.

Do I Have Enough to Retire?

Our study begins with a pulse check into the American psyche: How confident do they feel about being able to retire?

For our study, confidence levels were self-reported and then compared across the following age groups:

- Baby boomers born 1955-1964

- Gen X born 1965-1980

- Millennials born 1981-1996

- Gen Z born 1997-2004

The majority of Americans surveyed didn’t feel secure in their ability to retire. Only 46% said they felt confident about how much they had saved for retirement. The amount you need annually to retire varies from person to person, depending on lifestyle, income, and other factors. It’s estimated that about 75-125% of a person’s current income may suffice.

Saving for the Future

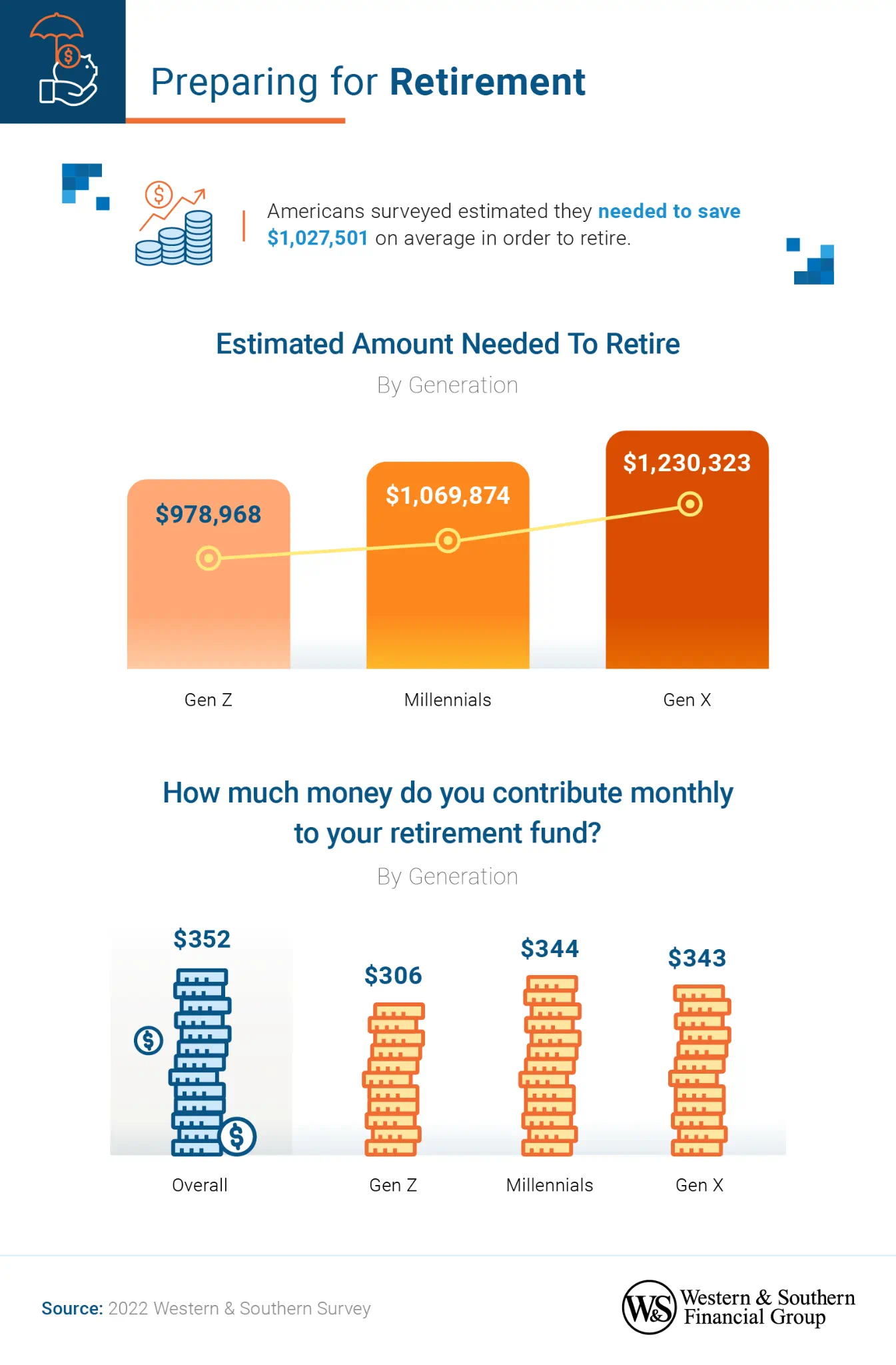

Next, we wanted to let individuals tell us how much they felt they would require to live comfortably post-employment. We also asked how much they contributed toward their retirement funds to achieve their financial goals.

