Key Takeaways

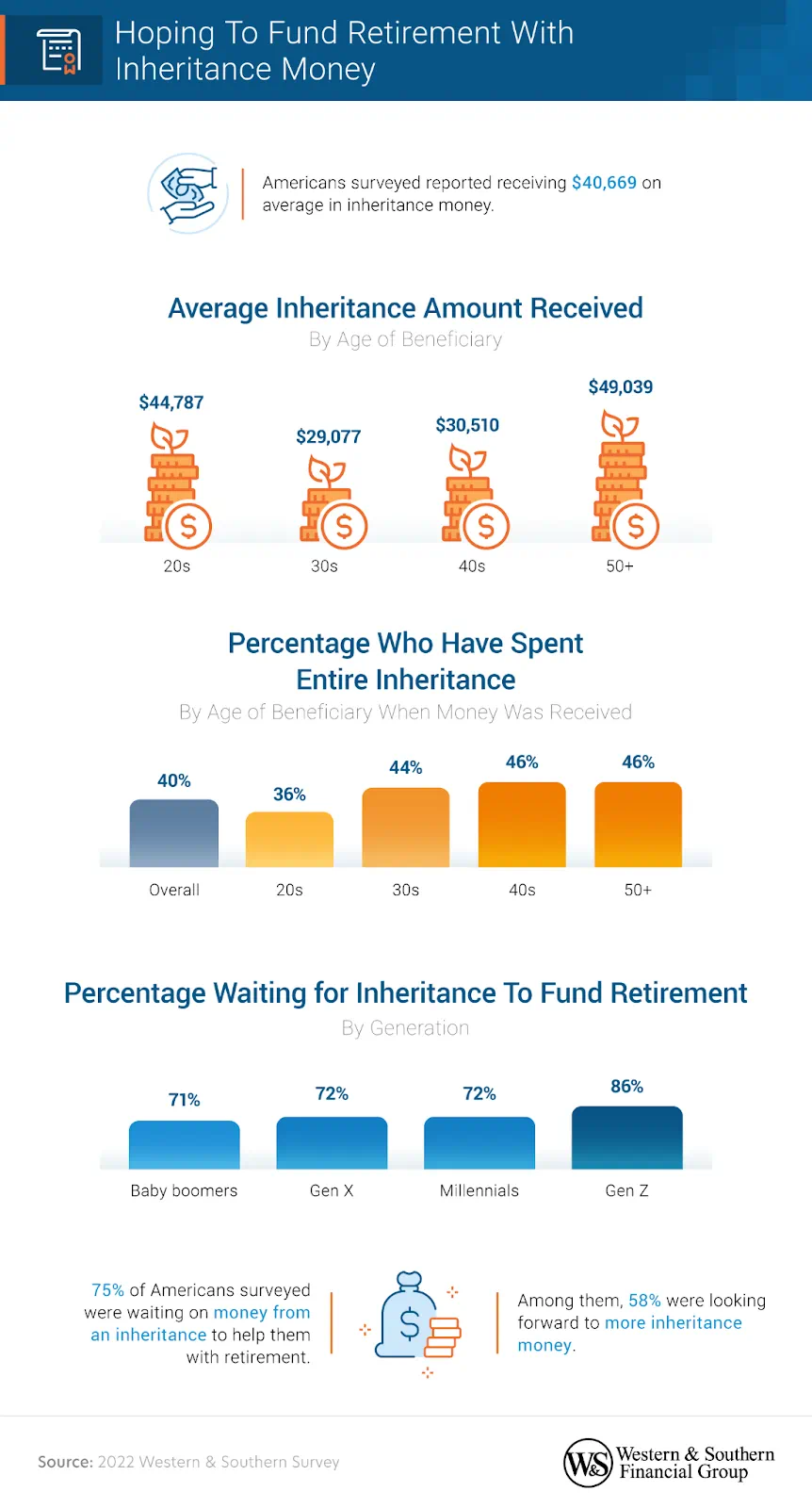

- 75% of Americans surveyed are waiting for inheritance money to help fund their retirement.

- 86% of Gen Zers surveyed are counting on money from an inheritance to help with retirement.

