The United States is entering a historic shift in age structure, one that will have sweeping implications for the economy, gross domestic product (GDP), labor force, and long-term financial stability. For the first time, older adults are on track to outnumber children, with the aging population expected to grow by over 30 million by 2060. As life expectancy rises and birth rates fall, this demographic change is reshaping everything from Social Security sustainability to retirement savings trends.

The effect of population aging reaches far beyond individual households. It influences tax revenues, labor market dynamics, and public expenditures on healthcare and long-term care. With fewer working-age people supporting a growing number of retirees, the U.S. faces a challenge of both economic growth and fiscal sustainability. This report explores the numbers behind that challenge and what they mean for America's financial future.

Key Takeaways

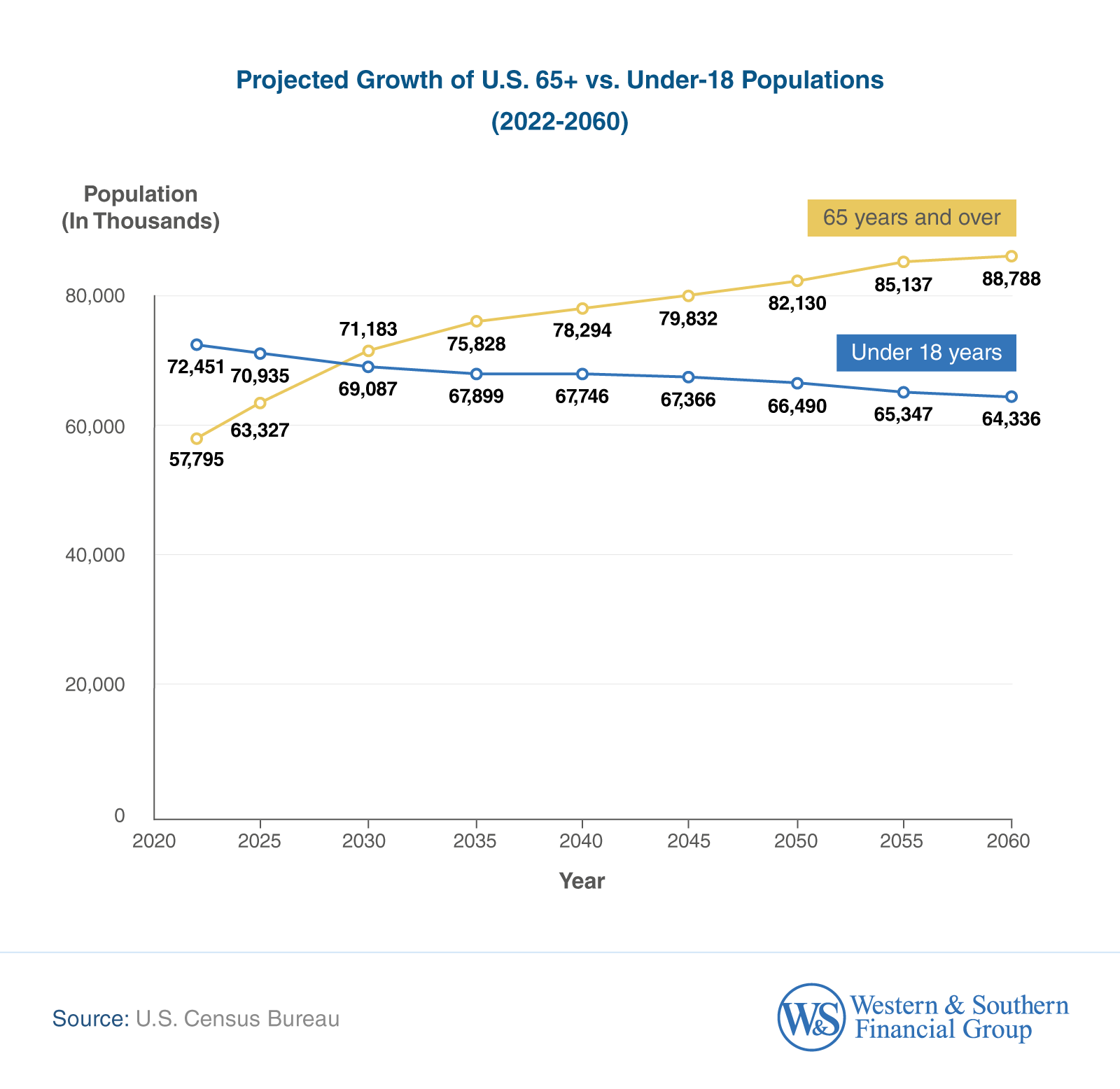

- The U.S. population aged 65+ is projected to increase by over 30 million by 2060, growing from 57.8 million in 2022 to 88.8 million, and surpass the population under 18 by 2030.

