Key Takeaways

- Per stirpes distribution ensures that inheritance passes down through the family line, even if a designated beneficiary predeceases the testator.

- This method prevents the unintentional disinheritance of grandchildren and ensures fairness among family branches.

- Per stirpes distribution simplifies estate planning for large families and reduces potential conflicts among heirs.

- It offers flexibility in estate distribution and automatically adjusts to changes in the family structure.

- While per stirpes may not be suitable for all estate plans, it benefits those seeking equitable distribution across family branches.

How Per Stirpes Works

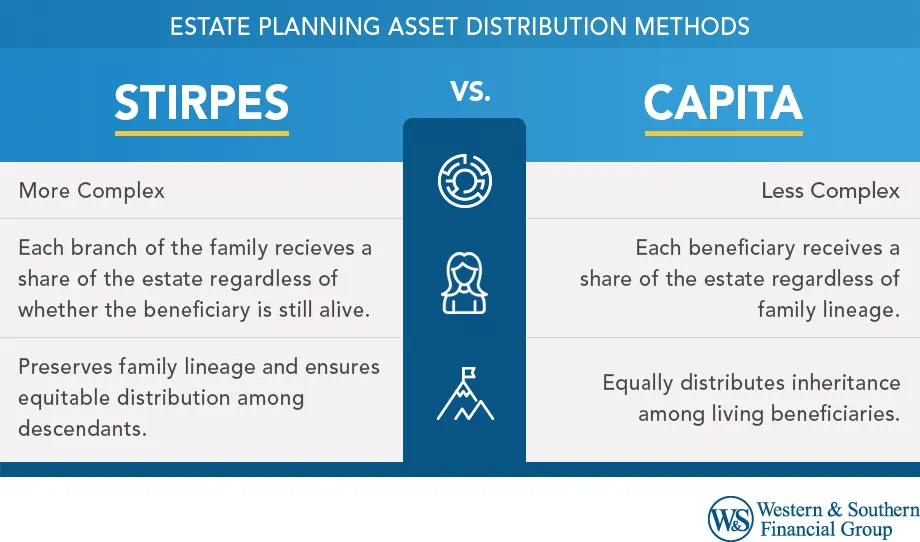

Per stirpes is a legal term used in estate planning and inheritance law, which refers to a method of distributing an estate where the assets are divided equally among the branches of the family.1

Under the per stirpes approach, if a beneficiary dies before the testator (the person who made the will), their share of the inheritance is not lost. Instead, it is divided equally among their descendants.

This distribution method ensures that a deceased beneficiary's descendants still receive their intended share, thus maintaining the balance of inheritance as originally planned by the testator.

Per stirpes designation can be applied in various aspects of estate planning, including wills and trusts.

Example Comparing Per Stirpes Vs. Per Capita Inheritance

- Sheila has three children: Brian, Chloe and Daniel.

- Brian has two children, Emma and Frank. Chloe has no children. Daniel has one child, Grace.

- Sheila designated Brian, Chloe, Daniel, Emma, Frank and Grace beneficiaries.

- Before Sheila passes away, Daniel dies.

Per Stirpes Distribution:

Per stirpes is a Latin phrase that means "by the roots" or "by the branch."2 It refers to a method of inheritance distribution that ensures your assets are passed down through your family line, even if a designated beneficiary passes away before you. This approach prioritizes maintaining family ties and ensuring each branch of your family receives a fair share of your estate.

- Initial Split: Sheila’s estate is initially divided into three shares, each corresponding to one of her children: Brian, Chloe, and Daniel, each receiving 1/3 of the estate.

- Daniel’s Share: Since Daniel has predeceased Sheila, his 1/3 share would be passed on to his descendant, Grace.

- Final Distribution: Brian, Chloe, and Grace (as Daniel’s child) each receive 1/3 of the estate. In this scenario, Emma and Frank (Brian’s children) receive nothing directly from Sheila.

Per Capita Distribution:

"Per capita is a Latin phrase that means "by the head" or "per person."3 It refers to a method of inheritance distribution where remaining living beneficiaries receive an equal share of the estate, regardless of their family lineage. This approach is more straightforward to administer than per stirpes inheritance, but it may not be fair to all beneficiaries if some have more descendants than others.

- Initial Consideration: Sheila has designated six beneficiaries: Brian, Chloe, Daniel, Emma, Frank, and Grace.

- Distribution: Since Daniel has predeceased Sheila, the distribution is now among the remaining five beneficiaries: Brian, Chloe, Emma, Frank, and Grace. Daniel's share does not go directly to Grace but is redistributed among all the surviving beneficiaries.

- Final Distribution: Brian, Chloe, Emma, Frank, and Grace each receive 1/5 of the estate.

Key Difference:

- Under per stirpes, the estate is divided according to the family branches, ensuring that Daniel's share is passed on to his child Grace.

- Under per capita, the estate is divided equally among all surviving designated beneficiaries, resulting in all of Sheila's grandchildren (Emma, Frank, and Grace) receiving equal shares along with Brian and Chloe.

Does Per Stirpes Include The Spouse?

No, per stirpes distribution does not generally include the surviving spouse. This is because per stirpes distribution is primarily concerned with passing assets down through the family line of the deceased person, focusing on their lineal descendants (children, grandchildren, and so on).

On the other hand, the surviving spouse is not considered a lineal descendant but rather a separate inheritor under the laws of intestate succession or the terms of a will. Their inheritance is typically treated separately from the per stirpes distribution, ensuring they receive their rightful estate share.

Does Per Stirpes Include Stepchildren?

