Key Takeaways

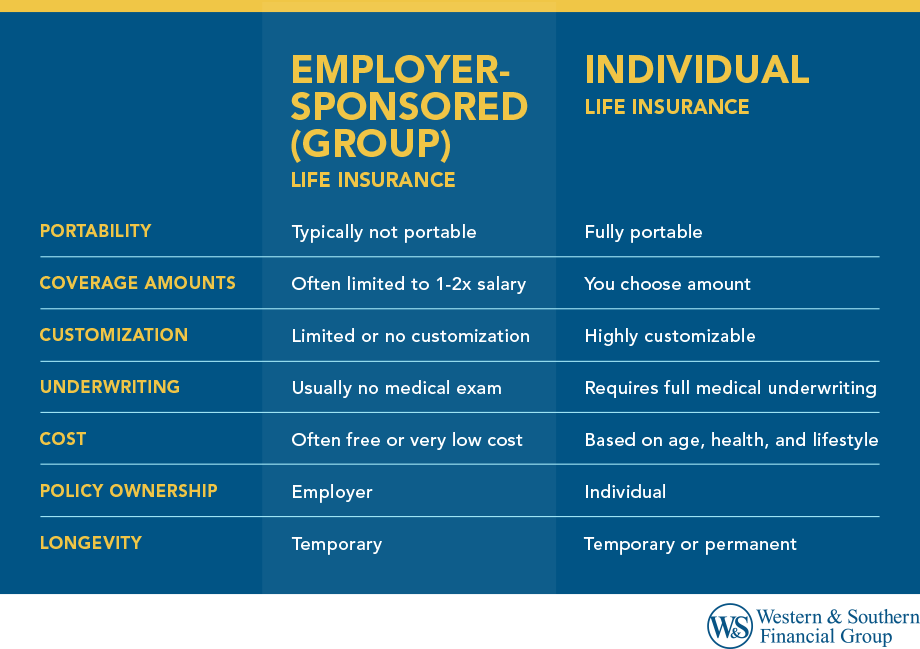

- Employer-sponsored life insurance is a valuable, low-cost benefit that provides a foundational layer of coverage, often without a medical exam.

- Group life insurance is tied to your job. If you leave or are laid off, you typically lose your coverage, creating a gap in protection.

- An individual life insurance policy is yours to keep, regardless of your employment, offering stable, customizable, and long-term protection.

- The value of employer-paid coverage over $50,000 is considered "imputed income" by the IRS and is subject to taxes.

- For most people, the optimal approach is to accept free employer coverage and supplement it with a more robust, portable individual policy.

What is Employer-Sponsored Life Insurance?

Often referred to as group life insurance, this is a policy provided by an employer to its employees as a workplace benefit. Basic coverage is typically included as part of workplace benefits at minimal employee expense.

This initial death benefit is designed to provide a basic financial safety net. Because the risk is spread across a large group of employees, the insurance company typically doesn't require individual medical exams. This "guaranteed issue" feature is a significant advantage, especially for individuals who might have health conditions that would make securing a private policy on the open market more difficult or expensive.

Many employers also offer supplemental life insurance, which allows employees to purchase additional life insurance coverage beyond the basic amount through convenient payroll deduction. While convenient, the potential cost and limitations of this extra group coverage warrant a closer look.

The Hidden Tax Implications of Group Coverage

A key detail often overlooked involves the tax consequences of employer-paid life insurance. According to the IRS, the cost of the first $50,000 of group-term life insurance coverage provided by an employer is not included in your income. The value of coverage exceeding $50,000, minus any amount you paid for it, must be reported as taxable income.

This "imputed income" is calculated using the IRS Premium Table I, which determines the cost per $1,000 of coverage based on your age. This amount is then subject to Social Security and Medicare taxes. While it may be a small amount, it's an important financial detail to be aware of.

Example

John, age 45, earns $80,000 a year, and his employer provides him with a group life insurance policy equal to twice his salary, or $160,000. The first $50,000 is tax-free. The remaining $110,000 is taxable. Using the IRS table, the cost for a 45-year-old is $0.15 per $1,000 of coverage per month.

- Taxable coverage: $110,000

- Monthly cost from IRS table: ($110,000 / $1,000) * $0.15 = $16.50

- Annual imputed income: $16.50 * 12 = $198

John will see an extra $198 added to his W-2 income for the year, which is then taxed. You should consult your tax advisor regarding how imputed income may affect your personal tax situation.

What is Individual Life Insurance?

An individual life insurance policy is a private contract between you and an insurance company. Unlike group insurance, you purchase it directly, and it’s tailored specifically to your needs, financial situation, and long-term goals. You own and control the policy, meaning it’s not tied to your employment and stays with you as long as you pay the premiums.

