Table of Contents

Table of Contents

Key Takeaways

- Calculate your income and expenses to decide how much you can spend on holiday shopping while considering ways to cut expenses, shrink your gift list, or suggest a Secret Santa exchange.

- Stick to your budget and focus on thoughtful gifts rather than expensive ones to prioritize financial goals during the holidays.

- Start shopping early and look for discounts, online sales, and Cyber Monday deals for savings and reduced shipping costs.

- Shop earlier in the season to find deals, avoid crowded stores, and enjoy more convenience before November and December.

- Save money year-round by setting aside small amounts regularly to reduce the financial burden of holiday gifts.

With the proliferation of online shopping, it's now easier than ever to overdo it with your holiday shopping — and potentially break your carefully planned holiday budget. So, if you want to be more proactive about managing your finances this season, you may want to explore setting a holiday spending plan.

The good news is it's easier than you may think. All it takes is a little bit of pre-planning. Here are some holiday finance considerations to help you stay in control of your holiday spending limit this year and the seasons to come.

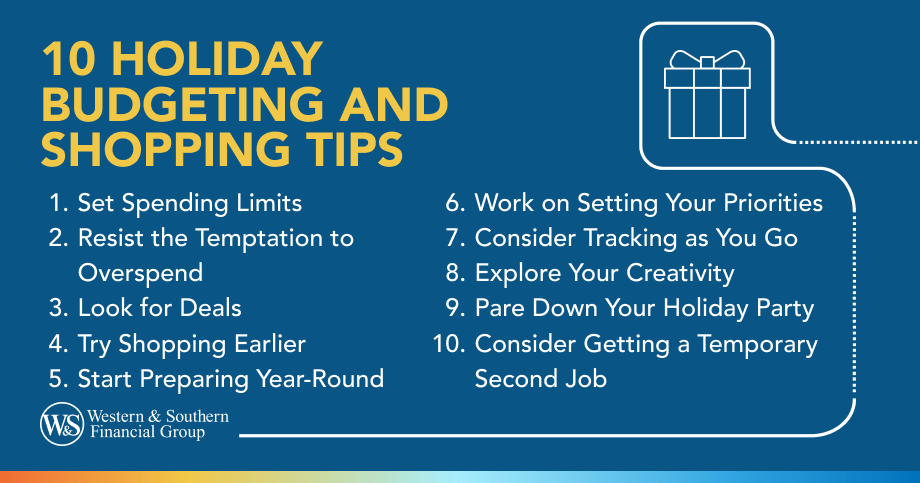

1. Set Spending Limits

Sometimes it's not possible to buy presents for every person on your list, but you probably won't know this until you sit down and look at your income and expenses.

Before you hit the stores, consider calculating your take-home pay after taxes and your expenses during November and December. If you have a surplus, you might consider allocating this to your holiday shopping budget.

However, if you have very little money left over or would prefer to put some of it toward your savings, you might consider cutting down on expenses. You could choose to shrink the gift list of who you're shopping for, look for more affordable gift options, or suggest doing a Secret Santa gift exchange with your family members.

Average Holiday Spending in 2022

2. Resist the Temptation to Overspend

You may feel tempted to buy expensive gifts for friends or family members, especially if they often lavish you with nice things. But consider resisting the temptation and sticking to your budget instead. Everyone has different circumstances, but keeping your own financial goals in mind during this expensive time of year can be especially important.

When it comes to holiday shopping on a budget, you may want to keep in mind that it's the thought that counts. If you set a budget ahead of time, and find ways to cut down on spending or bring in additional income, you can likely have a fun and happy holiday season without overspending.

3. Look for Deals

Once you determine what you can afford, consider starting your shopping early. Though Black Friday is the official start of the holiday shopping season, you might be able to find deals before then. Many stores have a clearance section and online pop-up sales, so be on the lookout for discounts.

