Table of Contents

Table of Contents

Video Transcript

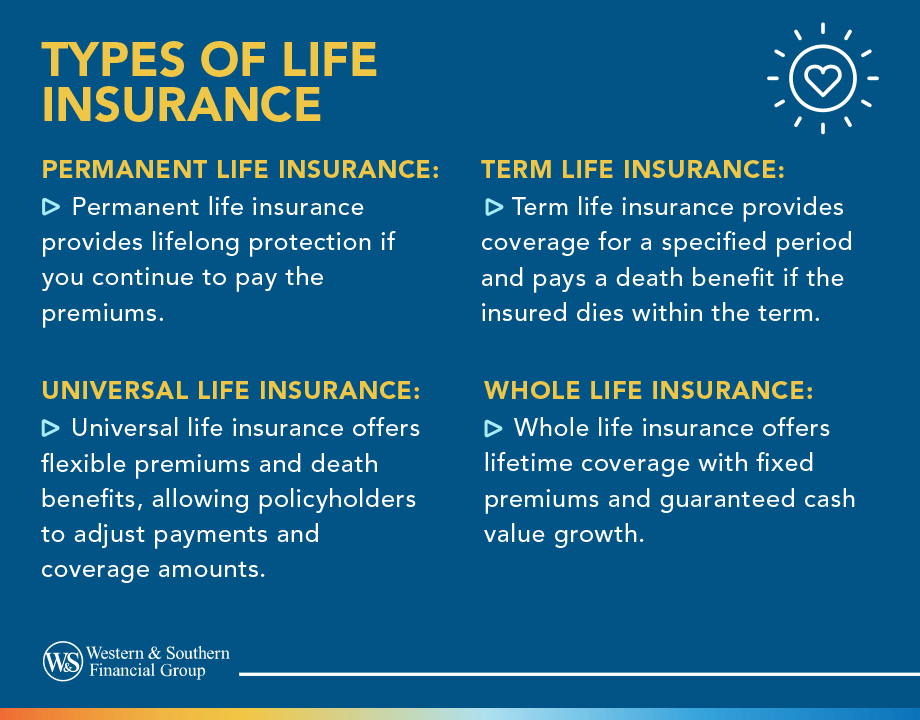

Today, let's talk about life insurance. You might wonder why it's important, or which type suits you best. We will help you navigate your options and make informed decisions. The three main types of life insurance are term life, whole life, and universal life. Each serves unique needs and financial goals, and we'll explain how.

Let's start with term life insurance. It's like renting an apartment. You pay rent — or in this case, premiums — for a certain period, known as the term. This could be 10, 20,or 30 years. If you pass away during this time, your policy pays out a death benefit to your beneficiaries. It's straightforward and generally the most affordable option, making it a great choice for temporary coverage needs.

Next up, whole life insurance. Think of it as buying a home instead of renting. It's permanent, lasting your entire life as long as the premiums are paid. Part of what you pay builds up as cash value, which you can borrow against. It's more expensive than term life but may offer long-term security and can be part of your financial strategy, growing tax-deferred over time.

Universal life insurance is all about flexibility to support lifes' little changes, providing a death benefit and a cash value component, like whole life. However, you can adjust your premiums and death benefits over time based on your changing needs. It's suitable for those who anticipate their financial situation might change and want the ability to tweak their coverage accordingly.

Choosing the right type of life insurance depends on your personal and financial situation. Think about how long you need coverage, what you can afford, and whether you're looking to accumulate a cash value. Consulting with a financial advisor can help clarify these points and guide you to the right decision.

Key Takeaways

- Many types of life insurance are available, with different rules for coverage, premiums and other policy benefits.

- Permanent policies, such as whole life and universal life, don't have a set expiration date. Temporary term policies do.

- Term policies start out more affordable but get more expensive if you decide to renew.

- Some permanent policies build cash value — money you can take out while alive. The way this works depends on the policy.

- Understanding the different types of life insurance can help you find what may best suit your unique needs.

Life insurance comes in many types. But how can you determine which one seems right for you? Comparing the different types helps you better understand your options.

You are a unique individual with unique needs. Learning more about term life, whole life and universal life insurance — and their differences — helps give you more confidence as you consider them.

When reviewing life insurance options, keep in mind there's a lot of variety in the market within the various categories. If you're trying to decide which type to buy, consider which solution best addresses your personal situation and unique needs.