These policies come in two primary forms:

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If the insured person passes away during the term, the beneficiaries receive the death benefit.

Term life is generally the most affordable type of life insurance, offering a large amount of coverage for a relatively low premium. It's straightforward protection without a savings or investment component. - Permanent Life Insurance: This category encompasses policies such as Whole Life and Universal Life. These policies are designed to last your entire lifetime and include a cash value component that grows over time on a tax-deferred basis.

This cash value can be borrowed against or withdrawn, providing an added layer of financial flexibility. Because of these features, whole life insurance and other permanent products have significantly higher premiums than term insurance.

The Portability Problem: Why Relying on Work Coverage is Risky

The single most significant drawback of employer life insurance is its lack of portability. When you change jobs, are laid off, or retire, that coverage typically vanishes.

While conversion options are available in some plans, premiums are typically based on your age at conversion and may be significantly higher than employer-provided rates.

This lack of portability creates a dangerous gap. Imagine leaving a job in your late 50s. Not only are you suddenly without coverage, but securing a new private policy at that age will be far more expensive than it would have been in your 30s or 40s. If your health has declined, you may even find it difficult to obtain coverage at all.

An individual life insurance policy solves completely this problem. It’s yours and stays with you, providing continuous protection through job changes, career breaks, and into retirement.

Building a Comprehensive Strategy: Using Both

For many people, the optimal strategy isn't choosing one over the other, but leveraging both. Think of it as a layered approach to financial security.

- Accept the Freebie: Always take the basic group life insurance offered by your employer, especially if it's free of charge. It’s an effortless way to establish a foundational layer of protection.

- Calculate Your True Need: Don't assume 1-2x your salary is enough. Consider your mortgage, outstanding debts, future education costs for your children, and income replacement for your surviving spouse. A financial advisor can help with a detailed needs analysis.

- Buy a Core Individual Policy: Purchase a private policy to cover the majority of your long-term needs. This policy will serve as the permanent, reliable core of your life insurance strategy.

- Use Supplemental as a Gap-Filler (Cautiously): If, after securing a robust individual policy, you still have a small coverage gap, using your employer’s supplemental life insurance can be a convenient, payroll-deducted option. However, compare its cost to simply increasing your individual policy, as the latter is often more cost-effective in the long run.

This hybrid approach ensures you have stable, long-term protection that you control, while also taking advantage of the low-cost benefits your employer provides.

Calculator

See how much coverage makes sense for you with our life insurance calculator to help you determine how much life insurance coverage you need.

Common Mistakes to Avoid

Navigating life insurance can be challenging, but being aware of common pitfalls can help protect your family from significant hardship down the road. Here are some key mistakes to steer clear of:

| Common Mistake | The Risk (Why It's a Problem) | The Solution (How to Avoid It) |

|---|---|---|

| Relying Only on Work Coverage | Your family's financial security is tied to your job and can disappear if you leave. | Secure a personal, individual life insurance policy that you own and control to serve as your primary protection. |

| Underestimating Your Needs | Accepting a default amount (like 1-2x salary) can leave a massive financial gap for your mortgage, debts, and kids' education. | Calculate your actual need by adding up your debts, mortgage, and future education costs. |

| Delaying Your Purchase | Premiums increase significantly as you age or if your health changes. | Lock in the lowest rates by buying a policy when you are young and healthy. |

Conclusion: Take Control of Your Financial Legacy

Your employer's life insurance is a valuable benefit, but it's a temporary safety net that you don't control. Use your workplace benefits as a great supplement, but build your core security on a policy that belongs to you alone.

Find out if employer vs individual life insurance gives you enough coverage. Request a Free Life Insurance Quote

Frequently Asked Questions

Can I have both employer and individual life insurance?

Is life insurance through my employer enough?

Is it cheaper to get life insurance through work?

Can you cash out employer-paid life insurance?

Is employer-provided life insurance worth it?

What is open enrollment life insurance?

Sources

- Group-Term Life Insurance – IRS.gov. https://www.irs.gov/government-entities/federal-state-local-governments/group-term-life-insurance.

- Publication 15-B, Employer's Tax Guide to Fringe Benefits - Internal Revenue Service (IRS). https://www.irs.gov/publications/p15b.

- What is imputed income and how does it affect my taxes? – Cornell Law School Legal Information Institute. https://www.law.cornell.edu/wex/imputed_income.

Footnotes

- Tax treatment of life insurance benefits may vary. Please consult your tax advisor to understand your individual situation.