On average, many Americans surveyed didn’t consider $1,000,000 to be enough for retirement, but they didn’t feel they needed very much more than that: Overall, they thought they’d only need an additional $27,501 on average (only about 3% more) to live life post-work. Our Gen X respondents averaged needing the most money in order to retire. But despite this, they also reported contributing about the same amount as millennials each month to their future retirement.

Let’s now look at how all respondents are working toward retirement.

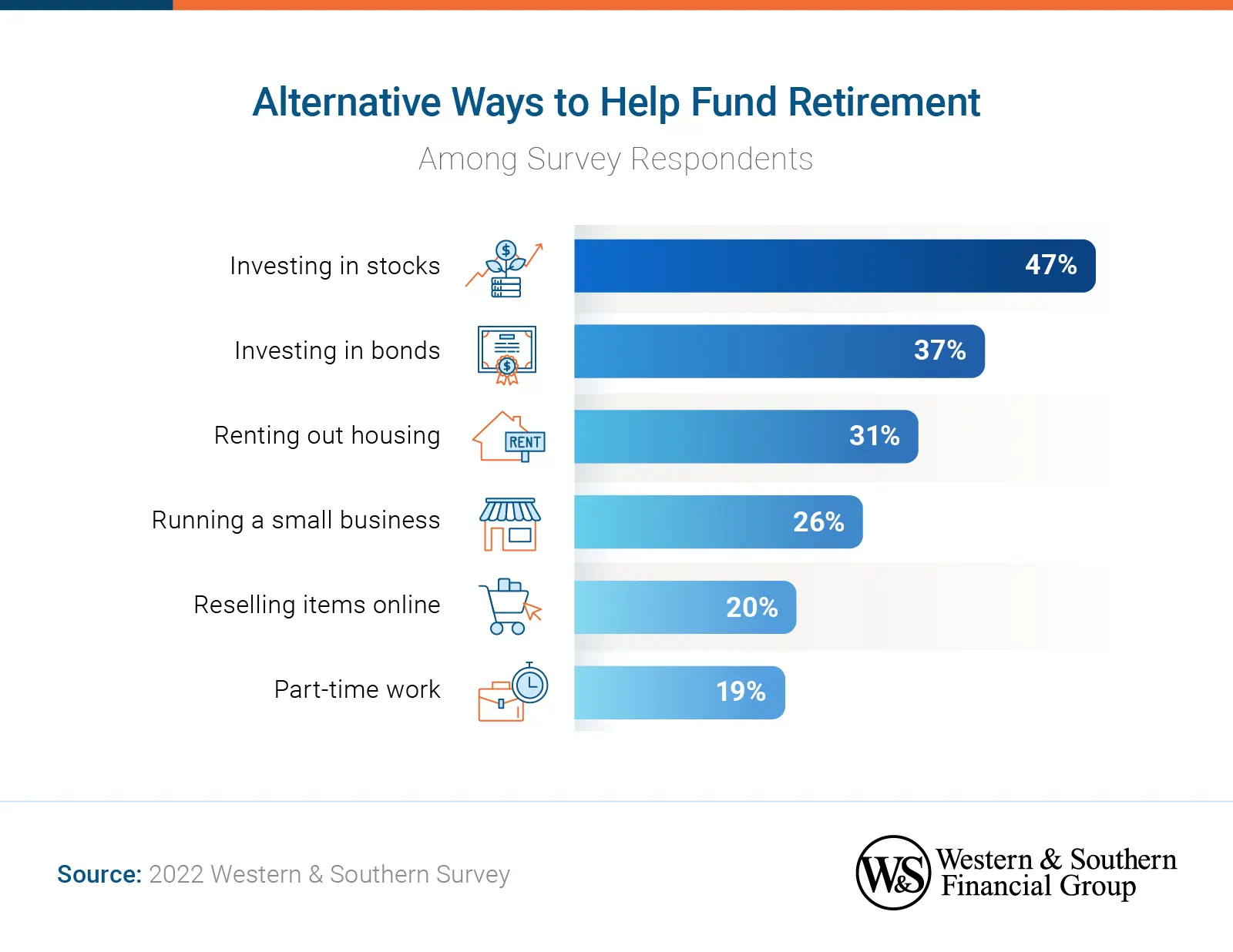

Most people surveyed invested in stocks (47%) or bonds (37%) as they worked toward saving for retirement. Respondents also employed different methods. For example, 26% ran a small business, while 20% resold items online to earn extra cash for savings. However, strategies differed among Americans who were close to retiring this year.