Permanent Life Insurance

Permanent life insurance is protection with no set expiration date. As long as you continue to pay the monthly premiums and do not terminate your policy for its cash surrender value, it remains in force.

There are different versions of permanent life insurance, each with different offerings. For example, whole life insurance charges the same premium the entire time, while universal life offers flexibility to adjust what you pay each year.

Tip

All types of permanent life insurance share the same feature: As long as you pay enough premium, your protection remains in force.

Life Insurance with Cash Value

Some permanent life insurance policies can build cash value as you pay premiums. This is a reserve of money available for you to take out while still alive, either through a withdrawal or a loan. Be aware, however, that taking out cash value reduces the death benefit for your beneficiaries.

The insurer pays a return on your cash value balance to help it grow. The type of return depends in part on the business results of the insurer and the type of permanent life insurance policy. For example, whole life pays a fixed interest rate. Life insurance with cash value has different rules, and it can grow in different ways, so consider all of your options.

Whole Life Insurance

As the name says, whole life insurance is designed to possibly last your whole life. As long as you keep paying the premiums, the coverage doesn't expire. Whole life insurance is the original form of permanent life insurance, offering various types to suit your coverage needs.

Benefits of Whole Life Insurance

Major benefits of whole life insurance include:

- Predictability: By design, whole life insurance provides lifetime coverage, and the premiums stay the same the entire time. Unlike other life insurance policies, whole life doesn't increase the cost as you get older. This can make it easier to budget over time.

- Potential for growth: Whole life insurance can also include cash value. If it does, the insurer pays a guaranteed set interest rate on your balance. It's generally based on conservative assumptions, which helps you plan how much your cash value may grow in the future. That in turn helps you better plan for upcoming goals.

Dividends In Whole Life Insurance

Some life insurance companies pay dividends to their whole life insurance policies. When the insurer makes a profit in a year, it may share part of it with its policyholders. As a result, your cash value balance could grow even more.

Single Premium Whole Life Insurance

With a single premium whole life insurance policy, you set up lifetime insurance protection with one large payment. From then on, you don't have to pay any more premiums. These life insurance policies can be useful for estate planning needs, such as setting up a large inheritance. However, they also have some special tax rules to consider.

Limited-Pay Whole Life Insurance

Limited-Pay Life Insurance offers a unique opportunity for those who want lifelong coverage without the financial burden of paying premiums indefinitely. A limited-pay life policy is whole life insurance in which premiums are paid over a specified period, such as 7, 10, 15, or 20 years. By condensing premium payments into a shorter timeframe, policyholders gain flexibility, knowing their insurance needs are met for life.

No-Exam Whole Life Insurance

While most life insurance policies generally require you to pass a medical exam when you sign up, no-exam whole life insurance does not. You may even be able to qualify with existing health issues. This life insurance option has some drawbacks though, such as higher premiums and restrictions on paying the death benefit. But they could make sense if you might not qualify for traditional whole life.

Can I Get Life Insurance Without A Medical Exam?

Yes, some policies guarantee you qualify, even with health issues. However, policies without medical exams can have drawbacks. They typically charge more and may limit how much coverage you can buy. In most cases, they also won't pay the death benefit if you die within a few years of signing up.

Ultimately, the better you can do on a medical exam, the better your cost for life insurance coverage.

Did You Know?

It's possible to buy life insurance without a medical exam.

How Does Life Insurance Replace Income?

Life insurance policies provide a death benefit. If you die while insured, your beneficiaries receive this large, lump-sum payment. Life insurance can help replace your income by creating a death benefit worth many years of your salary.

Financial professionals typically suggest aiming for a death benefit that's around six to 10 years of your salary. For example, if you earn $100,000 a year, you may want at least $600,000 in life insurance coverage if your goal is to replace your income.

Universal Life Insurance

Universal life insurance policies are another version of permanent coverage that can last your entire life. This life insurance type prioritizes flexibility. Universal life allows you to increase or decrease your premium — within limits, you can pay more or less as you choose.

That said, you have to pay enough to cover the underlying insurance cost each year. To keep lifetime coverage, you typically should build a cash reserve when you're young to help cover the increasing cost of insurance as you age.

Tip

Some universal life policies offer optional riders that provide access to a portion of the death benefit while still living, if diagnosed with a terminal illness, known as "living benefits riders."

