Key Takeaways

- Retirement doesn’t automatically lower your expenses - costs like travel, hobbies, and healthcare can still rise.

- Taxes don’t go away either; you’ll likely pay on Social Security and retirement withdrawals.

- Many retirees return to work for income, purpose, or enjoyment.

- Social Security and Medicare help, but they often don’t cover everything, especially out-of-pocket healthcare costs.

- Starting to save early gives your money more time to grow, while delaying may require saving more, working longer, or adjusting your lifestyle.

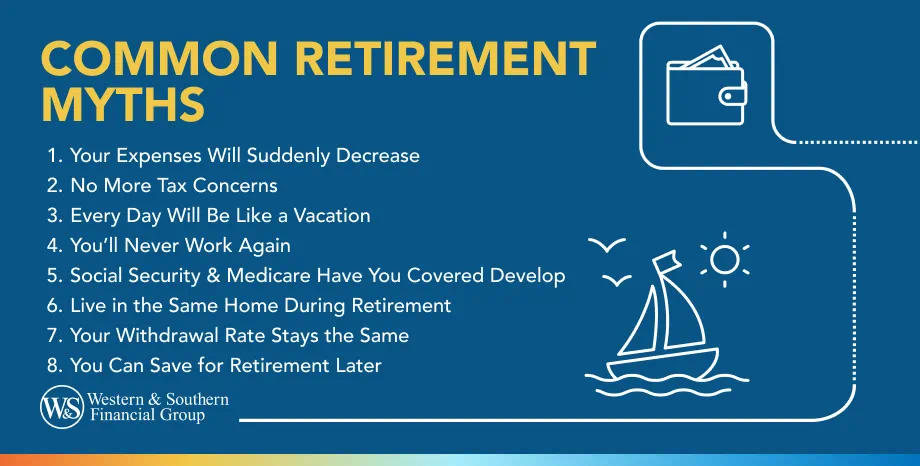

Entering retirement - whether you are 40, 50, 60 or 65 - marks a new chapter in your financial, professional and personal life, but like some retirees, you may find the reality doesn't quite align with your vision. Don't let the following five common retirement myths affect the ways you save, invest and otherwise prepare for your golden years.

Myth 1: Your Expenses Will Suddenly Decrease

The truth: Some costs may drop in retirement but others often rise.

Ask yourself: How much will you need to retire comfortably? That answer depends on several factors, especially the lifestyle you expect to enjoy and how much you’re able to save to reach that goal.

What Most Retirees Actually Save

Lifestyle Choices Can Offset Savings

After you retire, costs like commuting, work clothes, and business travel may drop, helping reduce spending. But your total expenses depend on your lifestyle - traveling, buying a beach home, or starting new hobbies could keep costs steady or even increase them.

Track your monthly spending to get a clear picture of your average expenses. Understanding your habits now can help you plan for a balanced retirement budget later.

Don’t Forget About Debt

Outstanding debt can affect your retirement budget as much as lifestyle changes. If you’re still paying off high-interest credit card balances, car loans, or personal debt, plan to eliminate them while you’re still earning income. Doing so can help:

- Reduce monthly obligations

- Eliminate interest and fees

- Free up cash flow once you retire.

Myth 2: No More Tax Concerns

The truth: Taxes don’t disappear when your paycheck does - they simply change form.

Possible Tax Advantages in Retirement

You may no longer get a W-2 in retirement, but taxes will still be part of your life. At age 73, you may have to take yearly minimum distributions from your retirement accounts, which count as taxable income.2 Social Security and other retirement benefits are also generally subject to income tax.

While some taxes continue, you might also qualify for new deductions and advantages you didn’t have while working:

- Qualified Charitable Distributions (QCDs): Taxpayers age 70 ½ and older can donate directly from their IRA to a qualifying charity and count that amount toward their RMD.3

- Medical Expense Deductions: You may be able to deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI).4

These strategies can help reduce your taxable income and make your savings last longer. Retirement changes how you’re taxed, not whether you are. With smart planning and awareness of withdrawals, benefits, and deductions, you can manage taxes effectively and keep more of your income.

Myth 3: Every Day Will Be Like a Vacation

The truth: Retirement often changes how you spend - not necessarily how much you spend.

Plan for Changing Priorities

Many people assume that retiring automatically means spending less. While you may save on commuting or work-related costs, other expenses can rise once you have more free time. Think about how you’d like to spend your time and money once you retire.