Per stirpes distribution excludes stepchildren unless the testator legally adopts them, as stepchildren are not legally recognized as the testator's lineal descendants. Lineal descendants, such as children, grandchildren, and great-grandchildren, are directly descended from the testator.

Pros: Benefits of Per Stirpes Distribution

Per stirpes distribution in estate planning offers several benefits:

- Consistency Across Generations: Per stirpes ensures that a deceased beneficiary's descendants still receive a share of the estate. This approach maintains consistency by ensuring that each branch of the family receives its intended portion of the estate, even if the original beneficiary has passed away.

- Prevents Disinheritance of Grandchildren: In cases where a beneficiary (such as a child of the deceased) predeceases the testator, per stirpes prevents the unintentional disinheritance of their children (the testator's grandchildren). It ensures that the share for a deceased beneficiary is passed on to their descendants.

- Reflects Testator's Wishes After Their Death: Per stirpes helps carry out the testator's wishes as closely as possible, even when the family structure changes due to the death of a beneficiary.

- Simplifies Estate Planning for Large Families: For testators with large families, Per Stirpes offers a straightforward method to divide their estate without constantly updating the will or trust as family circumstances change (like births, deaths, or marriages).

- Reduces Conflicts Among Heirs: Per Stirpes can reduce potential conflicts among heirs by clearly defining how the assets will be distributed in case of a beneficiary's death, as the distribution rules are clearly outlined and based on family lineage.

- Flexibility in Estate Distribution: Per stirpes allows for flexibility in planning, as it automatically adjusts the distribution based on the living descendants of the original beneficiaries, which can be particularly useful in dynamic family situations.

Overall, per stirpes distribution is beneficial in ensuring an equitable division of an entire estate, reflecting the testator's wishes, reducing potential family conflicts, and providing clarity and simplicity in estate planning, especially in complex family structures.

Cons: Drawbacks of Per Stirpes Distribution

While per stirpes distribution in estate planning has its benefits, it also comes with certain drawbacks:

- Potential for Unequal Distributions: Per stirpes can result in unequal distributions among grandchildren. For instance, if one beneficiary has more children than another, the deceased beneficiary's share divided among their children may result in smaller individual portions than cousins who are their respective parents' sole children.

- Complexity in Large Families: Per stirpes can become complicated in families with many descendants, especially when multiple generations are involved. Tracking the lineage and ensuring the accurate division of the estate can be challenging.

- May Not Reflect Current Relationships: Per stirpes does not account for the relationship between the testator and their descendants. A grandchild the testator never knew or had a relationship with could inherit a significant portion of the estate, while closer family members might receive less.

- Inflexibility with Changes in Family Dynamics: Although Per Stirpes provides a clear guideline, it lacks the flexibility to adapt to changes in family dynamics or the testator's wishes regarding individual beneficiaries after the will or trust is created.

- Possibility of Minor Beneficiaries: Per stirpes can result in minors inheriting property, which may necessitate the establishment of trusts or guardianships, adding to the administrative burden and costs.

- Not Suitable for All Estate Plans: Per Stirpes may not be suitable for all types of estate plans, particularly those in which the testator wishes to distribute assets based on need or personal relationships rather than lineage.

Understanding these drawbacks is crucial for individuals when deciding how to structure their estate plan and whether per stirpes distribution aligns with their intentions and family dynamics.

Is Per Stirpes Distribution Right for You?

Determining whether per stirpes distribution is a good idea involves considering several factors:

- Family Structure and Size: Per stirpes is often suitable for those with a clear family tree and a desire to keep the estate within the family lineage. If you have multiple children and grandchildren, per stirpes can ensure that each family branch is treated equally.

- Generational Concerns: If you anticipate that your children's needs or circumstances may vary significantly and want to ensure that the surviving descendants of a deceased child are not disinherited, per stirpes can be a good choice.

- Relationship Dynamics: Consider your relationships with potential beneficiaries, as per stirpes might not be ideal if you want to distribute your wealth unevenly among individuals.

- Future Changes in the Family: Consider future changes, such as births, deaths, and marriages. Per stirpes can simplify estate planning amidst these changes, as it automatically adjusts to the family's structure at the time of your passing.

- Administrative Simplicity: While per stirpes can simplify distribution, it can become complex in large families. Consider if your estate's executor can manage this distribution method.

- Legal and Tax Implications: Understand the legal and tax implications of a per stirpes distribution, as it might affect estate taxes or the creation of trusts for minor beneficiaries.

- Your Estate Planning Goals: Reflect on your overall goals for your estate. If ensuring equal distribution across branches of the family is important, per stirpes could be suitable.

- Consultation with Professionals: Discuss with estate planning attorneys and financial advisors. They can provide insights about your situation and help determine if per stirpes aligns with your estate planning objectives.

Ultimately, deciding if per stirpes distribution suits you depends on your unique family circumstances and estate planning objectives. It's a decision that should be made after careful consideration and consultation with a qualified estate planning attorney and Certified Financial Planner to ensure that your estate is distributed in a way that aligns with your wishes and provides for your heirs in the manner you intend.

Frequently Asked Questions

What does per stirpes mean for beneficiary?

What is the downside of per stirpes?

Does per stirpes go to grandchildren?

Does per stirpes avoid probate?

Sources

- American Bar Association - Glossary of Estate Planning Terms. https://www.americanbar.org/groups/real_property_trust_estate/resources/estate_planning/glossary/#P.

- Legal Information Institute - Per Stirpes. https://www.law.cornell.edu/wex/per_stirpes.

- Legal Information Institute - Per Capita. https://www.law.cornell.edu/wex/per_capita.

- Free Will from Fabric by Gerber Life, a member of the Western & Southern Financial Group Family of Companies. https://www.westernsouthern.com/about/family-of-companies.