The most popular strategy among respondents nearing retirement was to create a spending plan (46%). This group was also much more likely to consider medical expenses (43%) as part of their retirement plan. Other strategies those close to retiring in 2022 employed included:

- Saving 10-times my pre-retirement income (42%)

- Paying off debt first (39%)

- Accounting for events like inflation or potential negative investment returns (38%)

- Being aware of catch-up contribution limits for 2022 (37%)

- Forming a plan for claiming social security benefits (37%)

Is $1 Million Enough To Retire in 2022?

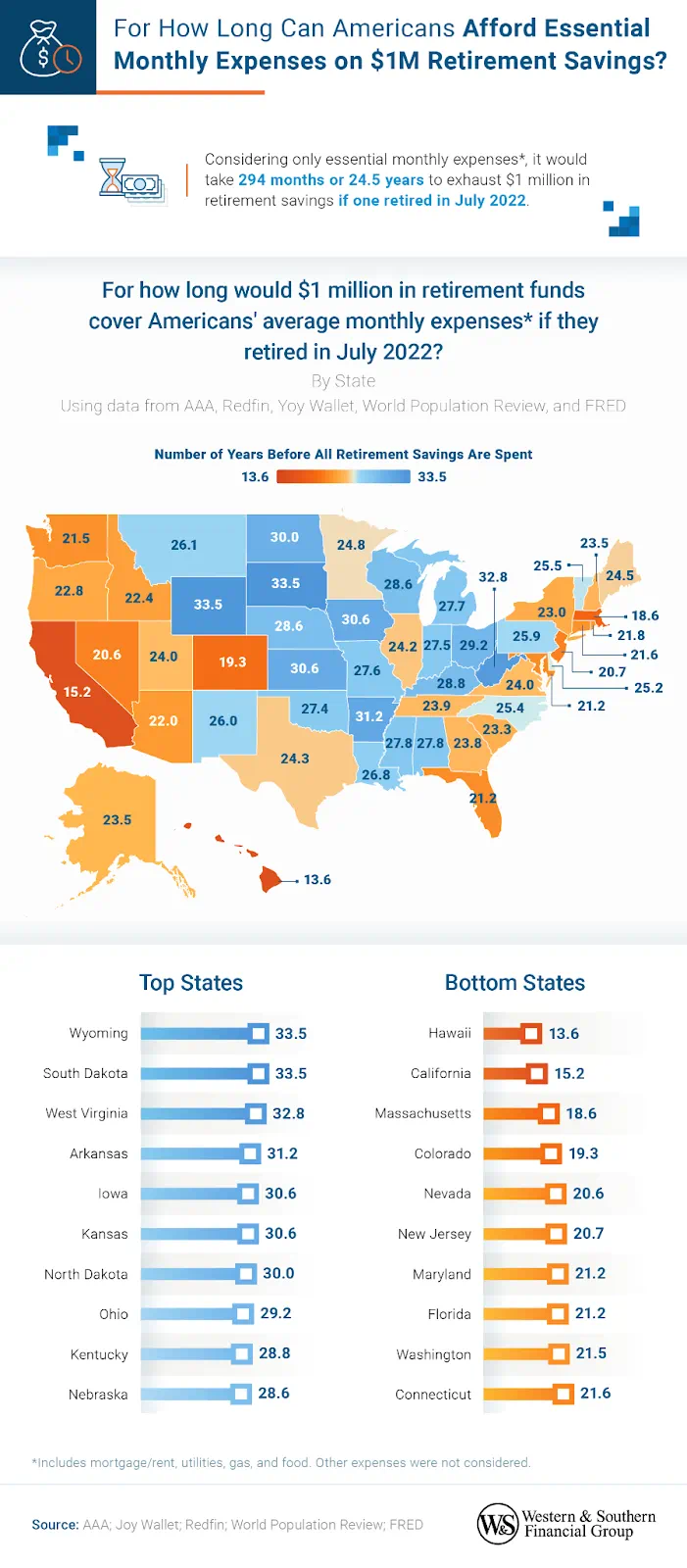

Lastly, we created a nationwide ranking of how long $1 million might last for a retired person based on their location. We based this on how much the average American spends on mortgage and rent, utilities, gas, and food (medical expenses were not considered). These time periods don’t account for retirees’ age, number of dependents, individual retirement plans, and sources of income besides retirement savings.

Today, a $1 million retirement fund could last more than 30 years in some states if used only to pay for essential monthly expenses without any additional financial assistance. While Wyoming offered the longest retirement length at 33.5 years solely based on this criteria,, such a sparsely populated state may be a drawback for some or a bonus for others looking for peace and quiet in their golden years. Other states that might be a good place to retire were South Dakota (which also offered 33.5 years) and West Virginia (32.8 years).

On the other hand, $1 million might not be enough for some people hoping to retire in Hawaii. If you retire there at 67 years old, it might only last until you’re around 80 (13.6 years). California and Massachusetts might also require extra income, savings, or financial help for those with a $1 million budget to afford a long enough retirement, since that amount would only last 15.2 or 18.6 years in those states, respectively.

Realistic Retirement in 2022

Retirement is a challenge for Americans in 2022. More than half of our survey respondents didn’t feel confident about their ability to do so, particularly the older generations. Overall, many people were seeking alternative ways to help fund their retirement accounts.

Inflation may make retirement more difficult today than in previous years. Still, it’s encouraging that there are plenty of states offering citizens a chance to comfortably retire on standard amounts. Younger respondents also displayed a sense of optimism and good saving habits, setting aside several hundred dollars each month for retirement. This may suggest a brighter future for America’s retirees.

Methodology