Additionally, some universal life insurance policies allow you to increase or decrease the death benefit Traditional universal life insurance offers cash value that may grow based on market interest rates. Your return changes each year depending on market conditions. Other versions of universal life may have different structures.

Benefits of Universal Life Insurance

Major benefits of whole life insurance include:

The benefits of universal life insurance are:

- Control: Universal life insurance policies give you have control in managing premium payments. Premium amounts can be adjusted up or down each year, depending on one's budget and income. Policyholders can pay more when they have extra income, and less when money is tight. It's important, however, to maintain sufficient cash value in the policy to cover the monthly insurance costs.

- Flexibility: With universal life insurance, you have the flexibility to adjust the death benefit. Without purchasing a new policy, the benefit can be decreased to a lower amount or increased to provide more coverage. This flexibility allows the death benefit to be tailored over time as needs and circumstances change.

Single Premium Universal Life Insurance (SPUL)

A Single Premium Universal Life Insurance policy provides lifelong coverage with a single upfront payment, eliminating the need for future premiums while offering tax-deferred cash value growth and a generally tax-free death benefit. Ideal for individuals with a significant lump sum who seek estate planning benefits, guaranteed lifetime coverage, and tax-advantaged growth.

Term Life Insurance

Term life insurance is temporary life insurance. The protection will continue for a set term, such as 10 years or 20 years. If you pass away during this period, your beneficiaries receive the death benefit. If you outlive the term, your coverage expires. However, some term policies allow you to either extend your coverage past the expiration date or convert to a permanent policy.

Benefits of Term Life Insurance

The major benefits of term life insurance include:

- Affordability: Term life insurance costs significantly less than permanent. Larger coverage amounts are more affordable with term life insurance.

- Simplicity: Term life insurance policies are more straightforward. You basically just need to know how long the term lasts and your premium.

- Level premium: Most term policies charge the same amount during the entire term.

- Variety of policy lengths: Term policies can be as short as one year to potentially 30 years or longer. You can align a coverage length to your protection needs.

Convertible Term Life

Convertible term life insurance allows you to swap your temporary term life insurance policy for permanent coverage. A health exam isn't generally required to make the change. You can qualify so long as you convert before the term policy expires. Accordingly, these policies can help keep your long-term insurance options open.

Increasing Term Life

Increasing term life insurance provides a death benefit that increases over the policy term, with higher premiums, in order to help maintain the value of the payout against inflation over time.

Decreasing Term Life

Decreasing term life insurance is a type of policy where the death benefit decreases over time, usually at a predetermined rate. This kind of insurance is often used to cover specific financial obligations that diminish over time, like a mortgage.

Renewable Term Life

Renewable term life insurance allows the policyholder to renew the coverage for an additional term at the end of the initial term period without providing evidence of insurability. This allows continued life insurance protection for an additional preset period of time without undergoing new underwriting.

Length of Coverage

When you sign up for term life insurance, you pick how long you want the coverage to last. The longer the term, the more expensive the premium. Some of the more popular options include:

- 10-year term: This policy is typically more affordable. This term could make sense in your 50s and 60s. You can get coverage for the rest of your career or add extra insurance protection to complement another term policy you bought earlier.

- 15-year term: This policy might make sense if you took out a 15-year mortgage or if you're in your 50s and expect to work another 15 years.

- 20-year term: This policy could be suitable when you just had a child. The term will last until they reach adulthood and provide crucial support should the unthinkable happen.

- 30-year term: This policy lasts the longest and keeps the same premium for decades. It could make sense if you're starting your career or if you don't have children but expect to in the future. You can set up long-term life insurance protection that will last for these needs.

Comparing Types of Life Insurance

Each type of life insurance has pros and cons. By understanding how different life insurance policies compare, you can find the option that best fits your coverage needs. Here's how the most common options match up.

Term Life vs. Permanent Life Insurance

There is a contrast between term life and permanent life insurance. Permanent life insurance can last your entire life as long as you keep paying the premiums. Term life insurance starts out more affordable than permanent coverage. However, it gets more expensive if you renew at an older age (and assuming you are still insurable). Term life insurance is temporary coverage with a set expiration date, whereas permanent life insurance doesn't have an expiration date.

Permanent life insurance policies can build cash value — money you can take out while you're alive. Term policies do not. Term life insurance could make sense when needs with clearly defined timeframes call for large amounts of protection, such as a policy that lasts until your kids grow up. Permanent coverage could be useful for long-term needs that don't go away, such as covering final expenses or providing an inheritance.