- Travel & recreation: Vacations, hobbies, and family visits can be rewarding and costly.

- Healthcare: Premiums, prescriptions, and medical care may increase over time.

- Home improvements: You may want to renovate, relocate, or age-proof your living space.

Tip

Review your monthly expenses at least once a year. Adjust your retirement budget to reflect any lifestyle or health-related changes.

Prepare for Inflation

Even modest inflation reduces purchasing power over time. Rising costs for groceries, gas, and insurance can make your savings stretch less in the future, so plan for inflation in your budget. Your retirement spending depends on lifestyle, health, and goals. Reviewing your budget and adjusting for inflation helps keep your finances on track.

Myth 4: You'll Never Work Again

The truth: Retirement doesn’t always mean the end of your professional life; for many, it’s the beginning of a new chapter.

The Rise of “Unretirement”

The pandemic reshaped how many Americans view work and retirement. Millions of older adults retired earlier than expected, before turning 65.5 However, the trend is reversing: about 1.5 million retirees have rejoined the workforce. This growing “unretirement” movement reflects a shift in how retirees define fulfillment and financial independence.

Why Retirees Are Returning to Work

- To counter boredom: Many retirees miss structure and purpose, so they return to work, often in roles tied to personal interests or hobbies.

- To build friendships: Work offers social connection and a sense of community that can fade in retirement.

- To try something new: Some see retirement as a “second act,” starting new careers or even launching businesses.

- To turn hobbies into income: Part-time work lets retirees pursue passions while learning more about what they love.

- Because opportunity knocks: Former employers may invite retirees back for consulting or part-time roles.

- Because they enjoy working: According to the 2025 Retirement Confidence Survey, 88% of retirees who plan to work do so simply because they like it.

- To boost savings: Extra income helps stretch retirement funds and keeps investments growing.6

Redefining What Retirement Means

Today’s retirees are rewriting the rules. For some, “retirement” doesn’t mean stopping work, but it means working differently. You might explore:

- A new career aligned with personal passions

- Volunteer work or community involvement

- Freelance projects that keep you engaged on your own schedule

Whether for financial reasons, personal fulfillment, or simply staying active, the modern retiree is proving that work and retirement aren’t mutually exclusive.

Plan ahead to maximize your retirement income and achieve your retirement goals. Start Your Free Plan

Myth 5: Social Security & Medicare Have You Covered

The truth: While Social Security and Medicare can help cover part of your retirement expenses, they’re unlikely to cover them all.

What Determines How Much You’ll Receive

How much you can live on depends on several factors, including:

- The age at which you claim Social Security benefits

- Your current and future healthcare needs

- The potential future depletion of the Social Security trust

Understanding these variables can help you plan more effectively and build savings to supplement what Social Security and Medicare provide.

How Far Social Security Really Goes

According to AARP, the average Social Security recipient receives $1,976 per month as of October 2025. Those who wait until full retirement age may receive up to $4,018 per month or about $48,216 per year.7

What Medicare Covers & What It Doesn’t

Medicare helps offset medical costs, but it doesn’t eliminate them.

- Part A covers hospital care.

- Part B requires monthly premiums and covers outpatient services.8

- Prescription drugs are handled under Part D, often with copays.

- Vision, dental, and hearing coverage usually require separate plans or out-of-pocket payments.

Retirees should factor these extra costs into their overall healthcare budget to avoid surprises later on.

Myth 6: Live in the Same Home During Retirement

The truth: Where you live in retirement should fit your needs - not just your nostalgia.

Why Staying Put Isn’t Always Practical

Many people assume they’ll remain in their longtime home after retiring, but that isn’t always realistic - or cost-effective. Even with the mortgage paid off, you’ll still face:

- Property taxes that may rise over time

- Maintenance and repair costs for aging systems or structures

- Upkeep and cleaning that become more challenging as you age

Managing a large home can turn into a burden, both financially and physically.

When It Might Make Sense to Move

Some retirees choose to:

- Downsize to reduce expenses and maintenance

- Relocate to be closer to family or better healthcare options

- Move to a more accessible or affordable community that supports aging in place

Each option can help improve quality of life — but the right move depends on your personal goals and financial situation.

Tip

Regularly review your housing. Consider costs, accessibility, and lifestyle needs at each stage of retirement.

Myth 7: Your Withdrawal Rate Stays the Same

The truth: Withdrawal strategies should evolve as your income needs, taxes, and market conditions change.