For this campaign, we pulled data from the following sources to estimate the basic average monthly expenses for Americans:

- AAA: Gas Prices by State

- Average Mortgage Payments by State

- Average Rent by State

- World Population Review: Utilities by State

- Personal consumption expenditures: Food

We also surveyed 1,036 Americans to explore how they have prepared for retirement. Among them, 61% were men, and 39% were women. The generational breakdown is as follows:

- Generation Z (born 1997-2002): 25%

- Millennials (born 1981-1996): 35%

- Generation X (born 1965-1980): 25%

- Baby boomers (born 1955-1964): 15%

For short, open-ended questions, outliers were removed. To help ensure all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question. The overall margin of error is plus or minus 3%, with a 95% confidence interval. For generational breakdowns, the margin of error was as follows:

- Generation Z

- Population size: 68,600,000

- Sample size: 256

- Confidence level: 95%

- MOE: 6%

- Millennials

- Population size: 72,190,000

- Sample size: 360

- Confidence level: 95%

- MOE: 5%

- Generation X

- Population size: 65,800,000

- Sample size: 268

- Confidence level: 95%

- MOE: 6%

- Baby boomers

- Population size: 70,230,000

- Sample size: 152

- Confidence level: 95%

- MOE: 8%

About Western & Southern

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500 company, is the parent company of a group of diversified financial services businesses. Its assets owned ($66 billion) and managed ($35 billion) totaled $101 billion as of June 30, 2022. Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company, Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fort Washington Investment Advisors, Inc.;1 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;1 Touchstone Securities, Inc.;2 W&S Brokerage Services, Inc.;1,2 and W&S Financial Group Distributors, Inc.

1 A registered investment adviser.

2 A registered broker-dealer and member FINRA/SIPC.

Review our current financial ratings.

Fair Use Statement

Find something useful in our study? Website may contain copyrighted material, the use of which may not have been specifically authorized by the copyright owner. This material is available in an effort to explain issues relevant to financial education, financial literacy and understanding. The material contained in this website is distributed without profit for educational purposes. Feel free to share it for any noncommercial purpose, but please link back to this page when doing so. This should constitute a "fair use" of any such copyrighted material (referenced and provided for in section 107 of the U.S. Copyright Law). If you wish to use any copyrighted material from this site for purposes of your own that do beyond "fair use," you must obtain expressed permission from the copyright owner.