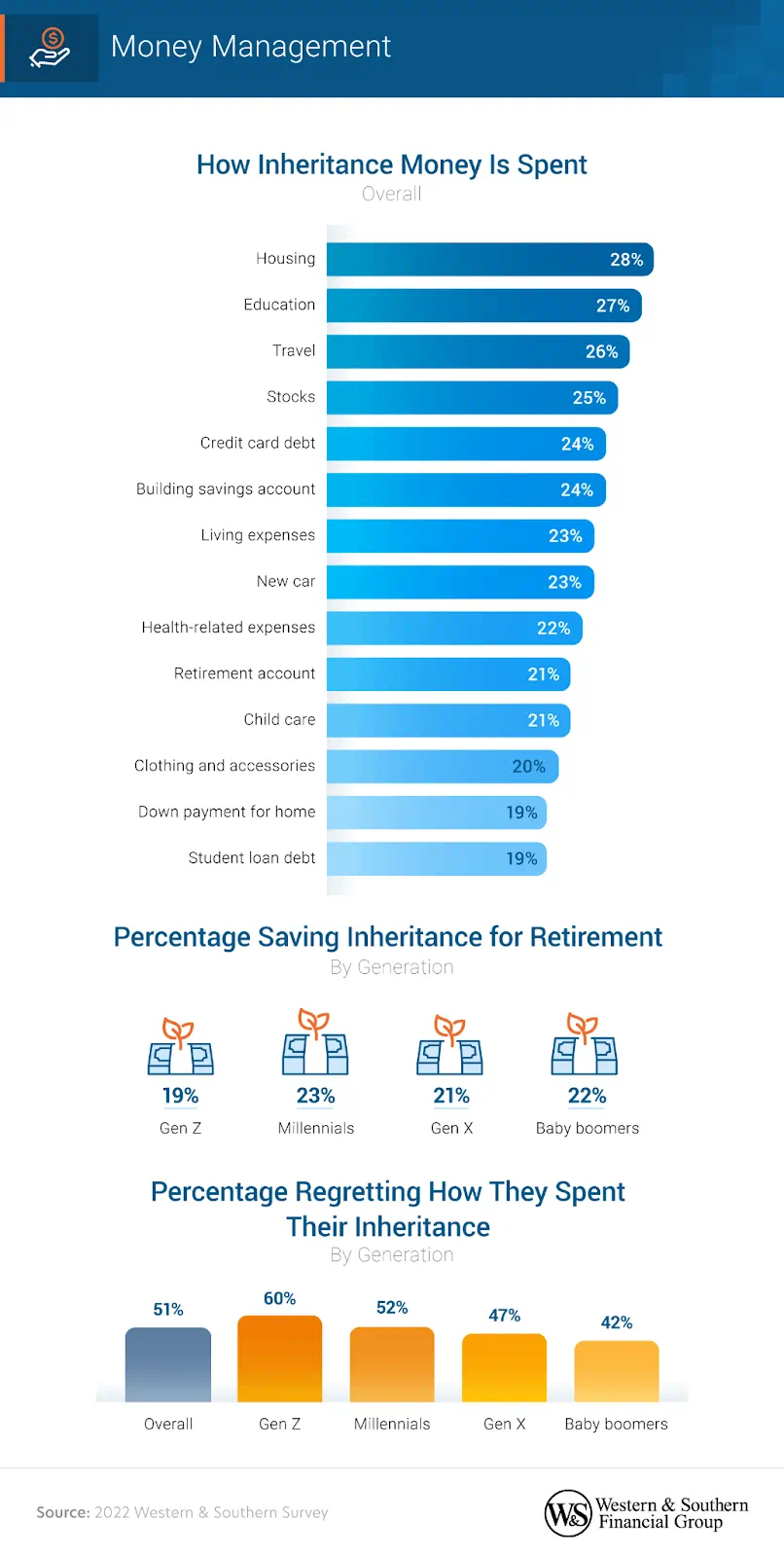

- Nearly 1 in 4 millennials surveyed have saved inheritance money for retirement funds.

- 1 in 2 Americans surveyed who have received an inheritance say it significantly impacted their personal finances.

- Over 50% of Americans surveyed regret how they spent their inheritance money.

Inheritance as a Retirement Strategy

Many Americans today are living paycheck to paycheck, making the prospect of retirement feel nearly impossible. That’s one reason some look to inheritance as a light at the end of the tunnel, a life event that can greatly affect their future security. To explore the impacts of receiving money after a loss, we surveyed over 1,000 Americans who had received a cash inheritance. We questioned them about how they used the money, how it made them feel and how it impacted their relationships.

Counting on Inheritance to Fund Retirement

First, we looked into how much respondents received from their inheritance, how much of it they’ve already spent and whether they were counting on it to retire.

