Table of Contents

Table of Contents

Video Transcript

Today, we're unpacking a question that many of you have asked: What exactly does life insurance cover? Whether you're considering buying a policy or just curious about how it works, understanding what life insurance covers is crucial to making informed decisions. Life insurance might seem complex, but it can help provide security for families to help with the unknown if something were to happen to you.

At its core, life insurance is designed to provide a payout known as a death benefit when someone passes away. This is the primary coverage life insurance offers.

It's meant to replace lost income and help cover life expenses for your dependents, like rent or mortgage payments. Pay off personal or household debts and handle funeral and other final expenses, which can be surprisingly costly. These are the essentials that most policies cover, ensuring that your family's immediate financial needs are met in your absence.

Many policies come with or allow you to add optional coverages known as riders. These can include critical illness coverage which pays out a lump sum if you're diagnosed with one of the specified critical illnesses covered under the policy. Disability rider provides a benefit amount if you become totally disabled and can't work as defined under the policy rider. Accidental death benefit offers additional coverage if death is due to an accident specified in the policy. Waiver of premium is designed to help provide financial protection if the policyholder becomes seriously ill or disabled and can no longer afford the insurance premiums. The insurance company will either cover the premiums or waive them.

Life insurance policies have common exclusions you should be aware of. Knowing exclusions is vital to avoid surprises when a claim is made. Please refer to your particular policy for details.

Choosing the right coverage means understanding your own needs and the needs of those who depend on you. Consider your current debts and financial obligations , your family's ongoing living costs and any future needs, like children's education or retirement plans for your spouse. This will help you tailor a life insurance plan that fits you and your loved ones.

Thanks for joining us today as we explored what life insurance covers. We hope this video has given you a clearer understanding of how life insurance works and how it may protect you and your family.

Key Takeaways

- Life insurance pays beneficiaries upon the insured's death, covering expenses like mortgages, education, and future income.

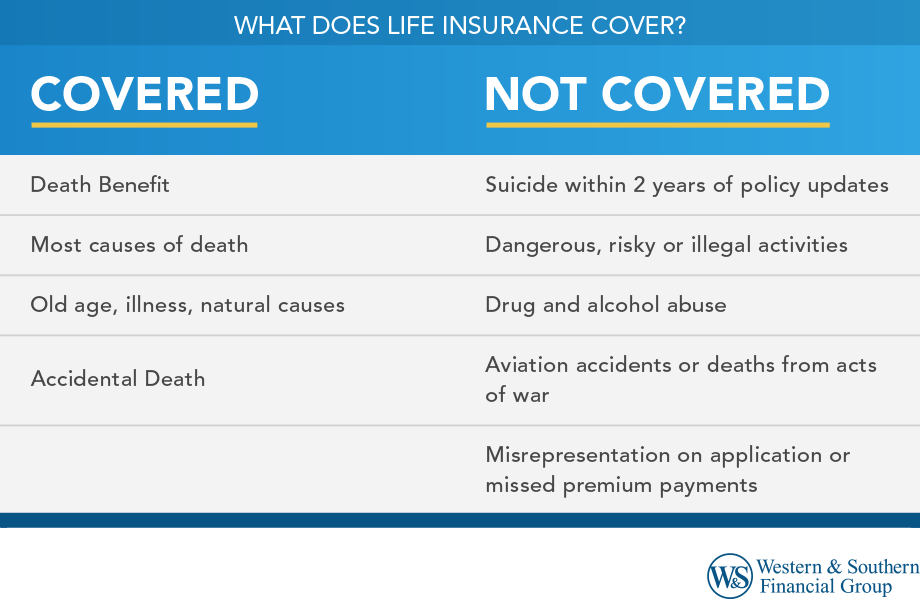

- Life insurance policies cover most causes of death, but exclusions such as suicide, dangerous or illegal activities, substance abuse, and misrepresentation can apply.

- Active coverage requires paid premiums; lapsed payments may void coverage.

- Types of life insurance policies include term life, whole life, universal life, and guaranteed issue policies, each with varying features and premiums.

- Riders provide extra benefits including accidental death, disability waivers, accelerated benefits, long-term care, guaranteed insurability, and term conversion options.

