Table of Contents

Table of Contents

Key Takeaways

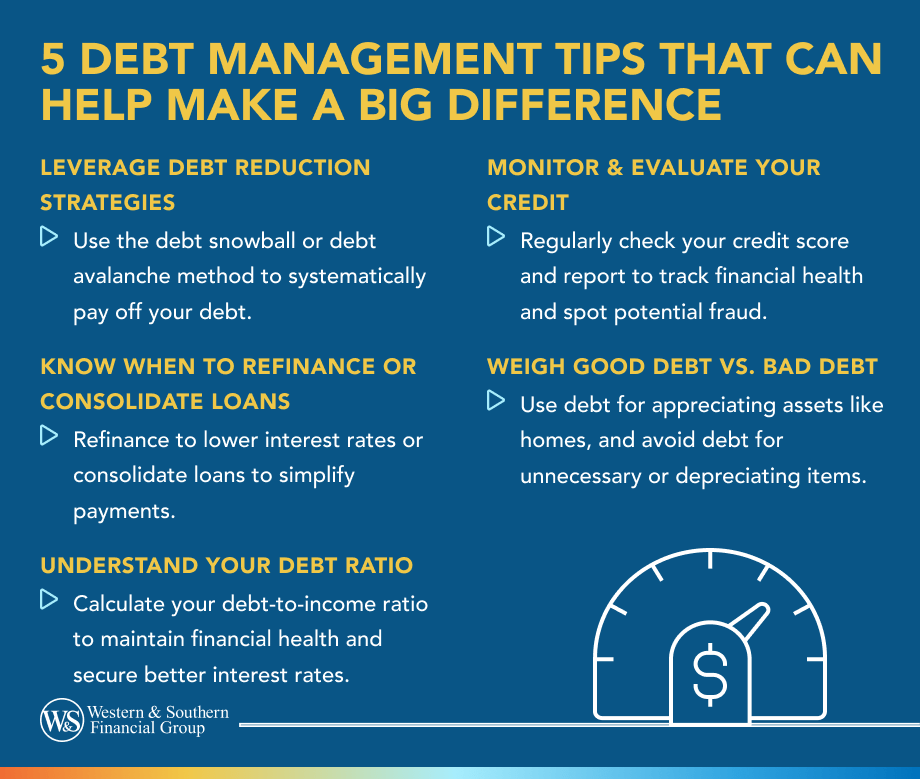

- The debt snowball and debt avalanche are strategies to reduce existing debt, with the snowball focusing on small debts first and the avalanche targeting high-interest debts first.

- Refinancing reduces monthly payments by lowering interest rates, while debt consolidation combines multiple debts into one for simplicity; know when to use each.

- Calculate your debt-to-income ratio by dividing total monthly debt payments by monthly income to measure financial health.

- Monitor credit reports and scores regularly to maintain good credit and detect potential fraud.

- Determine whether debt is "good" or "bad" based on whether it goes toward appreciating assets or depreciating items you can't afford.

Navigating debt can be a challenge. However, debt management can feel like second nature if you understand the basics and approach it equipped with some helpful strategies.

While learning new financial concepts may seem overwhelming, the most effective tips for managing personal debt are rather simple. In fact, some of the debt management tactics that can save you money — in both the short- and long-term — are relatively easy to implement and maintain.

Here are five debt management tips that can potentially help you improve your financial situation and reach your goals sooner.

1. Leverage Debt Reduction Strategies

There are two popular means of reducing existing debt. The first, known as the debt snowball, is where you start with the smallest debt before focusing on other obligations. The second is called debt avalanche, where you start by paying down the one with the highest interest rate first. The best debt reduction strategy to use is the one that you feel you can stick with over time:

- Debt snowball: Start by paying as much as possible every month on the loan or credit card with the lowest balance and make the minimum payments on other debt. When one debt is paid off, tackle the next lowest balance and repeat until you are debt free.

- Debt avalanche: Start by paying as much as possible every month on the loan or credit card with the highest interest rate.

2. Know When to Refinance or Consolidate Loans

Refinancing debt and consolidating loans may involve similar goals and strategies, but there are some subtle differences and unique circumstances to know. For example, refinancing primarily aims to reduce monthly payments by replacing a loan with a new loan that has a lower interest rate.

Consolidation combines multiple loans into one loan, primarily for simplification. Determining which strategy to use depends on the situation:

- When to refinance: A common refinance strategy involves refinancing a home mortgage. The general rule here is to refinance if your new interest rate is at least 1% lower than your existing rate. This is especially true if you finance the closing costs into the loan and plan to live in the home for at least five years, which gives you time to cover those costs and save money over time.

- When to consolidate: A common loan consolidation example is with student loan debt. In this case, a consolidation makes sense when you have multiple loans and want to simplify with just one monthly payment. Ideally, the new single monthly payment will be lower than the total of what you previously paid monthly for your multiple loans.

Refine your personal finance approach with a strategic look at refinancing options. Get My Free Financial Review

3. Understand How to Calculate & Use Your Debt Ratio

A debt ratio — or debt-to-income ratio — is a basic measure of financial health. Lenders use this to determine your creditworthiness when applying for new loans. It also helps them calculate what interest rates to charge you on the loans. Therefore, knowing how to calculate your debt ratio is important to not only maintain your financial health but also to save you money over time by keeping your interest rates as low as possible.

To calculate your debt-to-income ratio, divide your total monthly debt payments by your monthly income. For example, if you have a $400 auto loan payment, a $1500 mortgage and a minimum credit card payment of $100 per month, your total debt payments are $2,000. Assuming your income is $5,000 per month, your debt-to-income ratio is 40% (2,000 / 5,000 = 0.40).

4. Monitor & Evaluate Your Credit

Your credit score is a basic measure of your overall financial health. Accordingly, it's important to regularly monitor your credit, know your score and understand the primary factors that can impact your credit. Many banks offer complimentary credit-monitoring services, and there are free credit-monitoring apps available.

Individuals are also able to generate one free credit report annually at annualcreditreport.com.1 These resources can help you monitor your score and learn the actions that can have positive and negative effects on your credit. They can also help you spot potential signs of fraud, allowing you to react faster and alert your creditors to the issue sooner.

5. Weigh Good Debt vs. Bad Debt

Some people believe that all debt is bad. While this position is understandable, it's not always correct. For instance, debt can be good when used to finance a purchase, such as a home or vehicle, that can't easily be made with cash. Debt can be bad when used to buy items that are not necessary for living and carry a balance that can't be paid on a monthly basis.

A good use of debt is buying a home with a low-interest mortgage. A bad use of debt is buying a luxury item that you couldn't otherwise afford. Another general rule is to try using loans only on appreciating items, such as real estate, and avoid using loans for depreciating items, such as clothing or retail goods.

Bottom Line

Managing debt can be simplified if you learn and follow some general rules, such as learning the effective debt reduction strategies and monitoring your credit score and debt ratio. However, in some cases, it can make sense to seek guidance from a financial professional for more individualized debt management tips and advice. These individuals can provide a personalized look at your situation and help you create a custom plan to reach your unique financial goals.

Strengthen personal finance by implementing effective debt management strategies. Get My Free Financial Review

Sources

- AnnualCreditReport.com. https://www.annualcreditreport.com/index.action.