On average, respondents received an inheritance of $40,000-$50,000. When properly managed, and depending on an individual’s circumstances tens of thousands of dollars received at a young age can spell a sound future for those just starting out in life. As for the eldest respondents (born 1955-1964), such a windfall can help provide the last push for those whose retirement days are drawing near.

Understandably, Gen Z respondents (born 1997-2004) were decidedly the most hopeful about receiving the cash injection of an inheritance in order to retire: 86% were counting on inherited money to fuel their futures. Compared to the older generations, they were also less likely to have already spent all of their inheritance. If this indicates their financial wisdom, perhaps this young driving force of our nation may emerge with better financial health than their forebears.

What To Do With All That Money

Next, we asked survey participants about their plans for their inherited finances. Let’s see who’s saving the most and who’s spending it.

According to our findings, the use of these funds showed a generational divide: Of the people we surveyed, younger demographics spent more on housing, living expenses and investments, while older generations were more likely to spend it on travel. Gen Z, Gen X and baby boomer respondents were all fairly likely to use their inheritance to pay off debt, whether it was student loans or a credit card balance. While millennial respondents were less concerned about debt and more interested in padding their retirement accounts, our findings indicate that all those surveyed had an eye on the future to some degree.

With the loss of a loved one followed by a generous financial windfall, some impulsive spending may occur. Gen Zers surveyed held the most regret regarding how they spent their inheritance funds (60%), which correlated with their being the least likely to save it for retirement. Instead, 1 in 4 Gen Z respondents spent their inheritance on clothing and accessories.

Have Your Habits Changed?