Another option for saving money is to shop online. Cyber Monday — the biggest online shopping event of the year — takes place on the Monday after Thanksgiving. You can buy many small and big-ticket items on sale if you do your research beforehand and find out what different retailers plan to offer. You'll likely save on shipping costs too.

4. Try Shopping Earlier

You might be an early shopper already. There are a few reasons why people continue to shop earlier in the holiday season.

Consumers Start Holiday Shopping Early

The first reason is simply for convenience. You may be thrilled to have all your shopping out of the way early, so you don't need to worry about it anymore (and can avoid the crowds of shoppers). And second, starting before the official holiday season kicks off gives you ample time to look for savings and deals you might not otherwise find in November and December.

5. Start Preparing Year-Round

If you're on a fixed income and it's a struggle to spend a big chunk of money all at once, you may want to think about saving year-round. This way, the money you set aside for holiday gifts won't take away from what you need to pay the bills or add to your retirement savings.

Some people find it helpful to work on building their holiday funds throughout the year. Setting aside a little bit each month (or week) into a savings account earmarked for holiday spending can go a long way toward taking off some of the pressure of finding money to pay for gifts when the time comes.

6. Work on Setting Your Priorities

It's easy for your holiday shopping list to feel like it's a mile long, even when you only have a few family members and friends to shop for.

Accordingly, it's reasonable that you may not afford everything for everyone on your shopping list — and that's OK.

To help with decision-making, try going through your list and setting priorities. Then, consider allocating the majority of your budget to those top priorities. Afterward, if you have funds left over, you can decide if you want to either save money or tackle the lower priorities on the list.

7. Consider Tracking as You Go

It's easy to buy now and tell yourself you'll worry about the costs later. But that could lead to a big shock come January when your credit card debt is suddenly much bigger than you expected.

Another useful holiday budget tip to manage spending during the season is to keep track of every purchase you make. You may want to create a spreadsheet, write down your totals or use an app to list what you spend and subtract it from your budget. This can help you stay on track and within budget throughout all the festivities.

8. Explore Your Creativity

Showing your love and care for another doesn't have to mean material things and expensive gifts. After all, there's a reason why "it's the thought that counts" is a popular saying around the holiday season.

If you have some free time and a skill or hobby you love, such as baking or crafting, you may be able to create memorable gifts or holiday decorations that don't cost much. You might also just find that your friends and family would love a personalized gift from the heart over something store-bought. Give some thought to other ways you can explore your creativity and share the joy of the holiday season without having to shell out big bucks.

9. Pare Down Your Holiday Party

If you throw a holiday party every year, it may be a big line item in your budget. To cut down on expenses and potentially have more money to put toward shopping, consider throwing a scaled-down version of your usual affair and making it a potluck instead.

You could also do appetizers instead of a big spread, cook everything and ask guests to bring bottles of wine, pare down the decorations and signature napkins, or organize a group volunteer event at a local homeless shelter or hospital to shift the focus from holiday partying to holiday giving.

10. Consider Getting a Temporary Second Job

Even if you've done your best and followed all your holiday budgeting tips, you may not have much room to do all your holiday shopping. Yes, you could try to cut back holiday expenses even more, but that may be more difficult than finding a second job to earn extra cash.

The gig economy is in full effect, so consider becoming a ride-share driver, selling items that you no longer use, babysitting for the neighbors, or leveraging your writing, photography or design skills into freelance projects that can earn extra income.

For many, shopping during the holidays is a stressful time. If you can relate, you may be able to help yourself down the road by taking some of these seasonal shopping strategies into consideration. That way, you can focus on enjoying spending time with your loved ones instead of worrying about your budget.

Build a budget that aligns with your income and holiday priorities. Get My Free Financial Review

Sources

- 2024 Deloitte holiday retail survey. https://www2.deloitte.com/us/en/insights/industry/retail-distribution/holiday-retail-sales-consumer-survey.html.

- Gartner: 32% of holiday shoppers will start before November. https://www.retaildive.com/news/holiday-season-retail-shoppers-starting-before-november-consumer-behavior/727356/.