Term Life vs. Whole Life Insurance

The distinctions between term life and whole life insurance are similar to permanent versus term life. Term life is temporary insurance coverage, whereas whole life is permanent and can last your entire life. Term life insurance products start out charging less for the same death benefit than whole life. However, if you renew a term policy after it expires, the premium increases because you're renewing at an older age. There's also a chance you may not qualify for the new policy.

Whole life policies cost more than term at first, but the premium stays the same and doesn't increase as you get older. Whole life insurance policies can also build cash value, whereas term policies cannot.

Term Life vs. Universal Life Insurance

Understanding the nuances between term and universal life insurance is critical for making an informed decision. Term life insurance provides affordable coverage for a specific period, focusing solely on the death benefit, while universal life offers lifelong coverage and a cash value component that grows over time. Term life is simpler and cheaper, ideal for temporary needs, whereas universal life provides flexibility and potential tax advantages for long-term financial future.

Whole Life Vs. Universal Life Insurance

Whole life and universal life have some key differences. While both are permanent policies that can last your entire life, whole life insurance is more predictable. The premium stays the same after you sign up. If the policy has cash value, it grows by a fixed interest rate.

Universal life gives you more flexibility to change the premium and sometimes the death benefit. This can help with budgeting. You may have to plan the premium payments more on these policies because you generally have to pay enough in your early years to cover the higher insurance costs later as you get older. If universal life has cash value, the return changes each year based on market interest rates.

Find the right life insurance for you. Get a Life Insurance Quote

Guaranteed Issue Life Insurance

Guaranteed Issue Life Insurance, also known as Guaranteed Acceptance Life Insurance, is a specialized type of policy that offers quick approvals without medical exams or extensive health questionnaires. These features make it an ideal choice for individuals with pre-existing conditions, older adults, or anyone denied traditional life insurance. However, it often comes with higher premiums and lower coverage amounts.

Simplified Issue Life Insurance

Simplified Issue Life Insurance offers a quick and convenient way to get covered without the need for a medical exam. Ideal for those who need immediate coverage or have minor health issues. This type of insurance comes in various forms like term and whole life, each with its own set of pros and cons. However, it often features higher premiums and lower coverage limits compared to traditional life insurance policies.

Interest Sensitive Whole Life Insurance

Interest Sensitive Whole Life Insurance is a type of permanent life insurance offering a guaranteed death benefit and a cash value component that can grow based on current interest rates. Unlike traditional whole life insurance, which has fixed premiums and a fixed rate of return on the cash value, this policy allows for more flexible premiums and a cash value sensitive to interest rate changes.

Indexed Universal Life Insurance

Indexed Universal Life Insurance (IUL Insurance) is a type of life insurance policy that can help you protect your family and grow your wealth over time. It offers a unique combination of permanent coverage, flexible premiums, and tax-advantaged cash value growth linked to the stock market.

What Are Other Types Of Life Insurance Policies?

Here are some additional types of life insurance policies:

- Survivorship life insurance is a policy on the lives of two persons, such as spouses. These policies don't pay out the death benefit until both pass away. In exchange, they typically charge a lower premium than a policy for one person.

- Endowment Life Insurance offers a dual advantage: a death benefit and a guaranteed lump sum payout upon the policy term's conclusion, facilitating comprehensive, long-term financial strategizing.

- Final expense insurance, sometimes called burial insurance, eases the financial burden on your loved ones after your death.

- Group life insurance is a form of life insurance coverage extended by either an employer or an organization to their employees or members, ensuring financial security for beneficiaries should the insured individual pass away while belonging to the group.

- Joint life insurance is a policy that encompasses both partners and provides a payout upon the passing of either the first or second spouse, presenting opportunities for reduced expenses while offering a constrained range of coverage choices.

- Voluntary life insurance is additional life insurance coverage that employees can choose to purchase through their employer, beyond any basic life insurance the employer may provide, to help protect their families financially in case of death.

- Corporate-Owned Life Insurance (COLI): Helps protect businesses by insuring key employees and providing tax benefits.

Start With Personalized Insights

Tapping outside help may enable you to get a fuller picture of your financial situation and needs. Consider reaching out to an experienced financial professional for information and guidance, as well as assistance in identifying the life insurance coverage most appropriate you.

Additional Resources

Have life insurance tailored to your needs. Get a Life Insurance Quote