Whether you already have insurance or are looking to purchase a policy, it's helpful to know these rules so you don't get caught off guard when learning what life insurance does not cover. Here's what to know, as well as a rundown of the different types of policies available.

What Does Life Insurance Cover?

All life insurance policies include a death benefit. If you (as the person insured by the policy) pass away for a covered reason, the insurance company would pay your beneficiaries this benefit. For example, if you had a $250,000 policy, your beneficiaries would typically receive the full amount if the situation resulting in your death was covered by the policy, your premiums were paid and the policy's cash value had not been accessed previously. In turn, your beneficiaries could use the death benefit in numerous ways, including paying off a mortgage, setting up a college fund or providing future income.

A life insurance policy covers most causes of death, including old age, illness and other natural causes, as well as death by accidents. With that being said, a life insurance policy may not cover every single cause of death. Your policy will lay out situations when it will not pay the death benefit, which are called exclusions.

What Does Life Insurance Not Cover?

While the exact conditions of what your life insurance policy covers will depend on your individual contract, there are a few common exclusions when insurers generally will not pay the death benefit. These include:

Suicide

If you die from suicide or other self-inflicted injuries within two years of purchasing a policy, the claim could be denied. This exclusion typically only lasts two years from the date of purchase. After that, suicide may be covered.

Dangerous or Risky Activity

Policies may also deny claims when the death was caused by a high-risk activity, such as skydiving, deep-sea diving or race car driving. However, if you plan on doing these types of activities, you could let the insurer know when you purchase a policy and they may agree to cover these activities for an extra charge.

Illegal Activity

Life insurance can also deny claims if someone died while taking part in illegal activity, such as dying while attempting to rob a bank.

Drug and Alcohol Abuse

The illegal activity exclusion could extend to deaths caused by drug and alcohol abuse, such as someone dying while driving drunk or experiencing an overdose while using an illegal drug.

Aviation

If you fly your own plane, it's possible that your policy could exclude death from flights on private aircraft. Again, you may be able to pay extra to cover this risk.

Acts of War

In the past, life insurance policies would often exclude deaths from acts of war, such as a soldier going out on deployment. However, this exclusion has become less common in recent times.

Misrepresentation on Your Application

If someone lied or withheld information while applying, the insurer could deny a death benefit claim. This includes information that would have impacted the insurance decision, such as hiding a medical diagnosis, a smoker saying they didn't smoke or someone not disclosing a family history of health problems.

Life insurance companies typically have a window of time to deny claims for policies with incorrect information. It depends on the state, generally ranging from one year to two years after purchase. If a person dies during this contestability period, the insurer could check for misrepresentations. Otherwise, someone is generally covered after this period, even if they included wrong information on their application.

What Does Life Insurance Cover if You're Behind on Payments?

Life insurance will stay active as long as premiums are paid. If you stop paying the premiums, the policy and your coverage could eventually lapse.

There is typically a grace period after a missed premium payment. In the event of a covered death during the grace period, your beneficiaries would still receive the death benefit, minus the missed premium. However, if you go past the grace period without paying and then die, life insurance may not cover the death.

Does the Type of Policy Matter?

There are a few different types of life insurance, with different setups for the coverage and benefits. In terms of paying out a death benefit, insurers typically use the same exclusions for all their different types of policies (except for guaranteed issue — but more on that later).

Compare life insurance coverage options to find the best fit for your needs. Get a Life Insurance Quote

With that being said, the type of policy can impact how long your coverage can last. Here's a look at some of the more common options.

Term Life

Term life insurance is temporary coverage. These policies last for a set period of time. For example, a 10-year term policy would cover you for 10 years as long as premiums are paid. If you pass away from an eligible cause during this period, the policy would pay out the death benefit to your beneficiaries. If you outlive the term, the policy will end and will no longer cover you. You would need to purchase a new policy to stay insured. See "term conversion riders" below for exceptions to this.

These policies also do not include cash value — a benefit you can access while still alive. Permanent policies such as whole life and universal life can offer cash value, but term does not.

Whole Life

Whole life insurance policies offer coverage that can last your entire life. As long as you keep paying the scheduled premiums, this coverage will not expire. That way, you can stay covered and provide a death benefit for your beneficiaries no matter how long you live.