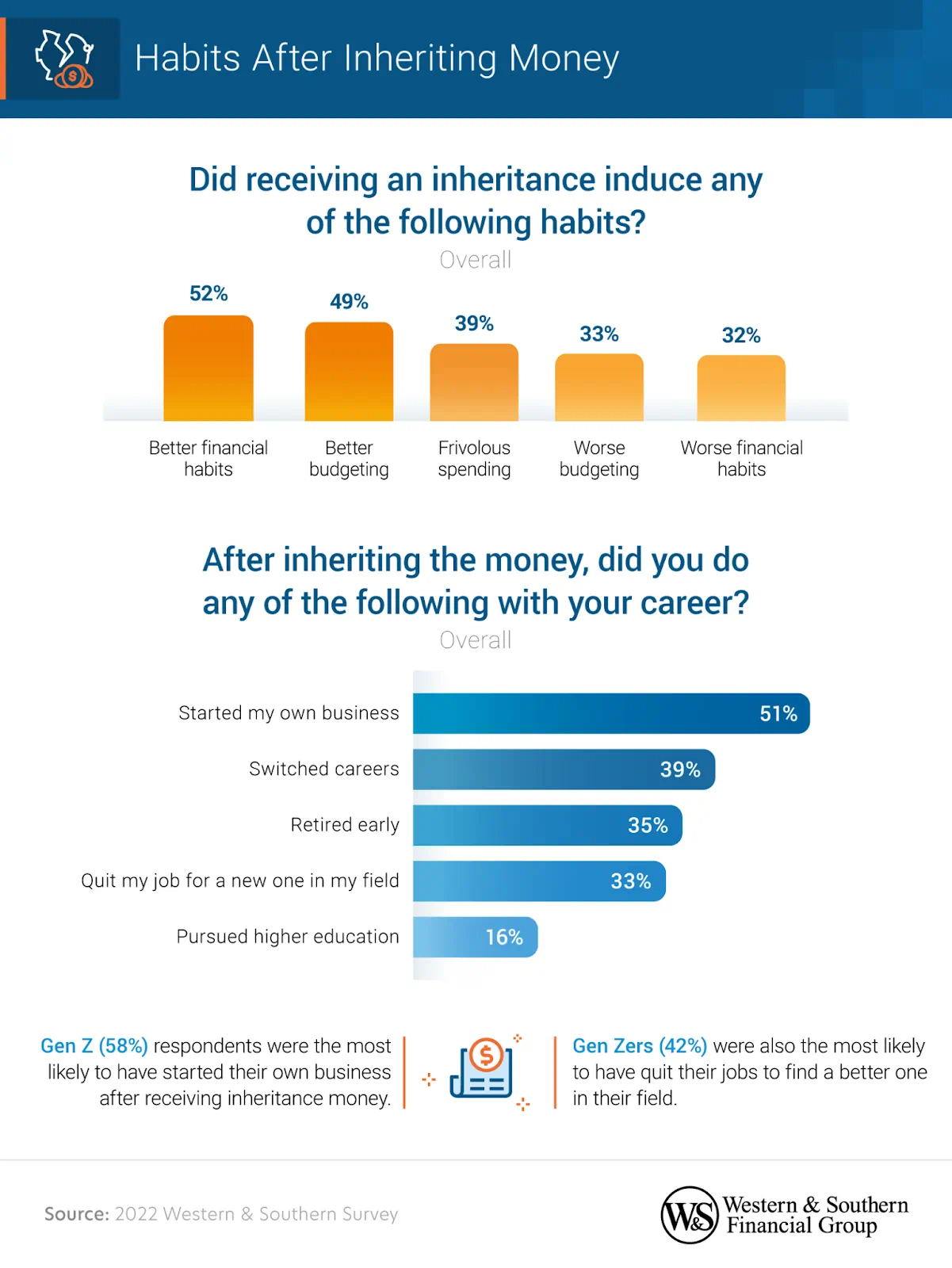

Receiving a large sum of money can affect how people behave, even if only for a short time. This part of our study examines whose habits have improved or worsened.

Over half of the recipients surveyed reported better financial habits (52%), and many also showed improved budgeting practices (49%). How they’ve reported using their inheritance funds reflects this, with many investing, saving and paying off debt. However, poor financial and budgeting habits and frivolous spending were also somewhat common (32-39%).

Not surprisingly, many took the opportunity to look for more fulfilling work. Gen Zers surveyed led the way not just in finding new work (42%) but in creating it: 58% of respondents who started a new business with their inheritance were Gen Zers. Since entrepreneurship can be a luxury, receiving a large sum of money early in life may provide a certain bravery in taking that leap.

Mixed Emotions About Inheritance

One of the most harrowing experiences in many peoples’ lives, the death of a loved one, is often followed by another: the allocation of funds and property of the deceased. But while it can form rifts among family members, others can find solace in the financial boost.