- The median age in the U.S. is expected to rise from 38.9 in 2022 to 45.3 by 2060.

- By 2050, Maine (25.5%) and Florida (25.0%) are projected to lead the nation in senior populations, while Utah, North Dakota, and Alaska will remain among the youngest, with just over 16% of residents aged 65 and older.

- Social Security's Old-Age and Survivors Insurance Trust Fund is projected to be depleted by 2033, at which point retirees may only receive 79% of their scheduled benefits without legislative reform.

- 1 in 5 Americans aged 50 and older have no retirement savings, while nearly half of non-retired adults don't feel confident they'll retire comfortably.

- Older Americans are staying in the workforce longer: Labor force participation among adults 75+ is projected to reach 10.1% by 2033 — nearly double the rate in 2003.

- State-level retirement savings vary widely: The average 401(k) plan balance in Connecticut is over $546K, while Utah's average is just $315K.

A Nation Growing Older

According to the U.S. Census Bureau, the aging population in the U.S. is accelerating. By 2030, Americans age 65 and older are expected to outnumber children under 18 for the first time in the country's history. From there, the growth continues. The number of older people is set to grow by more than 50% from 2022 to 2060.

By 2060, more than 88 million people will be 65 or older, up from 57.8 million in 2022—an increase of over 30 million older adults within the total population in less than four decades.

In 2022, women outnumbered men in the 65+ age group by 5.9 million. That gap is expected to widen, peaking in 2045 with 7.5 million more women than men in this age group (43.7 million vs. 36.2 million). By 2060, women are projected to maintain a significant majority among older adults, totaling 48 million compared to 40.8 million men.

At the same time, U.S. Census Bureau data shows that the nation's median age is steadily rising. In 2022, it was 38.9 years old. They project it will climb to 45.3 by 2060, a 6.4-year increase. This trend signals a growing share of older adults and a declining proportion of the working-age population.

Some regions are aging faster than others. The Weldon Cooper Center for Public Service projects that Maine will have the highest percentage of residents age 65 and older by 2050 (25.5%), followed by Florida (25.0%), Hawaii (24.2%), Vermont (23.9%), and Arizona (23.9%).

They also forecast that Utah and North Dakota will remain the youngest states, each with just 16.1% of residents in this age group. Alaska (16.4%), Texas (17.2%), and Nebraska (18.6%) also rank among the states with the lowest shares of older adults.

States with the highest 65+ populations tend to be in the Northeast, such as Maine, Vermont, and New Hampshire, and in the Sun Belt, including Florida, Arizona, and South Carolina, where retirees traditionally cluster. Mountain West and Plains states are likely to remain relatively younger, with lower shares of residents age 65 and older by 2050.

The U.S. Census Bureau predicts a slowdown in population growth, which adds to the challenge. In the early 2020s, the U.S. population increased by nearly 0.5% annually. By 2040, growth is projected to dip below 0.25% per year, and by 2050, it will decline to just 0.11%, the lowest sustained growth rate in modern history. From 2051 through 2060, this stagnation is expected to continue at 0.10%, reinforcing concerns about long-term demographic and economic effects.