Why a Fixed Withdrawal Rate May Fall Short

A fixed withdrawal rate might sound straightforward, but it often doesn’t hold up over decades of retirement. As you age, Required Minimum Distributions (RMDs) from tax-deferred accounts typically increase - raising both your annual withdrawals and your potential tax bill.

Building a More Tax-Smart Withdrawal Strategy

While Roth IRA conversions can help manage taxes, a truly tax-efficient withdrawal plan involves more than one tactic. It means:

- Drawing from different account types strategically (taxable, tax-deferred, and tax-free)

- Managing withdrawal timing to help reduce tax exposure

- Keeping your income consistent across changing market conditions

This balanced approach can make your savings last longer and minimize tax impact over time.

Stay Flexible as Life Changes

A flexible approach works best. Adjusting withdrawals as markets fluctuate, expenses change, or tax laws evolve can help your retirement savings last longer - and your plan stay on track.

Myth 8: You Can Save for Retirement Later

The truth: Time is your strongest ally when saving for retirement.

The Cost of Waiting to Save

Putting off retirement savings might seem harmless, but waiting even a few years can drastically reduce your long-term potential. The earlier you start, the more time your money has to grow through compound interest — and the less you’ll need to save later.

Why Starting Early Matters

When you begin saving early, your contributions have more time to:

- Grow through compounding: Interest earns interest, creating exponential growth.

- Reduce pressure later: Starting sooner means smaller, more manageable contributions.

- Build financial flexibility: Early savings can help you reach goals without major lifestyle cuts later.

Catching Up If You Started Late

It’s never too late to begin saving for retirement, but starting later often requires trade-offs, such as:

- Saving a larger percentage of your income

- Working longer before retiring

- Adjusting lifestyle expectations to align with available funds

Even small contributions made consistently can still build meaningful momentum over time.

Actionable Next Steps

Understanding the truth behind common retirement myths is just the beginning. The next step is to build a plan that fits your personal goals, lifestyle, and income needs. Here’s how to get started:

- Review Your Current Financial Picture: Review your retirement savings - 401(k)s, IRAs, and other investment - to confirm your allocation matches your risk tolerance and time horizon.

- Estimate Future Expenses: Consider healthcare, long-term care, travel, and hobbies in addition to basic expenses, using your current spending as a baseline adjusted for inflation and lifestyle changes.

- Assess Your Income Sources: List all your income sources, such as Social Security, pensions, annuities, part-time work, and investments, to see if they’ll cover your monthly needs.

- Plan for Taxes in Retirement: Even in retirement, withdrawals from different accounts are taxed, so consider strategies like Roth conversions or staggered withdrawals to help manage taxes.

- Revisit Your Plan Regularly: Review your strategy annually or after major life changes to keep up with shifting needs and market conditions.

- Work With a Financial Professional: A licensed financial representative can help you refine your retirement plan and find ways to make your savings and investments last longer.

The Bottom Line

Retirement misconceptions can make it challenging to know what your future will hold, but a little strategy and planning can help you prepare. Don't let retirement myths prevent you from working towards the personal, financial or professional future you want.

Prepare for a fulfilling retirement with plans designed for long-term success. Start Your Free Plan

Frequently Asked Questions

When are people most likely to feel happy in retirement?

What are common challenges people face in retirement?

Do you live longer if you retire earlier?

Which places are often associated with higher retirement satisfaction?

Sources

- Early Retirement Reality Check: Can $1M+ Cover It? https://www.nasdaq.com/articles/early-retirement-reality-check-can-1m-cover-it.

- Retirement Topics - Required Minimum Distributions (RMDs). https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds.

- IRA FAQs - Distributions (Withdrawals). https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-distributions-withdrawals.

- Publication 502, Medical and Dental Expenses. https://www.irs.gov/publications/p502.

- “Unretiring”: Why recent retirees want to go back to work. https://www.troweprice.com/personal-investing/resources/insights/unretiring-why-recent-retirees-want-to-go-back-to-work.html.

- Seven Surprising Reasons Retirees Are Going Back to Work. https://www.kiplinger.com/retirement/happy-retirement/surprising-reasons-retirees-are-going-back-to-work.

- How much Social Security will I get? https://www.aarp.org/retirement/social-security/questions-answers/how-much-social-security-will-i-get.html.

- Parts of Medicare. https://www.ssa.gov/medicare/plan/medicare-parts.