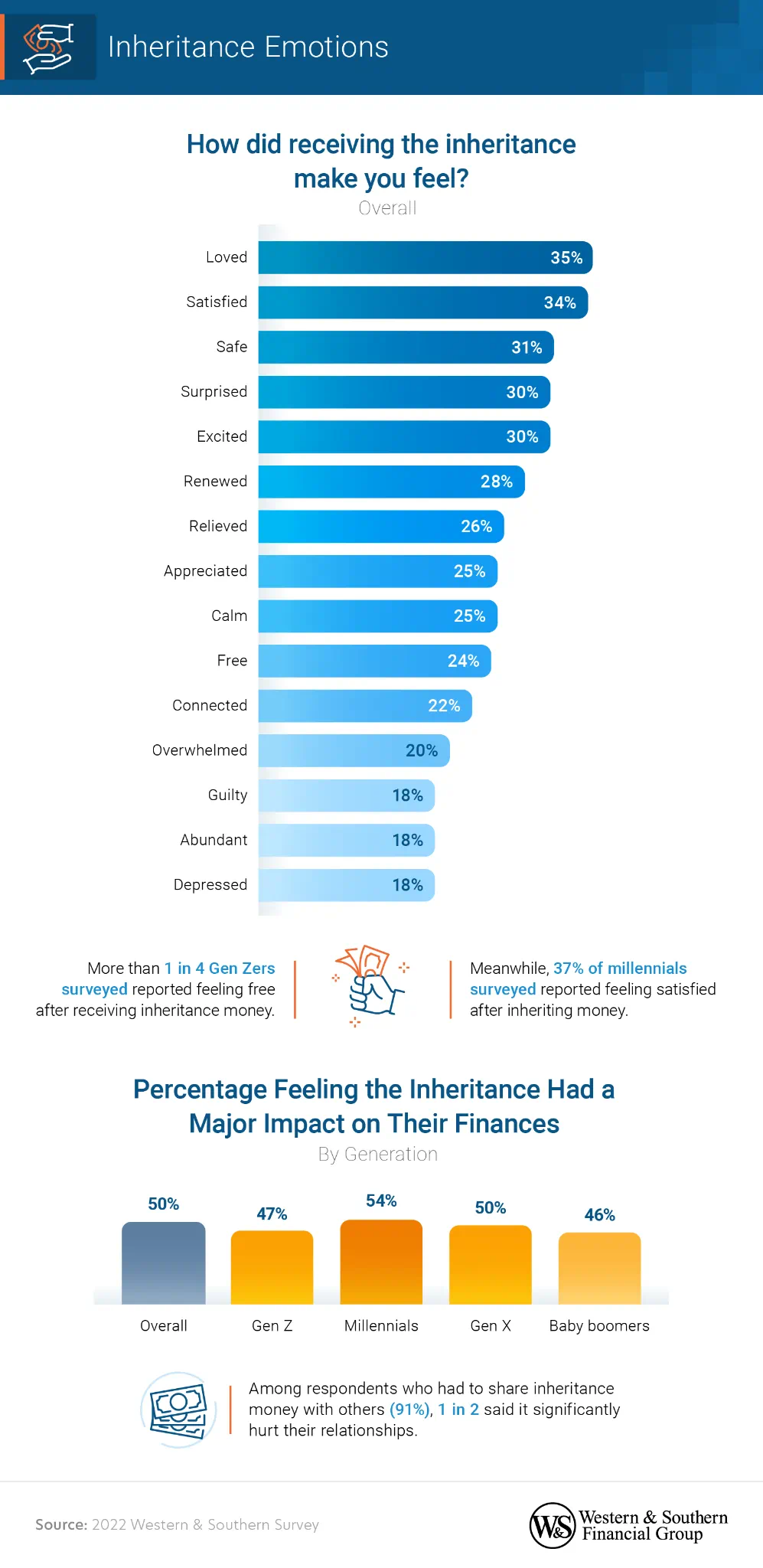

Half of the people surveyed said that their inheritance had a major impact on their finances It also caused a spectrum of emotions, most of which were positive. Feelings of love, satisfaction and safety were the ones most often reported. Over one-quarter of Gen Z respondents felt a sense of freedom upon receiving their inheritance, while over one-third of millennials surveyed expressed satisfaction.

But unfortunately, the division of a loved one’s estate can often divide a family. The majority of people surveyed had to split an inheritance with others (91%), and half of these divisions caused significant and adverse effects on respondents’ relationships. So, while many post-mortem endowments created positive life changes, others had unhappy outcomes.

Investing Inheritance for Retirement

Grief and riches are an unusual combination, but they can be a testament to a loved one’s ongoing care for your well-being. Fortunately, we found that most people surveyed wanted to invest their inheritance in themselves, fulfilling lifelong goals and planning for the future. That’s good news since younger generations may find that saving for retirement will require more preparation than it has in the past. While it may be difficult during an emotional time of loss, avoid impulsive behavior when it comes to your finances. Later on, you’ll be glad you did.

Methodology

We surveyed 1,015 Americans aged 18 and over who had received money via a cash inheritance. Among them, 55% were men, and 45% were women. Generation breakdown is as follows:

- Generation Z (born 1997-2004): 25%

- Millennials (born 1981-1996): 35%

- Generation X (born 1965-1980): 25%

- Baby boomers (born 1955-1964): 15%

For short, open-ended questions, outliers were removed. To help ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question. The margin of error is plus or minus 3%, with a 95% confidence interval. To calculate this, we entered the following data into Survey Monkey’s margin of error calculator:

- Current U.S. population: 332,403,650 x 20% = 66,480,730

- Confidence level: 95%

- Sample size: 1,015

We also used a source from Business Insider, citing a study that concluded about 20% of Americans receive an inheritance.

About Western & Southern

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500 company, is the parent company of a group of diversified financial services businesses. Its assets owned ($66 billion) and managed ($35 billion) totaled $101 billion as of June 30, 2022. Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company, Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fort Washington Investment Advisors, Inc.;1 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;1 Touchstone Securities, Inc.;2 W&S Brokerage Services, Inc.;1,2 and W&S Financial Group Distributors, Inc.

1 A registered investment adviser.

2 A registered broker-dealer and member FINRA/SIPC.

Review our current financial ratings.

Fair Use Statement

Find something useful in our study? This website may contain copyrighted material, the use of which may not have been specifically authorized by the copyright owner. This material is available in an effort to explain issues relevant to financial education, financial literacy and understanding. The material contained in this website is distributed without profit for educational purposes. Feel free to share it for any noncommercial purpose, but please link back to this page when doing so. This should constitute a “fair use” of any such copyrighted material (referenced and provided for in section 107 of the U.S. Copyright Law). If you wish to use any copyrighted material from this site for purposes of your own that go beyond “fair use,” you must obtain expressed permission from the copyright owner.