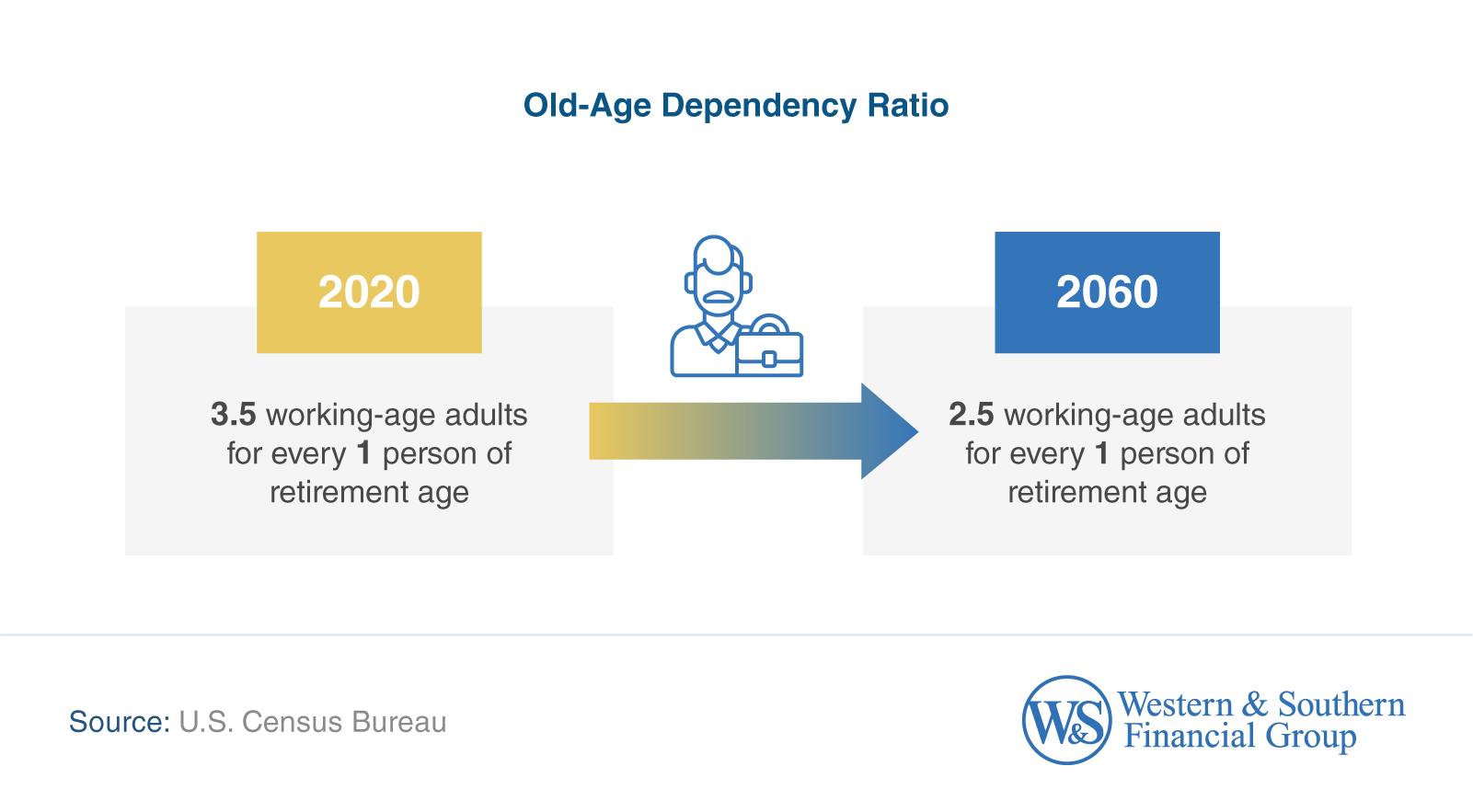

Behind these trends is a shrinking support base for retirees. As reported by the U.S. Census Bureau, there were 3.5 working-age adults for every person of retirement age in 2020. By 2060, they predict that number will fall to just 2.5. This shift may place additional strain on programs like Social Security and has broader implications for tax revenues, the labor force, and long-term economic sustainability.

Can Social Security and Medicare Keep Up?

Social Security is facing significant financial pressure as the aging population grows. According to the Social Security Administration (SSA) 2024 Trustees Report, the Old-Age and Survivors Insurance Trust Fund (OASI) is projected to be depleted by 2033. At that point, retirees would receive just 79% of their scheduled benefits.