Some of these policies also include the cash value benefit while you're alive. If your whole life policy has cash value, it will grow as you pay premiums. You can then borrow against the cash value through a loan, if desired. However, you would likely owe interest for taking out a policy loan, which could reduce the future death benefit.

Universal Life

Universal life insurance policies can also last as long as premiums are paid. With these policies, you have the flexibility to adjust how much you pay each year. You need to pay at least enough to cover the insurance cost, which gets more expensive as you get older.

If your goal is to keep the coverage for your entire life, you could pay extra in premiums while you're younger to build up a cash value reserve. Then, when you're older and the costs go up, you could use that reserve to help cover the higher amounts. The insurer can tell you how much you'd need to pay per year to maintain the coverage your whole life.

You can withdraw or borrow against the cash value of a universal life policy. However, loans and withdrawals may generate an income tax liability, reduce the account value and the death benefit, and may cause the policy to lapse.

Guaranteed Issue Policies

To qualify for the policies mentioned above, you need to pass medical underwriting. This can include answering health questions, providing blood and urine for lab testing and/or seeing a nurse for a physical.

A serious pre-existing medical condition could potentially disqualify you from obtaining coverage. If you know you have health issues that may affect your chances of qualifying, another option is to apply for a guaranteed issue policy. These policies may require answering a health questionnaire.

In exchange, they often charge a higher premium and limit the maximum possible death benefit. Also, they may restrict coverage during the first few years. For the first two or three years, depending on the insurance company, the policy might not provide the full death benefit following your passing. If you pass away from natural causes during this restricted period, the insurer could refund your premiums plus interest to your beneficiaries, but they would not pay out the death benefit. Other types of life insurance typically do not have this coverage restriction, but guaranteed issue policies do.

What Does Life Insurance Cover for Other Benefits?

Aside from the death benefit and cash value, your policy could also include additional benefits through riders. When you sign up, you have the option to purchase these riders for an additional charge. Your policy will also lay out the conditions for when they would pay these other benefits.

While the rules depend on the policy, here are some general standards for rider coverage:

- Accidental death. If you die in a covered accident, the policy could pay a larger death benefit to your beneficiaries. The policy will list what types of accidents are covered, such as car accidents, fires and falls. The policy may also list times when accidents will not be covered, such as an incident that happened because someone was intoxicated.

- Disability waiver. This rider covers you in case you become sick, injured or disabled and can no longer work. If that happens, the insurer will provide a waiver of the monthly deduction for the cost of insurance. The rider will explain what counts as disability — such as how many months you must be disabled for it to apply and the severity of the disability. Some policies will cover you so long as you're too disabled to work your own job, while others are stricter and will only cover you if you can't work any job.

- Accelerated death benefit. If you have a specified medical condition or terminal or chronic illness, this rider gives you the option to receive your death benefit while you're still alive to help cover the medical bills. The policy would lay out what types of illnesses the rider covers. Payment of accelerated death benefits, if not repaid, can reduce the death benefit and affect the other policy values, as well as affect a recipient's eligibility for Medicaid or other government benefits.

- Long-term care rider. Some life insurance policies also pay out early if you need long-term care, such as in a nursing home. This rider could give you money to help pay for these costs. The rider will explain when you would be eligible and the maximum amount you'd receive, based on the size of your death benefit.

- Guaranteed insurability. This rider gives you the option to buy more life insurance at certain milestones, such as after a set number of years or after a major life event, such as having another child. However, you must take action within a certain time frame to take advantage. With this rider, you could buy more coverage without needing to take another health exam.

- Term conversion riders. If you have a convertible term life insurance policy, you have the option to transition your temporary coverage into a permanent policy that can last your entire life, as long as premiums are paid — without going through medical underwriting. The price will be based on the age you make the conversion, but you don't have to worry about being denied permanent coverage due to health reasons.

For more help understanding what life insurance does not cover — as well as what it does — consider speaking with a financial representative. They can explain the necessary contract terms, so you can understand how the policy would handle the death benefit and other features.

Evaluate life insurance coverage and plan confidently for your family’s security. Get a Life Insurance Quote