Even when combining all Social Security trust fund assets, the SSA predicts full benefits can only be paid through 2035. Without intervention from policymakers, future payouts are expected to remain permanently reduced, hovering around 80% for subsequent generations. Here's how the projected timeline breaks down:

- 2022: Fully funded

- 2023: Operating with reserves

- 2033: OASI Trust Fund depletion; benefits drop to 79%

- 2035: OASDI combined trust fund depletion; benefits payable at 83%

- 2040 and beyond: Post-depletion plateau; benefits stabilize at approximately 80%

Medicare is also under mounting financial strain. Data from the Centers for Medicare & Medicaid Services details that Medicare expenditures rose from $675.9 billion in 2016 to $1.03 trillion in 2023, marking a 52% increase in just seven years.

This surge reflects the growing demand for long-term care and other health services among older adults. As life expectancy increases and the percentage of the elderly population expands, federal healthcare systems must manage rising healthcare costs while helping maintain coverage for millions of retirees.

The New Retirement Reality

Many Americans approaching retirement face growing uncertainty about their financial future. AARP reports that one in five adults age 50 and older has no retirement savings at all.

In a previous Western & Southern study, nearly half of non-retired adults (49%) reported lacking confidence that they'll be able to retire comfortably. Confidence levels also varied across age groups, with Gen X feeling the most concerned.

Confidence in Retiring Comfortably by Generation

- Gen Z: 41%

- Millennials: 50%

- Gen X: 52%

- Baby boomers: 47%

According to the same Western & Southern study, the ideal retirement age is also shifting further out of reach. Americans who have not yet retired said they would like to retire at age 64 but expect to realistically do so around age 70. Among younger adults, the gap between goals and expectations is especially wide.

Ideal vs. Realistic Retirement Age by Generation

- Gen Z: 61 vs. 69

- Millennials: 63 vs. 71

- Gen X: 65 vs. 70

- Baby boomers: 67 vs. 71

While 80% of Americans age 50+ have retirement savings, how much they have saved varies widely by state. Personal Capital data reveals that the average 401(k) plan balance is more than $546,000 in Connecticut. In contrast, Utah residents average just $315,000, the lowest in the nation. Gaps like these uncover the uneven distribution of human capital and economic preparedness among older adults nationwide.

Top 10 States With the Most Retirement Savings

- Connecticut: $546K

- New Jersey: $514K

- New Hampshire: $513K

- Alaska: $504K

- Vermont: $495K

- Virginia: $493K

- Maryland: $486K

- Massachusetts: $479K

- Minnesota: $471K

- Washington: $470K

Bottom 10 States With the Least Retirement Savings

- Utah: $315K

- North Dakota: $320K

- Mississippi: $348K

- Oklahoma: $361K

- Arkansas: $364K

- Hawaii: $367K

- West Virginia: $371K

- Tennessee: $376K

- Nevada: $380K

- Wyoming: $381K

Some older Americans are also working after retirement age. Employment projections by the U.S. Bureau of Labor Statistics show labor force participation among those age 75 and older may reach 10.1% by 2033, nearly double the rate from 2003. For adults age 65 to 74, participation is expected to hit 30.4% by 2033, up nearly 9 percentage points from 21.4% in 2003. This shift reflects not only changing retirement strategies but also broader demographic change and economic impact tied to population aging.

Frequently Asked Questions About the Aging Population

What are the financial issues with aging people?

Many older adults face financial insecurity due to insufficient retirement savings, rising healthcare costs, and longer life expectancy. According to a recent Western & Southern study, 20% of Americans over age 50 have no retirement savings, and many expect to work well past the traditional retirement age to support themselves.

What are the economic impacts of an aging population?

The economic effects of population aging include slower GDP growth, reduced workforce productivity, and increased pressure on public programs like Social Security and Medicare. A higher old-age dependency ratio means fewer working-age people are available to support retirees, straining tax revenues and long-term budget sustainability.

How does an aging population affect income?

As the labor force ages, income growth may slow due to lower workforce participation and shifts in job types. Older workers often transition to part-time roles or exit high-earning positions, affecting overall income tax contributions and household spending levels.

What are the main impacts of an aging population?

An older population influences nearly every aspect of national economics, from labor markets and healthcare systems to government expenditures and demographic balance. It also requires policymakers to adjust long-term financial strategies to help ensure future retirees receive adequate support without burdening younger generations.

How does an aging population affect productivity growth?

As the workforce ages, productivity growth may decline due to a shrinking pool of younger workers, slower labor force expansion, and reduced innovation output. While older workers bring experience and institutional knowledge, aging populations can limit economic dynamism and reduce overall efficiency in certain sectors.

What about global aging trends?

The United Nations tracks shifts in the world population and reports that population aging is a global phenomenon. Their research shows that declining fertility rates and increasing life expectancy are leading causes of aging in developed and developing nations alike.

Which countries are also facing aging population challenges?

Several countries are experiencing similar demographic changes. Nations like Japan, Germany, and the United Kingdom have seen increases in their elderly populations. These trends are also common across Europe, where aging societies are prompting actions like pension reforms.

The Coming Age Wave

The United States is entering a profound demographic transformation. By 2030, Americans age 65 and older will outnumber children under 18 for the first time in history — a tipping point with lasting economic implications. The data reveals a clear pattern: the population is aging rapidly, while the systems built to support retirees are under growing pressure.

Social Security's trust fund is on pace to be depleted by 2033, and Medicare expenditures have already surpassed $1 trillion annually. As the old-age dependency ratio climbs, the shrinking base of working-age adults will make it harder to sustain public programs and maintain current benefit levels. Policymakers face mounting urgency to address these challenges.

At the same time, millions of older adults are financially unprepared for retirement. One in five Americans over age 50 have no retirement savings, and nearly half of non-retired adults lack confidence in their ability to retire comfortably. While the average ideal retirement age is 64, most people expect to keep working until 70 or later, a shift already reflected in rising labor force participation among older workers.

From state-level gaps in retirement savings to the nation's slowing population growth rate, the economic impact of population aging is already in motion. Whether through strengthened financial strategies, targeted reforms, or new initiatives, the coming age wave demands a long-term response.

Methodology

This report synthesizes publicly available data from trusted government and financial institutions to analyze the financial and demographic impact of America's aging population. All data in this report were collected from the following authoritative sources:

- U.S. Census Bureau (2023 Population Projections)

- Bureau of Labor Statistics (Employment Projections)

- Social Security Administration (2024 Trustees Report)

- Centers for Medicare & Medicaid Services (CMS) and Congressional Budget Office (CBO)

- Western & Southern for generational confidence in retirement, savings shortfalls, and retirement age expectations

- Personal Capital: Used for state-level average retirement savings figures

- AARP Survey (April 2024)

About Western & Southern Financial Group

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500® company at No. 284, is the parent company of a group of diversified financial services businesses. Its assets owned ($82.6 billion) and managed ($40.2 billion) totaled $122.8 billion as of March 31, 2025.1 Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company,2 Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fabric by Gerber Life; Fort Washington Investment Advisors, Inc.;3 Gerber Life Agency;4 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;3 Touchstone Securities, Inc.;5 W&S Brokerage Services, Inc.;3,5 and W&S Financial Group Distributors, Inc.6 Western & Southern is a title sponsor of several major Cincinnati events every year. From 2002 to 2023, it served as the title sponsor of the nation’s longest-running professional tennis tournament played in its city of origin, the Western & Southern Open. The renamed Cincinnati Open is one of nine ATP Masters 1000 tournaments, the world’s premier tournaments after the Grand Slams, and a WTA 1000 tournament. The company proudly continues to serve as a major sponsor.

1 The financial information presented here is preliminary and unaudited.

2 Gerber Life is a registered trademark. Used under license from Société des Produits Nestlé S.A. and Gerber Products Company. 3 A registered investment advisor.

4 In the State of California, Gerber Life Agency, LLC is known as and does business as Gerber Life Insurance Agency, LLC.

5 A registered broker-dealer and member FINRA/SIPC.

6 W&S Financial Group Distributors, Inc. (doing business as W&S Financial Insurance Services in CA).

Review our current financial ratings.

From Fortune ©2024 Fortune Media IP Limited. All rights reserved. Used under license. Fortune and Fortune 500 are registered trademarks of Fortune Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse the products or services of Western & Southern Financial Group.

Fair Use Statement

These findings may be shared for non-commercial purposes as long as proper credit is given via a link to this page.